Effective demand is critical in macroeconomics as it denotes the total volume of goods and services consumers, businesses, and governments are willing to buy and have the purchasing power to do so at a certain price. Effective demand differs from general demand, which is measured purely in terms of wants, since it is indicative of real purchasing power and therefore central to real economic activities. Keynes introduced the concept in his magnum opus, The General Theory of Employment, Interest, and Money and has since been instrumental in national output investigations, employment levels, and government policy responses. Understanding how effective demand is determined, for example, by the amount of income, interest, government expenditure, consumer confidence, and wages, is important in judging the health of an economy. Economists commonly use effective demand when predicting business cycles, and governments use it to help make fiscal policy decisions.

What is Effective Demand?

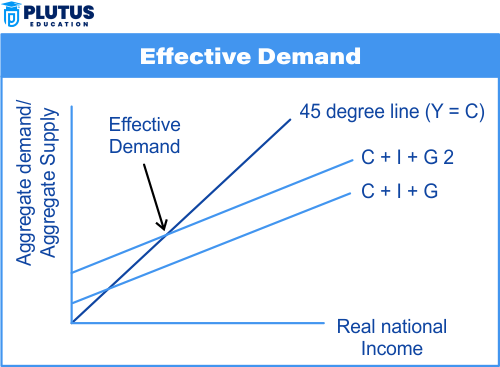

Effective demand is defined as the sum of goods and services that consumers, businesses, and government agencies are willing to buy at a given level of income, employment, and price levels in an economy. It depicts the connection between demand and the real purchasing power of buyers, while simple demand accounts for just the willingness to buy. Effective demand determines the level of equilibrium economic activity.

The term “effective demand” was coined by John Maynard Keynes in his book The General Theory of Employment, Interest, and Money (1936). According to Keynes, effective demand is the actual demand that leads to the production of goods and services, as it is influenced not only by consumers’ desires but also by their income and employment conditions. In this sense, effective demand determines the level of output, employment, and income in an economy. A high effective demand encourages businesses to produce more, which translates to more jobs and increased economic growth.

Effective demand is affected by several factors, such as consumer confidence, government spending, interest rates, and general economic stability. It establishes the level of output at which the quantity of goods and services produced is equal to the quantity demanded in an economy. If effective demand is below this equilibrium, businesses may cut down on production and lay off workers, leading to unemployment and lower income levels. Understanding the importance of effective demand helps economists and policymakers align supply with actual market needs.

The Formula for Effective Demand

Effective demand can be represented mathematically to understand the total spending in an economy. The formula captures the combined effect of consumption, investment, government spending, and net exports.

ED = C + I + G + (X − M)

Where:

- C = Consumption Expenditure

- I = Investment Expenditure

- G = Government Spending

- X = Exports

- M = Imports

This is also the Aggregate Demand (AD) formula in macroeconomics, and in Keynesian terms, effective demand is often equated to aggregate demand, because it represents the actual level of total spending in the economy that businesses respond to with production and employment.

Key Factors Affecting Effective Demand in Economics

To fully grasp the importance of effective demand, one must consider the various economic levers that influence it, such as income and interest rates. The determinants of effective demand go beyond simple consumer desire—they include income, interest rates, fiscal policy, and overall economic conditions. The factors determining demand are more than the simple want of consumers to spend money on the commodity. Other factors include income levels and interest rates, government policies, and the stability of the economy. Every one of these factors is vital in determining the actual amount of demand in the marketplace, keeping in view the purchasing power of the individuals and their economic environment.

Income Levels

Income is the most critical factor that influences effective demand. Earning more income increases purchasing power, which subsequently increases the demand for goods and services. Conversely, if income declines, the consumers tend to spend less, which lowers effective demand. A high-income consumer can purchase more than a low-income consumer, regardless of their identical preferences in goods and services.

Interest Rates

The central bank sets interest rates, which determine the cost of borrowing money. Low interest rates encourage people to borrow and spend, and thus there is an increase in effective demand. This is because consumers can borrow money cheaply to purchase goods like homes, cars, and appliances, and businesses can invest more in capital and production. Conversely, high interest rates reduce borrowing and spending, which lowers effective demand.

Government Spending

Government expenditure will also play a huge role in effective demand. Keyne, in stimulating the demand, especially when people are in economic dawns, put emphasis on the role of government expenditure. When the government increases its expenditure, this does not directly boost the demand for goods and services but will indirectly encourage private investment in the sector. Infrastructural projects, subsidies, and public services, amongst others, contribute to enhancing effective demand.

Consumer Confidence and Expectations

Among the most influential determinants of effective demand, consumer confidence plays a vital role in shaping purchasing patterns. Consumer confidence is the prime factor determining effective demand. When consumers feel confident about their financial future and the stability of the economy, they spend more. When there is uncertainty in the economy or it is in a recession, consumer confidence decreases and thus spending declines, reducing effective demand.

Employment and Wage Levels

Employment levels are directly proportional to income, an important determinant of effective demand. When more people are employed and wages are going up, the total income in the economy is on the rise, leading to greater effective demand. When employment levels decline or wage levels do not increase, then effective demand declines as fewer people have disposable income to spend.

Effective Demand in Keynes’ General Theory

According to John Maynard Keynes’s General Theory of Employment, Interest, and Money is a keystone work on modern macroeconomic thinking, within it, he conceives effective demand and considers that its establishment constitutes a basis for deciding upon aggregate activity level in any particular country. It is, Keynesian economics, fundamentally alters the old, orthodox classic economic position about market automatism with its concept as being ever self-correcting while the former suggests supply creating its respective demand. Instead, Keynes proposed that it is demand—effective demand—that drives production and employment levels in an economy.

Keynes’ View on Aggregate Demand

According to Keynes, aggregate demand is the sum of consumption, investment, and government spending. However, for aggregate demand to result in actual economic activity, it must be supported by the purchasing power of consumers and businesses. In his view, it is not enough for people to want something; they must also have the means to buy it. Effective demand, in this sense, is critical because it determines the level of output and employment in an economy. If effective demand is insufficient, businesses will reduce production and lay off workers, leading to a cycle of unemployment and lower income.

The Role of Investment in Effective Demand

Investment especially by firms is the other third driver of effective demand says Keynes. When the firm invests in new capital goods, such as machinery and factories, the increase in demand for labor, and materials leads to rising employment and wages. Subsequently, this results in higher consumer spending. A Keynesian economy determines both the level of national income and employment through the national level of investment that explains the overall level of effective demand.

The Paradox of Thrift

Another paradox of thrift that Keynes noted is one in which the more saving individuals do, the lesser their effective demand at a macroeconomic level. Savings can only mean less expenditure. And since businesses cannot sell what they do not produce, then reduced sales would result in lower production and eventually in layoffs. Effective demand, therefore is highly related to the economy’s total level of expenditure, not necessarily the overall level of savings.

Real-World Examples of Effective Demand

Examples from real life shed more understanding on effective demand. From government stimulus packages to the current trends of consumer spending behavior, the list is endless with examples of effective demand observed and analyzed.

Example 1: The 2008 Global Financial Crisis

The 2008 financial crisis was the time during which several economies were going through quite a drastic decline in effective demand. The financial system went bust; unemployment went up, and consumer confidence began to languish considerably. After the crisis, firms went deep into a reduced level of demand in terms of both goods and services, thereby lessening levels of production and nudging up unemployment. The governments in all corners of the world, with particular emphasis in the US and in Europe, came back with stimulus packages to shore up effective demand. These packages included direct financial assistance, a reduction in taxes, and increased government spending in order to put the productive services back into operation and enliven the aggregate demand.

Example 2: COVID-19 Pandemic and Economic Lockdowns

The COVID-19 outbreak is another prime example of the significance of effective demand. Consumer spending had plummeted with the lockdowns and restrictions of movement. The closure and downsizing of businesses at large led to job cuts and a resultant decline in total income. Governments bailed out by initiating large-scale stimulus programs direct cash payments for individuals and fiscal support to businesses to once again stir up effective demand. These steps therefore stabilized the economy and started the recovery process.

Difference Between Demand and Effective Demand

Although the terms “demand” and “effective demand” are often used interchangeably, they are not synonymous. The crucial difference between the two influences how economic theories and policies are formulated.

Demand vs. Effective Demand

- Demand is the readiness of consumers to buy goods and services at different price levels, regardless of their ability to pay. It reflects the desire to own or use a particular product, but it does not take into account whether consumers have the financial means to make the purchase.

- Whereas effective demand is the real demand for goods and services which has purchasing power to be made, it is much more realistic and ground-breaking. It is grounded on not only consumers’ desire but also on the capability to pay for those things which they wish.

For instance, a person may desire to purchase an expensive car, but if they lack the necessary income or credit to afford it, their desire does not translate into effective demand. In contrast, if a person has the financial means to make a purchase, their desire becomes part of the effective demand.

Effective Demand FAQs

1. What is effective demand?

Effective demand is much more than just wanting a product and involves how much of that good or service consumers are putting money aside for at a specific price during a specific time.

2. How is effective demand distinct from demand?

Even if the general demand indicates a desire to purchase, effective demand refers to both willingness and financial ability to make the purchase.

3. Why is effective demand significant in economics?

The effective demand gives shape to market realities, becoming the actual sales at the time and deciding the course of production, employment, and overall economic activity.

4. What are some implications that influence effective demand?

There are many diverse parameters under which income levels, conscious preference, price of goods in the market, future expectations, as well as availability of credit, count as some influential measures.

5. What is effective demand in relation to business planning?

Companies expect to drive demand by leveraging effective markets or effective demand to determine production levels for their products and pricing strategies.