Among common types of accounting errors is the errors of commission which arise in entries recorded inaccurately. Examples include such as posting into other accounts, entering the wrong amount, or inaccurately writing transactions. It may not be a huge deal at the beginning, but once it creeps through your records unnoticed and uncorrected, you are sure to leave a very serious mismatch with discrepancies within a business’s financial statements, generally and specifically on accuracy in record keeping.

Types of Errors in Accounting

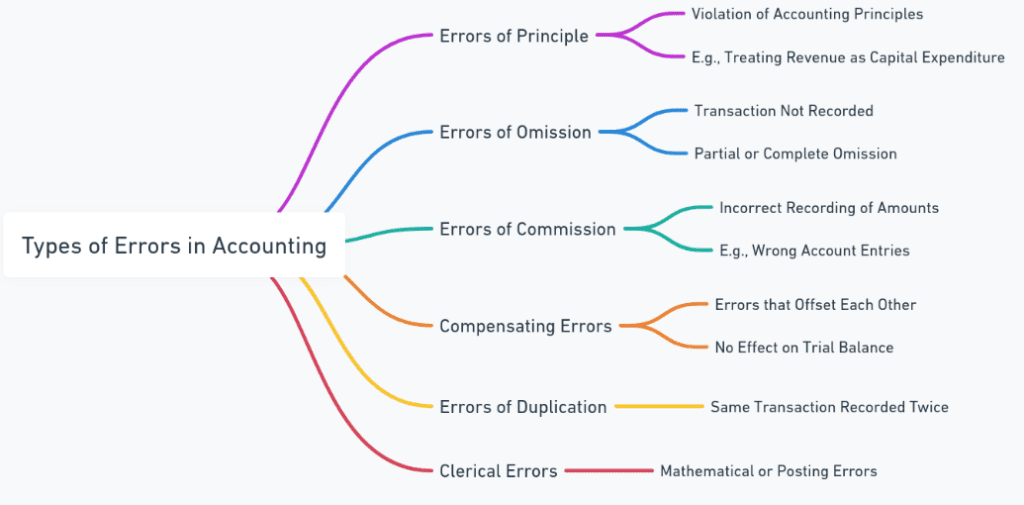

Accounting errors come in various forms, each impacting the records differently. Understanding these types of errors is essential for maintaining accurate records and preventing discrepancies.

1. Errors of Principle

These errors occur when entries are recorded against standard accounting principles. For example, recording a capital expenditure as a revenue expense goes against accounting norms.

2. Errors of Omission

Errors of omission happen when a financial transaction is entirely missed or omitted from the records. This can happen at various stages of entry, leading to incomplete financial data.

3. Errors of Commission

Errors of commission occur when an entry is incorrectly recorded in the books of accounts but in the wrong location. For example, recording a sale as a purchase or entering an amount in the wrong account.

4. Compensating Errors

Compensating errors are when two errors cancel each other out, making it harder to identify these inaccuracies without thorough review.

What are Errors of Commission?

Errors of commission account errors where a transaction has been posted but with incorrect information. This may either be in the form of the wrong amount being posted into an account or, in the case of numerical figures, the wrong numerical amount has been posted. As opposed to errors of omission, these transactions are not absent from the books but rather are full of errors that need rectification.

Errors of commission can occur in various ways, such as:

- Wrong Posting: Posting transactions in the wrong account.

- Incorrect Amounts: Entering incorrect figures, either too high or too low.

- Reversing Entries: Entering debit as credit or vice versa.

These errors are often identified during reconciliation and audit processes, where detailed comparisons highlight inaccuracies.

Rectification of Entry in Errors of Commission

Rectifying errors of commission is essential to ensuring accurate financial statements. The correction depends on when the error is discovered:

- If discovered before finalizing accounts: The error can be directly corrected in the books.

- If discovered after finalization: Adjusting entries are made to amend the balance sheet and income statement accordingly.

Examples of Errors of Commission

Understanding errors of commission is easier with examples to demonstrate typical scenarios:

- Wrong Account Entry: A payment for utility expenses of $200 is mistakenly recorded as a rent expense. Here, the entry is correct in amount but incorrect in classification.

- Incorrect Amount Entry: A sales invoice of $1,200 is mistakenly recorded as $2,100. Although the transaction itself is correct, the entered amount creates a discrepancy.

- Double Posting: If a purchase of supplies worth $500 is entered twice, it leads to an inflated expense account, impacting overall profit and loss calculations.

Errors of commission are a frequent yet correctable issue in accounting, resulting from minor inaccuracies in data entry. Identifying and correcting these errors is crucial for ensuring the accuracy of financial statements and maintaining the trustworthiness of financial information. By understanding and addressing such errors promptly, businesses can maintain a robust accounting system and improve financial reporting.

Errors of Commission FAQs

What is an example of an error of commission in accounting?

An example of an error of commission is posting a sales transaction to the purchases account.

How are errors of commission corrected?

Errors of commission are corrected through rectification entries that adjust the incorrect entry by debiting or crediting the correct accounts.

Are errors of commission detected during reconciliation?

Yes, errors of commission are often identified during reconciliation processes where account balances are compared for accuracy.

What is the impact of errors of commission on financial statements?

Errors of commission can misstate account balances, potentially impacting financial reporting accuracy and decisions based on the statements.

How can businesses minimize errors of commission?

Implementing double-check processes, training employees, and using accounting software can help minimize errors of commission.