Errors of omission occur when a financial transaction is either completely or partially omitted from recording in the accounting books and records. If not treated, such errors can easily cause problems in a company’s statement of accounts. Errors of omission normally arise due to overlooking and may be at one of the three levels- ledger entry, sub-ledger, or final accounts. In this tutorial, we will discuss what an omission error is, the types of omission errors, its impact on accounts, ways to rectify it, and how to prevent it.

What is Errors of Omission?

Omission errors are errors caused when a transaction is fully omitted or partially omitted in accounting records. This, of course, does not represent any kind of fraudulent intent. Errors of omission arise from such circumstances as oversight or accidents while accounting. In some other cases, errors may come about from weak accounting systems. These types of errors occur at all stages of an accounting cycle, starting with recording the first transactions up to finalizing statements of financial position. The books can then go unchecked in cases of balancing, but they distort the financial information and thereby can adversely affect business decisions, compliance, and reporting.

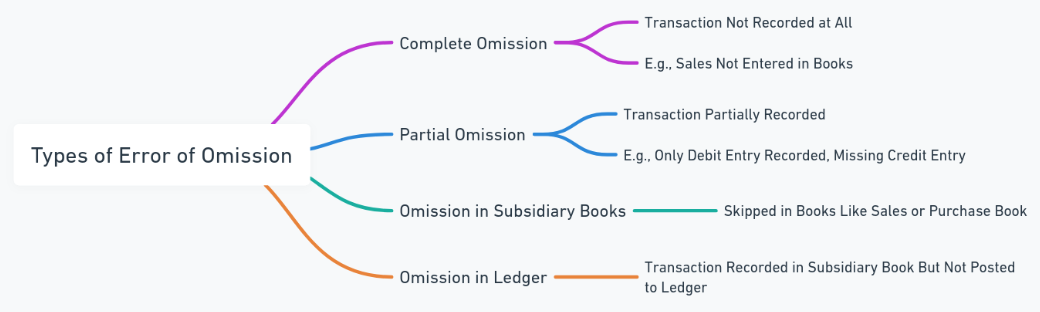

Types of Errors in Omission

Errors of omission can be categorized into two main types based on the extent of the omission: complete omission and partial omission.

Complete Omission

A complete omission would mean that an entire transaction goes unrecorded in the journal and ledger accounts. For example, when a cash sale is made by a firm, there would be no record of the same anywhere, resulting in wrong records of sales revenue and cash or bank balance. Errors of this type are not likely to come to light on the trial balance as the debit and credit sides would be zero, hence they cannot be detected with simple reconciliations.

Partial Omission

A case of missing transactions occurs partially, meaning that a journal contains a particular transaction not in the ledger account and vice versa. For example, if a firm books credit sales in the sales journal and fails to pass it in the debtor’s ledger. In such an instance, the trial balance may be correct, but that specific account will look false. Partial omissions are easier to detect compared to complete ones since they come about at the time of reconciliation processes.

Effect on Accounts

The impact of errors of omission varies depending on where the omission occurs and the type of transaction involved. Here’s a closer look at how errors of omission can influence accounts:

- Revenue and Expense Distortion: Errors of omission, especially those affecting revenue or expenses, can distort profitability. Unrecorded revenue leads to understated income, while unrecorded expenses may overstate profits, leading to inaccurate performance assessment.

- Balance Sheet Impact: If asset-related transactions, like sales or purchases, are omitted, the asset values in the balance sheet become incorrect, affecting total assets and liabilities.

- Cash Flow Mismatch: When cash transactions are omitted, it results in discrepancies in cash flow statements, impacting liquidity assessments.

- External Reporting Errors: Financial statements with omitted transactions can mislead stakeholders and may even result in regulatory penalties if discovered during audits.

Rectification of Entry

Rectifying errors of omission depends on whether the omission is detected within the accounting period or after the accounts have been finalized. Here’s how to handle it:

Rectification within the Same Accounting Period

If the error is identified within the same period, it can simply be corrected by recording the missing transaction in the appropriate accounts. For example:

- If a cash sale of $500 is omitted, the correction would involve debiting Cash and crediting Sales.

Rectification after the Accounting Period

If the error is discovered in a subsequent period, a journal entry may be required to adjust the opening balances of affected accounts:

- Use a Suspense Account temporarily to balance the accounts if necessary.

- For errors affecting profit and loss accounts, an adjustment entry can be made to reflect the missing transaction in the current period’s income or expense.

Example of Rectification Entry:

| Date | Particulars | Dr ($) | Cr ($) |

|---|---|---|---|

| Jan 1, 2024 | Sales Account | 500 | |

| To Cash Account | 500 | ||

| Narration: Rectification of unrecorded cash sale |

How to Prevent Mistakes

While errors of omission can often be accidental, adopting preventive measures can reduce their occurrence significantly.

1. Implement a Strong Internal Control System: Establishing a system where all transactions are reviewed by multiple personnel reduces errors. Setting up checks and balances can catch omitted transactions early on.

2. Use Automated Accounting Software: Automated systems help in capturing all transactions systematically, minimizing manual oversight. Most accounting software includes reconciliation features to detect discrepancies.

3. Regular Reconciliations: Monthly reconciliations of accounts payable, receivable, and bank accounts can highlight missing entries, enabling prompt rectification.

4. Conduct Frequent Audits: Conducting periodic audits and reviews ensures that all entries are systematically accounted for, with errors detected before financial statements are finalized.

Though errors of omission are generally unintended, they do indeed contribute to significant differences in the financial statements prepared and thereby undermine the credibility of financial reports. Once understood are the types and their consequences, businesses will take adequate preventive measures through sound internal controls, frequent audits, and appropriate use of accounting software to avoid these errors of omission. This will contribute toward sound decision-making and the creation of trust between a business and its stakeholders.

Errors of Omission FAQs

What are errors of omission in accounting?

Errors of omission occur when a transaction is either fully or partially omitted from accounting records, leading to inaccuracies in financial statements.

How do errors of omission affect financial statements?

They distort revenues, expenses, assets, or liabilities, affecting net income and balance sheet accuracy, which may mislead financial analysis.

What is the difference between complete and partial omission?

Complete omission means an entire transaction is missed in the accounts, while partial omission occurs when only part of the transaction is recorded.

How are errors of omission rectified?

They are corrected by recording the missing transaction in the correct accounts, either directly if found within the period or by adjustment entry if detected later.

What can help prevent errors of omission?

Implementing internal controls, using automated accounting systems, regular reconciliations, and periodic audits are effective methods to prevent errors of omission.