The expenditure method formula is one of the most commonly used methods in the calculation of a country’s Gross Domestic Product. The total spending within an economy over a given period is calculated, and from this, one is able to measure the overall economic activity. To judge the aggregate demand is to judge the country’s health. It is useful for economists and policymakers to monitor the trend of growth, make forecasts about future trends, and evaluate their fiscal policy effectiveness using this formula.

The expenditure method formula is expressed as:

GDP = C+I+G+(X−M)

Where:

- C = Private consumption expenditure

- I = Investment expenditure

- G = Government spending

- X = Exports

- M = Imports

This method measures the final value of all goods and services produced within a country’s borders, regardless of whether the production is by domestic or foreign entities.

What is Expenditure Method of National Income?

The expenditure method delivers a demand-side approach to GDP, representing the total value of all final goods and services acquired. Formulation assumes that the economic output must equal the sum of the total amount spent by the economy’s participants: households, businesses, governmental bodies, and the foreign sector.

This method is widely applied since it directly reflects consumer behavior, investment trends, and trade balances. Furthermore, it informs an economy of the demand conditions prevailing in it-whether people are spending more or less and whether businesses are investing at a level that will sustain growth over time.

How Expenditure Method Works?

The expenditure method formula pools together expenditures from the four key sectors of the economy-household, business, government, and net exports. Let’s now consider how each contributes to national income.

1. Consumption (C)

Consumption expenditures refer to households’ total spending on goods and services. They are often the largest component of GDP, reflecting consumer behavior and confidence.

Categories of Consumption:

- Durable Goods: Goods with a longer life, such as cars, furniture, or home appliances.

- Non-Durable Goods: Items consumed quickly, such as groceries, fuel, and clothing.

- Services: Expenditures on services like healthcare, education, transport, and entertainment.

Consumption patterns are heavily influenced by factors like household income, employment levels, and inflation. In most developed economies, household consumption constitutes more than half of the GDP.

2. Investment (I)

Investment expenditure captures spending on goods and services used for future production. Unlike consumption, this component focuses on long-term economic output.

Types of Investments:

- Business Investments: Expenses on machinery, equipment, and buildings.

- Residential Investments: Costs to erect homes or develop real estate.

- Inventory Investments: The quantity of the commodities unsold, which are retained at the end of the year by businesses.

Investment is very core to economic growth in that it reflects the confidence of businesses and efforts at building capacity. An increase in investment, for instance, is a reflection that businesses expect that demand will rise in the near future.

3. Government Spending (G)

Government expenditure encompasses all the spending by federal, state, and local governments on goods and services. This includes investments in infrastructure, healthcare, education, and defense.

Examples of Government Spending:

- Salaries paid to public servants.

- Investments in road and transportation projects.

- Military expenditures for national defense.

However, transfer payments, such as pensions and unemployment benefits, are not included in GDP because they do not reflect current production activities.

4. Net Exports (X – M)

The difference between exports and imports determines the contribution of the foreign sector to GDP.

- Exports (X): Goods and services produced domestically but sold to other countries.

- Imports (M): Goods and services purchased from foreign countries.

Net Exports = X−M

A positive value, therefore adds to GDP while a negative value, a trade deficit decreases it. For example, if the country exports machinery and technologies products, which are highly valuable, this will contribute towards a plus value in GDP from net exports as compared with the country relying on an import market.

Main Components of Expenditure Method

This section breaks down the primary components with specific examples and their relevance in real-world economies.

Private Consumption (C)

- Covers essential and non-essential household spending.

- Represents a large portion of GDP in developed countries.

- Example: Expenditure on groceries, rent, education, and luxury goods.

Gross Investment (I)

- Reflects capital investments made by businesses and households.

- Includes machinery purchases, infrastructure, and inventory changes.

- Example: A company purchasing new equipment or a family building a new house.

Government Expenditure (G)

- Essential for maintaining public services and infrastructure.

- Boosts the economy, especially during recessions through fiscal stimulus.

- Example: Government-funded healthcare programs or defense projects.

Net Exports (X – M)

- Balances the impact of international trade on GDP.

- Example: A country exporting cars and importing electronics, with exports higher than imports resulting in a positive net export figure.

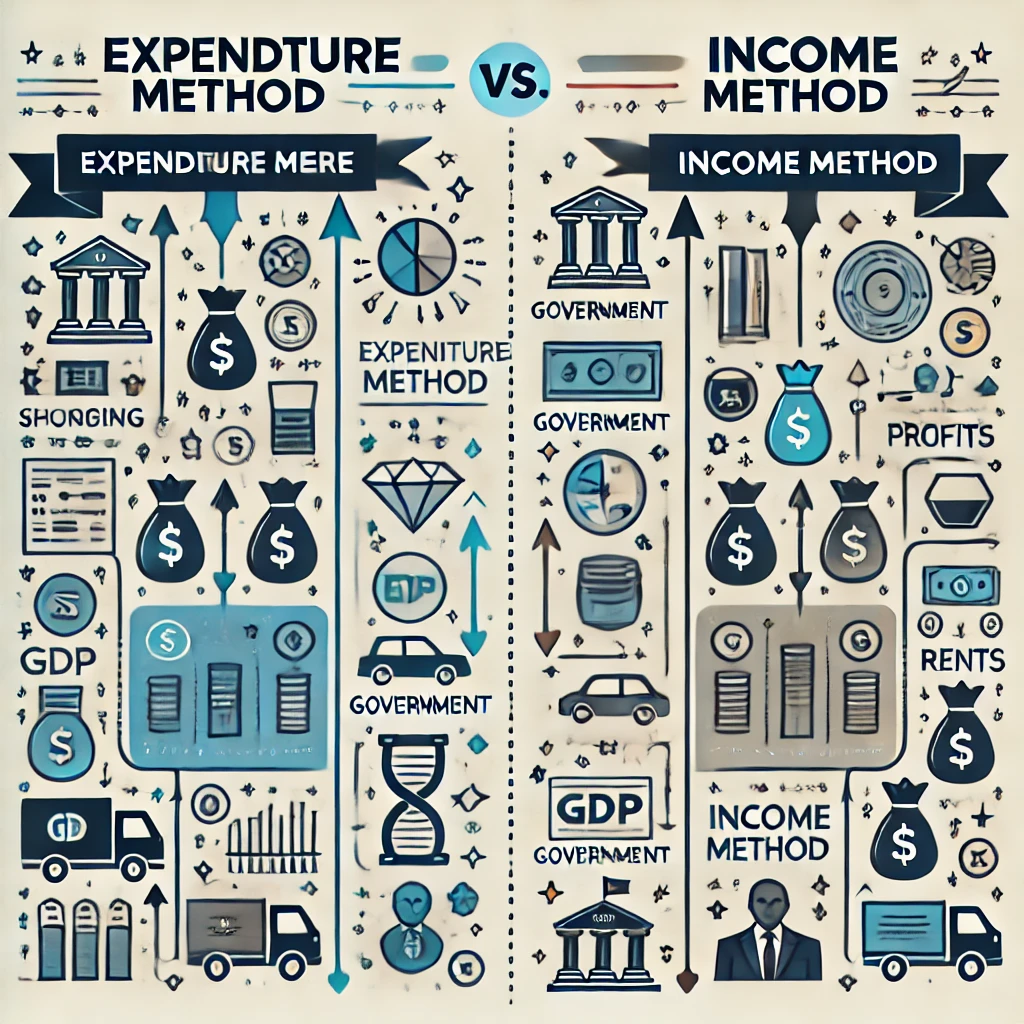

Difference Between Expenditure Method and Income Method

While both methods aim to calculate GDP, the expenditure method focuses on spending, and the income method centers on income generation.

| Aspect | Expenditure Method | Income Method |

|---|---|---|

| Focus | Tracks total spending in the economy | Measures income generated by production |

| Formula | GDP = C + I + G + (X – M) | GDP = Wages + Rent + Interest + Profits + Taxes |

| Approach | Demand-side analysis | Supply-side analysis |

| Main Use | Evaluates spending patterns and aggregate demand | Assesses income distribution and profitability |

| Key Sectors | Households, Businesses, Government, Foreign Trade | Labor market, capital owners, and businesses |

Both methods are equally important and are often used together to validate national accounts.

Conclusion

The expenditure method formula is an indispensable tool for measuring a nation’s economic performance. By analyzing the sum of household consumption, business investment, government spending, and net exports, policymakers can gauge the aggregate demand and identify potential economic challenges. This method not only captures the current state of the economy but also helps in forecasting future growth by tracking expenditure trends.

In conjunction with the income method, the expenditure method provides a well-rounded view of a nation’s economy, aiding decision-makers in designing appropriate fiscal and monetary policies.

Expenditure Method Formula FAQs

What is the expenditure method formula?

The expenditure method formula for GDP is:

GDP = C + I + G + (X – M)

It sums household consumption, business investments, government spending, and net exports to calculate the total value of output.

Why are imports subtracted in the expenditure method?

Imports are subtracted because they represent spending on goods and services produced outside the domestic economy, which do not contribute to the nation’s GDP.

What is the difference between the expenditure method and the income method?

The expenditure method calculates GDP by tracking spending, while the income method focuses on income generated from wages, rent, interest, and profits.

How does government spending affect GDP?

Government spending boosts GDP by funding public services and infrastructure. However, transfer payments like pensions are excluded from GDP.

Does the expenditure method account for financial investments like stocks?

No, financial investments in stocks and bonds are excluded because they do not directly contribute to current production or economic output.