If you want a global career in finance, then studying finance courses in Canada is the right step. Canada is one of the top countries for students who want to learn about money, banking, and investment. These courses help you understand finance from both a local and global view. You learn about accounting, stock markets, business laws, and financial technology. Many Indian students choose Canada because it has a friendly environment and easy work rules after graduation. The cost of living is also lower than countries like the USA or UK. Finance courses in Canada give you skills that match global job needs. These programs include real-life training, case studies, and internships. You can get jobs in Canada or return to India and work in top companies. These courses also help you prepare for careers like financial analyst, investment banker, and finance manager.

Top Finance Courses in Canada After 12th

Many students start planning their career in finance right after class 12. Canada has world-class colleges and universities. They offer programs that cover all areas of finance. These include short diplomas, bachelor’s degrees, and master’s level courses.

Popular Courses You Can Take After 12th

These courses help you learn finance step-by-step. You will gain basic and advanced skills for entry-level jobs.

- Diploma in Financial Services: This course teaches you how banks and financial institutions work. You also learn about customer service, savings, loans, and credit.

- Diploma in Business – Finance: This covers business math, accounting, and money management. It also introduces you to financial planning and budgeting.

- Bachelor of Commerce (B.Com) in Finance: This is a 4-year undergraduate program. It includes accounting, microeconomics, financial markets, and ethics in finance.

- Bachelor of Business Administration (BBA) – Finance Specialization: This program combines business management with financial skills. You also study leadership and strategic finance.

- Diploma in Accounting and Finance: This short course gives a mix of both accounting and finance basics. You learn how companies track money and make financial decisions.

Benefits of Studying After 12th in Canada

You get international exposure at a young age. You also build strong English skills. Canadian colleges give you chances to work part-time and gain work experience. These early courses make it easier to do PG programs later.

Postgraduate Finance Courses in Canada for Indian Students

If you have completed your graduation in India and want to study further, then PG finance programs in Canada are a great option.

Master’s Level Courses You Can Pursue

These advanced programs give you deeper knowledge of finance. They also prepare you for high-paying jobs.

- Master of Finance (MFin): This course trains you in investment banking, corporate finance, and portfolio management. It is best for those who want senior roles.

- MBA in Finance: MBA with a focus in finance teaches both business and financial leadership. It includes subjects like business strategy, risk management, and global finance.

- Postgraduate Diploma in Financial Planning: This short course helps you become a financial planner. You can advise people on savings, investments, and retirement.

- Postgraduate Certificate in Financial Analytics: Learn how to use data and tools like Excel, Python, or R to solve financial problems. It’s great for those who love numbers and analysis.

- Postgraduate Diploma in Banking and Wealth Management: You study how banks work and how to manage the wealth of high-net-worth individuals.

Advantages for Indian Graduates

Most PG courses allow students to work part-time during study. After graduation, you can get a work permit for up to 3 years. You also improve your global job chances. Many of these programs don’t need GMAT or GRE.

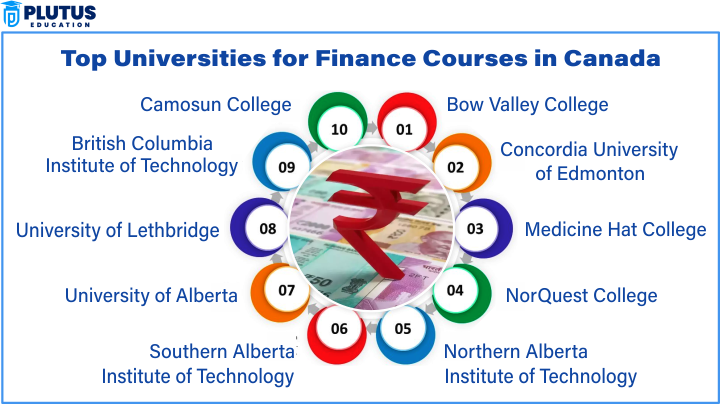

Best Colleges for Finance Courses in Canada

Canada is home to some of the best colleges offering top finance programs. Institutions like the University of Toronto, McGill University, and the University of British Columbia are well-known for their finance courses. These colleges provide strong academic foundations, global recognition, and excellent career support. Graduates often find roles in banking, consulting, and financial services across Canada and beyond.

| College/University | Type | Courses Offered |

| University of Toronto | Public University | B.Com, MBA Finance, Master of Finance |

| McGill University | Public University | BBA, MBA Finance |

| York University (Schulich) | Public University | BBA, MFin, MBA |

| University of British Columbia | Public University | B.Com, MBA Finance |

| Centennial College | Public College | Diploma in Business Finance |

| George Brown College | Public College | Financial Planning Diploma, Accounting & Finance |

| Seneca College | Public College | Diploma in Financial Services |

| Humber College | Public College | Advanced Diploma in Business Finance |

Why Choose These Colleges?

These colleges have modern classrooms and experienced faculty. They offer internship programs and career services. Many colleges also partner with industries for placements. Indian students prefer these colleges because they are in cities like Toronto and Vancouver, where part-time jobs are easily available.

Job Opportunities After Studying Finance in Canada

Finance courses in Canada prepare you for various job roles in different sectors. You can work in banks, companies, or start your own business.

Common Jobs After Finance Courses

You can apply for many different roles based on your interest and course type.

- Financial Analyst: You study company data and help in making investment decisions. This job suits those who love numbers and charts.

- Investment Banker: You help companies raise money and manage their investments. This job needs strong communication and finance knowledge.

- Financial Planner: You give advice to people on how to manage their money. You help in planning insurance, loans, and retirement.

- Risk Analyst: You find financial risks and help companies avoid losses. This role is in demand in both banks and IT firms.

- Accountant: You track income, expenses, and prepare reports. You also ensure that companies follow tax rules.

- Loan Officer or Credit Analyst: You work in banks and help approve or reject loans. You study credit scores and financial history of clients.

Expected Salaries in Canada

Finance graduates in Canada can expect starting salaries between CAD 45,000 to CAD 60,000 per year. With experience, professionals in roles like financial analysts or investment managers can earn over CAD 90,000 annually.

| Job Role | Average Salary (CAD per year) |

| Financial Analyst | $55,000 – $75,000 |

| Investment Banker | $80,000 – $120,000 |

| Financial Planner | $60,000 – $85,000 |

| Accountant | $50,000 – $70,000 |

| Credit Analyst | $55,000 – $80,000 |

You can earn more in big cities like Toronto, Vancouver, and Montreal. Salaries also increase as you gain experience and certifications.

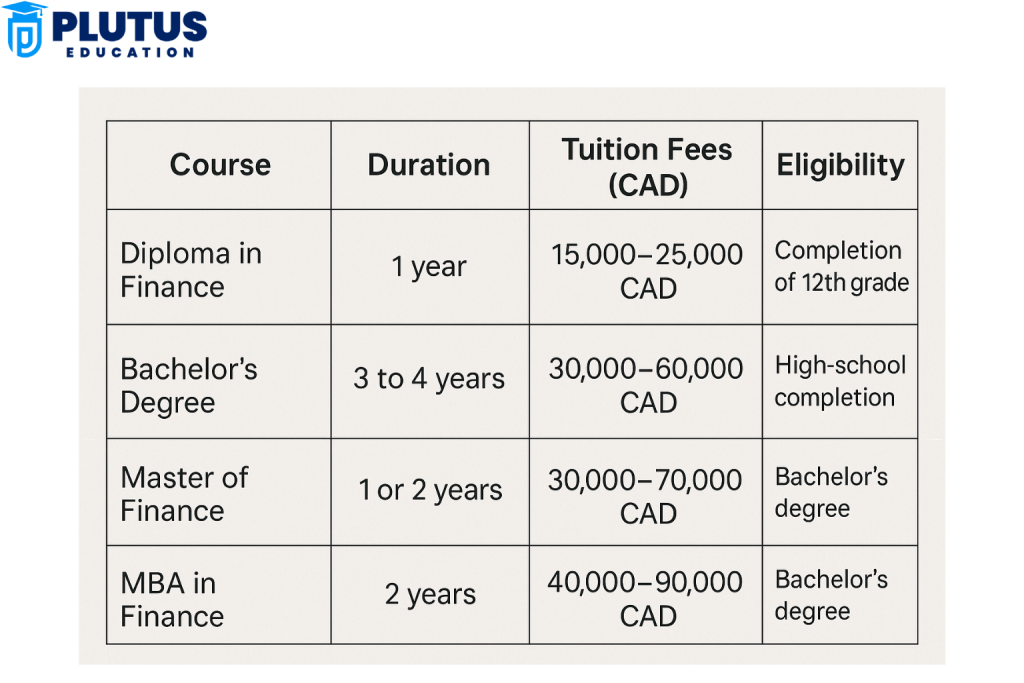

Cost of Studying Finance in Canada

The cost of studying finance in Canada usually ranges from CAD 15,000 to CAD 35,000 per year. This includes tuition fees for undergraduate or postgraduate programs at public universities. In addition to tuition, students need to budget for living expenses, which can range between CAD 10,000 to CAD 15,000 annually. Scholarships, part-time jobs, and financial aid options are also available to support students.

| Course Type | Average Tuition Fees (CAD per year) |

| Diploma Programs | $10,000 – $15,000 |

| Undergraduate Degree | $20,000 – $30,000 |

| Postgraduate Diploma | $15,000 – $25,000 |

| MBA or MFin | $30,000 – $50,000 |

Other costs include living expenses, health insurance, and travel. Students spend around $10,000 – $15,000 per year on living.

How to Apply for Finance Courses in Canada?

You must plan well and apply early. Canadian colleges follow two main intakes: September (Fall) and January (Winter). Follow these steps to increase your chances of admission:

- Choose the Course and College: Pick a course that matches your career goal. Visit official college websites and check entry requirements.

- Check Eligibility: Most UG programs need at least 70% marks in class 12. PG courses need a bachelor’s degree in finance or related field.

- Take a Language Test: You must take the IELTS or TOEFL. Most colleges need 6.5 bands in IELTS.

- Prepare Documents: Keep your transcripts, passport, SOP, and LORs ready. Some colleges ask for resumes and certificates too.

- Apply Online: Submit your application before the deadline. Pay the application fee.

- Apply for Study Permit: Once you get the offer letter, apply for a Canadian study visa. This takes about 4–6 weeks.

Finance Courses in Canada FAQs

1. What is the best course to study finance in Canada?

Master of Finance and MBA in Finance are top choices for PG level.

2. Can I study finance in Canada after 12th?

Yes. You can take diploma or bachelor-level courses after 12th.

3. Is finance a good career in Canada?

Yes. It offers good salary, job stability, and growth in many sectors.

4. Do finance courses in Canada require math?

Yes. Basic math is needed. Some courses also include statistics and financial calculations.

5. What is the cost of finance courses in Canada for Indian students?

It ranges between CAD 10,000 to 50,000 per year, depending on course and college.