Financial diploma courses teach the fundamental and advanced skills required for working within the world of cash and commerce. These courses offer assistance to students to learn about overseeing cash, ventures, keeping money, and accounting. Finance diploma courses are ideal for individuals pursuing better occupations or learning more about financial subjects. These courses, moreover, offer an assistance plan for occupations in banks, finance companies, and large trading firms.

Best Finance Diploma Courses with Certification

Online finance diploma courses offer adaptable learning choices. Numerous individuals select them since they can learn domestically and still gain a substantial certification. These courses cover budgeting, speculation, bookkeeping, and corporate finance. The best colleges offer certified finance diploma programs that help students develop their careers.

What are Online Finance Diploma Courses?

Online finance diploma courses are made for students who need to study but cannot attend college every day. These courses incorporate recordings, reading materials, tests, and real-world scenarios. Websites like Coursera, edX, Udemy, and LinkedIn Learning offer free certification courses instructed by industry specialists.

What Do You Learn In These Courses?

Most online finance diploma courses instruct:

- Essentials of Financial Accounting

- How to oversee money and arrange a budget

- Progressed subjects like budgetary modeling and corporate finance

- Venture managing an account diploma concept

- Aptitudes required for financial examiner confirmation parts

Numerous of these courses also offer certificates that bosses acknowledge. A few indeed offer money-related administration diploma, which makes a difference in higher-level employment

Popular Online Finance Diploma Programs

| Course Name | Platform | Certification | Duration |

| DipIFRS | Plutus Education | Yes | 3 to 4 months |

| Financial Markets | Coursera | Yes | 7 Weeks |

| Diploma in Finance | Alison | Yes | 10 Hours |

| Finance for Everyone | edX | Yes | 6 Weeks |

| Accounting and Finance Diploma Online | Udemy | Yes | Self-paced |

Many of these course options offer a diploma in finance and accounting, enabling students to study two subjects simultaneously.

Best Finance Diploma Courses for Career Growth in India

Specialization in the field of finance requires specific skills and certifications. The best diploma courses in finance are there to help you gain valuable knowledge. These courses increase your chances of employment in good companies.

Diploma in International Financial Reporting (DipIFRS)

When thinking of an upward career path in finance, one of the many eminent diploma courses is the Diploma in International Financial Reporting (DipIFRS), offered by ACCA. The course lasts around three to six months and trains the professionals in the International Financial Reporting Standards, thereby adding extra value to careers in multinational corporations, accounting firms, and global companies.

Post Graduate Diploma in Financial Management (PGDFM)

Another popular option is the Post Graduate Diploma in Financial Management (PGDFM), set up by reputed institutes like NMIMS and Symbiosis. This one- to two-year course deals with the nitty-gritty of corporate finance, budgeting, financial statement analysis, and strategic management, keeping in mind those who aspire to managerial positions in the finance department.

Financial Risk Management (FRM Prep)

The Financial Risk Management (FRM) Diploma is one of the best options to acquire knowledge in risk and compliance. Although it is technically a certification, various institutes employ diploma-style courses for preparation lasting 1 to 2 years, essentially offering a structured overview of credit risk, market risk, and operational risk, which are vital in banking and investment institutions.

Diploma in Certified Financial Planning (CFP)

The Certified Financial Planner (CFP) Diploma is another intense six- to twelve-month program designed for the wealth management and personal finance professional. This diploma covers taxation, retirement planning, estate planning, and risk management subjects that aid these professionals in catering to clients with complex financial needs.

Diploma in Investment Banking and Equity Research

An increasingly important diploma, gaining popularity, is the Diploma in Investment Banking and Equity Research, whose duration is mostly 3 to 6 months. It trains candidates in financial modeling, valuation techniques, Excel-based analytics, and M&A advisory services for high-pressure jobs in investment banks and financial consultancies.

Diploma in Financial Modeling and Valuation

In the same vein, a Diploma in Financial Modeling and Valuation is an intensive program providing training for corporate valuation, scenario analysis, and financial forecasting. The diploma entails a real 2 to 6 months’ duration and is particularly useful to analysts, finance students, or graduates of MBAs focused on corporate finance or consulting.

Advanced Diploma in Financial Accounting (ADFA)

The Advanced Diploma in Financial Accounting (ADFA) is practical for accounting professionals who want to augment their grasp of subject areas such as Tally ERP, GST compliance, and Excel-based financial reporting. It is generally recommended for six to twelve months; ADFA is suited for the job of someone who has been in SME or is already at some accounting level.

Executive Diploma in Finance (IIM-ISB)

Lastly, elite institutions like the IIMs and ISB offer Executive Diploma Programs in Finance, running from 6 to 12 months and designed for working professionals aspiring for senior roles in finance strategy, business analytics, or fintech. The programs blend academic rigor with practical applicability, often featuring campus residencies and opportunities for peer networking, which add to their prestige in any finance career.

Why Take These Courses for a Career?

Finance is the field where you can expect highly profitable jobs. Companies require people who know numbers, profit, investment, and laws. A real-life approach is adopted in the finance diploma programs. Students learn what they need to know about banking, insurance, tax planning, and business finance.

Finance Diploma Courses to Pursue Abroad

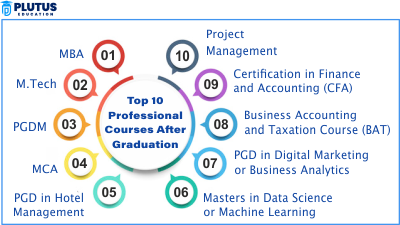

Among the most popular diploma courses in finance that one can pursue after graduation abroad are:

- Advanced Diploma in Finance – This course is ideal for students who want to lead financial teams or work in high-level positions.

- Diploma in Corporate Finance – It teaches company finance, budgeting, and mergers.

- International Finance Diploma – This course is intended for students to understand global financial rules and practices issues.

These include case studies, projects, and software training as well. These prepare the student for jobs such as a financial analyst, investment banker, or finance manager.

Career Prospects After Finance Diploma Courses

Students after these courses may apply for jobs such as

- Financial Analyst

- Investment Banker

- Risk Manager

- Budget Planner

- Auditor

- Corporate Finance Executive

The kinds of diplomas for which most companies hire are for finance and accounting fields but may also include areas such as tax planning, payroll, and planning.

Finance Diploma Course Eligibility

Finance diploma courses are for many types of learners. These programs suit both fresh graduates and working professionals. People from other fields can join the IO shift to finance careers. These courses are suitable for:

- Those students who finished school or college and want a job in finance, and those graduates from various fields, such as science or art, who wish to switch careers

- Working professionals who want more skills or better positions

- Entrepreneurs hoping to manage the money of their businesses better

All these courses would lead the student to possible careers in banks or other significant businesses. Some pursue these short-term finance courses in hopes of quickly learning just one subject, while others go for the long-term route, like a diploma in finance management or a financial planning diploma.

Skills Required Before Enrolling

No very complex skills are required when the candidate starts. Then, a little background in math and English shows learning potential. A few courses also require a person to have a high school pass certificate or a graduation degree. Students may need a bachelor’s degree for more advanced classes, such as corporate finance diplomas. These courses are the best certificate programs for finance professionals seeking new promotions or changing jobs. They give strong foundations for finance careers.

Diploma vs Degree Courses in Finance

Most students always ask whether to go for a diploma or a complete degree in finance. This subsection compares both to enable an informed choice. A degree program in finance, e.g., B.Com (Finance), BBA (Finance), or MBA in Finance, tends to be more extensive, taking 3–4 years at the undergraduate level and 1–2 years at the postgraduate level. They emphasize theoretical models, critical reasoning, and strategic financial choice. They are usually well-known internationally and may lead to lucrative positions in investment banking, corporate finance, and economic consulting.

Conversely, diploma programs in finance are shorter, skill-based courses meant to provide real-world knowledge and industry-ready skills. These courses, like Diploma in Financial Accounting, Diploma in Investment Management, or PG Diploma in Banking & Finance, are generally favored by individuals who wish to upskill fast or shift into finance from a different field. They usually last between 6 months and 2 years and cover tools such as Excel, Tally, QuickBooks, and financial modeling, making them highly relevant to positions such as financial analysts, account executives, or junior risk managers.

Duration and Cost

| Course Type | Duration | Approx. Cost (INR) |

| Diploma | 6 months–1 – 1 year | ₹15,000–₹60,000 |

| Degree | 3 years | ₹200,000–₹800,000 |

Educational programs Breadth

- Diploma courses offer job-oriented, skill-based preparation

- Degree program provides in-depth scholarly information

Work Openings

- Diploma holders can begin working early in:

- Entry-level Finance parts

- Managing an account and bookkeeping, Finance occupations

- Graduates with degrees qualify for:

Finance Diploma Courses FAQs

- What is a finance diploma course?

A finance diploma course teaches money management, banking, accounting, and investing skills. These courses help students get jobs or grow in their careers.

- Can I do a finance diploma course after graduation?

Yes, many people choose to take a finance diploma course after graduation to get better job options or change careers.

- Are there online finance diploma courses available?

Yes, many platforms offer online finance diploma courses. They provide certifications and are accepted by companies.

- Which course is best: a diploma in finance and accounting or a financial analyst diploma?

Both are good. A diploma in finance and accounting covers the basics, while a financial analyst diploma focuses on investment and market analysis.

- What is the duration of a financial management diploma course?

A financial management diploma usually takes 6 months to 1 year. It covers topics like budgeting, tax, and company finance.