Financial statements are responsible organized financial statements of a business, explaining the financial performance, position, and operating activities of the business for a given period. The documents form an important aspect of modern commerce, allowing the business to present its financial information in a structured and standardized way to external and internal stakeholders. Investors, management, regulators, and creditors, as users of the financial statements, will, therefore, use the information therein to assess the company’s financial viability and performance. Financial statements are very pivotal in any decision-making related to finance, be it with regard to profit analysis, liquidity assessment, or future investments. The significance of financial statements goes beyond mere compliance: they are key elements in the formulation of corporate strategy, the maintenance of investor confidence, and a major pillar of accountability for business conduct.

Meaning of Financial Statements

Financial statements are established records that constitute formal records and numerical and textual descriptions of the financial activities of a business: income, expenses, assets, liabilities, equities, and cash flows during an accounting period. Statements are prepared with respect to a particular set of accounting principles prescribed by GAAP or IFRS. Such standardization brings some conformity in the presentation of financial data. It aids in analyzing how effectively a business is functioning, its present standing financially, and its potential for further growth. Be it anything, either public or private, big or small, financial statement acts as the glaring evidence supporting the case for transparency and financial integrity.

Salient Features of Financial Statements

The usefulness of financial statements is primarily defined by their core features, which enhance their accuracy and reliability.

- Relevance is one core characteristic that restricts its reporting to the inclusion of only relevant and material financial data which affect decision-making. Thus the reports focus on main indicators such as profitability, liquidity, and solvency.

- Reliability also have a key characteristic whereby all information declared needs to be accurate, unbiased, and based on evidence from records or audit trails.

- Comparability enables users to compare financial statements between periods and also with those of other similar companies using consistent application of accounting standards.

- Completeness means the statements bring in all required financial disclosures, including notes and other supplementary statement information, to give a summarized whole on the subject.

- Understandability means the way the reporting is presented is lucid and logically arranged often with supporting graphs and summaries that aid comprehension by users unacquainted with the subject.

- Finally, consistency means the accounting policies are not changed throughout the years so that stakeholders are in a position to watch for trends and effectually understand the variations being reported year on year.

How Does Financial Statement Work?

Accountants prepare financial statements following specific accounting rules, like the Generally Accepted Accounting Principles (GAAP) for U.S. companies or the International Financial Reporting Standards (IFRS) for many international companies. These accounting standards ensure that financial statements are clear, consistent, and comparable, so financial data presentation is as similar as possible.

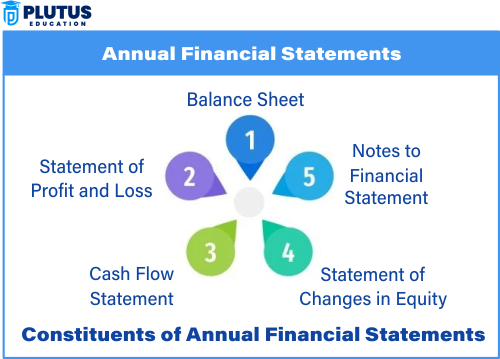

Types of Financial Statements of a Company

There are different kinds of financial statements, each showing a certain area of the company’s financial plight. These together give a thorough overview of the company’s status and activities. The most four important types of financial statements are the balance sheet, income statement, cash flow statement, and statement of changes in equity. Each of these statements will serve a different purpose in understanding a company’s operations and performance from a financial and operational perspective when considered holistically.

Balance Sheet: Looking at the Company’s Financial Standing

The balance sheet is also known as the statement of financial position that shows a snapshot of a company’s assets, liabilities, and equity at a certain date. It is based on the fundamental accounting equation:

Assets= Liabilities + Shareholder’s Equity

The assets of a company include everything owned by the company, including cash, inventory, property, and receivables. The liabilities represent what is owed by the company including loans, accounts payable, and accrued. Shareholders’ equity represents the residual interest in the assets of the company after deducting liabilities; hence it represents the net worth or book value of the company. The balance sheet is strategically analyzed for the solvency and capital structure of the company: whether it can service its short- and long-term obligations.

Assets

Assets represent what a company owns and are categorized as either current or non-current assets.

Current Assets

Current assets, often considered short-term assets, can be converted into cash within the firm’s fiscal year.

- Cash and Cash Equivalents: Any highly liquid asset, like cash, checking accounts, or money market funds.

- Accounts Receivable: Money owed by customers.

- Inventory: Products or raw materials used for products.

- Prepaid Expenses: Payments made in advance for expenses like rent or insurance.

Non-Current Assets

These assets, also called long-term assets, are critical for a company’s success but cannot be converted into cash within the firm’s fiscal year.

- Property, Plant, and Equipment (PP&E): Buildings, machinery, vehicles, or other equipment.

- Intangible Assets: Non-physical assets like patents and trademarks.

- Long-term Investments: Stocks, bonds, or notes held more than one year.

- Deferred Tax Assets: Taxes due back for overpayment or advance payment.

Liabilities

Current Liabilities

The liabilities due within a year.

- Accounts Payable: Money owed to suppliers and vendors.

- Short-term Debt: Loans or credit lines due within the year.

- Accrued Expenses: Incurred, but unpaid costs like wages or taxes.

- Unearned Revenue: Money received for goods or services not yet delivered.

Non-Current Liabilities

Often called long-term liabilities, these are the company’s financial obligations not due within a year.

- Long-term Debt: Debt payable in more than one year, such as bonds or long-term loans.

- Deferred Tax Liabilities: Future tax payments.

- Pension Liabilities: Employee retirement benefits obligations.

- Lease Liabilities: Long-term lease commitments for buildings or equipment.

Equity

Equity, also called net assets, represents the company’s assets minus its liabilities. Net assets are payable to shareholders.

- Common Stock/Preferred Stock: Value of issued shares.

- Retained Earnings: Profits not distributed as dividends.

- Treasury Stock: The company’s repurchased stock.

Income Statement: Measuring Revenue & Cost

The income statement (also called the profit and loss statement, P&L) is a very important component of corporate finance that explains how much revenue was brought in and what expenses were incurred during a specified time frame and, therefore, whether the company made a profit or a loss. It starts with revenues from sales and then subtracts operating expenses, such as salaries, rent, utilities, and depreciation. The income statement reflects chilling non-operating expenses, such as interest costs or tax obligations. It closes with the net income or loss after subtracting all expenses from revenue. Together with these three other important performance indicators with which it works, this number is a significant gauge for stakeholders assessing how well a company uses its resources, controls its costs, and generates profits through its core business operations.

Cash Flow Statement: Monitoring Inflows and Outflows of Cash

The cash flow statement illustrates the inflow and outflow of cash in the company, segregating inflows and outflows under operating activities, investing activities, and financing activities. Operating activities embrace the common day-to-day operations of a business, for example, cash receipts from customers or cash paid to suppliers. The cash outflows associated with investing activities would involve the purchase of a long-term asset, or cash inflows from the disposal of investment. Changes in financing activities reflect how the capital structure has been altered through activities such as issuing shares, borrowing funds, and paying dividends. The statement thus assists the user in assessing the company’s liquidity position. In turn, liquidity generation is how far the company can satisfy its financial commitments, invest for future growth, or distribute cash to shareholders. Thus a strong cash flow put in any company’s operational efficiency and financial viability.

Statement of Changes in Equity: Explaining Equity Movements

The statement of changes in equity explains variations in shareholders’ equity during a specified period. It keeps track of how profits and losses, dividends, and all other equity-related activities affect the total net worth of a company. An activity starts with the opening equity balance, proceeds to add net income or subtract net losses, and ends with changes due to dividend distribution, revaluation surplus, or issuance of new shares. It provides a complete breakdown of how and why the equity position has changed over a given period of time. Investors and analysts refer to this statement to understand the financial decisions affecting shareholder value, especially the retention or distribution of profits.

Importance of Financial Statements for Stakeholders

Financial statements are necessary for all stakeholders: shareholders, creditors, regulators, and management. These statements are key players for investors; they offer considerable insight into profitability and potential growth and help investors make an informed investment decision. Creditors mainly look at these statements to evaluate their risk and the creditworthiness of the company before extending loans or lines of credit. Regulators ensure compliance of the financial statements with statutory norms and visibility in operation with respect to the external world. Internally, management in a company looks at these reports as indicators of performance, weaknesses, future growth, and strategy. Ultimately, financial statements constitute the very lifeblood of financial communication between a company and its stakeholders.

Financial Statements of a Company FAQs

Q1. What are financial statements used for in decision-making?

They help stakeholders analyze a company’s performance, assess financial health, and make strategic investment, lending, and operational decisions.

Q2. What are the primary elements of the balance sheet?

Assets, liabilities, and shareholders’ equity represent the financial position of the company at a specified time.

Q3. Why is the income statement useful?

It shows the revenues and expenses, which help assess the profit potential for the business during a given time frame.

Q4. What role does a cash flow statement play?

It keeps track of cash generated and used in operations, investing, and financing by highlighting the liquidity status of a company.

Q5. How will financial statements analysis inform business decisions?

It enables businesses to identify strengths and weaknesses, forecast trends, and make data-based strategic decisions.