The term foreign exchange rate refers to the price at which one country’s currency can be exchanged for another. Foreign exchange rates are crucial to international trade, investment, and economic stability, as they impact the cost of importing goods, the value of exports, and overall financial markets. Understanding the dynamics of foreign exchange rates, the factors influencing them, and the advantages and disadvantages of different exchange rate systems helps in grasping global economic interactions and strategies that nations adopt to manage their economies effectively.

What is Foreign Exchange Rate?

The foreign exchange rate is the rate at which one currency can be exchanged for another. It serves as a metric to gauge the relative value of currencies between countries. This rate fluctuates constantly based on supply and demand, international trade, and economic conditions, making it a critical element in global finance. For example, if the exchange rate of USD to INR is 75, it means 1 US dollar can be exchanged for 75 Indian rupees.

Key Concepts in Foreign Exchange

- Direct and Indirect Quotation: A direct quotation expresses the value of one unit of a foreign currency in terms of the domestic currency, while an indirect quotation does the opposite.

- Spot Rate vs. Forward Rate: The spot rate applies to immediate transactions, whereas the forward rate applies to future transactions at a specified rate.

Factors Affecting the Exchange Rate

The value of a currency in the foreign exchange market is influenced by several factors. Understanding these factors is essential for policymakers and investors alike.

1. Interest Rates

Higher interest rates offer lenders in an economy a better return relative to other countries. Consequently, higher interest rates attract foreign capital and cause the exchange rate to rise.

2. Inflation Rates

Countries with lower inflation rates exhibit a rising currency value as their purchasing power increases relative to other currencies. Nations with higher inflation typically experience depreciation in their currency.

3. Economic Indicators and Policies

GDP growth, trade balances, and fiscal policies play a major role. A strong economy attracts foreign investments, strengthening its currency value.

4. Political Stability and Economic Performance

Countries that are less politically stable are often less attractive to foreign investors. This instability leads to a depreciation of the currency, as seen in markets influenced by political tensions.

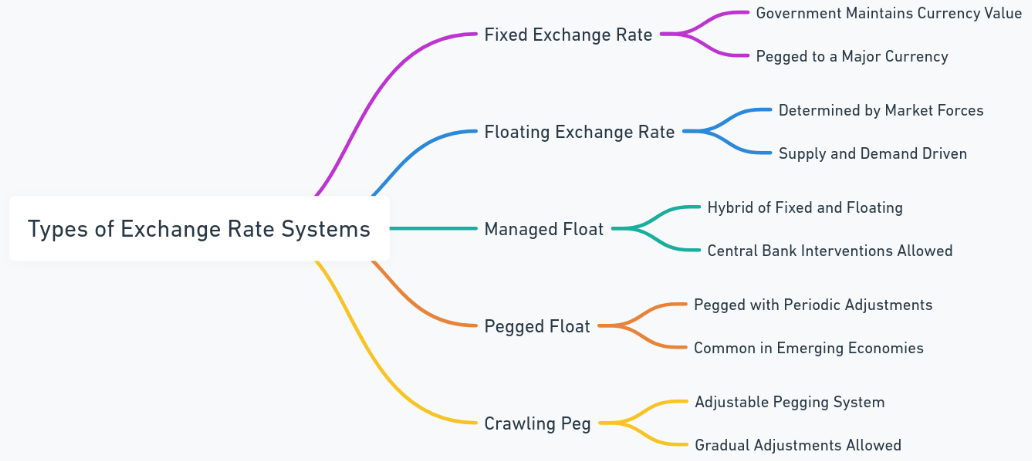

Types of Exchange Rate Systems

Various exchange rate systems are employed globally to control and stabilize currency value. Each system has its unique mechanisms, advantages, and disadvantages.

1. Fixed Exchange Rate System

In a fixed or pegged system, a country’s currency is tied to another major currency, such as the US dollar, or a basket of currencies. Central banks intervene in the foreign exchange market to maintain the pegged rate.

Pros and Cons

- Advantages: Provides stability, controls inflation, and minimizes speculation.

- Disadvantages: Limits flexibility and can lead to artificial inflation.

2. Floating Exchange Rate System

In a floating exchange rate system, currency value is determined by market forces without direct intervention. The rates fluctuate freely based on demand and supply in the global market.

Pros and Cons

- Advantages: Greater flexibility and automatic adjustment to economic shifts.

- Disadvantages: Can be volatile and create unpredictability in international trade.

3. Managed Float or Hybrid System

In a managed float system, market forces determine the exchange rate but with occasional intervention from the central bank to control excessive volatility.

Pros and Cons

- Advantages: Balances stability with flexibility, better suited for managing economic crises.

- Disadvantages: Risk of inconsistency due to unpredictable interventions.

Advantages of Exchange Rate Systems

Exchange rate systems, whether fixed, floating, or hybrid, bring specific advantages that support economic stability and trade facilitation. Here are a few key benefits:

1. Enhanced Trade and Investment

A stable and predictable exchange rate encourages both imports and exports, fostering international trade and attracting foreign investment.

2. Reduced Inflation Risk

A managed or fixed exchange rate system can help reduce the inflation risk by providing consistent purchasing power. This is beneficial in economies with volatile markets and prices.

3. Economic Stability

Countries that maintain stable exchange rates can control the unpredictability associated with their currency. This stability supports long-term economic planning and aids in reducing the cost of borrowing.

Disadvantages of Exchange Rate Systems

While exchange rate systems offer several benefits, they also come with certain disadvantages, impacting both domestic and international markets.

1. Limited Flexibility in Fixed Exchange Systems

Fixed systems may limit the ability of a country to adjust to economic shifts. This rigidity can restrict a government’s response to economic crises and global market changes.

2. Volatility in Floating Exchange Systems

Floating exchange rates are subject to rapid changes due to market forces, which can disrupt the domestic economy and lead to inflationary pressures.

3. Cost of Maintaining Exchange Rates

Countries with managed or fixed systems may face substantial costs related to currency interventions and reserve requirements.

Foreign Exchange Rate FAQs

What is a floating exchange rate system?

A floating exchange rate system is where the currency value is determined by market forces without direct government or central bank intervention.

How does inflation impact foreign exchange rates?

Higher inflation generally leads to currency depreciation, while lower inflation helps in currency appreciation due to increased purchasing power.

Why do central banks intervene in foreign exchange markets?

Central banks intervene to stabilize currency values, manage inflation, and control economic stability, especially in a managed or fixed exchange rate system.

What is the difference between spot rate and forward rate?

The spot rate is the current exchange rate for immediate transactions, while the forward rate applies to future transactions at a pre-determined rate.

How does political stability affect foreign exchange rates?

Countries with stable political environments attract foreign investment, strengthening their currency. Conversely, political instability may lead to currency depreciation due to reduced investor confidence.