When it comes to advancing your career in the finance industry, the choice between FRM vs CFA can be crucial. These two globally respected certifications—Financial Risk Manager (FRM) and Chartered Financial Analyst (CFA)—are often compared by aspiring finance professionals looking to specialize in areas like investment analysis, risk management, portfolio strategy, and more. While both are excellent for upskilling and opening doors to top financial roles, their focus areas differ significantly. This article will help you evaluate which certification aligns best with your career goals in finance by comparing curriculum, difficulty level, job roles, salary, and industry demand.

What is FRM? (Financial Risk Manager Certification)

The FRM certification is a specialized designation awarded by the Global Association of Risk Professionals (GARP). It is recognized as the gold standard for professionals seeking to work in financial risk management roles. The FRM curriculum dives deep into risk models, credit risk, market risk, operational risk, and investment risk. It is ideal for those interested in identifying, analyzing, and mitigating financial risks within banks, hedge funds, asset management firms, and regulatory bodies. Professionals who pursue FRM usually aim to become Risk Analysts, Credit Risk Managers, or Chief Risk Officers (CROs).

What is CFA? (Chartered Financial Analyst Certification)

The CFA certification, offered by the CFA Institute, is widely regarded as the most prestigious investment management credential in the world. Unlike FRM, the CFA course has a broader curriculum that includes investment analysis, equity research, portfolio management, financial reporting, wealth management, and ethical standards. CFA charterholders often pursue roles in investment banking, asset management, equity analysis, and private equity. The CFA designation is ideal for individuals who want a deep understanding of the global financial markets and aspire to make strategic investment decisions.

FRM vs CFA: Curriculum and Focus Areas

The most important distinction between the two certifications lies in their focus and scope. The FRM syllabus is tightly concentrated on risk assessment, modeling, and regulatory frameworks, and it demands strong quantitative and analytical skills. It prepares professionals to manage the internal and external financial risks that affect businesses.

On the other hand, the CFA curriculum is much broader, covering portfolio strategy, valuation techniques, economics, derivatives, and fixed income investments. It’s ideal for those who want to excel in asset allocation, investment banking, or mutual fund management. While FRM is risk-centric, CFA offers a multi-disciplinary overview of the finance world.

| Aspect | FRM (Financial Risk Manager) | CFA (Chartered Financial Analyst) |

| Primary Focus | Risk assessment and management | Investment analysis and portfolio management |

| Core Subjects | Credit risk, market risk, operational risk, risk models | Economics, financial reporting, equity, derivatives, ethics, wealth management |

| Ideal For | Professionals aiming for roles in risk, compliance, and governance | Individuals seeking careers in investment banking, equity research, asset management |

| Program Depth | Deep and narrow focus on risk | Broad and diverse coverage of finance topics |

| Quant Intensity | High – strong statistical and mathematical base required | Moderate – analytical and conceptual understanding needed |

FRM Exam Structure: 2 Parts of Risk Specialization

The FRM exam is divided into two parts. Part I focuses on tools for risk assessment—such as quantitative analysis, valuation and risk models, and financial markets. Part II covers practical application topics like market risk, credit risk, operational risk, and current issues in financial markets. Both parts emphasize real-world case studies and require deep understanding of risk-based decision-making.

The exam is offered in May and November and is considered highly quantitative, making it challenging for non-math backgrounds.

CFA Exam Structure: 3 Levels of Financial Expertise

The CFA exam consists of three levels. Level I tests foundational concepts in finance, accounting, and ethics. Level II focuses on the application of tools in portfolio analysis and valuation. Level III revolves around synthesizing information for portfolio management and client scenarios. It takes around 2.5 to 4 years to complete the CFA program depending on preparation and pass rate.

Unlike FRM, the CFA program integrates ethics deeply into all three levels, preparing you not just for knowledge, but ethical leadership in finance.

| Element | FRM | CFA |

| Number of Levels | 2 Parts | 3 Levels |

| Exam Frequency | May and November (both parts) | Feb, May, Aug, and Nov (Level I), others twice a year |

| Duration to Complete | ~1 to 1.5 years | ~2.5 to 4 years |

| Pass Rate | ~40–50% | ~40% (varies by level) |

| Format | MCQs with case studies | MCQs + case-based vignettes + essay-type (Level III) |

FRM vs CFA: Difficulty Level and Preparation

Both these certifications have been tough in their own way and have differing areas of difficulty. The FRM is heavily quant-based and requires excellent mathematical and analytical reasoning. Given its niche focus on risk models, this add to its challenge, as it is very much targeted. It is for individuals who are good in stats and want to make a career start specializing in quantitative finance.

The CFA, on the contrary, is very deep and wide, covering many areas of finance. The challenge is on the width of topics and retention for application. CFA exams are notoriously difficult on ethical case studies and call for a good time and study discipline.

| Criteria | FRM | CFA |

| Quantitative Difficulty | High – focuses on modeling, probability, and statistics | Medium – focus on understanding, valuation, and financial reasoning |

| Breadth of Syllabus | Narrow but deep | Broad and comprehensive |

| Study Time Estimate | 200–250 hours per part | 300–350 hours per level |

| Mathematical Rigor | Strong requirement for quant background | Balanced approach with qualitative and quantitative skills |

| Key Challenge | Grasping deep quantitative risk concepts | Managing a vast syllabus and preparing ethical case-based answers |

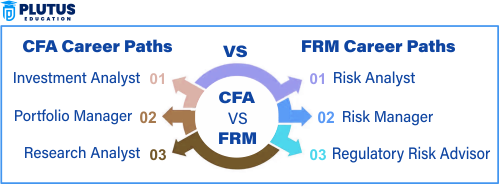

Career Opportunities: FRM vs CFA Jobs

FRM-certified professionals often take up roles like Market Risk Analyst, Credit Risk Officer, Risk Consultant, or Quantitative Analyst. They are highly valued in banks, regulatory bodies, insurance companies, and consulting firms focused on risk and compliance. FRM jobs are more focused and technical in nature.

CFA charterholders, in contrast, enjoy diverse roles such as Investment Banker, Portfolio Manager, Equity Research Analyst, or Wealth Manager. CFA opens doors across asset management, hedge funds, private equity, and investment advisory. It’s a more flexible credential suitable for leadership positions in finance.

| Area of Work | FRM Certification | CFA Certification |

| Primary Roles | Risk Analyst, Risk Manager, Credit Risk Officer, Compliance Manager | Investment Analyst, Portfolio Manager, Equity Research Analyst |

| Industries | Banking, Insurance, Regulatory Bodies, Risk Consulting | Asset Management, Investment Banking, Hedge Funds, Private Equity |

| Entry-Level Titles | Risk Consultant, Quant Analyst | Junior Analyst, Associate Analyst, Financial Analyst |

| Executive Roles | Chief Risk Officer (CRO) | Chief Investment Officer (CIO), Portfolio Strategist |

| Geographical Demand | High in banking hubs: Singapore, Hong Kong, Frankfurt | Global recognition across North America, Europe, Asia |

Salary Comparison: Which Pays More – FRM or CFA?

In terms of salary, both certifications lead to high-paying finance roles, but the pay varies depending on role, experience, and region. FRM-certified professionals typically start at ₹9–12 LPA in India, with senior positions like Chief Risk Officer fetching upwards of ₹30+ LPA.

CFA charterholders usually begin with salaries between ₹6–10 LPA, rising to ₹25–35 LPA for roles in portfolio management and investment banking. Additionally, CFA professionals often enjoy performance-based bonuses, especially in asset management firms.

| Career Stage | FRM Average Salary (INR) | CFA Average Salary (INR) |

| Entry-Level | ₹9 – ₹12 LPA | ₹6 – ₹10 LPA |

| Mid-Level | ₹15 – ₹22 LPA | ₹18 – ₹26 LPA |

| Senior-Level | ₹28 – ₹35 LPA+ | ₹30 – ₹40 LPA+ |

| Bonus & Perks | Often performance-based in risk roles | High variable bonuses in asset management |

| Roles with Highest Pay | CRO, Senior Risk Consultant | Portfolio Manager, Investment Banker |

Global Recognition and Industry Demand

Both certifications have global recognition, but their industry demand differs. FRM is more specialized and highly sought after by firms looking for risk management expertise. It’s also gaining traction with regulatory bodies and governments for roles in compliance and governance.

CFA, on the other hand, is the gold standard in the investment world. From Wall Street to Dalal Street, the CFA designation is highly respected by recruiters in asset management, private equity, and capital markets. CFA charterholders are viewed as well-rounded finance experts.

CFA vs FRM – Which Course Should You Choose?

The decision between FRM vs CFA depends entirely on your career goals and interests. If your ambition lies in managing financial risk, working with quantitative models, or pursuing roles in risk analysis, the FRM certification is your ideal path. It’s a niche program but one with significant value in risk-sensitive sectors.

On the other hand, if your interests are broader—ranging from investment banking to portfolio management, or equity research to financial strategy, the CFA program offers a more diverse range of opportunities. It’s better suited for those aiming for executive leadership roles in financial services or investment firms.

| Aspect | FRM (Financial Risk Manager) | CFA (Chartered Financial Analyst) |

| Full Form | Financial Risk Manager | Chartered Financial Analyst |

| Conducted By | Global Association of Risk Professionals (GARP) | CFA Institute (USA) |

| Primary Focus | Specialization in financial risk management, including market risk, credit risk, operational risk, and liquidity risk | Comprehensive coverage of investment analysis, portfolio management, equity research, economics, and financial reporting |

| Exam Levels | 2 Parts – FRM Part I and Part II | 3 Levels – CFA Level I, II, and III |

| Duration to Complete | Around 1 to 1.5 years (if both parts cleared in first attempts) | Around 2.5 to 4 years depending on preparation and success in each level |

| Eligibility | No strict academic criteria, but background in finance or quantitative fields is beneficial | Minimum of Bachelor’s degree (or final-year student) or 4 years of professional work experience in a relevant field |

| Curriculum Depth | In-depth coverage of quantitative risk topics, models, and global regulatory frameworks | Covers a wide spectrum of finance topics including investment tools, asset classes, ethics, and portfolio strategy |

| Quantitative Rigor | Very high – involves statistics, probability theory, and risk modeling | Medium – strong in finance and analysis, moderate in mathematical intensity |

| Best Suited For | Professionals targeting careers in risk assessment, regulatory compliance, credit analysis, and quant finance | Aspirants looking to build careers in investment banking, asset management, equity research, and financial analysis |

| Job Roles After Completion | Market Risk Analyst, Operational Risk Manager, Credit Risk Officer, Quant Analyst | Portfolio Manager, Equity Research Analyst, Financial Analyst, Investment Banker |

| Exam Difficulty | Considered difficult due to deep focus on quantitative finance and real-world application | Equally tough due to breadth of syllabus and inclusion of complex ethical, financial, and analytical concepts across three levels |

| Exam Frequency | Held in May and November (Part I and Part II) | Level I: Feb, May, Aug, Nov; Level II & III: twice a year |

| Industry Demand | In-demand in banks, credit rating agencies, financial regulators, fintech, and consulting firms | Highly valued by mutual funds, private equity firms, investment banks, hedge funds, and global advisory firms |

| Global Recognition | Globally accepted in risk management and compliance domains | Globally regarded as the gold standard for investment professionals |

| Starting Salary (India) | ₹8 – ₹12 lakhs per annum for freshers or associates | ₹6 – ₹10 lakhs per annum for entry-level analysts |

| Mid-Level Salary (India) | ₹15 – ₹22 lakhs per annum for roles like Risk Manager or Senior Analyst | ₹18 – ₹26 lakhs per annum for roles like Senior Financial Analyst or Investment Associate |

| Senior-Level Salary (India) | ₹30 – ₹40+ lakhs per annum for positions such as Chief Risk Officer, Head of Risk | ₹35 – ₹45+ lakhs per annum for positions like Portfolio Manager, Investment Strategist, CIO |

| Professional Growth | Vertical growth in risk specialization roles; suitable for niche financial governance tracks | Versatile growth in broad investment and leadership roles, including strategy and fund management |

| Time Investment | Moderate – requires focused effort over a shorter duration | High – demands long-term commitment across 3 levels |

| Cost in INR | Approx. ₹90,000 to ₹1,20,000 (USD $1,100–$1,400) excluding prep materials | Approx. ₹2,00,000 to ₹3,30,000 (USD $2,400–$4,000) for all three levels (excluding coaching, travel, and resources) |

| Ethics Emphasis | Low – ethics is not a major part of FRM syllabus | High – ethics is a core pillar, tested in all 3 levels and essential to the CFA Charter |

| Experience Requirement | 2 years of relevant risk or financial experience required for FRM certification | 4,000 hours (approx. 4 years) of relevant work experience required to obtain the CFA charter |

| Certification Earned | FRM Certificate awarded by GARP after clearing both exams and fulfilling work experience | CFA Charter awarded by CFA Institute after clearing all levels and meeting work requirements |

| Long-Term ROI | High ROI in risk-prone sectors like banking, regulatory, fintech, and treasury | Excellent ROI across investment banking, fund management, and global finance roles |

| Can You Pursue Both Together? | Yes – CFA + FRM dual credentials are increasingly popular and highly rewarded in global financial roles | Yes – many professionals combine both to maximize versatility and marketability across finance, risk, and investment verticals |

FRM vs CFA FAQs

Q1. Which is harder – FRM or CFA?

FRM is more quantitative, while CFA is broader. Difficulty depends on your background and strengths.

Q2. Can I pursue both CFA and FRM?

Yes, many professionals pursue both to gain expertise in risk and investment domains.

Q3. What are the salary differences between CFA and FRM?

CFA often has higher earning potential in investment roles, while FRM pays well in risk-focused jobs.

Q4. Which is better for risk management roles?

FRM is better suited for risk management, regulatory, and compliance careers.

Q5. Is CFA worth it for investment banking?

Absolutely, CFA is a top-tier credential for investment banking, asset management, and equity research.