The GDP deflator is one of the most significant indicators for an economy, as it shows price level changes. It functions as an all-round indicator for an inflation or deflation measure, and this deflator provides a measure of price change for all domestically produced goods and services and does not replicate other indices such as the CPI. Through its special formula, the GDP deflator reveals how much of the change in GDP over time is due to price instead of output volume change.

What is the GDP Deflator?

The GDP deflator captures all the changes in the price of all goods and services included in the GDP. That is to say, the measure of inflation or deflation in the economy will come from the GDP deflator. On the other hand, while CPI captures changes in prices for a definite basket of goods, the varieties of goods and services covered stretch to investment goods and governmental services.

Key Characteristics of GDP Deflator

- Broad Coverage: Reflects price changes across all goods and services produced domestically.

- Flexible Composition: Adjusts for changing consumption patterns over time.

- Real-Time Application: Serves as a real-time reflection of inflation based on GDP components.

By understanding the GDP deflator, economists and policymakers can gain insights into how price changes impact economic growth.

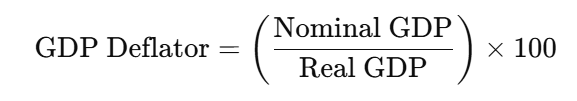

GDP Deflator Formula

The formula of the GDP deflator is very important in economic analysis since it removes the influence of price changes and shows the right view of growth in an economy. Let’s go through the formula again:

- Nominal GDP: Reflects current prices and includes inflation.

- Real GDP: Represents GDP after adjusting for inflation, offering a constant price measure.

Using the deflator, analysts distinguish the portion of GDP growth due to volume increases from the part attributable to price increases.

How to Calculate GDP Deflator?

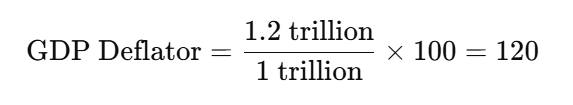

To accurately calculate the GDP deflator, we need both nominal and real GDP data, which represent the GDP measured at current and constant prices, respectively.

- Obtain Nominal GDP: This is a figure obtained by calculating for a specific period at a given time.

- Calculate the real GDP: This figures about GDP that has been discounted in inflation to reflect at constant prices.

- Divide and Multiply: Divide nominal GDP by real one after that multiply by 100 then give out the deflator.

For instance, if a country’s nominal GDP is $1.2 trillion and its real GDP is $1 trillion:

This result indicates a 20% increase in price levels since the base year.

GDP Deflator vs. Consumer Price Index (CPI): What is the Difference?

Though both the GDP deflator and CPI are measures of inflation, they have distinct differences that suit them to different economic analyses.

| Feature | GDP Deflator | Consumer Price Index (CPI) |

|---|---|---|

| Coverage | All goods and services in GDP | Selected basket of goods and services |

| Scope | Excludes imported goods | Includes imports, excluding capital goods |

| Weighting | Dynamic weights (based on GDP components) | Fixed weights (based on a standard basket) |

| Utility | Better for measuring general economic inflation | Better for tracking cost-of-living changes |

The GDP deflator responds to the structure of changes in the composition of the economy’s production and is a fixed basket based on the consumption goods on which the CPI is built, which makes it more reflective of the overall economy while having CPI focused more on the household’s consumption patterns.

Importance of the GDP Deflator in Economic Analysis

The GDP deflator is important to policymakers, investors, and economists because it gives them a comprehensive view of the economy’s price changes. Government fiscal and monetary policies become better formulated through the data from GDP deflator analysis.

Uses of the GDP Deflator:

- Monetary Policy Decisions: They use it to measure inflation and change interest rates.

- Analysis of Economic Growth: It isolates the effects on price level from actual growth in production.

- Investment Planning: It guides investors by providing an inflation-adjusted perspective of the economy.

Advantages and Limitations of the GDP Deflator

Advantages:

- Comprehensive Inflation Measure: It encompasses all output of the domestic economy.

- Measures the Current Patterns of Consumption: Corrects for current economic structure.

- Informative about Policy: It gives guidelines to policymakers to devise control measures for inflation.

Limitations:

- Excludes Imports: This doesn’t account for imported goods, which can also impact inflation.

- Delayed Reporting: Real GDP data can be delayed, limiting timely analysis.

The GDP deflator is one of the more important measures that will determine how much inflation has affected the performance of an economy as a whole. It sets up the concept of nominal and real GDP differently to give clearer insight into growth, irrespective of price variation. This measure allows policymakers and economists to make the right choices in terms of monetary policy, economic analysis, and controlling inflation.

GDP Deflator Formula FAQs

What is the GDP deflator?

The GDP deflator is an economic measure of price level changes, calculated as the ratio of nominal GDP to real GDP.

How is the GDP deflator different from CPI?

While CPI measures price changes based on a fixed basket of goods, the GDP deflator includes a broad range of goods and services produced domestically, excluding imports.

How is nominal GDP related to the GDP deflator?

Nominal GDP is adjusted by the GDP deflator to remove the impact of price changes, giving real GDP.

Why is the GDP deflator important?

The GDP deflator is crucial for analyzing economic inflation, helping to separate price impacts from output volume in GDP growth.

How does the GDP deflator affect investment decisions?

The GDP deflator helps investors assess the real growth of an economy, providing insights into inflation-adjusted economic health.