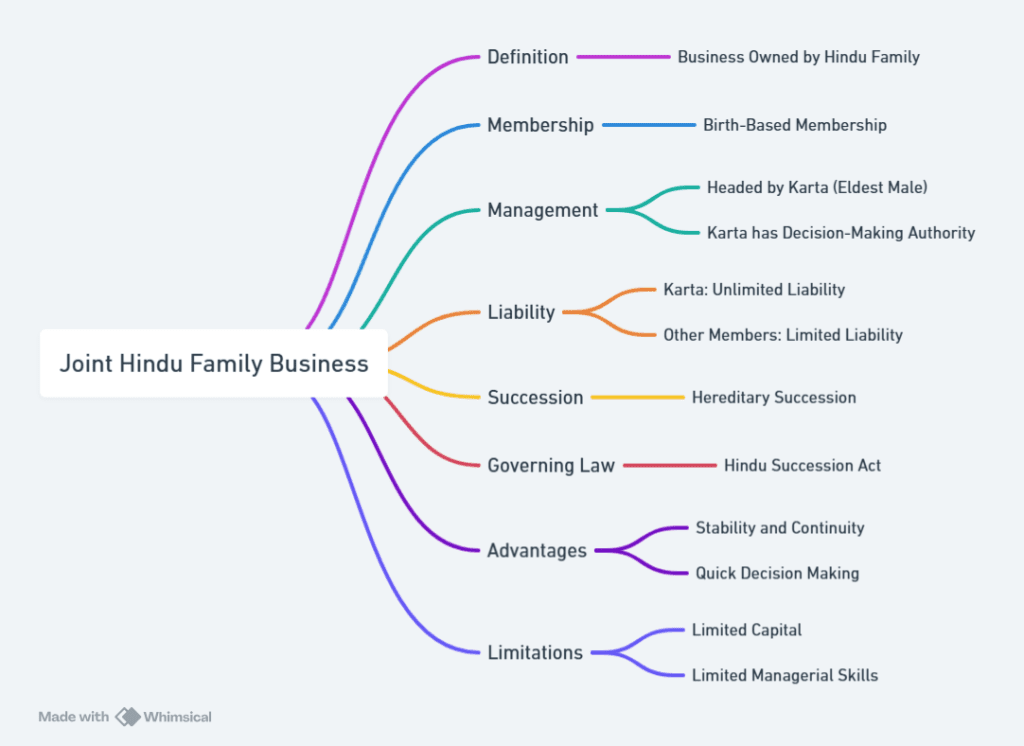

A Hindu Undivided Family business, popularly known as a Joint Hindu Family Business, is one of the special forms of business structure, mainly followed in India among Hindu families. The business is operated under the Hindu Law with the eldest family member called the “Karta,” and all other members of the family become co-partners. This article discusses the meaning, characteristics, key terms, and merits of a Joint Hindu Family Business and discusses its structure, systems, and limitations.

Meaning of Joint Hindu Family Business

The Joint Hindu Family Business is a traditional business model wherein the family members are owners of a Hindu Undivided Family (HUF). In this structure, assets and resources are jointly owned and managed by family members who share profits and liabilities under the Hindu Succession Law. The HUF business model operates under the “Mitakshara” or “Dayabhaga” law schools, wherein every member, called a coparcener, has an undivided right in the family property.

Key Characteristics of Joint Hindu Family Business

The Hindu Undivided Family business has unique characteristics that distinguish it from other business forms.

1. Formation Based on Status

This business form is automatically created at the birth of a child in a Hindu family. Unlike other business forms, no legal process or registration is needed to initiate a Joint Hindu Family Business.

2. Management by Karta

The Karta, or the eldest male member of the family, leads the business, while all other family members or coworkers participate as per their hierarchical status.

3. Liability Distribution

The Karta holds unlimited liability, meaning they are responsible for debts if the business fails. However, other coparceners’ liabilities are limited to their shares in the property.

4. Perpetual Existence

The business continues through generations. Even with the death of the Karta, the business does not dissolve, as a new Karta takes over.

5. Inclusion of Minors as Coparceners

A unique feature is that minors can be coparceners, inheriting rights to family property by birth without direct management responsibilities.

Important Terms Used in a Joint Hindu Family Business

- Karta: The eldest male member who manages the business and financial transactions of HUF.

- Coparceners: All males, minor or major, born in the family who have a share of the property.

- Mitakshara and Dayabhaga Schools: Two different systems of inheritance law. Mitakshara applies to the rest of India, while the Dayabhaga system applies to Bengal and Assam.

Systems Used in a Joint Hindu Family Business

The two major systems governing the HUF business are the Mitakshara and Dayabhaga systems. Both systems lay out inheritance and management laws but differ in coparcener rights.

Mitakshara System

Under this system, each male family member inherits a share by birth, leading to an equal right over the family property. Female members can also become coparceners following the 2005 amendment in the Hindu Succession Act.

Dayabhaga System

Here, the property is passed on after the death of the father and ensures that an individual can own a different share. Thus, making his property more independent. In this system, one may give their share to whom they will. However, in the Mitakshara shares are held within a family by birth.

Merits of a Joint Hindu Family Business

1. Effective Control: There can be quick and effective decision-making without consulting all the members since control is central to Karta.

2. Continuity: It carries on well through generations to maintain stability and ensure perpetual succession.

3. Limited Liability for Members: Members are protected from liability arising out of the business as other family members cannot be charged beyond their share in the family assets, while Karta has unlimited liability.

4. Supportive Family Systems: This form promotes the working and loyalty of family members, which is to preserve and maintain the unit and cultural heritage of a family system.

5. Tax Benefits: HUFs are treated as separate units under the Income Tax Act of India, and this has the added advantage of tax benefits.

Limitations of a Joint Hindu Family Business

While Joint Hindu Family Businesses offer numerous advantages, they also come with limitations.

1. Limited Management Scope: Since Karta has all the power, there may not be enough space for others to provide some inputs or ideas that would affect business growth and innovativeness.

2. Conflicts: Family tussles arising from any decision, profit sharing, and karta’s acts are likely to affect the smooth running of the business.

3. Unlimited Liability to the Karta: The unlimited liability to the Karta makes him liable for debts, which in turn create a heavy financial burden upon the Karta if they are high.

4. Constrained Source of Capital: As it is a family business, it cannot expand the capital and, therefore, may inhibit growth and competitiveness.

5. Dependence on Members’ Skills: The family business depends upon the family members’ expertise, thus limiting the general skill mix and knowledge.

Hindu Undivided Family Business FAQs

What is a Hindu Undivided Family business?

A Hindu Undivided Family business is a family-owned business governed by Hindu law, where members share profits and inherit property collectively, managed by the Karta.

Who can be a Karta in a Joint Hindu Family Business?

The Karta is typically the eldest male member, but in recent times, female members may also become Karta.

What are the benefits of a Hindu Undivided Family business?

This model provides tax benefits, continuity across generations, and centralized control, promoting familial support and unity.

What is the difference between the Mitakshara and Dayabhaga systems?

The Mitakshara system grants inheritance rights by birth, while the Dayabhaga system gives inheritance rights after the father’s death, allowing for more individualized property rights.

Can females become coparceners in a Hindu Undivided Family?

Yes, following the 2005 amendment in the Hindu Succession Act, daughters also have coparcenary rights in the family’s joint property.