The ICMAI full form is the Institute of Cost Accountants of India. Previously known as ICWA (Institute of Cost & Work Accountants of India), it is a premier statutory body responsible for regulating and developing India’s Cost and Management Accountancy profession. It offers the Certified Management Accountant (CMA) course that provides professionals with costing, financial management, and business strategy knowledge. The ICMAI CMA course comprises three levels: Foundation, Intermediate, and Final, covering cost accounting, financial analysis, taxation, and corporate laws. ICMAI CMA, certified worldwide, generates opportunities in manufacturing, banking, consultancy, and government sectors.

What is ICMAI?

ICMAI, or the Institute of Cost Accountants of India, was established to advance and regulate the cost accounting profession in India. The institute provides certification for cost and management accountancy professionals, allowing them to analyze and control business costs effectively. ICMAI is recognized for its contributions to developing strategic cost management skills among professionals. ICMAI’s mission is to foster and promote the highest standards of professional excellence and ethics in cost management.

- Provides certification as a Cost and Management Accountant (CMA).

- Sets standards and guidelines for the accounting practices in India.

- Offers training and education to professionals in cost management and financial analysis.

History of Institute of Cost Accountants of India (ICMAI)

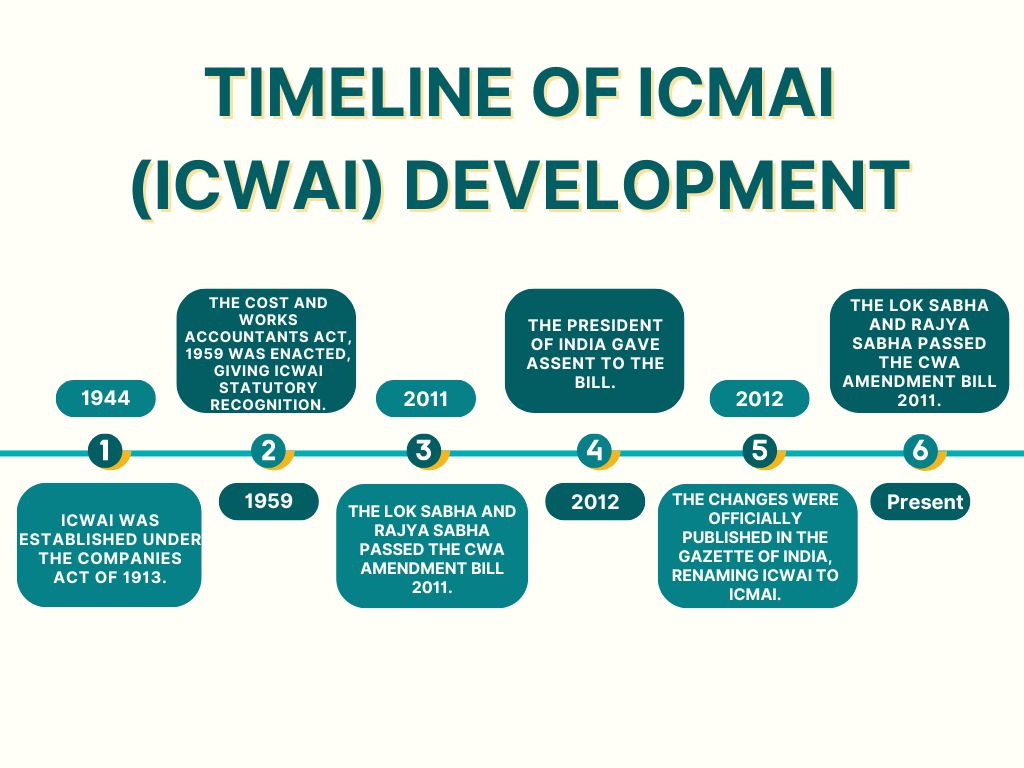

The Institute of Cost Accountants of India (ICMAI), then ICWAI, was formed as a registered limited company on 14th June 1944 under the Companies Act of 1913. It became statutorily recognized when the Parliament of India passed “The Cost and Works Accountants Act, 1959,” on 28th May 1959, vesting ICWAI with powers to regulate cost and management accountancy.

In 2011, both houses of Parliament enacted the CWA Amendment Bill and received the President’s assent on January 12, 2012. The amendments, released on January 13, 2012, changed the name of ICWAI to ICMAI, bringing it in line with international accounting standards.

ICMAI has more than 98,500 active members and plays an essential role in cost management, corporate governance, and financial decision-making across industries. It remains to improve the financial framework of India through its CMA certification and regulation.

What Are Ethical Standards for ICMAI Certified Professionals?

Ethical standards for ICMAI-certified professionals are designed to ensure that members adhere to the highest levels of integrity, transparency, and professionalism. These standards guide the actions and decisions of CMAs, ensuring that their conduct aligns with ethical practices in the financial industry. Ethical standards play a crucial role in maintaining the trust and reliability of the ICMAI community.

- Integrity: Professionals must be honest and straightforward in their professional relationships. They should avoid any behaviour that might discredit the profession or institute.

- Confidentiality: Maintain the confidentiality of client information and use it only for authorized purposes. Avoid disclosing sensitive data unless legally obligated.

- Objectivity: Refrain from allowing bias or conflicts of interest to influence financial judgments or decisions. Ensure that all professional assessments are impartial and fair.

Benefits of Becoming an ICMAI Member

Becoming a member of ICMAI offers numerous benefits to professionals aspiring to excel in cost and management accounting. It provides a prestigious qualification and opens doors to various career opportunities in both public and private sectors. ICMAI certification is a valuable asset for anyone aiming to build a successful career in finance and accounting.

- Professional Recognition: ICMAI-certified professionals are recognized as experts in cost and management accounting. They enjoy a high level of credibility and respect within the finance industry.

- Diverse Career Opportunities: Professionals can work in various roles, including financial analyst, cost controller, auditor, and business consultant. ICMAI membership enhances one’s eligibility for senior-level positions in top organizations.

- Skill Development: ICMAI provides continuous learning opportunities to stay updated with the latest finance and cost management trends. Offers networking opportunities with industry experts and peers.

Eligibility Criteria for ICWAI

The eligibility criteria for ICWAI (now known as ICMAI) outline the qualifications needed to enrol in the Cost and Management Accountancy program. Meeting these criteria is the first step towards achieving the CMA designation. The structured approach ensures that students gain comprehensive cost and management accounting knowledge.

- Foundation Course: Candidates must have passed a recognised board’s 10+2 examination or equivalent. Students awaiting their results can also apply provisionally.

- Intermediate Course: Completing the Foundation course or graduation from any recognized university. Commerce graduates can directly enrol in the intermediate course.

- Final Course: Completing the Intermediate course is mandatory to qualify for the Final level. Students should have adequate practical training to advance to the Final stage.

ICMAI Syllabus

The Certified Management Accountant (CMA) qualification, issued by the Institute of Cost Accountants of India (ICMAI), is highly regarded in cost and management accounting. To qualify as a CMA, candidates must pass three levels of exams—Foundation, Intermediate, and Final—and undergo three years of work experience. This course is focused on core topics like Management Accounting, Cost Accounting, Financial Accounting, Taxation, Cost Audits, GST Audits, Internal Audits, and Corporate Laws. With the successful completion of this program, one becomes a Certified Cost and Management Accountant (CMA), focusing on financial planning and cost control.

ICMAI New Syllabus 2022

The ICMAI syllabus has changed over the years to meet international standards. The new Syllabus 2022, launched in response to India’s New Education Policy (NEP) 2020, strengthens skill development and course learning objectives. In the past, the 2016 syllabus was adopted in line with the International Education Guidelines (IEG) of IFAC to ensure Mutual Recognition Agreements (MRA) under the WTO’s General Agreement on Trade in Services (GATS).

ICMAI Subjects and Examination Process

The CMA course covers core subjects like Management Accounting, Financial Accounting, Strategic Management, Taxation, Corporate Law, Financial Management, Business Valuation, and Operations Management. Candidates with a recognized university degree can enroll directly at the Intermediate Level. Furthermore, students who have passed the Final Examination of the Institute of Company Secretaries of India (ICSI) can apply for paper-wise exemptions under a reciprocal arrangement.

ICMAI Exam Schedule and Results

ICMAI holds CMA exams twice a year, in June and December, at various centers in India and abroad. Results of the June session are announced in August, and those of the December session are announced in February.

Career Opportunities

A certification from ICMAI opens up a wide range of career opportunities in both private and public sectors. CMAs are in demand for their expertise in financial management, cost analysis, and strategic planning. These roles offer excellent growth prospects and competitive salary packages, making the ICMAI qualification highly valuable.

- Financial Analyst: Analyzes financial data to help organizations make informed investment decisions. CMAs in this role assess risks, forecast revenues, and develop financial models.

- Cost Controller: Manages and reduces the company’s operational costs by implementing cost-effective strategies. Works with different departments to monitor and control expenses.

Conclusion

The ICMAI full form represents the Institute of Cost Accountants of India, a leading body for regulating the cost and management accounting profession in India. With its focus on ethical standards, skill development, and professional growth, ICMAI certification provides a solid foundation for a rewarding career in finance. Understanding its eligibility criteria and membership benefits can help aspiring professionals navigate their career paths more effectively.

ICMAI full form FAQs

What is full form of ICMAI?

The full form of ICMAI is the Institute of Cost Accountants of India.

What are the benefits of becoming ICMAI certified professional?

It provides recognition, diverse career opportunities, and continuous skill development in the field of cost management.

Who is eligible for ICMAI CMA Foundation course?

Candidates who have passed the 10+2 examination or equivalent are eligible for the Foundation course.

How does ICMAI support ethical standards?

ICMAI promotes integrity, confidentiality, and objectivity in its ethical guidelines for certified professionals.

What are career options after ICMAI certification?

Career options include roles such as Financial Analyst, Cost Controller, Internal Auditor, and more in various sectors.