Businesses in India face tough competition, rising costs, and limited resources. They must take smart steps to manage money, reduce waste, and increase profit. That’s why cost accounting is more important today than ever before. Cost accounting helps companies understand their total costs, fix the correct selling prices, control spending, and increase profits. In simple words, cost accounting is a system that records, measures, and reports the cost of making goods or services. So, what is the importance of cost accounting? It clearly shows where money is going, which product is making a profit, and which department is not. It helps business owners, managers, and even students make better decisions. When a company knows its real cost, it can plan its budget better, set correct prices, control inventory, and avoid losses.

What Is Cost Accounting? — Meaning and Objectives

Before we go deeper, we must know what cost accounting means. It is different from financial accounting. It has its own rules, goals, and reports.

Cost accounting means the process of recording, classifying, analyzing, and controlling the costs of a business. It tells how much money a company spends to produce each unit of product or service. It does not follow fixed formats like financial accounting. Instead, it focuses more on internal use and future planning.

Cost accounting aims to:

- Find the cost per unit of a product or service.

- Help in controlling costs and increasing efficiency.

- Assist in planning and budgeting.

- Support decision-making for pricing and investments.

- Reduce waste and idle time.

Every business, manufacturing or service, can use cost accounting to manage better. For example, a bakery can use cost accounting to track the cost of each cake, including flour, electricity, and labour. This helps the owner know if they are making a profit or not.

Types of Cost Accounting

Businesses use different types of cost accounting methods based on their needs.

1. Standard Costing

It uses fixed costs (called standards) and compares them with real costs. The difference is called variance. Variance helps find performance gaps.

2. Marginal Costing

It separates fixed and variable costs. It helps in decisions like taking a new order when there is extra capacity.

3. Activity-Based Costing (ABC)

It assigns costs to activities like packing, moving, or quality checking. Then, it assigns these costs to products based on how much activity is used.

4. Job Costing

This method is used when products are made on order. Each job or order has its cost record.

5. Process Costing

It is used when continuously producing goods like paper, cement, or oil.

Each method has its tools and reports, but the main aim is always the same—to know the real cost and save money.

Each method helps in knowing costs in a better and more detailed way.

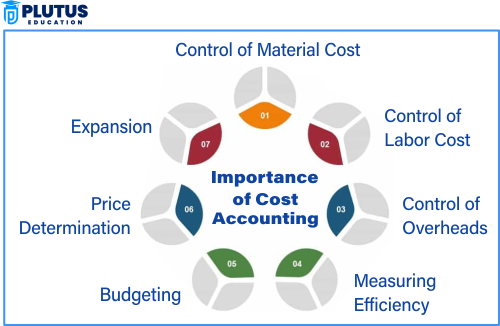

Importance of Cost Accounting in Business Operations

Cost accounting plays a significant role in running a business properly. It helps in making wise decisions, saving money, and increasing profits. Here are the most essential points that explain why every business should use cost accounting:

1. Helps Fix the Right Selling Price

Cost accounting is significant in helping a business fix the correct selling price. Every product or service has many costs, like raw materials, wages, rent, and electricity. A company may set the wrong price if it doesn’t know the real cost. Cost accounting helps find the cost per unit so the business adds a good profit and sets the right price. This way, the price is not too high to lose customers or too low to lose money. It helps businesses remain profitable and fair in a competitive market.

2. Controls and Reduces Extra Costs

Every rupee spent on business matters. Cost accounting tracks all costs, such as material, labour, fuel, and transport. If something is costing more than planned, the report will show it. This helps the manager take quick action to stop extra spending. For example, if more raw material is being used than needed, the manager can check the reason and fix it. Cost accounting helps find small leaks that become significant losses. It helps keep spending in control and save money regularly.

3. Helps in Budget Planning

Budgeting is essential in every business, big or small. Cost accounting gives past data that helps in planning for the future. It shows how much the business usually spends and earns. With this information, managers can create a monthly or yearly budget. They can plan where to spend more and where to save. Cost accounting gives numbers, not guesses. That’s why budgets made using cost data are more accurate. Good budgeting helps the business grow safely and handle sudden problems better.

4. Checks Profit for Each Product

Not all products give equal profit. Some products may sell well but provide very little income. Cost accounting checks the cost and selling price of each product. Then, it shows the exact profit per item. The business can stop or improve if any product gives a loss or a significantly low margin. This helps the company focus on products that provide higher profit. It also helps remove or change products that are not worth continuing. This keeps the business innovative and focused.

5. Improves Business Decisions

In business, every small or big decision can affect success. Cost accounting gives real facts and figures to support those decisions. For example, if the company thinks of buying a new machine or starting a new branch, it needs to know the cost and possible return. Cost accounting compares different options and helps choose the better one. It also helps in decisions like reducing prices, increasing salaries, or outsourcing work. With precise data, managers make fewer mistakes and better plans.

6. Reduces Waste of Material and Labor

Wastage is a significant hidden cost in many businesses. Cost accounting helps find waste in material, worker time, or energy use. It shows how much input is used and how much output is gained. If the difference is too high, it points to waste. It also indicates whether workers are sitting idle or misusing machines. The company can improve its process, train workers, and manage machines by reading this data. This increases productivity and reduces waste.

7. Helps in Performance Check

Every team and department in a company must work well. Cost accounting tracks performance by checking how much they spend and what results they give. The report will show if one department uses more money but gives poor output. The company can then train that team or change the process. At the same time, if another team is working well, they can be rewarded. This keeps all teams alert and active. It creates healthy competition and improves the work environment.

8. Useful in Setting Business Targets

To grow, every business must set clear targets. These targets can be for sales, profits, or production. Cost accounting helps set real and practical targets using past data. When teams know their targets, they can plan better. It also helps track how close the company is to meeting its goal. If the company is behind the target, it can take steps early. This keeps the business moving in the right direction and motivates teams to give their best.

9. Supports Growth and Expansion

Growth is not just about selling more. It’s also about choosing the right product, market, and time. Cost accounting shows which product gives the highest return. It also shows where spending less provides better output. Based on this, the business can plan where to invest next. For example, it can open a new store, buy better machines, or expand into new markets. When growth is based on cost data, it is safer and more successful.

10. Helps in Tax Planning and Loan Approval

While cost accounting is not legal like financial accounts, it still supports tax planning. It shows real business costs. This helps avoid wrong tax entries and fines. Also, when the company wants a loan, the bank asks for income and expense details. Cost reports give precise data and help the loan get approved. It shows that the business is stable and well-managed.

11. Improves Efficiency and Planning

When a company uses cost accounting, it gets precise numbers for every activity. It sees which step takes more time or money. This helps in making small changes that give significant results. Managers can plan, workers perform better, and machines are used better. Over time, these changes improve total output and lower costs. It makes the business stronger from the inside.

12. Essential for Competitiveness

In India and other countries, the market is full of choices. People go to other sellers if a company doesn’t offer the right price. Cost accounting helps set a price that is low enough to attract customers and high enough to make a profit. It also allows the business to reduce waste and offer better services. All these things make the company better than others in the same market.

Methods of Cost Accounting

Every business is different. Some sell products, others provide services. So, they need different ways to calculate their costs. That’s why cost accounting uses various methods to match the type of business. These methods help know the price of making a product or delivering a service. Let’s look at the primary methods of cost accounting one by one.

1. Job Costing Method

Job costing is used when a company makes products based on orders. Each job may need other materials, machines, or time.

Example: A printing company that prints wedding cards for different customers uses job costing. Each order has a separate cost sheet.

2. Process Costing Method

Process costing is used when the same product is made in large quantities and continuously well for industries where production happens in stages.

Example: A soap factory producing thousands of bars daily uses process costing.

3. Batch Costing Method

Batch costing is like job costing, but a whole batch is produced instead of one item. This method is practical when products are made in groups, each group is the same.

Example: A bakery that bakes 500 chocolate cakes in one go uses batch costing.

4. Contract Costing Method

Contract costing is used in big jobs that take a long time and money, like construction projects. Each contract has its cost record.

Example: A construction company that builds roads or bridges uses contract costing.

5. Operating Costing Method

Operating costing is used in service industries. It calculates the cost of giving a service, not making a product.

Example: A bus company uses operating costs to determine the cost per kilometre of each bus.

6. Unit Costing Method (Output Costing)

Unit costing is used when identical products are made in large numbers. The cost per unit is the primary focus.

Example: A pen-making factory uses unit costing to determine each pen’s cost.

7. Multiple Costing Method

Multiple costing uses a mix of two or more methods. It is used when a product needs many small parts or processes.

Example: A car company uses multiple costs for parts and process costs for assembly.

Advantages of Cost Accounting for Small and Large Businesses

No matter the size, all businesses gain from cost accounting. It gives more control and helps the owner understand issues of money better.

Benefits for Small Businesses

Small businesses often run on tight budgets. They can’t afford significant losses. Cost accounting helps them avoid mistakes.

- Better pricing

Small shops and local businesses can fix the right price using unit cost data.

- Lower waste

They can track where resources are getting wasted and stop it.

- Improve profits

Even small savings in cost increase total profit over time.

Benefits for Large Enterprises

Big companies have multiple departments and factories. Cost accounting helps track each unit’s performance.

- Department-wise control

Managers can see which unit uses more power or labour and take action.

- Project costing

It helps track the cost per project or batch. This helps in knowing which product is more profitable.

- Data for shareholders

Internal cost reports help the company show investors growth plans and cost control.

FAQs: Importance of Cost Accounting

Q1. What is cost accounting in simple words?

It is a method to record and study how much a business spends to make a product or service.

Q2. Why is cost accounting important for students?

It helps build financial skills, and many accounting, business, and finance jobs need this knowledge.

Q3. Can small businesses use cost accounting?

Yes. Even small shops or startups can use basic cost sheets to control costs and plan profit.

Q4. What is the biggest advantage of cost accounting?

It helps control spending and increase profits by tracking every rupee spent.

Q5. What is the biggest disadvantage of cost accounting?

It may need expert staff or software to manage it properly, which can be costly.