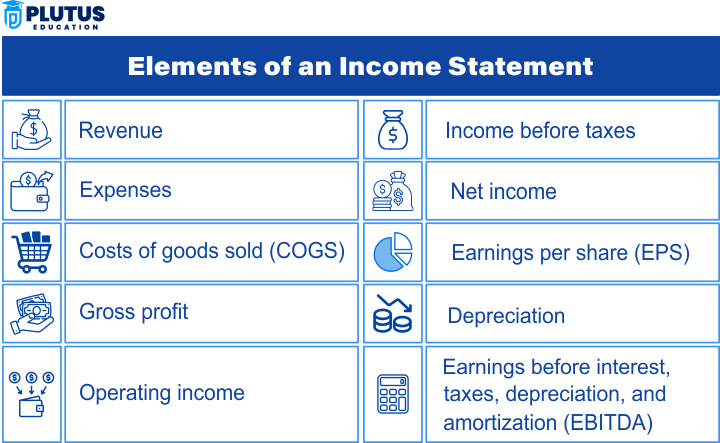

An income statement is a financial statement that lays out a company’s revenue, expenses, gains, and losses during a set accounting period. IAe insights into various aspects of a business, including its overall profitability and earnings per share. An income statement is one of the central financial statements a firm uses to find how it has been doing within a period. A concise summary of the income and expense discernment of a business is called “profit and loss account”, in other words, reflecting the gains or losses incurred in the course of doing business or on an accounting basis. It is a summary of the standing of any corporation regarding profit or loss for its investors, shareholders, and managers for decision-making. For example, deriving some insights into the operation or health of a business from an income statement would require people to even understand how to read an income statement. An income statement summarizes a company’s revenue and expenses over a specified period to reveal net profit or loss, referred to as the profit and loss statement. The article opens up the format of an income statement, its essential components, examples from real life, differences between income statements and the balance sheet, etc.

What is an Income Statement?

To begin with, a structured income format is used to show what happens to the revenue over time through net income. An income statement or profit and loss statement depicts a company\’s revenues and expenses for a particular period. The income statement discusses the financial performance of the organization during a specified period, usually fiscal quarter or year, with respect to the revenue earned and the costs incurred to generate that revenue, ultimately resulting in a profit or a loss for that business. Small businesses often rely on the profit and loss statement to assess their financial performance quickly.

An income statement answers the fundamental question: How much money did a company make?

The income statement is important because it shows the generation of sufficient revenues to pay for the costs incurred, provides valuable information regarding profitability, and measures a company’s working efficiency. Income statements also help stakeholders, investors, and analysts determine if a business is managing its expenses properly and if it can generate goods or services.

- Revenue is defined as total income obtained from selling goods or services. Profitability, whether operating or non-operating, is derived from the earning of revenue. These will include direct expenses, essential cost of goods sold, indirect expenses, and operating expenses.

- Net Income: The final figure on the income statement is revenue less operating profitability of the firm.

Another significant element of the income statement is important financial ratios, including gross profit margin, operating margin, and net profit margin, as well asd operational efficiencies of the income statements.

Types of Income Statement

An income statement can be prepared in different formats depending on the complexity of a business’s operations and reporting preferences. The two most common formats are the Single-Step Income Statement and the Multi-Step Income Statement. While both present the same final result—net income or net loss—they do so using different levels of detail. Understanding the difference is essential for accurate financial analysis, regulatory compliance, and investor communication.

Single-Step Income Statement

A Single-Step Income Statement is the simplest format used primarily by small businesses, service companies, or entities with a straightforward revenue model. As the name suggests, this format uses a single calculation step to determine net income:

Net Income = Total Revenues – Total Expenses

Key Features

- Combines all revenues (operating and non-operating) in one section.

- Lists all expenses (operating and non-operating) in another section.

- No differentiation between the cost of goods sold, operating expenses, or other types of expenses.

- No subtotals like gross profit or operating income are shown.

Example of a Single-Step Income Statement

| Items | Amount ($) |

| Revenues | |

| Sales Revenue | 200,000 |

| Interest Income | 5,000 |

| Total Revenues | 205,000 |

| Expenses | |

| Cost of Goods Sold | 80,000 |

| Salaries Expense | 40,000 |

| Rent Expense | 10,000 |

| Utilities Expense | 5,000 |

| Income Tax Expense | 15,000 |

| Total Expenses | 150,000 |

| Net Income | 55,000 |

When to Use?

- Businesses with simple operations

- Entities that don’t require detailed financial breakdowns

- Sole proprietors and small companies for internal use

Multi-Step Income Statement

A Multi-Step Income Statement provides a more detailed breakdown of revenues and expenses, helping readers better analyze a company’s operating efficiency and profitability. It separates operational and non-operational items, making it ideal for larger businesses or corporations.

Key Features

- Separates revenues and expenses into operating and non-operating sections

- Highlights key performance metrics:

Gross Profit = Revenue – COGS

Operating Income = Gross Profit – Operating Expenses

Net Income = Operating Income + Other Income – Other Expenses

- Offers greater financial transparency

Example of a Multi-Step Income Statement

| Items | Amount ($) |

| Revenue | |

| Sales Revenue | 500,000 |

| Cost of Goods Sold (COGS) | (200,000) |

| Gross Profit | 300,000 |

| Operating Expenses | |

| Salaries and Wages | (100,000) |

| Rent | (25,000) |

| Marketing | (20,000) |

| Utilities | (5,000) |

| Total Operating Expenses | (150,000) |

| Operating Income | 150,000 |

| Other Income/Expenses | |

| Interest Income | 10,000 |

| Loss on Sale of Equipment | (5,000) |

| Net Income | 155,000 |

When to Use?

- For public companies and large enterprises

- When investors, regulators, or analysts require detailed insight

- For companies with multiple income streams and cost layers

Key Differences Between Single-Step and Multi-Step Income Statements

While both single-step and multi-step income statements aim to report a company’s net income, they differ in structure and level of detail. Understanding these differences helps determine which format best suits a business’s reporting and analysis needs.

| Aspect | Single-Step | Multi-Step |

| Complexity | Simple | Detailed |

| Audience | Internal use, small businesses | External reporting, investors, regulators |

| Presentation | One step to calculate net income | Multiple subtotals (gross profit, operating income, etc.) |

| Separation of Items | No separation of operating/non-operating items | Clear separation |

| Best For | Service businesses, sole proprietors | Manufacturers, retailers, and large corporations |

Income Statement Format

The correct income statement format-whether single or multi-step-would depend on the complexity of the business and its needs for reporting. With a standardized format for the income statement in place, the same criterion for consistency throughout the reporting periods and industries will be guaranteed. The income statement format is intended to spotlight a company’s financial performance for a certain period like a month, quarter, or year. The income statement is designed to capture the incomes earned and expenses incurred for that stunningly defined point in time.

- Revenue or Sales: It is that amount of sale or income a company generates. Revenue consists of any income a company derives from its sales of goods and services.

- Cost of goods sold (COGS): It includes direct costs that go into the actual manufacturing of goods or services sold by the company. Such direct costs may include raw materials, direct labor, and manufacturing expenses. The result of minus COGS from revenue is gross profit.

- Gross profits: It refer to the revenue less COGS. Gross profit is an important indication of how efficiently a firm produces its goods and services.

- Operating Expenses: These costs include rent, utilities, salaries, advertising, and other general expenses incurred in normal business activities. They exclude the cost of producing the goods.

- Operating Income: This is gross profit less operating costs. It’s the amount a company earns from its normal activities.

- Other income and expenses: These are separate from normal operational income and expenses and include income from interest, profit/loss from investment, or one-off transactions, such as selling an asset.

- Net Income: The bottom line on an income statement, and usually the most important single measure of how well a company has done because it represents the profit/loss generated for the shareholders after taking all costs, taxes, and non-operating items out from revenues.

| Items | Amount |

| Revenue | $500,000 |

| Cost of Goods Sold (COGS) | $200,000 |

| Gross Profit | $300,000 |

| Operating Expenses | $150,000 |

| Operating Income | $150,000 |

| Other Income | $20,000 |

| Net Income | $170,00 |

Comparative Income Statement Format

The comparative income statement format lets one compare financial performance year by year or look for trends in performance. This comparative income statement format shows the company performance through time. It brings in working with revenues, expenses, and net income. This enables companies to make historical performance-based decisions through juxtaposed data.

- Column 1: The Structure of a Comparative Income Statement One Income Statement for the Current Year: This is the most recent income statement, typically for the current year, comprising all the normal entries, including revenues, COGS, and net income.

- Column 2: Income Statement of the Last Year: The second column is that of the previous year income statement to view that last period in an easy comparison to one another, stating whether growth or decline exists.

- Column 3: Difference/Variance The difference or the variance for the two periods is contained in this third column. This column will be able to help follow any improvement, realize a problem, and track trends.

| Description | Current Year | Previous Year | Variance |

| Revenue | $1,000,000 | $900,000 | +$100,000 |

| Cost of Goods Sold (COGS) | $400,000 | $350,000 | +$50,000 |

| Gross Profit | $600,000 | $550,000 | +$50,000 |

| Operating Expenses | $300,000 | $250,000 | +$50,000 |

| Operating Income | $300,000 | $300,000 | $0 |

| Other Income | $10,000 | $15,000 | -$5,000 |

| Net Income | $310,000 | $315,000 | -$5,000 |

The comparative income statement format helps managers and stakeholders identify whether the business is improving or facing financial challenges.

Difference Between Balance Sheet and Income Statement

The balance sheet and the income statement are key financial statements, but they differ in their purposes and the information presented. The profit and loss statement is one of the three core financial reports, alongside the balance sheet and cash flow statement

The balance sheet is more concerned with the financial position of a company at a given point in time, while the income statement is a summary of the financial performance of a company over a period. Let’s break down the key differences:

| Aspect | Income Statement | Balance Sheet |

| Purpose | Shows profitability over a period. | Shows financial position at a specific point in time. |

| Time Frame | Covers a period (e.g., monthly, quarterly, yearly). | Represents a snapshot at a single moment in time. |

| Focus | Revenue, expenses, profits/losses. | Assets, liabilities, equity. |

| Key Components | Revenue, expenses, net income. | Assets, liabilities, shareholders’ equity. |

| Usefulness | Evaluate the company’s finances | Evaluate the company’s financial position. |

| Formula | Revenue – Expenses = Net Income. | Assets = Liabilities + Shareholders’ Equity. |

| Frequency | Typically prepared quarterly or annually. | Prepared at a specific time (e.g., end of year). |

In a way, both of these statements are related, but the income statement details the flow of revenues and expenses over time, while a balance sheet at any given time states what the company owns and owes.

Income Statement vs Cash Flow Statement

The income and cash flow statements are among the standard financial reports, but they have opposite purposes. The income statement deals with profitability over a specified time, and the cash flow statement deals with actual receipts and payments in cash by the business. The analysis of both these reports helps evaluate earnings from the perspective of the company’s liquidity and financial stability.

| Aspect | Income Statement | Cash Flow Statement |

| Purpose | Shows profitability over a period | Shows actual cash inflow and outflow |

| Focus | Revenues and expenses | Operating, investing, and financing cash activities |

| Time Frame | Covers a set period (e.g., monthly, quarterly, annually) | Covers the same period as the income statement |

| Includes Non-Cash Items | Yes (e.g., depreciation, amortization) | No (only actual cash movements) |

| Key Output | Net Income (Profit or Loss) | Net Cash Flow (Positive or Negative Cash Movement) |

| Helps Assess | Profitability and performance | Liquidity, solvency, and cash management |

| Used By | Investors, management, analysts | Lenders, investors, CFOs, and finance teams |

Income Statement Example

An example income statement provides an actual picture of how such a financial statement is laid out and how the components work together. Let’s have a more detailed example using a sample business:

| Items | Amount |

| Revenue | $1,200,000 |

| Cost of Goods Sold | $500,000 |

| Gross Profit | $700,000 |

| Operating Expenses | $300,000 |

| Operating Income | $400,000 |

| Other Income | $20,000 |

| Net Income | $420,000 |

In this case, the income statement is straightforward in showing that the company had $1,200,000 in revenue. After deducting the direct costs of production and COGS, the company has a gross profit of $700,000. After deducting operating expenses, the company has an operating income of $400,000. Next, after adding other income, the net income for the period will be $420,000. This is a profitable business, but the true value of an income statement is in its ability to provide insights into a company’s financial health and operational performance.

Income Statement FAQs

1. What is an income statement?

An income statement is an accounting report that presents a company’s revenues, expenses, and profits during an accounting period. It is useful to measure the profit margins and operational performance of the company.

2. Why is the income statement an important document?

The income statement indicates whether a company is earning a profit or incurring a loss. The document assists in making decisions for managers, investors, and creditors by providing a picture of the financial health.

3. What is the difference between gross profit and net income?

Gross profit is revenue minus the cost of goods sold, showing profit from core operations. Net income is profit after all expenses, taxes, and non-operating items are deducted.

4. What are the types of income statement formats?

The two main types of income statements are single-step and multi-step. The single-step presentation is the simplest, while the multi-step offers a more extensive analysis of operating versus non-operating activities.

5. How frequently is an income statement prepared?

The frequency of preparation for income statements depends on the nature of the business and regulatory requirements, hence monthly, quarterly, and annually. Public firms are mandated to report on them quarterly and annually.