Income tax is the most important form of tax that every earning person in India must pay to the government. This tax is taken from a person’s income and is used to fund national development. From building roads to paying for army defense, from running government schools to launching health schemes, every rupee collected through income tax helps in managing the country’s economy. Whether a person is a salaried employee, a businessman, a professional like a doctor or lawyer, or someone who earns rent or interest – all such people fall under the scope of income tax, provided their annual income crosses a minimum threshold called the basic exemption limit. The Indian income tax system follows a progressive tax model, where people who earn more pay more tax as a percentage of their income. However, the government also gives opportunities to taxpayers to reduce their tax burden through deductions, exemptions, and rebates.

What is Income Tax?

Income tax is a compulsory payment made by every individual or organisation who earns income above a certain limit. It is called a “direct tax” because it is paid directly by the person who earns the income. Unlike indirect taxes like GST, which are collected during purchase of goods and services, income tax is based on how much you earn during a financial year. This tax must be paid to the government once every year by filing a return, which shows how much income you earned and how much tax you paid.

In India, income tax is governed by the Income Tax Act, 1961. The department responsible for collecting and managing it is the Income Tax Department, under the Ministry of Finance. Every financial year, which runs from 1st April to 31st March, people who earn money above a certain limit are required to calculate their tax, apply deductions if any, and file a return with the government. The process of reporting is called filing an Income Tax Return (ITR).

Key Terms in Income Tax

- Assessment Year (AY): The year in which income tax is assessed and paid.

- Financial Year (FY): The year in which income is earned.

- Gross Total Income: Total income before deductions.

- Taxable Income: Income left after applying all deductions.

- Income Tax Return (ITR): Form submitted to declare your income and tax paid.

What are the Tax Slabs in India?

In India, the government follows a slab system to decide how much income tax a person has to pay. This means different levels (or slabs) of income are taxed at different rates. As your income increases, the percentage of tax you have to pay also increases. This system is known as progressive taxation, and it is designed to make tax collection fair and balanced. People who earn more contribute more to the government’s resources.

There are two types of tax regimes in India: the old regime and the new regime. The old regime offered various tax deductions under different sections like 80C, 80D, and others. The new regime, on the other hand, has lower tax rates but removes most deductions and exemptions.

Here is a simple look at the tax slabs under the new regime for the financial year 2024-25:

| Income Range | Tax Rate |

| Up to ₹3,00,000 | Nil |

| ₹3,00,001 – ₹6,00,000 | 5% |

| ₹6,00,001 – ₹9,00,000 | 10% |

| ₹9,00,001 – ₹12,00,000 | 15% |

| ₹12,00,001 – ₹15,00,000 | 20% |

| Above ₹15,00,000 | 30% |

In the old regime, the basic exemption limit changes based on your age:

- For individuals below 60 years: ₹2.5 lakh

- For senior citizens (60–80 years): ₹3 lakh

- For super senior citizens (above 80 years): ₹5 lakh

You can choose between the two regimes each financial year while filing your ITR. Salaried people can switch every year, but business owners can switch only once in a lifetime.

Who Has to Pay Income Tax in India?

Anyone who earns above the exemption limit is required to pay income tax. This applies to both individuals and organizations. However, different rules apply based on factors such as age, income type, and residential status. The Income Tax Act defines several classes of taxpayers and their duties.

In the case of individuals, if your total annual income (after deductions) is more than ₹2.5 lakh under the old regime, or ₹3 lakh under the new regime, you are liable to pay income tax. This includes students who earn through part-time jobs, freelancers working online, and retired persons receiving pension or interest income.

The following people must pay income tax in India:

- Salaried individuals working in government or private companies

- Self-employed professionals like doctors, lawyers, and freelancers

- Businessmen and entrepreneurs running their own businesses

- People earning rent from property or land

- Investors earning interest, dividend, or capital gains

- Non-resident Indians (NRIs) if they earn income in India

It is important to note that income from all sources is combined while calculating tax. If the total is more than the limit, the person must file ITR and pay tax. Students, women, and pensioners also come under this rule if their total income exceeds the allowed exemption.

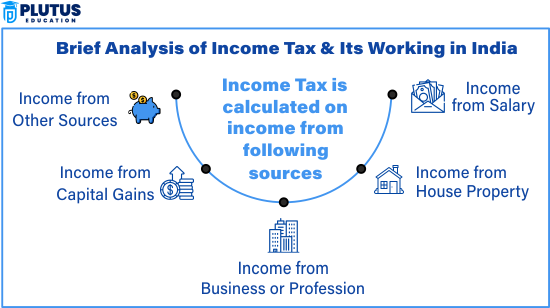

Five Heads of Income Under Income Tax Act

For proper calculation, the Income Tax Act has divided income into five heads. Each head defines a different type of income and has different rules for deductions and exemptions. When filing your return, you must mention income under each head clearly.

1. Income from Salary

This includes all money received by an employee from an employer. It covers basic pay, dearness allowance, HRA, bonuses, commissions, and allowances. Salary income also allows certain benefits like:

- ₹50,000 standard deduction

- HRA exemption if living in rented house

- Transport and meal allowance in specific cases

2. Income from House Property

If you own a building or land and earn rent from it, the earnings fall under this head. Even a second house that is vacant is taxed based on notional rent. You can claim:

- 30% standard deduction

- Municipal tax paid

- ₹2 lakh interest deduction for home loan under Section 24(b)

3. Income from Business or Profession

People who are self-employed, run businesses, or practice professions (like medicine, law, architecture) fall under this head. You pay tax on net profit, after deducting business expenses such as salaries, rent, utility bills, and depreciation on machines.

4. Income from Capital Gains

When you sell an asset such as property, gold, shares, or mutual funds for a profit, that profit is taxed under capital gains. These are of two types:

- Short-term capital gains (STCG) for assets held less than 36 months

- Long-term capital gains (LTCG) for assets held longer than 36 months

Tax rate depends on the asset type and duration.

5. Income from Other Sources

This includes all residual incomes like:

- Interest on fixed deposits and savings account

- Dividends from shares

- Winnings from lottery or games

- Gifts exceeding ₹50,000

You must include these while filing ITR and pay tax as applicable.

Deductions Under Income Tax

Deductions reduce your taxable income. The Income Tax Act provides many sections under which you can claim deductions and save money legally. These deductions are especially useful under the old tax regime.

The most commonly used deductions are:

| Section | Deduction Type | Maximum Limit |

| Section 80C | LIC, PPF, EPF, ELSS, tuition fees | ₹1.5 lakh |

| Section 80D | Health insurance premium | ₹25k – ₹75k |

| Section 24(b) | Interest on home loan | ₹2 lakh |

| Section 80E | Education loan interest | No upper limit |

| Section 80CCD(1B) | NPS contribution | ₹50,000 (extra) |

By planning your savings under these sections, you can reduce the amount of tax you need to pay. Students can especially benefit by encouraging their parents to invest in tax-saving options like PPF and ELSS.

How to File Income Tax Return (ITR)

Filing your Income Tax Return (ITR) is a yearly duty. It is a process in which you tell the government how much income you earned, what tax you paid, and how much refund (if any) you are due. Today, filing is fully online and paperless.

Step-by-Step Guide to File ITR:

- Register on the Income Tax e-Filing Portal

Visit www.incometax.gov.in and create an account using PAN. - Choose Correct ITR Form

- ITR-1: For salaried persons

- ITR-2: For capital gains and more than one property

- ITR-3: For business income

- ITR-4: For presumptive taxation scheme

- ITR-1: For salaried persons

- Fill in Your Income Details

Add all incomes under the five heads. Declare deductions under 80C, 80D, etc. - Check Tax Payable

The portal automatically calculates your tax. Verify the amount. - Submit and Verify ITR

Submit online and verify using Aadhaar OTP or bank account. Verification must be done within 30 days.

Filing your return on time helps avoid penalties under Section 234F and keeps your financial record clean.

Income Tax FAQs

Q1. Is income from a part-time job taxable?

Yes. Any income earned is taxable if total income crosses ₹2.5 lakh.

Q2. What is the due date to file ITR?

For individuals, it is 31st July of the assessment year.

Q3. What happens if I don’t file ITR?

You may pay penalties and won’t get a refund or loan approvals.

Q4. Is savings interest taxable?

Yes, but up to ₹10,000 is exempt under Section 80TTA.

Q5. Can I change the tax regime every year?

Yes, salaried people can choose the regime each year while filing ITR.