Internal auditing is an element of critical importance to organizational governance, risk management, and operational efficiency. It acts as a watchdog that monitors the internal processes, controls, and mechanisms of risk management and ensures that they are performing in line with expectations. In the context of this independent and objective activity, various operations of an organization are evaluated to determine their effectiveness, its management assured, and continuous improvement created. This audit also acts as an internal vanguard in fraud detection, regulatory controls, and improving business efficiency.

Internal Audit Meaning

Internal audit is the checking and assessing of an organization’s governance and risk management processes and procedures over internal controls against the regulatory requirements and the organization’s objectives. These differ from external audits in that the latter mainly examine financial accuracy and stipulated conditions. Internal audit scrutinizes the operational and strategic processes within the organization. It is not just a matter of compliance but efficient operation, or managing risks to achieve something through its objective.

Internal auditors act as a link between management and the board by providing independent reviews of controls through objective assessments. Regular auditing helps organizations optimize efficiencies, minimize risks, and avoid fraud.

What is the Role of Internal Audit?

The role of internal audit has gradually evolved into an operational function and further extended towards strategic and risk management domains. Below are the main roles of internal audit within an organization:

Risk Management

Internal auditing aids in the identification, assessment, and prioritization of risks that may further jeopardize the organization. Such risks may include financial risks, operational risks, compliance risks, among others, and reputational risks. Having identified the risks, the internal auditors then go ahead to assess whether adequate controls are put in place to mitigate the risks.

Internal Control Assessment

Internal auditing helps in ascertaining the proper working of controls in an organization. This includes financial reporting and operation and IT functions that are supposed to deliver and produce in line with organizational goals. If there are weaknesses or inefficiencies in internal controls, an internal audit would make suggestions on how they should be effective.

Operational Efficiency

An internal audit not only helps in identifying financial and compliance issues but also deals with the efficiency of the operations of an organization. It does this by checking if or not the resources are used efficiently. That is, streamlined processes of the organizations, that departments work in a cost-efficient manner, and so forth. Discovering inefficiencies allows the organization to cut costs and increase productivity with the help of internal audits.

Fraud Prevention and Detection

The internal audit is one of the best lines of defense against fraud through examining financial records, reviewing transactions, and ensuring that controls function well. It acts as an interface in the detection of fraudulent activity prevention within the organization.

Compliance with Regulations

Another function of an internal audit is compliance with laws, regulations, and industry standards, including everything from financial regulations to health and safety standards to some environmental laws. Routine audits guarantee that the organization will remain compliant and thus avoid heavy penalties.

Types of Internal Audits

Internal audits can be diverse based on what the auditors are supposed to focus on. Each type of audit has its goal of addressing different areas and, therefore, accomplishing different objectives while ensuring all aspects of the organization are checked and improved.

Compliance Audits

Compliance audit ensures that an organization complies with all internal policies, industry standards, and any kind of legal restrictions. Audits of compliance assist organizations in maintaining compliance with laws and regulations such as SOX, ISO standards, and other statutory requirements. Compliance audits also check on adherence to internal policies related to ethics, workplace safety, and environmental regulations.

- Objective: The purpose of a compliance audit is to assess the compliance of an organization with external regulations and internal policies.

- Outcome: I prepare thorough compliance reports indicating areas not in compliance, making recommendations for the necessary corrective action.

Operational Audits

Operational audits require a focus on the efficiency and effectiveness of processes used within an organization. An audit in this category would delve into more than mere compliance. Hence, track the internal operations of the organization to see if resources are being utilized to effectively produce what the organization aims at.

- Purpose: Identify waste and bottlenecks with opportunities for improvement to make it operate in a better way.

- Outcome: Process improvement suggestions, cost-cutting, and productivity increase.

Financial Audits

Like external financial audits, which are essentially concerned with how to ensure the correctness of financial statements, internal financial audits go deep into procedures and controls in the financial process. Internal financial auditing ensures that financial information is correct, financial processes are effective, and financial resources are appropriately used.

- Purpose: To help ensure accurate financial reporting and the validity of financial transactions.

- Outcome: Reports that identify potential financial risks and areas in which the controls over financial activities can be improved.

IT Audits

In the digital age, information technology plays a crucial role in every organization. IT audits assess the effectiveness and security of the organization’s IT infrastructure, ensuring that systems are secure, data is protected, and the IT environment supports the organization’s objectives.

- Objective: To evaluate the reliability and security of IT systems, data integrity, and cybersecurity measures.

- Outcome: IT audit reports identify vulnerabilities, recommend security enhancements, and suggest improvements in IT governance.

Environmental Audits

Environmental audits evaluate the organization’s adherence to environmental laws and regulations. These audits focus on sustainability practices, waste management, pollution control, and the organization’s overall impact on the environment.

- Objective: To ensure compliance with environmental regulations and promote sustainability.

- Outcome: Recommendations to reduce environmental impact and improve sustainability initiatives.

Difference Between Internal Audit and External Audit

Though both internal and external audits aim to assess an organization’s operations, they differ in several critical aspects:

| Aspect | Internal Audit | External Audit |

|---|---|---|

| Purpose | Focuses on improving internal controls, risk management, and governance. | Focuses on providing an independent opinion on financial statements. |

| Scope | Broad, covering operational, financial, and IT areas. | Primarily focuses on financial accuracy and statutory compliance. |

| Reporting | Reports to management and the audit committee. | Reports to shareholders and regulatory authorities. |

| Frequency | Conducted continuously throughout the year. | Typically conducted annually. |

| Focus | Ensures organizational efficiency, fraud detection, and risk management. | Ensures accurate financial reporting. |

Internal Audit Process

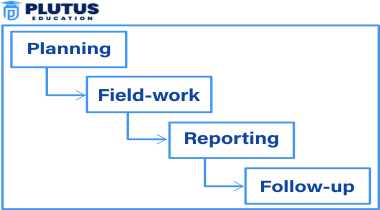

The internal audit process follows a structured approach to ensure a thorough review of internal controls, risk management, and governance processes. Below are the steps involved:

1. Planning

An internal auditor would define the scope, objectives, and time to be used in conducting the audit during the planning phase. This stage is notable for the following:

- Identification of the objectives: The management and the auditors collaborate to identify the areas of concern

- Risk assessment: Areas tagged risky are also subjected to review.

- Defining an audit scope: The actual process, departments or systems to be reviewed are specified by the auditors.

2. Fieldwork

Fieldwork involves data collection, interviews, and testing. Internal auditors look over the record, transaction, and control to determine whether they are in existence or are working effectively. The primary activities undertaken include:

- Document review: Comparing the policies, procedures, and financial records.

- Observation: In this case, the auditor may observe processes that are going to understand the flow of work workflow.

- Interview: This is the key personnel with an insight into the procedure and control.

3. Reporting

Once the fieldwork is completed, auditors compile their findings into a report that outlines:

- Audit findings: Details of identified issues or deficiencies.

- Risk implications: The potential risks posed by each issue.

- Recommendations: Suggestions to improve internal controls, processes, or governance.

4. Follow-up

After submission of the audit report, a follow-up phase is provided to ensure that recommendations become effective. Thereafter, following reviews by the auditors can be targeted at determining whether corrective measures have been implemented.

Internal Audit Reports: The 5 C’s

A report of the internal audit becomes well-structured and is hence, actionable to know how an organization improves its working. Typically, the 5 C’s framework is followed for reporting most internal audits:

- Condition: The weakness or deficit was described during the audit.

- Criteria: The benchmark or standard against which the condition was judged.

- Cause: The underlying reason for the deficiency.

- Consequence: The impact or potential risk associated with the issue.

- Corrective Action: Recommendations to address the problem and mitigate risk.

What Are the Professional Standards in an Internal Audit?

International auditing standards ensure professionalism, objectivity, and integrity for internal auditors. A few frameworks or guidelines govern the internal audits:

- Institute of Internal Auditors (IIA) Standards: These standards reflect principles of integrity, objectivity, confidentiality, and competency.

- ISO Standards: ISO standards act as an organized approach to auditing if internal audits are associated with quality management or environmental practices.

- COSO Framework: It is one of the most accepted frameworks in the risk assessment and management and internal controls assessment.

These standards will ensure that the work of internal audits is adequate, reliable, and useful to the organization.

Conclusion

Internal audit is not just compliance-based. It is much more of a support tool for organizational growth by identifying risks, improving controls, and enhancing operational efficiency. In so doing, internal auditors ensure professionalism in giving insight that supports the enhancement of adaptation to change in environments and regulatory compliance and achieving objectives.

Internal Audit FAQs

How does internal audit differ from external audit?

Internal audit focuses on improving internal processes, while external audit evaluates financial statements for accuracy and statutory compliance.

What are the key roles of internal audit?

Key roles include risk management, internal control evaluation, operational efficiency, fraud detection, and regulatory compliance.

What is an operational audit?

An operational audit reviews the efficiency and effectiveness of business operations, identifying areas for process improvement and cost reduction.

What are the five C’s in an internal audit report?

The five C’s are Condition, Criteria, Cause, Consequence, and Corrective Action, which structure the findings and recommendations of the audit.

Why are IT audits important in today’s business environment?

IT audits ensure that an organization’s IT infrastructure is secure, reliable, and supports overall business objectives, protecting against data breaches and operational disruptions.