The Internal Rate of Return (IRR) is a capital budgeting financial measure that calculates the profitability of an investment. It is the discount rate at which an investment’s Net Present Value (NPV) equals zero. The IRR assists companies in making decisions on whether to undertake a project or not, depending on anticipated returns. The higher the IRR, the more profitable the investment. Nevertheless, there are limitations in the internal rate of return technique, such as the assumption of reinvesting at a constant rate. This article investigates the formula for IRR, its application, examples, and limitations.

What is Internal Rate of Return?

Internal Rate of Return (IRR) is that discounting rate which makes the present value of future cash flows into the project equal to the initial investment. The IRR is, in other words, the rate at which a project will break even point on an NPV basis. Companies apply IRR to compare investment propositions and choose the ones with the best returns.

An increased Internal Rate of Return (IRR) increases the investment’s desirability. Given that IRR is independent of the form in which investment comes, it serves to compare and rank a group of several investments on an analogous scale. Out of investments that are equally appealing, one having the greatest IRR will mostly be the desired one to select.

Internal Rate of Return Formula

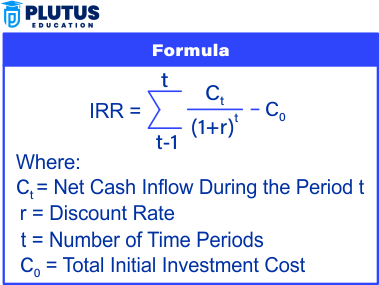

The IRR does not have a direct formula like other financial metrics. Instead, it is calculated by setting the Net Present Value (NPV) to zero and solving for the discount rate. The general IRR equation is:

Internal Rate of Return Example Calculation

A firm is proposing to buy some new equipment of ₹60,00,000. The life of the asset is estimated as four years, and it would yield ₹20,00,000 per annum in profits. In the fifth year, it would be sold for a scrap value of ₹8,00,000.

Meanwhile, another option of investment promises a 12% return rate, which is above the hurdle rate of the company, i.e., 9%. So that the company can utilize its capital in the best possible manner, it should compare both.

Applying the IRR formula from Excel (=IRR()), the internal rate of return for buying equipment would be computed at 15%. Since that rate is in excess of the hurdle rate as well as higher than the alternate investment, then it makes business sense to have the company proceed with buying equipment.

| Year | Cash Flows (₹) | Present Value of Cash Flows (₹) |

| 0 | -60,00,000 | -60,00,000 |

| 1 | 20,00,000 | 17,39,130 |

| 2 | 20,00,000 | 15,12,290 |

| 3 | 20,00,000 | 13,14,160 |

| 4 | 20,00,000 | 11,43,620 |

| 5 | 28,00,000 | 13,93,800 |

| NPV | 0 | |

| IRR | 15% | |

The above table indicates that when the discount rate is 15%, the Net Present Value (NPV) equals zero, which verifies the IRR. The project is financially feasible because the IRR is greater than the hurdle rate of 9%.

What is Internal Rate of Return Used For?

A key metric for evaluating investor profitability is the internal rate of return (IRR). IRR calculation is often used by businesses and investors in capital project evaluation, investment options comparison, and financial viability analysis before proceeding with a decision.

Capital Budgeting

The internal rate of return in capital budgeting is useful in various ways.IRR is helpful for corporations to make a decision either to accept or reject the investment project. The higher the IRR, the more profitable the project. IRR is compared with a required rate of return by businesses. In another example, if a project has 15% IRR and the required return is 12%, the company is saying that they will accept that project over the one that has only 10% IRR.

Comparing Investment Options

Investors use IRR to compare several potential investments and choose the best one. Its benefits help businesses determine where to spend their money for the best payouts. If it has two factory expansion plans, it will choose the factory expansion project with a higher IRR because it is expected to yield greater profitability in the long term.

Private Equity and Venture Capital Decisions

Investors and venture capital firms use IRR to determine potential gain before investing in startups and private companies. In investing, IRR serves as a reliable guideline, as high IRR means higher expected profits. To illustrate, a venture capital firm may only take the risk and invest in startups with an IRR above 20% in order to minimize their financial risk whilst also maintaining their return.

Determining Cost of Capital

The IRR is compared with the weighted average cost of capital (WACC) to evaluate efficiency. If IRR is higher than WACC, the investment will likely be profitable. This is used by businesses to see if a project will produce a greater return than the cost of financing it. It also helps companies keep financially well-off and prevents them from sinking into losses.

Real Estate and Infrastructure Investments

Real estate developers and infrastructure companies use the IRR method to evaluate the long-term profitability of projects. It guarantees that expenditure on properties, roads, and buildings yields returns that match the initial costs. For example, a property developer planning construction of an apartment project will only proceed if the IRR is at least 18%. A higher IRR validating better long-term development.

Disadvantages of IRR

Within investment analysis, the internal rate of return (IRR) provides a very helpful figure, but also some limitations that could yield incorrect decisions. By learning its limitations, businesses can utilize more accurate results when calculating financial decisions such as Net Present Value (NPV) or Modified Internal Rate of Return (MIRR).

Assumes Reinvestment at IRR

IRR also assumes that all future cash flows from a project are reinvested at the same rate as the IRR itself. The truth is that the business reinvests cash at various rates, generally below the IRR. This assumption has the potential to unrealistically inflate returns, yet may not deliver realistic profitability of the activity.

Ignores Project Scale

IRR provides the return in percentage and does reflect, only, the profitability of a project. An absolute profit of a small project with a high IRR may have less value than a project with a lower IRR but vastly higher overall profits. Before going for any investment decision, companies should check on IRR and total profit.

Cannot Compare Projects with Different Timeframes

Comparing projects with different durations is not a good fit for IRR. For example, a 5 year project may have a higher Internal Rate of Return (IRR) than a 10-year project, thus making direct comparison infeasible. A long-term project with a lower IRR can still yield more profit than a short-term project with a higher IRR.

Multiple IRRs for Non-Conventional Cash Flows

Multiple IRR associated with even cash flow change If a project has cash flows that alternate between positive and negative, it can lead to multiple IRRs. That leaves the decision making in confusion because the IRR formula can have multiple possible return rates. Instead, businesses rely on Modified IRR (MIRR) or Net Present Value (NPV) to derive better results.

Internal Rate of Return FAQs

What is the internal rate of return formula?

IRR is calculated using the formula: =∑Ct/(1+IRR)t−C0

What is the internal rate of return method?

The IRR method aids in analyzing investment profitability by determining the discount rate, which will make NPV equal to zero.

What are the advantages and disadvantages of the internal rate of return?

The advantages include that it is simple to compare projects. The disadvantage is that it makes unrealistic reinvestment rates.

What is a good IRR for investment?

A good IRR varies with industry norms and risk considerations, but a higher IRR is generally better.

Why does IRR sometimes return multiple values?

If a project has fluctuating cash flow signs (+/-), it can generate more than one IRR, which creates confusion.