In any quest for careers in finance, accounting, and money and credit management, there is a legitimate wonder about the qualifications globally acquired and accepted in other countries. ACCA, the Association of Chartered Certified Accountants, is a recognized international qualification. The most pertinent question that pops up in the minds of an individual as they come out into the job market is: How valuable is ACCA in Canada? There are particular routes and recognition guidelines for this. In Canada, ACCA members can pursue opportunities in various accounting and finance roles, but the profession is regulated by CPA Canada. To practice as a Chartered Professional Accountant in Canada, ACCA members usually need to go through a mutual recognition agreement (MRA) or a bridging program, depending on the province. While ACCA itself is highly regarded by employers, aligning with CPA Canada credentials enhances career prospects, particularly in regulated public practice. This makes understanding the ACCA-to-CPA pathway crucial for those aiming for long-term careers in Canada.

Is ACCA Equivalent to a Degree in Canada?

In most places, ACCA is accepted as equivalent to a university degree in Canada, but mainly at some level, depending on the context in which you compare it. In some ways, ACCA is not directly recognized as a university degree but equated to a postgraduate qualification in most aspects.

- Educational Comparability: In Canada, a ACCA qualification is equivalent to a bachelor’s degree in accounting or finance. More so, even some universities in Canada give concessions to the students qualified with the ACCA, which means they can continue their higher education from a postgraduate level with advanced standing.

- Accreditation and Credential Recognition: Services like World Education Services (WES) are used by Canada to examine foreign credentials. According to WES, among others of this kind, the status of ACCA is different in different cases. Generally, it will be evaluated as equivalent to a Canadian degree or high-level diploma.

Key Points to Remember

- While it does not replace the award of a university degree granted from a Canadian institution, an ACCA qualification is surely worth millions in the eyes of most employers.

- In the vast majority of cases, people with an ACCA qualification have advanced standing when coming to Canada to pursue further academic qualifications.

Is ACCA Recognised in Canada?

Yes, ACCA is recognized in Canada, but there are specific regulations and pathways for practising as a Chartered Accountant in the country.

- Provincial bodies: The accounting profession in Canada is regulated at the provincial level, with organizations such as CPA Ontario, CPA Alberta, and so on. These are primarily bodies recognizing ACCA qualifications through Mutual Recognition Agreements (MRAs) or some other avenues.

- Mutual Recognition Agreement (MRA): ACCA and CPA Canada had a mutual recognition agreement and a pathway for ACCA members to become CPA members in Canada. This has been recently updated, so there are now a couple of requirements that must be satisfied by ACCA before the CPA designation is granted.

Steps to Recognition

- Qualification Evaluation: Members of ACCA might be asked to evaluate their qualifications against the regulations under Canadian authorities.

- Bridging Courses: After the evaluation, ACCA professionals could be asked to take additional courses or pass exams depending upon the standards set by CPA.

- Practical Experience: Relevant work experience in accounting or finance may also be needed to obtain the CPA designation.

ACCA is recognized in over 180 countries, making it one of the most widely accepted accounting qualifications globally.

Can You Pursue ACCA in Canada?

Yes, you can pursue ACCA in Canada by studying through ACCA’s global network of approved learning partners or through self-study.

- Learning Partners: ACCA has learning partners that are local Canadian educational institutions offering courses and training to prepare you for the ACCA exams. The learning partners provide resources and coaching so that you meet ACCA’s global standards.

- Exam Centers: The ACCA qualification is offered in several locations across Canada, ensuring students’ flexibility to study in their locality either online or in person.

- Eligibility: To enrol in the ACCA course, an individual must possess an essential educational qualification analogous to a high school diploma. Mature students with appropriate work experience can also join the course.

Key Points to Remember:

- ACCA can be pursued directly in Canada with the same curriculum as in any other country.

- You can study through ACCA’s approved learning partners or self-paced online learning.

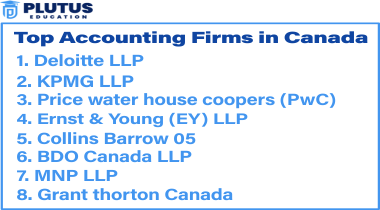

Top Hiring Firms in Canada for ACCAs

Several multinational firms and major Canadian companies value ACCA qualifications highly and frequently hire ACCA-qualified professionals.

| Company | Sector | Location |

|---|---|---|

| Deloitte | Audit and Consulting | Toronto, Vancouver, etc. |

| Ernst & Young (EY) | Advisory, Assurance | Montreal, Calgary |

| KPMG | Audit and Taxation | Toronto, Ottawa |

| PwC (PricewaterhouseCoopers) | Financial Services | Vancouver, Toronto |

| RBC (Royal Bank of Canada) | Banking and Finance | Nationwide |

| Scotiabank | Investment Banking | Toronto, Calgary |

- Career Prospects: Such firms would provide ACCA-qualified professionals with career opportunities in financial analysis, tax consultancy, and management accounting.

- High Demand: Employer demand for widely recognized accreditations such as ACCA remains at its peak across the finance and consulting industries.

Key Points to Remember:

- Top accounting firms in Canada actively seek ACCA professionals for their global experience and knowledge.

- ACCA opens doors to various roles in finance, consultancy, and more.

Conclusion

Since ACCA is not equivalent to a degree in Canada, it is a professional qualification that has developed a lot of scope for career growth. It has been accepted and recognized by employers and the provincial regulatory bodies of Canada; this means that professionals with an ACCA degree can easily merge into the financial institutions of Canada. Pursuing the ACCA in Canada is entirely possible. It presents structured and respectable pathways toward an acclaimed qualification, which today is a precious way to deal with the challenges of competitive job markets.

ACCA Opportunities in Canada FAQs

Is ACCA considered a degree in Canada?

No, ACCA is not considered a degree in Canada. However, it is often treated as equivalent to a postgraduate qualification or a high-level diploma.

What is the process to convert ACCA to CPA in Canada?

ACCA members must have their qualifications assessed, complete any required bridging courses, and demonstrate relevant work experience to convert to CPA in Canada.

Can I work in Canada with an ACCA qualification?

Yes, many Canadian companies, especially in the finance sector, recognize ACCA qualifications, and you can work in various roles such as financial analyst and more.

Do Canadian universities offer exemptions for ACCA?

Yes, some Canadian universities provide exemptions for ACCA-qualified individuals, allowing them to pursue Master’s programs with advanced standing.

Is ACCA a good qualification for immigrating to Canada?

ACCA is a valuable credential for professionals looking to immigrate to Canada, especially in finance, accounting, and business consultancy roles.