Choosing the best career after BCom (Bachelor of Commerce) is important to optimize salary potential and achieve consistent career advancement. The business and finance industries provide various career options that suit the varied skill sets and interests of BCom graduates. From management accounting and financial analysis jobs to investment banking and consulting jobs, these jobs guarantee high salaries and provide great career growth opportunities. Read on to discover which careers have the best potential for a bright future after BCom.

Career After BCom in Different Sectors

With an understanding of the wealth of options, graduates of BCom are in a position to carve a path to a good and successful career. The various options available after b.com include the following. The private and public sectors both provide a wide range of choices.

| Sector | Roles and Certifications Needed | Salary Range | Key Features |

|---|---|---|---|

| Banking | Probationary officers, relationship managers | ₹5 LPA to >₹12 LPA | High earning potential requires certifications |

| Finance | Financial analysts, investment bankers, CFA, FRM | ₹4 LPA to >₹15 LPA | Broad opportunities suitable for teaching or business |

| Insurance | Actuaries, claims analysts, risk managers | ₹3 LPA to ₹8 LPA | Stable, growth in a career requires certifications |

| Accounting | Junior accountants, Chartered Accountants (CA), CPA | ₹2.5 LPA to >₹10 LPA | Stability, legal compliance, progression to CFO |

| Taxation | Tax consultants, GST practitioners, BAT | ₹3 LPA to ₹7 LPA | Intellectual, analytical, expanding scope due to GST |

| Wealth Management | Financial advisors, portfolio managers, CFP | ₹5 LPA to >₹15 LPA | Long-term client relationships, financially rewarding |

| Commerce | Teachers (BEd, UGC NET), entrepreneurs | ₹3 LPA to variable | Broad opportunities, suitable for teaching or business |

| Education | Specializations in MCom, MBA, CA, CMA, ACCA | ₹7 LPA to ₹10 LPA | Enhances job prospects and specialization |

| Government Services | Income tax officers, civil servants | ₹4 LPA to ₹6 LPA | Benefits like pensions, housing, stability |

Jobs After BCom

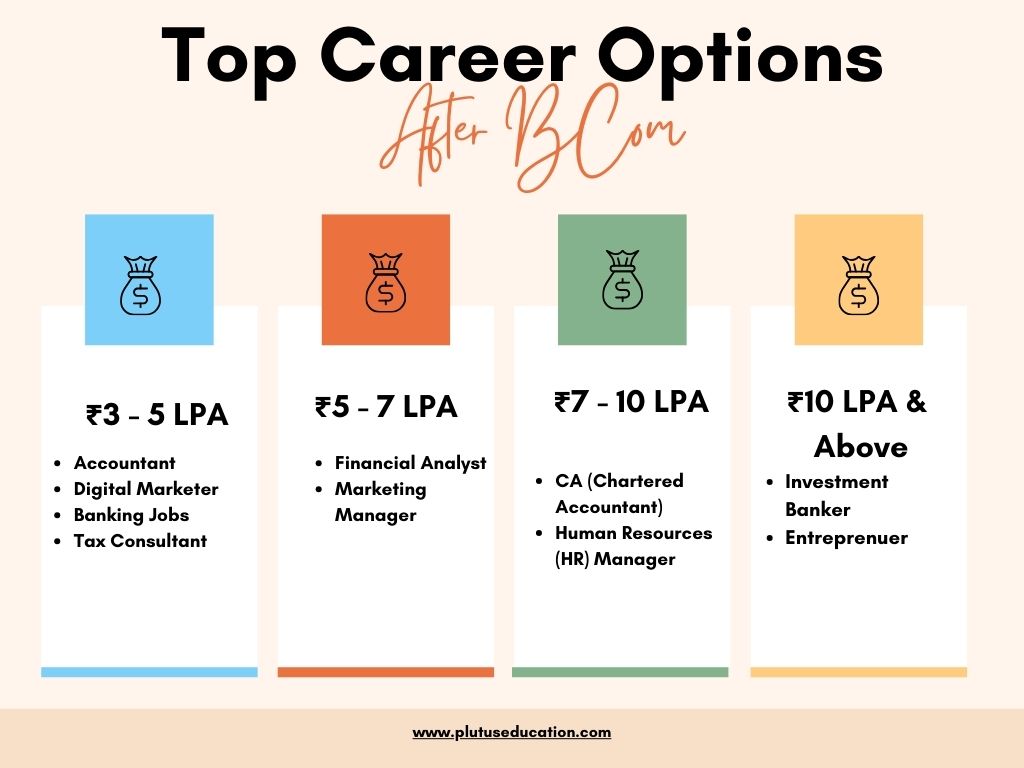

From classic roles in accounting and finance to newer careers such as data analytics and digital marketing, employment opportunities are hardly scarce in commerce. Some of the most successful career paths for bcom graduates are as follows:

| Job Role | Average Salary (₹/Year) | Best For | Skills Required |

| Accountant | ₹3-6 LPA | Commerce Students | Tally, Excel |

| Financial Analyst | ₹5-12 LPA | Finance & Investments | CFA, Excel |

| Digital Marketer | ₹3-10 LPA | Marketing Careers | SEO, Google Ads |

| Investment Bankers | ₹10-₹30 LPA | Financial modelling, M&A advisory | Analytical skills |

| Banking Jobs | ₹3-10 LPA | Commerce Students | Numerical & reasoning ability |

| CA | ₹8-30 LPA | Accounting & Finance | CA Certification |

| Marketing Managers | ₹5-12 LPA | Marketing Career | SEO, Google Analytics |

| Entrepreneur | Highly Variable | Business | Business, Adaptability |

| Tax Consultant | ₹3.5-8 LPA | Finance & Investments | CPA, Tax Laws |

| HR Managers | ₹4-10 LPA | Management | Excel, MBA |

Accountant

An accountant is essential for ensuring the accuracy of financial documents, compliance with regulations, and efficient operations in many sectors. They handle tax preparations, audits, and budgeting within organizations.

- Job Role: Manage financial records, prepare and analyze budgets, and perform audits.

- Eligibility Criteria: BCom degree; certifications like CA or CPA enhance prospects.

- Average Salary: ₹3 LPA to ₹6 LPA

- Skills Required: Precision, confidentiality, numerical skills, and expertise in accounting software.

- Top Companies Hiring: Deloitte, PwC, EY, KPMG.

Financial Analyst

Financial analysts provide insights and guidance on investment decisions based on market trends and financial data analysis. They work across banking, corporate sectors, and consultancy firms.

- Job Role: Analyzing financial data, forecasting market trends, and advising on investment strategies.

- Eligibility Criteria: BCom degree; further qualifications like CFA or MBA preferred.

- Average Salary: ₹4 LPA to ₹8 LPA

- Skills Required: Analytical skills, understanding of financial markets, proficiency in data analysis tools.

- Top Companies Hiring: Goldman Sachs, Morgan Stanley, Accenture.

Digital Marketer

Digital marketers drive brand awareness and lead generation through digital channels. They strategize and execute marketing campaigns on social media, emails, and websites.

- Job Role: Designing and managing online campaigns, SEO/SEM, and content strategy.

- Eligibility Criteria: BCom degree with a specialization or certifications in digital marketing.

- Average Salary: ₹3.5 LPA to ₹7 LPA

- Skills Required: SEO/SEM, data analytics, creativity, and strategic planning.

- Top Companies Hiring: Google, Facebook, digital marketing agencies.

CA (Chartered Accountants)

Chartered Accountants are highly respected in business and finance, with expertise in accounting, auditing, and tax matters. They hold positions in audit firms, corporate finance, and consultancy.

- Job Role: Auditing financial statements, financial advising, and tax planning.

- Eligibility Criteria: Completion of CA exams after BCom.

- Average Salary: ₹7 LPA to ₹15 LPA

- Skills Required: Expertise in finance, ethical judgment, and strategic thinking.

- Top Companies Hiring: All major audit and consultancy firms, including Deloitte and EY.

Investment Banker

Investment bankers help companies and governments manage financial assets, raise capital, and provide financial consultancy. They work in deal structuring, mergers, and acquisitions.

- Job Role: Financial modelling, deal structuring, M&A advisory.

- Eligibility Criteria: BCom, preferably with an MBA or similar qualification.

- Average Salary: ₹10 LPA to ₹30 LPA

- Skills Required: Analytical skills, expertise in financial instruments, and strong negotiation skills.

- Top Companies Hiring: J.P. Morgan, Barclays, Credit Suisse.

Banking Jobs

Banking jobs hold various roles, such as loan officers, bank tellers, and branch managers, providing stable career options with growth potential.

- Job Role: Managing customer accounts, financial advising, and transaction handling.

- Eligibility Criteria: BCom degree; additional certifications may be required for higher roles.

- Average Salary: ₹3 LPA to ₹10 LPA

- Skills Required: Customer service, attention to detail, numerical ability.

- Top Companies Hiring: HDFC, SBI, ICICI.

Tax Consultant

Tax consultants ensure clients comply with tax regulations and benefit from allowable tax strategies. They work for both corporations and individual clients.

- Job Role: Plan taxes, prepare tax returns, and consult on tax laws.

- Eligibility Criteria: BCom in Accounting or Taxation; additional certifications like ACCA or CFA.

- Average Salary: ₹3.5 LPA to ₹8 LPA

- Skills Required: In-depth knowledge of tax laws, analytical skills, and attention to detail.

- Top Companies Hiring: PwC, Deloitte, independent consultancy services.

Marketing Manager

Marketing Managers develop, implement, and execute marketing plans to attract and retain customers. They work across industries in the corporate sector.

- Job Role: Leading marketing campaigns, analyzing market research, and product branding.

- Eligibility Criteria: A BCom degree specializing in marketing; an MBA is preferred.

- Average Salary: ₹5 LPA to ₹12 LPA

- Skills Required: Creativity, strategic planning, and leadership skills.

- Top Companies Hiring: Unilever, Procter & Gamble, marketing agencies.

Entrepreneur

Entrepreneurs use their business acumen to start and manage their businesses. This path offers limitless potential but comes with high risks.

- Job Role: Business planning, management, and operations handling.

- Eligibility Criteria: BCom degree; business experience or MBA can help.

- Average Salary: Highly variable; potentially unlimited.

- Skills Required: Innovation, risk management, leadership, adaptability.

- Top Companies Hiring: Self-employed; varies widely.

Human Resources (HR) Manager

HR managers oversee company employees’ recruitment, training, and welfare, crucial in shaping the workplace environment and culture.

- Job Role: Recruitment, employee relations, payroll management.

- Eligibility Criteria: BCom with HR specialization; further qualifications like MBA in HR.

- Average Salary: ₹4 LPA to ₹10 LPA

- Skills Required: Communication, empathy, and organizational skills.

- Top Companies Hiring: Tech Mahindra, Infosys, large corporations.

Scope After BCom

A Bachelor of Commerce (BCom) qualification offers a solid stepping stone to various industry and career choices. The range of work after BCom is wide, covering conventional fields of accounting, finance, and taxation, as well as contemporary areas such as e-commerce, digital marketing, and business analytics. This flexibility makes the course very attractive to commerce majors.

- BCom graduates are ready with significant skills, such as financial management, the ability to think analytically, and knowledge of economic principles. These abilities are highly transferable in any field, and commerce graduates represent highly valuable assets to any sized organization.

- Furthermore, the emergence of the digital economy has demanded specialist knowledge in data analytics and digital strategy in commerce professionals, expanding the opportunities for BCom graduates.

- Following the immediate employment opportunity, a lot of students regard the B Com degree as the springboard to higher education or professional certificates such as the Chartered Accountant (CA), Certified Financial Planner (CFP), or Chartered Financial Analyst (CFA).

- These qualifications open pathways to specialized and high-paying roles. At the present job market, the flexibility of a BCom degree helps its graduates to work in both traditional and new industries, which guarantees long-term career development and security.

Government Jobs After BCom

Competitive exams are a smart option for BCom graduates to get high-difference and steady jobs in the government or banking industry. It is not only on these exams that they measure your capacity to know, but in fact, to do so, on top of your resourcefulness and a more general level. The passing of these tests can be the gateway to well-paying and promising benefits careers. To pass these exams well, the examinees must invest a lot of time in preparation. High quantitative aptitude, reasoning, general knowledge, and English scores are required. Participating in coaching, undertaking mock tests, and keeping abreast of news and events are all very effective methods of increasing the likelihood of success.

| Exam | Role | Salary (Approx) |

| SBI PO | Bank Probationary Officer | ₹7–₹12 LPA |

| UPSC Civil Services | IAS/IPS Officer | ₹10–₹15 LPA |

| SSC CGL | Income Tax Officer | ₹6–₹10 LPA |

| RBI Grade B | RBI Manager | ₹10–₹14 LPA |

Factors that Influence Salaries

BCom graduates’ salaries are determined by several factors, enabling them to choose the right career. Knowledge about these factors allows BCom graduates to skillfully plan their career paths to achieve maximum professional development and monetary security.

- Experience: Freshers’ salaries rise with experience as graduates develop expertise. For instance, starting salaries for an accountant could be ₹2.5–₹3 LPA, while senior positions could command ₹10–₹15 LPA.

- Certifications: Certifications such as CA, CFA or CPA can greatly increase earning capacity and job prospects, with salaries 50-100% higher than their non-certified counterparts.

- Industry: The choice of industry affects salary levels. Well-paying industries such as investment banking provide initial salaries of ₹8–₹10 LPA, whereas teaching may provide ₹3–₹5 LPA but with greater stability.

- Location: Salaries differ by location, with urban areas providing higher compensation due to the cost of living and demand for talent. For instance, a financial analyst in Mumbai receives 20−30% more than in smaller cities.

- Specialization: Specialization in high-demand fields such as taxation or financial analysis may result in greater remuneration, particularly in the case of specific expertise-driven positions such as GST consultancy.

- Company Size and Reputation: Larger or reputable companies often offer superior compensation, while startups may pay lower entry-level wages but promise fast-track growth and stock options.

- Negotiation Skills: Efficient negotiation skills contribute to better pay packages since candidates who project their skills and qualifications will get better offers.

Jobs After BCOM FAQs

What is the highest-paying job after BCom?

Chartered accountants, financial analysts, and investment bankers are among the highest-paying occupations.

What is after b com government job and salary ?

After a BCom, you can work in the government as an income tax officer, bank probationary officer, or civil servant. These jobs offer a salary of around INR 7-10LPA.

Which job is best after BCom for freshers?

For a BCom fresher, one of the best job options is an Accountant, Financial Analyst, Bank PO (Probationary Officer), or Tax Consultant, depending on your specific career goals.

What are some jobs after b.com and salary?

Some of the jobs are bcom is:

- Accountant: INR 2.5-4 LPA.

- Financial Analyst: INR 3.5-5 LPA.

- Tax Consultant: INR 3-4.5 LPA.

- Banking Jobs (Relationship Manager, Credit Analyst): INR 3-4 LPA.

Is BCom good for banking jobs?

Yes, BCom is a good foundation for pursuing a career in banking, as it provides essential knowledge in accounting, finance, and economics, which are crucial skills for various banking roles.