The net addition made to total cost of production is the increase in the total cost incurred by a company as it produces one more unit of output. It is this concept that explains how efficiently resources are being used in the production process. Knowing marginal cost can help businesses understand their cost structure, make better decisions on pricing, and even optimize their production processes so that profitability can be maximized.

What is Marginal Cost?

Marginal cost refers to the extra cost associated with producing one additional unit of output. It is an important concept in economics, as it guides firms on how much increasing the production level will cost. Marginal cost varies with the increase in total cost due to an increase in output. In essence, it is the amount by which cost increases if the company expands its production by one unit.

The concept of marginal cost is necessary for understanding decisions on price, level of production, and investments. For instance, in case the marginal cost incurred to produce one more unit is less than the amount at which that unit is sold, then increasing its production would be a very profitable decision. Conversely, if the marginal cost becomes more than the selling price, then the production of more units would result in losses.

In the context of total production, the net addition made to the total cost of production directly corresponds to the marginal cost. As businesses analyze their production process, they can determine whether the additional costs associated with increasing output are worth the additional revenue generated by those outputs.

Marginal Cost Formula

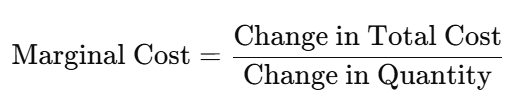

The marginal cost formula is a mathematical expression that helps in determining the additional cost incurred for producing one more unit. The formula is as follows:

Where:

- Change in Total Cost refers to the increase in the total cost of production when the output level increases.

- Change in Quantity refers to the increase in the number of units produced.

This formula provides a critical insight into how changes in production will impact total cost. In most firms, marginal cost is used to determine the cost-efficient level of production. If the marginal cost is below the revenue generated by the product, increasing production is usually desirable.

How to Calculate Marginal Cost

To calculate marginal cost, one must first have the total cost of production at different levels of output. The total cost includes both fixed costs and variable costs.

Steps to Calculate Marginal Cost

- Find the Total Cost at Two Different Output Levels: Collect the total cost at the original level and the level of output that results from an increase.

- Compute the Change in Total Cost: Subtract the total cost increased from the original level’s total cost.

- Compute the Change in Quantity: Subtract the original level of output from the increased level of output.

- Apply the Marginal Cost Formula: Use the formula to calculate marginal cost.

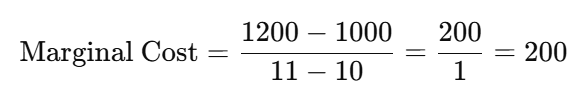

For example, if the total cost of producing 10 units is $1000 and the total cost of producing 11 units is $1200, the marginal cost would be calculated as:

Thus, the marginal cost of producing the 11th unit is $200.

Key Considerations in Marginal Cost Calculation:

- Variable vs. Fixed Costs: Only the variable costs contribute to changes in marginal cost, as fixed costs remain unchanged regardless of the production level.

- Economies of Scale: In some cases, increasing production leads to a decrease in marginal cost due to economies of scale, where larger production volumes reduce per-unit costs.

Marginal Cost Example

Let’s look at a practical example to understand the concept of marginal cost better. Consider a gadget factory. At the level of 1000 gadgets produced, the total cost is $50,000. If the factory decides to increase production to 1001 gadgets, the total cost increases to $50,500.

In this case, the change in total cost is $50,500 – $50,000 = $500, and the change in quantity is 1001 – 1000 = 1. Therefore, the marginal cost is: Marginal Cost=500/1=500

This means that the cost of producing the 1001st gadget is $500. If the selling price per gadget is higher than this cost, it would be profitable for the company to increase production.

Marginal Cost Curve

The marginal cost curve represents the relationship between the quantity of output produced and the marginal cost incurred. It usually takes a U shape, reflecting the law of diminishing returns. In the beginning, as production increases, marginal cost decreases due to economies of scale. Beyond a certain point, however, the marginal cost begins to rise as production becomes less efficient.

The U-shape of the marginal cost curve is a direct result of the interplay between fixed and variable costs.

- Decreasing Marginal Cost: First, the marginal cost is decreasing because a fixed cost is spread out over more units, providing economies of scale.

- Increasing Marginal Cost: However, if the production level increases even further, there may be inefficiencies—the factory might have to use overtime, workers get exhausted, and so on. Therefore, the marginal cost will rise.

Why does the Marginal Cost Curve Matter?

- It helps businesses determine the most cost-efficient level of output.

- Comparing marginal cost with the price at which one sells goods helps understand optimal pricing strategies.

- It helps understand where the business should stop increasing production or switch to another production strategy.

Businesses can use the marginal cost curve to analyze their cost structure and make strategic decisions about pricing and output levels.

Difference Between Marginal Cost and Marginal Revenue

While both marginal cost and marginal revenue are crucial for understanding a business’s profitability, they represent different concepts.

- Marginal Cost: People consider the marginal cost to be the extra price of producing one more unit of output. It works from the side of the business’s production.

- Marginal Revenue: One defines marginal revenue as the extra revenue obtained from selling one more unit of the output. It works on the revenue side of business.

The key difference between marginal cost and marginal revenue lies in their relationship to profitability:

- A company can increase its profits by producing and selling more units if the marginal revenue is greater than the marginal cost.

- If marginal cost is greater than marginal revenue, the company needs to decrease its production or look for ways to lower its cost structure.

Net Addition to Total Cost of Production FAQs

What does marginal cost mean?

Marginal cost refers to the increase in total cost that results from producing one additional unit of output. It is a key concept in economics that helps businesses determine how much it costs to expand production.

How do you calculate marginal cost?

Marginal cost is calculated using the formula: Marginal Cost = Change in Total Cost/Change in Quantity. This gives the additional cost incurred for producing one more unit.

What is the difference between marginal cost and marginal revenue?

Marginal cost refers to the additional cost of production, while marginal revenue is the additional revenue from selling one more unit. Companies compare them to determine optimal production levels and pricing strategies.

Why does marginal cost increase with higher production?

Marginal cost increases with higher production due to diminishing returns. As production expands, inefficiencies arise, such as the need for overtime or the exhaustion of resources, leading to higher costs.

How does the marginal cost curve help in decision-making?

The marginal cost curve helps businesses understand the relationship between production levels and costs, enabling them to make informed decisions about pricing and output to maximize profits.