A nation needs money to run itself, and a government needs money to run a nation. Governments have only a few ways to collect revenue. There are basically 2 types of income Tax Revenue and non-tax revenue. This entire income from export revenue is non-tax revenue for a government. Non-tax revenue includes public service fees, fines, penalties, interest, and dividends and profits from government receipts. Non-tax revenue, in contrast, comes almost entirely from voluntary payments, services and penalties, unlike tax revenue which is mandatory. Some governments stay afloat with non-tax revenue to keep budgets in the black without extracting only taxes from its citizens. In this article we will learn what non-tax revenue means, the sources of non-tax revenue, and the difference between non-tax and tax revenue.

Non Tax Revenue

Non tax revenue meaning Non tax revenue has a simple meaning. It is the money a government makes other than taxes. All the taxes are collected by law from individuals and organisations. Non tax revenue comes from activity of government, penalties, interest of loans and service fees. In this way, governments can offer public services with non-tax revenues, thus decreasing the burden of taxes. Thereby, it also helps in improving the welfare of public and in decreasing the tax burden on the public.

Types of Non Tax Revenue

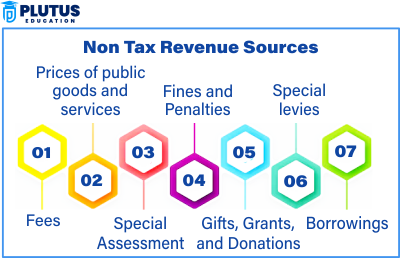

Non tax revenue has many kinds? Each is from an enumerated government function or service. The primary group of categories is listed below:

Types of Non Tax Revenue

There are many types of non-tax revenue. Each comes from an enumerated government function or service. The main categories are the following:

- Administrative Revenue – This involves fees charged for government services such as the issuance of passports, vehicle registration, and registration of lands.

- Interest and Dividends – Revenues are earned from loans given to businesses, individuals, and foreign countries. There are also dividends received from state-owned companies.

- Fines and Penalties – Set by courts against offenders and penalties charged by government authorities against violators.

- Commercial Revenue – Governments run enterprises, such as railways, telecom services, and energy companies, and they earn profits from them.

- Grants and Aid – These are funds provided to governments by international businesses and other countries for development projects.

- Lottery, Gaming and Betting Revenue – Governments run a lottery or regulate gaming and betting businesses for revenue generation.

- License and Permit Fees – These are fees for government licenses for business, driving, liquor, and other regulated activities.

Non Tax Revenue Example

A few common examples of non-tax revenue are

- Passport application fees.

- Fines for traffic rule violations.

- Interest on government loans extended to companies.

- Dividends from government banks and industries.

- Tolls collected on highways.

- Revenue from lottery ticket sales.

Governments utilise such revenues to provide public services and trim down fiscal deficits. Non-tax revenue in India comprises railways, telecommunication, interest on loans, and petroleum exploration.

Primary Sources of Non Tax Revenue

Non-tax revenues are derived from different activities practised by the government. Some of the primary sources are:

- Government services are charged under public service fees, including education, healthcare services, and licensing. While schools charge tuition fees, hospitals can charge for treatment.

- Interest and dividends – The government loans money to individuals, businesses, or foreign countries and earns interest thereon. In addition, the government generates dividends from its shareholding in state-owned enterprises.

- Penalties and fines – Those that contravene the law are fined, while businesses will incur penalties for contraventions of regulations.

- Profits from public sector industries constitute another important source of non-tax revenue. Many national governments have companies operating in the transport, power generation, and manufacturing sectors. Profits derived from these sectors form one primary source of nontax revenue.

- Taxes on lotteries and betting – Some governments operate lotteries or earn revenues through taxation on gambling.

- Environmental fees are taxes on companies for pollution, resource consumption, and carbon emissions.

Difference Between Non Tax Revenue and Tax Revenue

There is more than a clear distinction between tax revenue and non-tax revenue. Tax revenues are collected via direct and indirect taxes, which everybody and businesses must uphold through the law. On the contrary, non-tax revenue includes revenue from fees and fines and the interest they accrue on loans granted to the government, as well as services offered by the government.

| Feature | Tax Revenue | Non Tax Revenue |

| Basis of Collection | Compulsory payments | Voluntary or service-based payments |

| Examples | Income tax, GST, excise duty | Passport fees, fines, dividends |

| Dependency | Regular and predictable income | May fluctuate |

| Payment Requirement | Citizens and businesses must pay | Paid when using services or breaking rules |

Government Non Tax Revenue

Tax revenue is a crucial ingredient to fund public services, thereby examining the fringes of tax burdens on citizens. So, the governments globally also find a soul between tax and non-raised revenue for the purpose of budgetary and economic stability. In India, non-tax revenue is very significant as it contributes to the annual income of the government, while its outlay usually goes for infrastructure, defence and social welfare projects.

Non Tax Revenue and Capital Receipts

Government revenue consists of two types of income – revenue receipts and capital receipts. Government income comes from a wide range of sources, two of them — capital receipts and non-tax revenue — are closely interrelated. Before moving to tax revenues, it should be clarified that non-tax revenues include the income generated by this: they levy fees interest fine services. Such revenues are included in the revenue receipts. Loans taken by the government, the sale of government property, and foreign investments are capital receipts. These revenues may be tax and non-tax.

Importance of Capital Receipts

Capital receipts finance infrastructure in the long run whereas non-tax revenues bolster expenditure in the short run. Some forms of non-tax revenue, particularly dividends received from public sector companies, produce capital receipts when reinvested in government projects.

Relevance to ACCA Syllabus

These are special topics under the ACCA examinations – as it relates to financial reporting in public sector accounting and revenue recognition. As non-tax revenues, including service fees, dividends, and rental income, form an important part of total government and business revenues, ACCA candidates need to understand that these sources are not derived from taxation. Such a topic is crucial in regards to Public Financial Management, Financial Reporting and Management Accounting. The non-tax revenue enables the accountants to prepare and analyze the financial statements for the government and non government entities.

Non-Tax Revenue ACCA Questions

Q1: Which of the following is not an example of non-tax revenue?

A) Corporate income tax

B) Property tax

C) Fines and penalties

D) Sales tax

Ans: C) Fines and penalties

Q2: What is the typical categorization of non-tax revenue in government financial statements?

A) Under tax revenue

B) As a part of the government borrowings

(C) Amounts that are considered Other income or operating revenue

D) Under capital expenditure

Ans: C) As other income or operating revenue

Q3: Among the following, which is NOT a usual source of non-tax revenue?

A) License fees

B) Customs duty

C) Leasing from government Services

D) Service charges

Ans: B) Customs duty

Q4: Consider how non-tax revenue is recognised in terms of financial reporting.

A) When cash is received

B) If it is earned and measureable

C) Once the government give its stamp of approval

D) Only when spent on any type of capital project

Ans: B) If it is earned and measurable

Q5: Which accounting standard is the most relevant in respect of recognition of government non-tax revenue?

A) IFRS 9

B) IFRS 15

C) IAS 20

D) IFRS 16

Ans: B) IFRS 15

Relevance to US CMA Syllabus

Non-tax revenue is significant for US CMA (Certified Management Accountant) candidates in the process of cost management, budgeting, and financial performance evaluation. CMA helps organisations to know the various streams of revenue that lead towards economic sustainability. Non-tax revenue is used in governmental and non-profit accounting for financial planning and control purposes.

Non-Tax Revenue US CMA Questions

Q1: Which of the following is a major source of non tax revenue for government entities?

A) Individual income tax

B) Sales tax

C) Fees for public services

D) Corporate income tax

Ans: C) Payment for government services

Q2: What is the accounting treatment of recognition of non-tax revenues from service fees by a company?

A) When invoiced

B) When payment is received

C) at the time the service is provided and performance obligation is satisfied

D) At the end of the financial year.

Ans: C) At the point of service delivery and performance obligation satisfaction

Question 3: In the context of financial reporting, what best describes non-tax revenue?

A) Money given directly from taxing people

B) Non-tax revenue

C) Money received from stockholders

D) Interest income from loans only

Ans: B) Income of a firm/budget from non-tax activities

Q4: Should non-tax revenue be included in an analysis of financial performance?

A) It is not included on the financial statements

B) It enhances operating cash flows and net income

C) It minimizes monetary liabilities

D) Only appears in the financial statements of the government

Ans: Option B- It increass operational cash flow and net income

Q5: Give an illustration of none tax revenue in the context of corporate financial management?

A) Payroll tax

B) Income from properties you own to rent out

C) Value-added tax

D) Import duty

Ans: B → Rental income from owned properties

Relevance to US CPA Syllabus

The US (Certified Public Accountant) CPA syllabus covers non-tax revenue under financial accounting and government accounting and non-profit financial reporting. The Rules underlying the non-tax revenue at the federal level are advocating guidelines for other government agencies at inter- and supranational levels, as well as corporations and non-profits, shaping financial disclosures and governing fund management; the level where CPAs will encounter the core scope of their practice.

Non-Tax Revenue CPAQuestions

Q 1: How is non-tax revenue recognized in the accounts of a government entity?

A) As a liability

B) As an expenditure

C) Revenue from operations or other revenues

D) As an asset

Ans: C) As operating or other revenue

Q2. Which of the following is NOT non-tax revenue?

A) Government fines

B) Parking fees

C) Payroll tax

D) Sale of government land

Ans: C) Payroll tax

Q3: When appropriately for non-tax revenue information represented in financial reporting in accordance to GAAP?

A) When collected in cash

B) At the time revenue is earned and measurable

C) At the end of the fiscal year only

D) If there is a shift in government policies

Ans: B) When earned and measurable

Q4: How important is non-tax revenue for the financial sustainability of a government?

A) It leads to a higher tax collection

B) It lowers the dependency over debt financing

C) This means that no tax revenue is needed

D) It has no bearing on financial sustainability

Ans: B) It decreases the reliance on debt financing

Q5: Where will a large portion of non-tax revenue be mainly recorded?

A) Statement of Cash Flows

B) Income Statement (Statement of Activities for Not-For-Profits)

C) Balance Sheet

D) Change in Equity Statement The

Ans: B) Income statement (Statement of Activities for Non-Profits)

Relevance to CFA Syllabus

The Ielts test in CFA is a pivot element of financial reporting and evaluation of investment and finance of the Economy. It is important, though, because CFA candidates need to understand how analysis supports government budgets, corporate earnings and economic performance which can be assessed outside of taxation.

Non-Tax Revenue non-tax-revenue/CFA Questions

Q1: In the realm of financial analysis, name a type of non-tax revenue.

A) Sales tax

B) Returns from investments to a government unit

C) Corporate income tax

D) Capital gains tax

Ans: (b) Investment dividend received by government entity

Q2: What is the significance of non-tax revenue in a company’s financial well-being?

A) It improves revenue mix and financial strength

B) It raises tax liabilities

C) It reduces the tax compliance burden

D) You have nothing to lose in financial terms

Ans: A) Revenue diversification and greater financial resilience

Q3: Why is non-tax revenue important in public finance?

A) Revenue Generation — Not a Tax

B) It abolishes all tax revenues in government budgets

C) More likely to lead to financial mismanagement

D) It will not be reported publicly on the financial statements

Ans: A) It help to make money without taxation

Q4: When analyzing investment decisions, how can analysts include consideration of non-tax revenue?

A) Temporary revenue source

B) A key part of an organisation’s subscription revenue streams

C) As an outside balance sheet item

D) As an extraordinary item

Ans: B) As a Is a revenue streams review of an organisation

Q5: Which financial metric is directly impacted by non-tax revenue?

A) EBITDA

B) Net profit margin

C) Tax expense

D) Deferred tax liability

Ans: B) Net profit margin