Financial management is the lifeblood of every business. It ensures that companies use money wisely and reach their goals. The objectives of financial management focus on how a business plans, raises, uses, and controls money. The main aim is to maximize the value of the firm while balancing risk and return. Financial management decisions help in growth, survival, and stability of a business. It affects day-to-day operations and long-term planning. Every company, small or big, needs solid financial management to succeed. The objectives of financial management are very clear. First, it helps businesses use their funds wisely. Second, it ensures regular income and smooth operations. Lastly, it helps in increasing the worth of the company in the market. These goals help a business stay profitable and secure. It also helps in taking better investment and financing decisions.

What is Financial Management?

Financial management means handling a company’s money in the best way possible. A finance manager decides how to raise funds, where to invest, and how to control costs. The focus stays on earning more and saving more.

Finance is the backbone of any business. No plan or strategy can work without money. So, companies need to manage funds carefully. They use tools and techniques to control and plan finances. This helps them avoid losses and make profits.

Financial management includes three key decisions:

- Investment Decision: Where to invest money.

- Financing Decision: How to raise funds.

- Dividend Decision: How much profit to share with shareholders.

A business cannot grow without proper finance planning. The finance team prepares budgets, controls expenses, and creates value for the company. Good financial management improves performance and helps achieve goals faster.

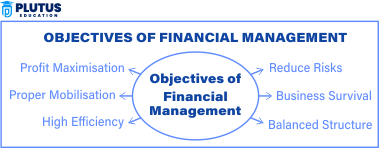

Main Objectives of Financial Management

The objectives of financial management guide how companies use their money. These goals support decision-making and make a business strong and profitable. Let’s look at the main objectives.

1. Profit Maximization

This is one of the oldest goals. Every business wants to earn more profit. Profit is the reward for taking business risks. Higher profit means better growth and survival.

- Helps in increasing shareholder wealth.

- Encourages more investment in the company.

- Supports expansion and diversification.

But profit maximization has limits. It ignores risk, long-term stability, and social responsibility. That’s why other goals are also important.

2. Wealth Maximization

This is a modern goal. It focuses on increasing the value of the firm. It looks at future earnings and the time value of money.

- Ensures long-term growth.

- Balances risk and return.

- Reflects on the company’s share price.

Wealth maximization is better than just chasing profits. It includes ethics, growth, and customer satisfaction too.

3. Efficient Fund Utilization

Companies must use money wisely. Wasting money leads to loss and failure.

- Proper budgeting helps avoid extra costs.

- Investment in the right projects gives good returns.

- Tracking expenses ensures better planning.

Using funds efficiently improves financial health and builds trust.

4. Ensuring Liquidity

Every business needs cash to run daily tasks. Liquidity means having enough cash to pay bills and salaries.

- Avoids cash crunch during emergencies.

- Helps build a good credit record.

- Keeps business running smoothly.

Liquidity management is a key job of the finance team.

Importance of Financial Management

Financial management plays a very important role in every business. It provides control over money and helps in decision-making. When companies manage their funds well, they avoid waste and become more efficient. Good financial management means companies can plan their future, avoid financial stress, and make strong investments.

1. Better Financial Control

Financial management tracks income and expenses. It keeps the company’s money in check.

- Prevents waste and misuse.

- Sets clear limits and budgets.

- Tracks costs against results.

With better control, companies stay within their budget.

2. Smooth Business Operations

No work happens without money. Financial management makes sure money is available on time.

- Salaries are paid on time.

- Bills and loans are cleared.

- Inventory and supplies are maintained.

This keeps the business stable and active.

3. Improved Planning and Strategy

Finance plays a big role in planning. A good financial plan supports business goals.

- Helps in setting targets.

- Shows how to reach those targets.

- Makes teams more focused.

Without financial planning, even good ideas can fail.

4. Informed Decision-Making

Finance helps managers make better choices.

- Shows risk and return for each project.

- Helps choose between debt and equity.

- Guides in investment and savings.

This brings stability and growth in the long run.

Wealth Maximization vs Profit Maximization — Which One is Better?

Both wealth maximization and profit maximization are important objectives of financial management, but they are different. Profit maximization focuses only on earning as much profit as possible. It does not worry about long-term goals, risks, or how the profit is made. Companies following this goal may sometimes ignore quality, ethics, or customer needs just to increase profits.

On the other hand, wealth maximization looks at the big picture. It wants to increase the overall value of the business over time. It includes all future earnings, the time value of money, and also considers shareholder interests. This goal also encourages companies to think about long-term success rather than just quick money.

| Basis | Profit Maximization | Wealth Maximization |

| Focus | Short-term earnings | Long-term firm value |

| Risk consideration | Ignored | Considered |

| Time value of money | Not included | Included |

| Shareholder interest | May not match | Directly related |

Wealth maximization is the better goal. It considers all aspects like time, risk, return, and ethics. It gives a balanced view for the company’s future.

Role of Finance Manager in a Company

The finance manager plays a central role in meeting the objectives of financial management. This person plans, controls, and monitors all money-related activities. Finance managers help companies use their funds in the best way. They prepare budgets, plan expenses, and check if the company is spending within limits. They also analyze the company’s income and compare it with targets.

- Financial Planning: Forecasting future needs and setting budgets.

- Cost Control: Reducing unnecessary expenses.

- Risk Management: Identifying and managing financial risks.

- Investment Decisions: Choosing the best options for returns.

- Compliance: Ensuring laws and regulations are followed.

A finance manager supports every department. He or she helps teams use money wisely and meet targets. In big companies, this role is even more critical.

Objectives of Financial Management FAQs

Q1: What are the main objectives of financial management?

They are profit maximization, wealth maximization, efficient fund usage, and maintaining liquidity.

Q2: What is wealth maximization in financial management?

It means increasing the overall value of the business in the long term.

Q3: Why is liquidity important in financial management?

Liquidity helps pay daily bills and keeps the business running smoothly.

Q4: What is the difference between wealth and profit maximization?

Wealth maximization focuses on long-term value; profit maximization looks at short-term gains.

Q5: What are the functions of financial management?

Key functions include budgeting, financial planning, investment decisions, and cost control.