A trial balance is a must-have knowledge for anyone handling account work or financial management. This is because a trial balance will guarantee the completeness and accuracy of any financial records, as every debit having been entered should equal the same amount of credit in the accounting ledger. The trial balance’s prime purpose is to prepare financial statements and spot potential mistakes within bookkeeping. This article discusses the definition, objectives, and limitations and mainly covers the key features of a trial balance, tracing relevance in maintaining it within financial records.

What is Trial Balance?

A trial balance is a statement of all the debit and credit balances realised from the ledger accounts of a business at one particular point in time. Preparing a trial balance aims to test the mathematical accuracy of the bookkeeping entries and confirm that the total debits equal the total credits. It represents a check before preparing final financial statements, such as the income statement and balance sheet.

Key Aspects of Trial Balance

- Compilation of Account BalancesA trial balance is a list of all the account balances from the ledger in a single document compiled to present the business’s financial position.

- It also includes revenue and expense accounts and asset, liability, and equity accounts.

- Format of Trial BalanceThe trial balance is split into two columns, usually the debit column and the credit column.

- The accounts are listed systematically, beginning with asset accounts, then the liability accounts, and then the equity accounts, with both debit and credit amounts side by side.

- Purpose of VerificationThe trial balance would identify arithmetic errors in the ledger accounts and could be sure of everything transacting during the accounting period.

- It is also usually the first step of the financial reporting process, giving one an easier perspective on the company’s position.

Examples of Trial Balance Usage

- Account Entries Verification: Account entries in the ledger must be balanced to avoid discrepancies with financial statements.

- Preparing Financial Statements: A base for preparing suitable income statements, balance sheets, and cash flow statements.

- Error Detection: Every possible error or inconsistency in debit and credit balances that would influence the company’s financial records.

Trial Balance Format

| Account Name | Debit (₹) | Credit (₹) |

| Cash Account | 50,000 | |

| Accounts Receivable | 30,000 | |

| Inventory | 20,000 | |

| Accounts Payable | | 40,000 |

| Sales Revenue | | 78,000 |

| Interest Expense | 3,000 | |

| Drawings/Withdrawals | 15,000 | |

| Total | 118000 | 118000 |

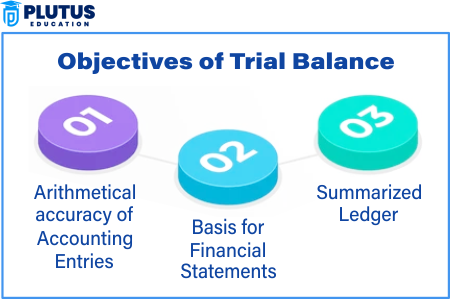

Objectives of Trial Balance

The purposes of a trial balance focus mainly on its role in setting up the correctness and completeness of financial transactions. Knowing these objectives is very important for businesses to strive to uphold integrity within their accounting procedure.

Ensuring Arithmetical Accuracy

- The primary purpose of a trial balance is to prove the accuracy of book entries, checking whether the debits tally with the credits.

- This mathematical check helps identify errors as inclusive and inadvertent overlooking, duplicate, or incorrect posting.

Simplifying Financial Statement Preparation

- A trial balance is the basis on which final financial statements are prepared. It includes the profit and loss account and the balance sheet.

- This accounting method makes financial reporting clear and systematic by summarising all the ledger accounts.

Detecting Errors in Ledger Accounts

- Carrying out a trial balance mainly identifies discrepancies in the ledger and tries to locate any errors as soon as possible.

- Although the trial balance results were confirmed arithmetically accurate, they also tell accountants that the wrong or incomplete entries must be rectified before finalising accounts.

Ensuring Compliance & Transparency

- Preparing a well-designed trial balance ensures that it complies with accounting principles and standards, ensuring transparency.

- It boosts the credibility of the financial statements and, therefore, gives confidence to stakeholders concerning the accuracy of the company’s financial data.

Limitations of Trial Balance

Although it may be one of the most essential tools for a good accountant, there are still some limiting factors in using the trial balance on error detection. Therefore, the critical considerations and limitations before ensuring accurate financial reporting are discussed below.

Inability to Detect All Types of Errors

- A trial balance still does not detect errors, such as omissions in the ledger, compensation errors, or wrong entries, if the total debit entries equal the total credit entries.

- Errors like double postings or postings to the wrong account sneak through, as they do not affect the overall balance.

Not a Substitute for Financial Statements

- A trial balance does not depict a business’s overall position regarding its financial health.

- It is only a preliminary step and cannot replace the rich insights in details provided by financial statements such as the income statement or the balance sheet.

Does Not Ensure Correct Valuation

- The trial balance does not prove the value assigned to accounts; it may unwittingly commit a mistake in the valuation of either assets or liabilities.

- It might still be stated inaccurately even then if the underlying valuation principles are not applied correctly.

Subject to Human Error

- Since a trial balance is also prepared manually or semi-manually, there can still be human error in the data entry or calculation.

- The correctness of the trial balance thus depends on how diligent and skilful the accountant is in handling the entries.

Features of Trial Balance

Trial balance is one of the features that shows the process of summarising and verifying the accuracy of financial data. These make it an indispensable instrument in the accounting procedure.

Systematic Arrangement of Accounts

- A trial balance is a systematic listing of all debit and credit balances in the ledger, thus providing an uncluttered and organised view of all account entries.

- Grouping and presenting accounts to ensure that errors are easily identified increases the convenience of error detection.

Double-Entry Principle

- It relies on the double-entry accounting system whereby each transaction has at least two accounts affected, so the debits always equal the credits.

- This principle is essential to ensure that there is an evenness in accounting the financial records and that discrepancies don’t occur.

Periodic Review Tool

- A trial balance is often prepared at regular intervals such as monthly, quarterly or annually. It helps check to see if financial transactions are correctly accounted for.

- It enables companies to monitor their typically reviewed financial position and rectify the issues quickly.

Preparation of Financial Statements

- The trial balance is the major paper used in making final financial statements, including the income and balance sheets.

- It, therefore, centralises the financial data, thus making it easier to prepare complete reports for all stakeholders.

Objective of Trial Balance FAQs

What is the purpose of a trial balance?

The sole purpose is that debits must equal the total credits, and this only proves that the entries into the ledger are correct.

Which one of the following is not an objective of trial balance?

The detection of valuation errors is not considered the objective of a trial balance because it works on the principle of arithmetical accuracy.

What are the disadvantages of a trial balance?

A trial balance cannot detect errors of omission, compensating mistakes, or wrong valuations in ledger accounts.

How often should one prepare a trial balance?

A trial balance is prepared at regular intervals or intervals appropriate to the business practice, such as monthly, quarterly, or annually.

What is a trial balance’s role in preparing financial statements?

It is a starting point for producing accurate financial statements by summarizing all account balances from the ledger.