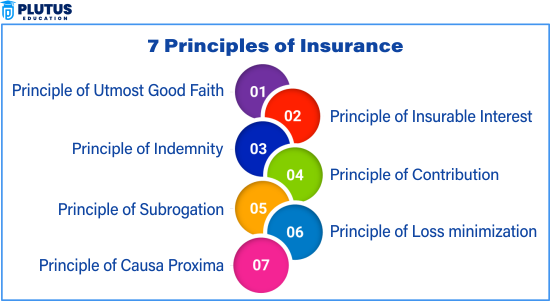

The fundamental principles that guide an insurance contract’s relation to other contracts have been referred to as insurance principles. These rules ensure efficiency, integrity, and fairness in all insurance transactions. Untoward events must be insured against without being anticipated. Insurance will only function on behalf of either party after the parties have agreed to certain stipulations in more specific guidelines. The insurance system is based on these moral and legal precepts.

Meaning of Principles of Insurance

The principles of insurance are a set of legal and ethical standards that govern the conduct of both insurers and policyholders. These principles ensure that the insurance process remains fair, transparent, and reliable.By outlining the obligations and expectations of each party precisely, they seek to foster confidence and reduce conflict. Insurance firms can provide effective coverage and customers can get legitimate claims without any delays or conflicts by adhering to these standards. These tenets serve as the foundation for all insurance contracts and direct each stage from proposal to claim resolution.

A policyholder pays an insurance firm a premium in order to receive financial protection against particular risks. Certain guidelines must be adhered to in order for this procedure to be legitimate and legal. Loss minimization, contribution, subrogation, indemnity, utmost good faith, and proximate cause are a few of these. These rules are not merely recommendations; they are legally binding and aid in preventing disputes, deception, and abuse.

1. Principle of Utmost Good Faith (Uberrimae Fidei)

Definition

This principle means that both the insurer and the insured must disclose all material facts honestly and completely at the time of entering into the contract. Any form of misrepresentation or omission can make the policy void.

Detailed Explanation

The insurance contract heavily depends on trust. The insured must share all important facts such as medical history, pre-existing conditions, property damage, or previous claims. The insurer must also provide complete clarity on policy terms, conditions, and what the insurance does and does not cover.

If either party fails to act with honesty, the purpose of insurance is defeated. For example, hiding a chronic disease when purchasing health insurance can lead to claim rejection later. Similarly, if the insurer hides important exclusions, the policyholder may feel cheated.

Importance

This principle builds transparency, reduces fraud, and ensures that both parties enter into the contract with full understanding and honesty. It is the backbone of a valid insurance agreement.

Example

If a person suffering from a heart disease hides their condition while buying a health insurance policy, the insurance company can reject the claim based on breach of utmost good faith.

2. Principle of Insurable Interest

Definition

The principle of insurable interest says that the person buying the insurance must have a direct financial or legal relationship with the subject matter of insurance. They must suffer a financial loss if the subject is damaged.

Detailed Explanation

Insurable interest ensures that insurance remains a protection tool rather than a profit-making scheme. You cannot take insurance for something that you do not own or control. It helps prevent moral hazard and speculation. This interest must exist at the time of the policy and at the time of loss in most types of general insurance.

For instance, you can insure your own house, car, or business but cannot insure your friend’s property or a stranger’s assets. In life insurance, insurable interest must be present when the policy is purchased.

Importance

It ensures that insurance remains meaningful and is taken only to recover losses and not for gambling or earning benefits from another person’s loss.

Example

A person can insure their own house, car, or life of a spouse but cannot insure a stranger’s property.

3. Principle of Indemnity

Definition

The principle of indemnity means that the insurance company will only compensate the insured for the actual amount of financial loss suffered. The insured should neither make profit nor suffer a loss.

Detailed Explanation

This principle applies to non-life insurance such as fire, marine, and motor insurance. It ensures that insurance replaces the actual loss but never pays more than what was lost. The goal is to bring the insured to the original financial position before the loss happened.

If your insured bike gets damaged in an accident and the cost of repair is ₹20,000, then that is the maximum amount the insurer will pay, even if the bike was insured for ₹50,000. This prevents any unfair advantage.

Importance

It avoids misuse of insurance contracts and keeps them fair and compensation-based rather than profit-making tools.

Example

If a vehicle insured for ₹10 lakh gets damaged and the repair costs ₹4 lakh, the insurer will pay ₹4 lakh only.

4. Principle of Contribution

Definition

This principle applies when the insured has more than one policy for the same subject matter. If a claim arises, the insured can claim from all policies, but the total compensation cannot exceed the actual loss.

Detailed Explanation

If a property worth ₹5 lakh is insured with two companies—₹3 lakh with Company A and ₹2 lakh with Company B—and it suffers a ₹2 lakh loss, both companies must share the burden in proportion. Company A will pay ₹1.2 lakh and Company B will pay ₹0.8 lakh.

This rule prevents the insured from claiming full compensation from multiple sources. It maintains fairness among insurers and ensures that the total claim does not exceed the real loss.

Importance

It discourages over-insurance and protects insurers from paying excess amounts, maintaining balance in the insurance ecosystem.

Example

If a warehouse worth ₹6 lakh is insured with two companies for ₹3 lakh each and suffers a ₹3 lakh loss, both insurers pay ₹1.5 lakh each.

5. Principle of Subrogation

Definition

Subrogation means that once the insurance company has paid the insured for their loss, it gets the legal right to claim that amount from any third party responsible for the loss.

Detailed Explanation

This principle prevents the insured from gaining double compensation. Suppose your car is damaged due to another driver’s mistake and the insurer pays you. Later, the insurer can recover that amount from the driver who caused the accident.

This right of recovery moves from the insured to the insurer after the claim settlement. It helps insurers reduce their liability and recover losses from responsible third parties.

Importance

It ensures that the insured does not benefit more than once and that the real liable party is held responsible.

Example

If a car insured by the company is hit by another car, and the insurer pays for the damage, the insurer can sue the third-party driver.

6. Principle of Proximate Cause

Definition

Proximate cause is the nearest and direct cause of the loss or damage. It helps identify the true reason behind the damage to determine whether the insurance policy covers the loss.

Detailed Explanation

Many losses result from a chain of events. To decide claim validity, insurers look at the dominant cause. For instance, if fire damages goods on a ship, and the fire was caused by lightning, the proximate cause is fire. If the policy covers fire damage, the insurer must pay.

It simplifies decision-making by eliminating distant or minor causes and focusing on the main reason for loss.

Importance

This principle guides proper claim settlements and ensures that coverage applies to actual and direct causes of damage.

Example

If goods are damaged due to a fire started by lightning, and the policy covers fire but not lightning, the insurer will pay because fire is the proximate cause.

7. Principle of Loss Minimization

Definition

This principle states that the insured must take all possible steps to minimize the damage or loss even after the insured event has occurred.

Detailed Explanation

The insured must act as a responsible person and not behave carelessly just because they have insurance. They should make every effort to reduce damage and protect the insured subject.

For example, if there’s a fire in an insured warehouse, the owner must call the fire brigade and try to save as much as possible. If the owner does nothing, the insurer might reduce the compensation.

Importance

It ensures responsible behavior and prevents reckless actions that could increase losses unnecessarily.

Example

If a fire breaks out in a warehouse, the owner must call the fire brigade and take steps to stop the fire from spreading.

Principles of Insurance FAQs

Q1. What are the seven principles of insurance?

The seven principles are Utmost Good Faith, Insurable Interest, Indemnity, Contribution, Subrogation, Proximate Cause, and Loss Minimization.

Q2. Why is the principle of indemnity important?

It ensures that the insured does not profit from a claim and only gets compensation for actual loss.

Q3. What happens if good faith is not followed?

The insurer can cancel the policy or deny the claim if any party hides important facts.

Q4. When is insurable interest required?

Insurable interest must exist at the time of contract in life insurance and at the time of loss in general insurance.

Q5. What is an example of proximate cause?

If a policy covers fire but not earthquake, and fire is caused by an earthquake, the insurer may not pay unless fire is the proximate cause