Redemption of debentures involves the redemption of the borrowed money to the debenture holder when the debentures mature. A debenture is essentially a debt note, enabling companies to borrow money from the public or institutional investors with the promise to repay the principal and interest at predetermined intervals. Redemption occurs when the company delivers its promise by returning the face value, or the principal of the debenture, to the holders either on maturity or before this date as agreed upon by the terms.

Redemption of debentures is one of the significant financial liabilities that a firm incurs at the time of issuing these securities to raise funds. Generally, a company promises to return to the debenture holders the issued amount on a certain date while paying the interest during the term. It can be either in one installment at maturity or in installments over time. Companies should well plan redemption strategies for a stable financial situation because they directly affect cash flow and the total debt structure. The article deals with the idea of debenture redemption, possible methods, and related accounting procedures.

What is Redemption of Debentures?

Redemption of debentures means repayment of the principal amount to debenture holders. A company issuing debentures, in effect, raises funds that it repays after a given fixed tenure and often with interest. Redemption of debentures may also be done at maturity or in advance, depending upon the agreement terms of the company. This is an important feature of corporate finance because it enables the company to fulfill its debt obligations and, therefore, to gain credibility in the debt markets.

Importance of Redemption

- Maintains corporate credibility and investor trust.

- Prevents legal or financial penalties from defaults.

- Strengthens the company’s balance sheet by reducing liabilities.

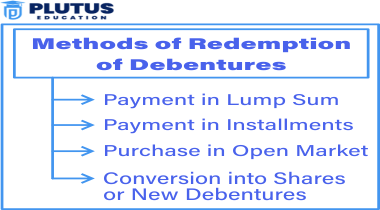

Methods of Redemption of Debentures

Issuing debentures to raise funds involves promising the return of principal at the end of a specified tenure or even earlier than that, depending on the terms of the issue. The redemption of debentures differs according to the company’s financial strategy and needs. There are various ways through which redemption of debentures may take place, each offering its merit and procedure. Some of the significant major methods are below.

Redemption in Lump Sum

Redemption of debentures in a lump sum is probably the most simple and most frequently used form. In this, the company pays the entire principal amount due to the debenture holders at some designated date, usually at the maturity of debentures.

Features of Lump Sum Redemption:

- The entire principal sum is paid at one time on the due date.

- Periodic interest payments The interest payment is made semi-annually or annually for the term of the debenture.

- This method is used when the company believes that, at the time of maturity, it should have quite enough liquidity to settle the full amount.

Redemption by Installments

In the installment method, there is redemption in installments over time, rather than in one single installment at maturity. The company pays predetermined installments of the principal with interest on the remaining amount.

Features of Installment Redemption:

- Debentures are redeemed step-by-step.

- Most of the redemption happens on an annual basis, thus decreasing the burden on the cash flow of that company.

- An important factor is that the interest decreases with each repayment as the principal amount reduces.

- Installments provide flexibility to the corporation in managing cash flow over the period.

Redemption by Purchase in Open Market

The process of the company purchasing its own debentures from the open market before the maturity date. This technique is normally applied when the market value of the debentures is relatively low compared to their face value. The company can make an open-market purchase of debentures to retire them early or lower the interest payments.

Features of Open Market Purchase:

- Debentures are also bought back at current market prices, and that could be below the face value of the issue price.

- It helps the company to prepay debts and save on the money of interest costs.

- Thus, cancellable repurchased debentures will reduce the overall liability of the company.

Redemption by Conversion

Other companies may issue convertible debentures. These convertible debentures allow the holders of the debenture to convert their debentures into the equity shares of the company at their choice as stipulated in terms of the debenture issue. This conversion technique might be opted by a firm for debt reduction without utilizing its cash accrual.

Features of Conversion Method:

- The cash repayment is replaced by equity shares among debenture holders.

- All terms of the conversions, for example, the ratio that may be made between shares and debentures, will depend on the time of issue.

- This is very attractive to firms looking to reduce their debt while leaving the cash flow intact.

Pros & Cons of Redemption of Debentures

| Methods | Pros | Cons |

| Redemption in Lump Sum | – Simple and easy to manage. – Debenture holders are fully repaid at maturity. | – It requires a large cash outflow at once, straining liquidity. – Not suitable for companies with unpredictable future cash flows. |

| Redemption by Installments | – Spreads repayment over time, reducing the burden on cash flow. – Provides better flexibility in managing cash flows. | – The debt liability remains for a longer period. – Ongoing payments may limit the company’s ability to invest in new opportunities. |

| Redemption by Purchase in Open Market | – Allows companies to buy back debentures at potentially lower market prices, saving costs. – Reduces interest obligations over time.Offers flexibility to retire debt early. | – Requires the company to have sufficient liquidity to make the purchases. – Market prices may fluctuate, making timing and savings unpredictable. |

| Redemption by Conversion | – Preserves cash flow since no direct cash repayment is required. – Reduces the company’s debt and interest burden. | – Dilutes the ownership structure, impacting existing shareholders. – May not be favorable for companies looking to maintain tight control of equity shares. |

Conclusion

Redemption of debentures is that financial activity that tends to influence cash flow and debt management from an organizational perspective. The redemption methods are quite flexible depending upon the adopted financial strategies by the company and market conditions. Lump sum, installment redemption, and open-market purchases are undertaken only after proper planning as well as accounting to ensure the financial stability and credibility of the organization. Efficient management of debenture redemption is crucial for maintaining investor confidence and smooth business operations.

Redemption of Debentures FAQs

What is the redemption of debentures?

Redemption of debentures refers to the repayment of the principal amount to debenture holders at the time of maturity or earlier as per agreed terms.

How does a company account for debenture redemption?

Companies record the redemption by debiting the debenture account and crediting the bank account, or using alternative entries depending on the redemption method used.

What is a sinking fund for debenture redemption?

A sinking fund is a reserve where a company sets aside money annually to ensure enough funds are available for debenture repayment at maturity.

Can debentures be converted into shares?

Yes, debentures can be converted into shares if the debenture terms allow it. This is a method of redemption known as redemption by conversion.

What is redemption by open market purchase?

In this method, the company buys back its debentures from the market, often at a price lower than the face value, helping reduce its liabilities efficiently.