Royalty in economics refers to a payment made by one party, known as the licensee, to another party, known as the licensor, for using intellectual property, natural resources, or other assets. Such payments are usually periodic and calculated as a percentage of revenue generated from the use of the asset or resource. Understanding royalties is very important for businesses and individuals who engage in the entertainment, technology, mining, and publishing industries. Royalties help in inciting innovation, protecting intellectual property, and giving the creators of resource owners a constant flow of income in economics.

Royalty Meaning

To understand the meaning of royalty, it is important to understand its basic concept. In economic terms, the owner of a resource, intellectual property, or other assets receives a royalty as payment in exchange for the right to use or exploit that asset. The payment can either be a fixed amount or a percentage of the revenue generated by using the asset. The most widespread industries where one will likely come across royalties are film, music publishing, mining, patent licensing, and many others.

The concept of royalties makes it easier for the asset owner, whether it be an idea, an invention, or a physical commodity, to receive passive revenue. The writer gets the royalty whenever his book sells, while the musician gains the same amount of money each time his song airs on the radio. So would the mining company make a payment of royalties, this time to the state or owner of the property based on the quantity extracted of the mineral from that particular location?

Economically, royalties play a huge role in encouraging innovation. It is an incentive for creators, inventors, and owners of resources to innovate and invest in new ideas since they can monetize their intellectual property or physical assets without necessarily being involved in the commercial production process. This aligns the interests of both parties: the licensor (owner of the asset) and the licensee (user of the asset), promoting mutually beneficial business arrangements.

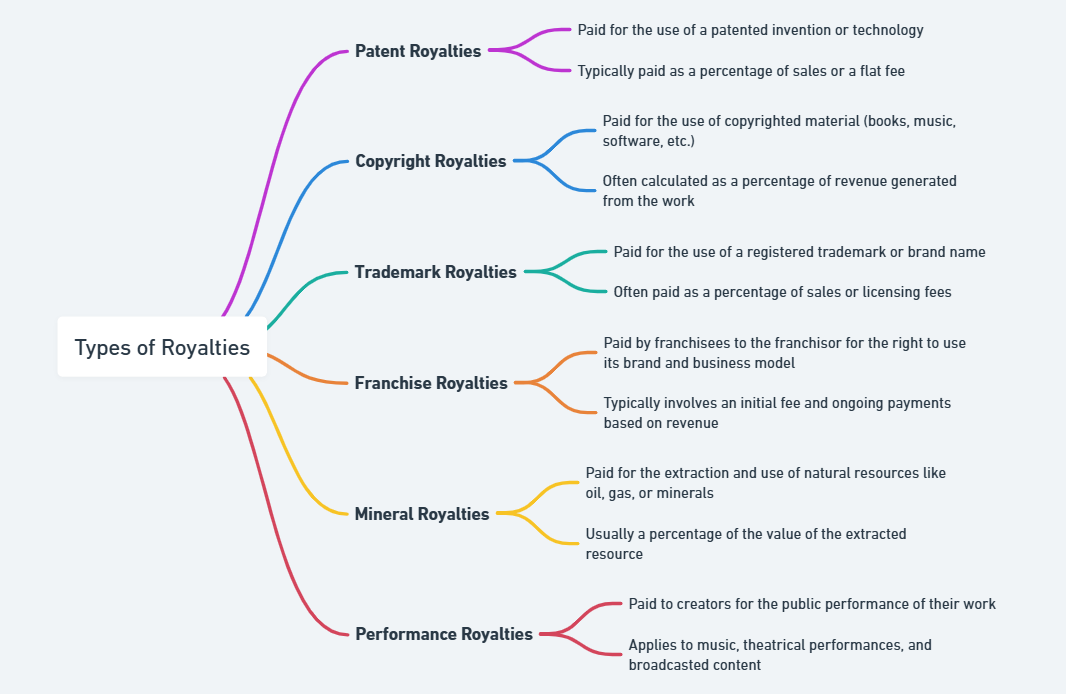

Types of Royalties

Royalties take many forms, and each type of royalty is unique to the nature of the asset licensed. Businesses and creators must understand these different types of royalties as they define how payments are structured and negotiated. Below are the major types of royalties in business:

1. Copyright Royalties

The most typical royalty in the intellectual property world is copyright royalties, which are paid to a copyright owner each time his copyrighted work is reproduced, performed, or otherwise used. For example, an artist is paid copyright royalties every time their song airs on the radio when it is streamed over the internet, or used as part of a commercial.

2. Patent Royalties

Companies pay a patent royalty to use a patented invention or technology. Whenever a company uses a patented process or product, they have to pay the owner of the patent the right to use it. Companies usually charge a patent royalty as a percentage of the sales revenue or by unit produced and paid on a fixed fee.

3. Mineral and Resource Royalties

Mineral royalties are major payments in industries such as mining and oil extraction. Royalties are paid for the right to extract minerals, oil, or gas from land owned by a government, landowner, or private entity. Royalties are usually calculate based on the volume or value of extracted resources.

4. Franchise Royalties

Most franchise businesses generate their income from franchise royalties. The royalties are usually a percentage of the sales of the franchisee and are paid to the franchisor in return for the right to use the franchise’s brand, business model, and intellectual property.

5. Trademark Royalties

When a business uses a registered trademark or brand name, it might need to pay trademark royalties to the trademark owner. Trademark royalties compensate the owner for allowing another business to leverage its established brand and customer recognition.

Each type of royalty plays a pivotal role in ensuring that creators, inventors, and resource owners receive compensation for their efforts. The asset being licensed includes an intellectual property right, a physical resource, or a brand name.

Why Are Royalties Important to Business Owners?

Royalty payments mean a lot to business persons, especially those operating in companies that depend on intellectual properties, mining, or franchises. Let’s see why royalties are important to the business person, especially regarding business growth and long-run profitability.

Revenue Generation Without Direct Production Involvement

One of the most important benefits of royalties for business owners is that they can earn money without being directly involved in the production or sale of licensed assets. For instance, a music producer can earn royalties from the sale of albums or streaming without having to be involved in the creation of every copy. Similarly, the owner of a patent can obtain royalty income from businesses utilizing patented technology for their operations. They thereby receive money from the intellectual property they created without ever producing and selling products themselves.

Long-Term, Passive Income

Royalties generate passive income for business owners. Industries such as publishing, music, and technology consider it a vital source of income because royalties may continue to flow for many years after the original work or invention was created. For example, a bestselling author or an inventor with a popular patented product may receive royalty payments for many years after the initial product was introduced.

Incentive for Innovation

Royalty agreements encourage innovators and business people to invest in innovation. They know that their intellectual property or assets will be compensated for, thus encouraging further research and development. Businesses that rely on patents, copyrights, or trademarks benefit from this innovation ecosystem, where continuous improvements and inventions are rewarded through royalty payments.

International Revenue Potential

Many businesses also get international royalties. With global licensing agreements, a business is able to enter markets it may not be in. For instance, by licensing a product in foreign markets, one can earn revenues through that means. Business owners benefit from global demand without necessarily needing to establish themselves in another country.

Leverage for Negotiations and Partnerships

Owning intellectual property or other valuable assets can position the business owner to have better negotiating power over various deals. The payee usually pays periodical payments quarterly or annually after setting terms. This comes in handy, especially if entering into joint ventures or when expanding product lines or strategic alliances since the royalty structure synchronizes the interests of either party.

How Do Royalties Work?

How royalties work in mechanics is fairly straightforward but necessary for both licensors and licensees. At its core, royalties represent a payment for the use of an asset under certain agreed-upon conditions.

1. Negotiating the Terms

The first step to a royalty agreement is in negotiating the terms. For instance, this includes the percentage or amount of the payment, the duration of the agreement, and the nature of the use. As an example, in the case of a book publishing contract, the author may be paid a percentage of the retail price of each book sold. Alternatively, a mining company can negotiate a royalty rate dependent on the volume of minerals extracted.

2. Payment Structure

The payment structure concerning royalties may differ from one industry to another and assets involved. Some royalties are always a fixed fee per unit of product, while other royalties may be based upon a percentage of the generated revenue by the asset itself. In the case of intellectual property, the frequency of use or the geographically defined region may establish the royalty.

3. Collection and Distribution

The payee usually pays periodical payments quarterly or annually after setting terms. In the case of intellectual property royalties, third-party agencies or publishers may collect and distribute such payments. For example, a music publisher may collect royalties from radio stations and streaming platforms on behalf of an artist and then remit the payments accordingly.

4. Compliance and Auditing

The parties must agree to the terms to ensure they calculate the royalties correctly. Licensees are often obligated to provide detailed reports of sales or usage, and licensors will audit these reports to ensure the correct amount is being paid.

What Is a Royalty Account?

A royalty account is a type of special bank account for recording and managing royalty payments. It actually helps both licensors and licensees maintain the proper records regarding the calculation, collection, and distribution of royalty payments.

Tracking Royalty Payments

The accounts of royalty help in tracing payments made under an agreement. For example, an artist who produces music will have a royalty account with the record label to track all royalties earned from selling or streaming their music.

Reporting and Transparency

These accounts detail how royalty amounts are computed, paid, and received. Both parties to a royalty agreement depend on such information to ensure fair compensation and avoid disputes over terms of payment.

Payment Management

Doing a royalty account ensures that its payments are processed correctly. It may both track incoming and outgoing payments to ensure that those payable amounts are credited against the right parties. On royalties, this is useful, especially for licensors that should monitor the income in case their intellectual property is assets.

Tax and Legal Compliance

Certain tax laws in some jurisdictions govern royalty payments. A royalty account keeps track of payments for reporting purposes and, more importantly, keeps one in line with the tax laws, especially when payment flows across borders.

Difference Between Rent and Royalty

Though rent and royalty are both forms of pay for the use of an asset, there is a fundamental difference between these two. Knowing these differences allows businesses to make appropriate decisions when entering into a contract or agreement involving any of these payments.

1. Nature of the Asset

Typically, people pay rent to use tangible assets like land, buildings, or machinery. It’s a payment for the temporary use of property. In contrast, royalties are generally associated with intangible assets, such as intellectual property (patents, trademarks, copyrights), or natural resources like minerals and oil.

2. Payment Structure

Tenants usually pay rent for tangible assets such as land, buildings, or machines. In other words, it is paid for the temporary use of property. Roys are generally associated with intangible assets such as intellectual property such as patents, trademarks, and copyrights, as well as natural resources such as minerals and oil.

3. Duration and Ownership

Rent agreements are often shorter-term and involve no transfer of ownership. Royalties, however, are often long-term and may continue for the duration of the asset’s commercial life.

4. Risk and Reward

Rent payments are certain because they do not depend on the success of the business using the asset. Royalties, however, depend on how well the licensed asset is performing in the market.

Royalty Meaning in Economics FAQs

What is the difference between royalty and commission?

Payments for the use of an asset are royalties while facilitating a sale or transaction incurs a fee known as commission. Royalties typically represent a percentage of the revenue generated, while commissions often represent a fixed percentage of the sales price.

Do royalties apply to all industries?

No, industries such as music, film, publishing, and mining most commonly see royalties. When companies license intellectual property, natural resources, or assets for use, they apply.

How do you determine royalty rates?

Various factors, including the type of asset, the industry, the negotiated agreement, and market conditions, determine royalty rates. In some cases, industry standards or historical data can guide rate decisions.

Is royalty income taxable?

Yes, royalty income is subject to taxation, and the tax rate can vary depending on the jurisdiction. Businesses and individuals receiving royalties must report this income on their tax returns.

Can we negotiate royalties?

Yes, the licensor and licensee can negotiate royalty agreements. Factors like the percentage rate, payment structure, and duration are often subject to negotiation depending on the value of the asset and the relationship between the parties.