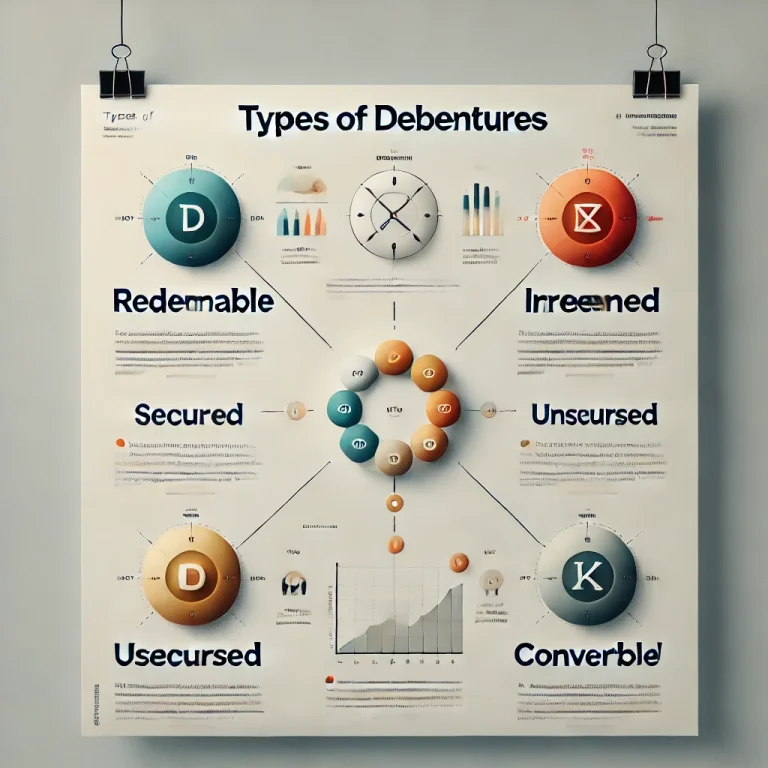

A debenture is a debt instrument issued by a company to raise funds from the public or financial institutions with a promise to repay the principal amount and a certain interest rate at fixed intervals. Unlike shares, it does not give a share of ownership in the company but provides a stable return in the form of interest being paid. Depending on the type of security and convertibility, the debentures are classified into different types. Debentures can be classified into several types based on factors like security, convertibility, redeemability, and registration. These include secured and unsecured, convertible and non-convertible, redeemable and irredeemable, and registered and bearer debentures.

Meaning of Debentures

Debentures can be described as an instrument representing a loan taken from an investor against the company. The lender, in return, obtains interest and returns the principal amount given on the expiry of a certain maturity period. Debentures can either be secured or unsecured, convertible, or non-convertible, and may have different terms of repayment. Unlike shares, debentures do not grant the holder any ownership right or stake in that company. Instead, the issuer of debenture is a creditor, and the return is fixed via the rate of interest, often referred to as the “coupon rate,” regardless of whether or not the firm is operating in the black.

Debentures are a source of assured income for investors seeking fixed returns, and more importantly, preferred by firms as a source of fundraising without dilution of equity.

Different Types of Debentures

There are various kinds of debentures, each characterized by different features that help serve the varied financial needs of both companies and investors. Some of them include:

Secured Debentures

This type of debenture is secured by the assets of the company and, therefore, gives security to the debenture holders. In case of a default by the company in its debt obligations, debenture holders who have issued secured debentures can claim the assets of the company for the recovery of their investment. For instance, a real estate company would issue secured debentures that would be supported by its property assets.

Unsecured Debentures

Also named naked or simple debentures, they are not secured by particular assets. Only the genuineness and financial soundness of the company serve as a promise for redemption. Generally, the risk associated with unsecured debentures is greater than that of secured debentures. However, unsecured debentures bear a greater rate of interest as compensation for the risk.

Convertible Debentures

The convertible debentures provide an option to the holder to convert into equity shares of the company after a specific period or at a predetermined rate. This makes it a good investment source for those wanting a debt and equity hybrid. Investors earn the upside of share price appreciation and get a fixed interest during the period of holding the debentures.

Non-Convertible Debentures (NCDs)

The name itself says that it cannot be converted into an equity share. So these are purely debt instruments and will be providing fixed interest over the term. NCDs are specifically meant for those who want fixed income without getting the equity market volatility

Redeemable Debentures

Redeemable debentures have a specific maturity date whereby the amount will be repaid to the company along with any outstanding interest. The redemption value can be at face value, at a premium, or at a discount, depending on the terms of issuance. It gives investors a clear exit, thus attracting risk-averse individuals.

Irredeemable Debentures (Perpetual Debentures)

These debentures do not carry any fixed date of maturity, and the corporation can even refuse to pay the principal amount. Irredeemable debenture holders keep on receiving interest payments till infinity or until the company decides to redeem them. Usually, such debentures are issued by companies having high stability and good financial health.

Registered Debentures

Registered debentures are entered on the company’s register of debenture holders and registered for transferability, and their transfers must be registered. The issuer is entitled to pay interest and capital payments to registered holders only.

Bearer Debentures

The bearer debenture holder has no record in the books of the company. The holder of the physical certificate is therefore entitled only to interest payments and the principal at maturity. These can be transferred by mere delivery, making them extremely flexible but riskier in case they get lost or stolen.

What are Key Features of Debentures?

Debentures have specific features that make them a popular financial tool between companies and investors. Here are some of the main aspects of debentures.

1. Fixed interest payments: There is obligatory payment of interest at a fixed rate, or coupon rate over its term, which makes it a predictable source of income for investors.

2. No Ownership Rights: The holders of debentures are not the owners. They do not have any claim in equity or hold voting rights, which is one main difference in comparison to equity holders.

3. Tenure: Debentures possess tenure with repayment of the principal amount on maturity. This tenure period is either short-term (less than 5 years) or long-term (over 10 years).

4. Liquidation Preference: Once again, at the time of liquidation, debenture holders are ensured a claim on the company’s assets that surpasses that of shareholders, though only secured creditors have preference over this.

5. Convertible and Non-Convertible: There exist two kinds of debentures namely convertible and non-convertible. The former provides a right to convert into equity shares so that debenture holders might be able to enjoy any rise in the capital value, which is unimaginable in the case of the latter.

6. Market Trading: Most of the debentures are quoted on stock exchanges, so investors can trade in the secondary market by buying or selling.

Use of Debentures

Debentures are widely issued by companies for raising capital in a non-diluting manner. They are applied in various industries and serve different purposes, in addition to the purposes:

1. Financing Growth: Companies raise funds required for the growth project, such as the introduction of new product lines, geographical markets, or facilities, without diluting the control of existing shareholders.

2. Refinance: Debentures can be issued to refinance previously existing debts when interest rates on previous debt are higher than to manage the debt of the company at hand and reduce the costs associated with servicing those debts.

3. Working Capital: A debenture provides a company’s working capital to run day-to-day activities, cash flow, and managing short-term financial obligations.

4. Project Financing: Through debentures, firms also raise funds for capital-intensive projects, that is infrastructure development or high technology upgrades requiring substantial capital outlays.

Why Invest in Debentures?

Investing in debentures could be a very strategic move for most people looking for a low-risk investment with stable returns. Here are some reasons why you should invest in debentures:

1. Stable Income: Debentures always have fixed interest payments, making them attractive investments for a steady income.

2. Lower Risk: Debentures are relatively safer compared to equity shares because the holders of debentures are entitled to regular interest payments, irrespective of the company’s profitability, and are also preferred as regards liquidation.

3. Diversification: Debentures help to diversify the risk by adding to the overall portfolio since they balance the increased volatility of stocks with the stability provided in fixed-income securities.

4. Tax Benefits: The interest on different kinds of debentures provided by some countries are tax benefits. Hence making them a potential investment avenue in terms of tax efficiency.

5. Liquidity: Many debentures are traded on various exchanges. Thus, investors are free to trade these in the secondary market. Thereby being liquid and flexible in the management of their portfolios.

Conclusion

Debentures play a very, very important role in corporate financing, and it is considered that equities are stable from an investor’s standpoint. Their different forms, features, and reasons for investment can guide both companies and investors to make smart financial decisions. Whether secured or unsecured, convertible or nonconvertible, debentures offer a host of benefits from which differing investments and corporate needs can be fulfilled.

Types of Debentures FAQs

What is principal difference between secured and unsecured debentures?

The key difference between secured and unsecured debt lies in the presence or absence of collateral. Secured debt is backed by an asset, which the lender can seize if the borrower defaults. Unsecured debt, on the other hand, is not backed by collateral, and lenders rely on the borrower’s creditworthiness to repay the loan.

Do debentures accrue into equities?

Convertible debentures may be converted into equity shares at a future date or at a predetermined rate.

What are the key features of debentures?

Key features of debentures include a written promise of repayment, a fixed interest rate, a specific repayment tenure, and the option of being secured or convertible.

Why do investors buy debentures?

Debentures represent low-risk investments with constant returns; thus, the debentures are appropriate for steady income and portfolio diversification.

Are debentures traded on the stock exchange?

Most of the debentures are listed on the stock exchanges, so yes, there is liquidity and flexibility in case the investors wish to trade them on the secondary market.