Demand elasticity calculates the responsiveness of the quantity demanded of a good to variations in its price, income, or the price of related goods. It helps businesspeople and economists determine the impacts of varied factors that affect consumer behavior and demand for products. In short, it reflects consumer sensitivity to such changes. This boosts decisions over product pricing, marketing, and formulation of policies.

Elasticity of demand is critical for firms to predict the variations in sales when a price hike or cut has occurred and for governments to expect variations in response to taxation or subsidies. The various types of elasticity capture different aspects of this responsiveness, thus helping to paint a comprehensive picture of market dynamics.

What is Elasticity of Demand?

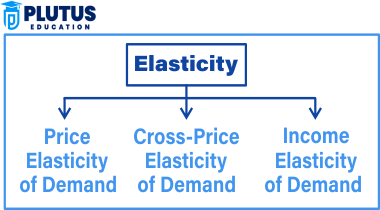

The elasticity of demand is defined as the responsiveness of demand for that good or service due to a change in price or any other influencing factor, for example, consumer income or the price of complementary goods. The elasticities include price elasticity, income elasticity, and cross elasticity. These enable the concerned firms to determine the pricing strategy, approximate revenue shifts, and measure market response in varying conditions.

Types of Elasticity of Demand

The different types of elasticity capture various dimensions of consumer response to changes in economic conditions. The primary types include:

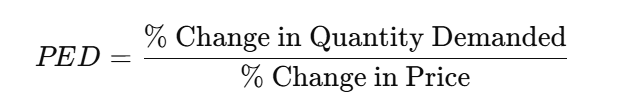

Price Elasticity of Demand (PED)

Price Elasticity of Demand (PED) refers to the change in quantity demanded in response to a change in the price of a good. It is calculated using the following formula:

Categories of Price Elasticity of Demand

- Elastic Demand (PED > 1): In this case, the percentage change in demand is more than the percentage change in price. For example, luxury goods have elastic demand because consumers can delay the purchase or forego buying the product if the prices are increased.

- Inelastic Demand (PED < 1): Here, the change in the percentage of demand is smaller than the change in the price. Essentials like gasoline are mainly affected by inelastic demand, wherein a buyer has to buy, regardless of how high the prices may climb.

- Unitary Elasticity (PED = 1): The percentage change in demand is equal to the percentage change in price, meaning there’s no rise in total revenue.

- Perfectly Elastic Demand (PED = ∞): A small price increase can cause zero demand. Such a situation arises rarely and is generally found in very competitive markets.

- Perfectly Inelastic Demand (PED = 0): The demand will remain the same due to any change in the price. Life-saving drugs are generally found in this category since consumers will buy them irrespective of the price.

Factors Affecting Price Elasticity of Demand

- Substitutes Availability: The more substitutes for a product, the more inelastic demand tends to be.

- Necessity vs. Luxury: Necessities tend to have an inelastic demand, but luxuries are more elastic.

- Time Period: In time, consumers will learn to change their behavior to adjust to changed prices, making demand more elastic in the long run.

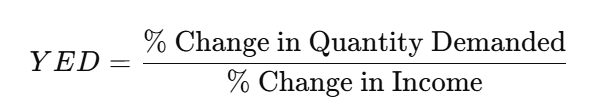

Income Elasticity of Demand (YED)

Income Elasticity of Demand (YED) measures how the quantity demanded of a good responds to changes in consumer income. The formula for income elasticity is:

Categories of Income Elasticity

- Positive Income Elasticity (YED > 0): Increased income means increased demand. It applies to normal goods like electronics or clothes.

- Negative Income Elasticity (YED < 0): Demand is inversely proportional to the increase in income. Inferior goods, for example, cheap-brand groceries, often have negative income elasticity.

- Income Elastic (YED > 1): The percentage rise in demand is more significant than the rise in income and often occurs with luxuries.

- Income Inelastic (0 < YED < 1): A lesser percentage change in demand than income change, mainly for necessities.

Significance of Income Elasticity

- Luxury vs. Necessity Goods: Knowledge of which is a luxury and which is a necessity will help businesses identify where they need to sell more to which income group, thereby making the right change in their marketing strategy accordingly.

- Effect on Economic Growth: Whenever the economy goes into growth, demand for luxury goods rises at a higher percentage rate than the increase of income whereas demand for inferior goods falls.

3. Cross Elasticity of Demand (XED)

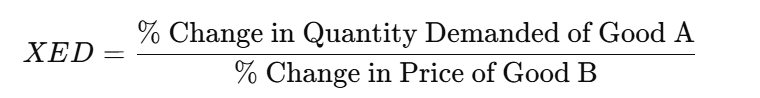

Cross Elasticity of Demand (XED) assesses how the demand for one good changes in response to the price change of another related good. It is calculated as:

Categories of Cross Elasticity

- Positive Cross Elasticity (XED > 0): This implies that XED is positive, and for substitute goods, where an increase in the price of Good B increases demand for Good A, for example, when tea prices rise then demand for coffee may increase.

- Negative Cross Elasticity (XED < 0): This corresponds to complementary goods, wherein an increase in Good B’s price decreases the demand for Good A. For instance, if the price of a printer increases, then the demand for the ink used by the printer would decrease.

- Zero Cross Elasticity (XED = 0): The products do not have any relation with each other. There is no change in the demand for one good for the change in the price of another good.

Applications of Cross Elasticity

- Competitor Analysis: The firms can measure how the price moves of their competitors will impact on the price of their products.

- Complementary Goods Marketing: Companies can market complements and offer discounts on one good to generate demand for another.

Elasticity in the Real World

Elasticity helps businesses establish how to price products, especially when dealing with competitors and economic fluctuations. For instance, a business selling inelastic goods will be able to increase prices because it will not lose so much in sales, while in elastic goods, the selling business needs to be careful to avoid raising prices.

- Inelastic Demand Curve: Steeper, as demand doesn’t change much with price changes.

- Elastic Demand Curve: Flatter, showing that small price changes significantly affect demand.

Types of Elasticity of Demand FAQs

What is the significance of income elasticity of demand?

Income elasticity of demand helps businesses understand how changes in consumer income affect the demand for their products, enabling better pricing and marketing strategies.

How does cross elasticity of demand differ from price elasticity?

While price elasticity measures the responsiveness of demand to changes in the price of the same good, cross elasticity measures the effect of price changes of related goods.

What does it mean if a product has perfectly inelastic demand?

Perfectly inelastic demand indicates that consumers will purchase the product regardless of its price, common for necessities like life-saving drugs.

Why is understanding price elasticity important for businesses?

Price elasticity helps businesses predict how changes in price will affect their sales and revenue, allowing them to set optimal prices.

How do substitutes affect price elasticity?

The more substitutes available for a product, the more elastic its demand will be, as consumers can easily switch to alternatives when the price rises.