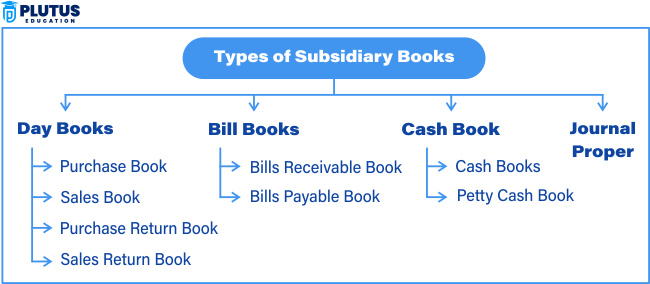

The subsidiary books are classified into different types based on recorded transactions, helping an organisation maintain a neat and systematic financial record. Every subsidiary book is set up to accommodate a particular kind of day-to-day transaction, thus avoiding the necessity of repeated record-keeping in the leading journal. This classification promotes efficiency, accuracy, and clarity in bookkeeping. The most important types are Day Books, to record credit purchases and sales; Bill Books, for monitoring bills receivable and payable; Cash Books, which denote all cash and bank transactions including petty expenses; and Journal Proper, for recording non-regular or special entries. These accounting books serve a dual purpose: facilitating the accounting system and helping ensure effective internal control and easy reference during audits or financial analysis.

What are Subsidiary Books?

Subsidiary books are special accounting books for recording certain business transactions that occur regularly and repeatedly, such as purchases, sales, and cash movements. Instead of cluttering a manual with many routine entries, these subsidiary books categorise transactions, making accounting systematic and efficient. They also distribute accounting work, reducing errors, improving efficiency, and saving time.

Types of Subsidiary Books

The most common types of subsidiary books include Day Books (like Purchase and Sales Books), Bill Books (Bills Receivable and Bills Payable), Cash Books (including Petty Cash Books), and the Journal Proper for non-regular or adjustment entries. These books compose the structure of an efficient double-entry bookkeeping system, and their role is paramount in keeping those financial records neatly and efficiently.

Day Books

The Day Books are primarily subsidiary books which record day-to-day transactions of some specific kind. These are the Purchase Book for all credit purchases of goods, the Sales Book for all credit sales of goods, the Purchase Return Book to log the return of goods purchased on credit, and the Sales Return Book to document the return of goods sold on credit. These books act in favour of accounting by segregating similar transactions so that the accounting may be done more efficiently and lessen the burden on the general journal.

Purchase Book

The Purchase Book is a subsidiary book in which all credit purchases of goods bought for resale in business are recorded. Cash purchases and assets bought purely for internal use are not recorded. The entries of this book are dated with the name of the supplier, invoice number, details regarding the goods purchased, and the amount. It streamlines the accounting by separating frequent credit purchases from the general journal, allowing full attention to tracking creditors and best handling inventory.

Sales Book

A sales book records all sales of goods and services made through credit sales. Thus, like the Purchase Book, cash transaction sales and sales from non-trading assets will not be included. Entries typically include customer names, invoice details, items sold, quantity, price, and the total amount. This makes the book a significant source document for entrance into the sales ledger and necessary for managing credit sales and accounts receivable, as well as the evolution of sales figures over time.

Purchase Return Book

Also called the Return Outward Book, this book records goods returned to suppliers because of faults, excess quantity, or misplacement. Such details include return date, supplier name, and invoice reference. Apart from maintaining a separate record for easy account reconciliation with suppliers and adjustment of payables on the amounts payable to suppliers, such bookkeeping would ensure correctness in the financial statement, as it reduces the total amount of purchases owed.

Sales Return Book

The Sales Return Book, also known as the Return Inward Book, records customer returns due to damages, expiration, or dissatisfaction with goods received. It gives information about which customers, what invoice numbers returned items have been credited to, and the relevant amounts. This will ensure the business can adjust revenues and update inventories accurately. Keeping a separate record of returns helps evaluate product quality and customer satisfaction, enriching ideas about how they can be improved.

Bill books

All transactions related to bills of exchange and promissory notes are recorded in the Bill Books. The Bills Receivable Book registers those bills that are expected to be received by the business, primarily from its customers, whereas the Bills Payable Book records those bills that the company is liable to pay to its creditors. These books are helpful in cash management, monitoring outstanding receivables, and making timely payments thereby improving financial control and planning.

Bills Receivable Book

The Bills Receivable Book is where all the bills of exchange and promissory notes a business expects to receive from customers or debtors are entered. The bill date, due date, amount, drawer, and acceptor accompany each entry. This helps account for receivables and plan cash flows to ensure timely collection follow-ups. Clear-cut pictures of outstanding dues along with their maturity timelines can be produced through this book.

Bills Payable Book

All bills of exchange or promissory notes that a company must pay together with its creditors have been compiled in this book. The Bills Payable Book includes the issuance date, the due date, the name of the payee, amount, and terms. It is an instrument for orderly payments in the business process, thus preventing default and maintaining good relationships with suppliers. The regular checking of this book helps financial planning and disbursement.

Cash Book

A cash book is a primary book of original entries where all cash and bank transactions of a business are recorded in chronological order. It serves the dual purpose of a journal as well as a ledger. In this book, every transaction involving cash receipts or payments is documented with full details, including the date, amount, and source or destination of funds. Because every business transaction involving cash or bank passes through the cash book, it also acts as the backbone for preparing financial statements and verifying the accuracy of accounts.

Types of Cash Books

Like other subsidiary books in accounting, cash books are categorised based on the nature and complexity of the business’s financial transactions. Each type of cash book is suited to different business needs, and understanding them is essential for academic exams and practical business applications.

Single Column Cash Book

The single-column cash book is the simplest form used by small businesses or entities with minimal banking activity. It includes only one column—the cash column—on both the debit and credit sides. The debit side records all cash received, while the credit side records all cash payments made by the business. It does not contain a column for banks or discounts, making it ideal for sole proprietorships or small vendors dealing mainly in cash.

Format:

| Date | Particulars | L.F. | Amount (₹) |

| YYYY-MM-DD | Description of entry | xxx | 0.00 |

This format focuses purely on cash movement and is often introduced early in commerce education to familiarise students with fundamental accounting principles.

Double Column Cash Book

This type of cash book includes two columns on each side—one for cash and one for bank. It is commonly used in businesses that frequently deal with bank deposits, withdrawals, and cash transactions. The double-column format helps simultaneously track cash and bank balances without maintaining separate books for each. This format is handy when firms receive payments directly into their bank accounts or make payments via bank transfers.

Format:

| Date | Particulars | L.F. | Cash (₹) | Bank (₹) |

| YYYY-MM-DD | Description of transaction | XXX | 0.00 | 0.00 |

This book provides an integrated view of both liquidity positions, which helps accountants or students in preparing bank reconciliation statements.

Triple Column Cash Book

The triple-column cash book is the most comprehensive version. It includes three columns for cash, bank, and discounts. The discount column records cash discounts allowed and received, helping businesses track how much they save or offer as incentives during transactions. It is highly relevant in large-scale operations or organisations that frequently offer or receive discounts.

Format:

| Date | Particulars | L.F. | Discount (₹) | Cash (₹) | Bank (₹) |

| YYYY-MM-DD | Description of transaction | XXX | 0.00 | 0.00 | 0.00 |

This type of cash book is significant for understanding the impact of trade discounts on profitability and for preparing accurate financial summaries.

Petty Cash Book

A petty cash book records daily business expenses, such as stationery, tea, courier, or postage. A petty cashier typically handles these using the imprest system, where a fixed amount is given for the week or month and replenished as needed. The petty cash book helps minimise the number of transactions entered into the main cash book.

Format:

| Date | Particulars | Voucher No. | Postage (₹) | Conveyance (₹) | Stationery (₹) | Total (₹) |

| YYYY-MM-DD | Description of expense | XXX | 0.00 | 0.00 | 0.00 | 0.00 |

It is essential for tracking minor but frequent expenses, which otherwise become difficult to manage or audit

Comparison of Different Types of Cash Book

| Type | Columns | Use | Ideal For |

| Single Column | Cash only | Records only cash receipts & payments | Small businesses, cash-only deals |

| Double Column | Cash + Bank | Tracks both cash and bank transactions | Firms with frequent bank dealings |

| Triple Column | Cash + Bank + Discount | Manages cash, bank, and discount entries | Medium/large businesses with discounts |

| Petty Cash Book | Expense-wise petty heads | Records minor daily expenses (imprest system) | Offices, institutions, and daily spending |

Journal Proper

The journal proper is a general journal for transactions not assigned to specialised subsidiary books. It makes entries for certain unique and non-routine transactions, such as opening, adjustment, closing, and rectification entries. Since all other routine transactions are recorded in their books, the Journal Proper is the final safeguard to avoid omitting any transactions; thus, it stands as a catch-all for non-routine entries, preserving the integrity and completeness of the accounting record.

Types of Subsidiary Books FAQs

What is a cash book in accounting?

A cash book is a financial journal that records all cash and bank transactions chronologically and is used as both a journal and a ledger in accounting.

How many types of cash books are there in accounting?

There are four types of cash books: single-column, double-column, triple-column, and petty cash books, each designed for specific types of financial transactions.

Why is the petty cash book important?

The petty cash book is vital for managing minor and frequent expenses and recording them systematically without cluttering the main cash book.

How does a cash book help in auditing?

Cash books provide a detailed record of each transaction, making it easier for auditors to verify entries and ensure that the financial data is accurate and transparent.

Is a cash book different from a ledger?

Yes, a cash book acts as both a book of original entries and a ledger for cash/bank transactions, whereas a ledger contains classified accounts of all business transactions.