The ACCA qualification is one of the most recognized accounting credentials worldwide. Each examination session furnishes plenty of information regarding student performance, success rates, and business needs. What has been a recent cause for much debate is the ACCA pass rates. Again, reflecting not only the academic rigor but also the preparedness of future accountants, these pass rates are quite telling. In this article, we are going to walk through the present ACCA pass percentages and what factors are dominating them and then offer means to achieve more success in the exams.

Download ACCA Passing Percentage 2025 PDF

Historical Trends in ACCA Pass Percentages

Over the past decade, ACCA pass percentages have shown consistent patterns across exam sessions, with Applied Knowledge papers typically recording higher pass rates (70–85%), Applied Skills papers averaging 45–55%, and Strategic Professional papers ranging between 35–50%. Data released by ACCA for each quarterly session indicates relatively stable global trends, though individual paper performance can fluctuate based on syllabus changes, exam format updates, and examiner feedback.

Historical Pass Rates

- Foundation papers: ACCA foundation papers have always reported higher pass rates (70%-90% in general) because the foundational subjects are introductory and meant to create a foundation of knowledge.

- Applied Skills: FR and FM types of papers usually have pass rates ranging between 45% and 65%.

- Professional papers: The pass rate for Strategic Professional papers, for example, SBL, is generally lower—40%–50%—mainly because these are advanced-level papers.

Download ACCA Pass Percentage PDF

Impact of Global Factors on Trends

- COVID-19 pandemic: During the pandemic, ACCA implemented remote exams, which slightly affected pass rates as students adapted to the new exam environment.

- Changes in syllabus: Periodic updates to ACCA syllabuses also lead to fluctuations in pass percentages as students and tutors acclimatize to new content.

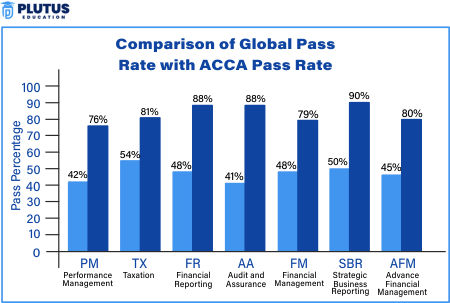

ACCA Passing Percentage by Paper

Each ACCA paper has its challenges and passes percentages, which fluctuate depending on the difficulty level and candidate preparation.

Applied Knowledge and Applied Skills

- F1 (Business and Technology): Consistently maintains high pass rates of around 80%, largely due to its fundamental nature.

- F4 (Corporate and Business Law): Pass rates for this paper typically range from 75%-85% globally.

- F7 (Financial Reporting): One of the tougher papers, with pass rates typically between 45%-55%.

|

Exam session |

BT |

MA |

FA |

LW |

PM |

TX |

FR |

AA |

FM |

|

Mar 2025 |

N/A |

N/A |

N/A |

N/A |

42 |

55 |

49 |

47 |

50 |

|

Sep 2024 |

N/A |

N/A |

N/A |

N/A |

42 |

53 |

50 |

47 |

52 |

|

Jun 2024 |

89 |

68 |

68 |

79 |

42 |

55 |

51 |

44 |

48 |

|

Mar 2024 |

N/A |

N/A |

N/A |

N/A |

45 |

53 |

52 |

44 |

48 |

|

Dec 2023 |

85 |

68 |

69 |

78 |

42 |

54 |

48 |

41 |

48 |

|

Sep 2023 |

N/A |

N/A |

N/A |

N/A |

40 |

54 |

47 |

42 |

49 |

|

Jun 2023 |

83 |

63 |

72 |

80 |

40 |

56 |

49 |

45 |

52 |

|

Mar 2023 |

N/A |

N/A |

N/A |

N/A |

44 |

53 |

52 |

44 |

49 |

|

Dec 2022 |

79 |

61 |

68 |

82 |

43 |

52 |

49 |

40 |

51 |

|

Sep 2022 |

N/A |

N/A |

N/A |

N/A |

40 |

52 |

50 |

44 |

51 |

|

Jun 2022 |

85 |

64 |

69 |

82* |

41 |

52 |

51 |

39 |

52 |

|

Mar 2022 |

N/A |

N/A |

N/A |

N/A |

40 |

51 |

50 |

44 |

50 |

|

Dec 2021 |

84 |

65 |

71 |

83 |

43 |

49 |

50 |

38 |

50 |

|

Sep 2021 |

N/A |

N/A |

N/A |

N/A |

37 |

52 |

48 |

39 |

52 |

|

Jun 2021 |

88 |

68 |

74 |

86 |

41 |

50 |

51 |

39 |

53 |

|

Mar 2021 |

N/A |

N/A |

N/A |

N/A |

44 |

46 |

47 |

43 |

46 |

|

Dec 2020 |

84 |

69 |

73 |

86 |

40 |

51 |

48 |

39 |

45 |

|

Sep 2020 |

86 |

72 |

77 |

88 |

39 |

49 |

50 |

41 |

52 |

|

Mar 2020 |

N/A |

N/A |

N/A |

N/A |

35 |

46 |

44 |

36 |

44 |

|

Dec 2019 |

82* |

64* |

71* |

83* |

38* |

49* |

46* |

38* |

43* |

|

Sep 2019 |

N/A |

N/A |

N/A |

N/A |

41* |

51* |

46* |

36* |

50* |

|

Jun 2019 |

85* |

66* |

72* |

84* |

38* |

52* |

50* |

39* |

46* |

|

Mar 2019 |

N/A |

N/A |

N/A |

N/A |

42* |

46* |

47* |

37* |

50* |

|

Dec 2018 |

83* |

64* |

72* |

82* |

39* |

51* |

51* |

38* |

43* |

|

Sep 2018 |

N/A |

N/A |

N/A |

N/A |

43* |

49* |

51* |

37* |

47* |

|

Jun 2018 |

83* |

67* |

71* |

80* |

38* |

50* |

50* |

40* |

48* |

|

Mar 2018 |

N/A |

N/A |

N/A |

N/A |

39* |

46* |

48* |

39* |

46* |

|

Dec 2017 |

77* |

65* |

71* |

77* |

42* |

51* |

49* |

40* |

48* |

|

Sep 2017 |

N/A |

N/A |

N/A |

N/A |

43* |

48* |

47* |

37* |

48* |

|

Jun 2017 |

83* |

64* |

68* |

77* |

43* |

50* |

48* |

43* |

46* |

|

Mar 2017 |

N/A |

N/A |

N/A |

N/A |

38* |

41* |

47* |

38* |

40* |

|

Dec 2016 |

82* |

63* |

71* |

82* |

40* |

52* |

50* |

40* |

45* |

|

Sep 2016 |

N/A |

N/A |

N/A |

N/A |

39* |

47* |

48* |

44* |

47* |

|

Jun 2016 |

83* |

63* |

72* |

80* |

41 |

46 |

47 |

45 |

46 |

|

Mar 2016 |

N/A |

N/A |

N/A |

N/A |

39 |

44 |

51 |

41 |

41 |

|

Dec 2015 |

84* |

64* |

68* |

74* |

41 |

53 |

45 |

46 |

45 |

|

Sep 2015 |

N/A |

N/A |

N/A |

N/A |

39 |

47 |

44 |

42 |

35 |

|

Jun 2015 |

85* |

58* |

63* |

75* |

37 |

50 |

40 |

39 |

41 |

|

Dec 2014 |

83* |

58* |

59* |

70* |

44 |

43 |

43 |

45 |

40 |

|

Jun 2014 |

80* |

60* |

63* |

45 |

39 |

53 |

47 |

40 |

40 |

|

Dec 2013 |

74* |

61* |

57* |

43 |

41 |

45 |

39 |

35 |

45 |

|

Jun 2013 |

72* |

64* |

54* |

37 |

44 |

52 |

45 |

40 |

45 |

|

Dec 2012 |

65* |

59* |

55* |

41 |

37 |

47 |

53 |

34 |

43 |

|

Jun 2012 |

64* |

52* |

56* |

54 |

42 |

45 |

48 |

56 |

37 |

|

Dec 2011 |

63* |

53* |

54* |

49 |

38 |

48 |

56 |

36 |

38 |

|

Jun 2011 |

70* |

57* |

55* |

55 |

37 |

51 |

38 |

40 |

38 |

Note:

(*) Results achieved by students for paper-based and computer-based examinations.

Professional Papers

- Strategic Business Reporting (SBR): A professional-level paper, SBR often records pass rates in the range of 45%–50%, making it one of the more challenging exams.

- Strategic Business Leader (SBL): SBL, an integrated case study paper, usually has a pass rate of around 50%.

|

Exam session |

SBL |

SBR |

AFM |

APM |

ATX |

AAA |

|

Mar 2025 |

53 |

50 |

45 |

39 |

52 |

39 |

|

Sep 2024 |

53 |

52 |

44 |

39 |

49 |

38 |

|

Jun 2024 |

52 |

49 |

46 |

37 |

47 |

37 |

|

Mar 2024 |

52 |

49 |

46 |

33 |

49 |

38 |

|

Dec 2023 |

52 |

50 |

45 |

34 |

49 |

34 |

|

Sep 2023 |

50 |

50 |

45 |

34 |

48 |

34 |

|

Jun 2023 |

51 |

51 |

47 |

34 |

43 |

34 |

|

Mar 2023 |

50 |

50 |

45 |

35 |

45 |

34 |

|

Dec 2022 |

49 |

47 |

41 |

33 |

39 |

32 |

|

Sep 2022 |

49 |

51 |

42 |

34 |

43 |

34 |

|

Jun 2022 |

50 |

49 |

41 |

33 |

42 |

31 |

|

Mar 2022 |

50 |

46 |

43 |

34 |

38 |

33 |

|

Dec 2021 |

51 |

48 |

41 |

32 |

37 |

34 |

|

Sep 2021 |

51 |

48 |

38 |

30 |

36 |

34 |

|

Jun 2021 |

46 |

44 |

39 |

32 |

41 |

32 |

|

Mar 2021 |

50 |

52 |

39 |

36 |

44 |

32 |

|

Dec 2020 |

49 |

47 |

42 |

32 |

40 |

35 |

|

Sep 2020 |

51* |

49* |

37* |

33* |

38* |

33* |

|

Mar 2020 |

47* |

51* |

33* |

32* |

44* |

33* |

|

Dec 2019 |

46 |

48 |

33 |

33 |

35 |

30 |

|

Sep 2019 |

49 |

52 |

36 |

31 |

36 |

36 |

|

Jun 2019 |

51 |

48 |

38 |

33 |

43 |

31 |

|

Mar 2019 |

46 |

49 |

35 |

32 |

33 |

30 |

|

Dec 2018 |

48 |

47 |

41 |

33 |

40 |

31 |

|

Sep 2018 |

45 |

47 |

35 |

33 |

30 |

30 |

|

Jun 2018 |

– |

– |

40 |

35 |

40 |

34 |

|

Mar 2018 |

– |

– |

41 |

29 |

37 |

30 |

|

Dec 2017 |

– |

– |

33 |

29 |

36 |

35 |

|

Sep 2017 |

– |

– |

35 |

32 |

33 |

31 |

|

Jun 2017 |

– |

– |

34 |

32 |

43 |

32 |

|

Mar 2017 |

– |

– |

35 |

28 |

38 |

32 |

|

Dec 2016 |

– |

– |

33 |

30 |

34 |

31 |

|

Sep 2016 |

– |

– |

37 |

35 |

35 |

32 |

|

Jun 2016 |

– |

– |

40 |

38 |

35 |

32 |

|

Mar 2016 |

– |

– |

38 |

33 |

44 |

30 |

|

Dec 2015 |

– |

– |

35 |

29 |

42 |

39 |

|

Sep 2015 |

– |

– |

36 |

30 |

45 |

29 |

|

Jun 2015 |

– |

– |

36 |

28 |

34 |

40 |

|

Dec 2014 |

– |

– |

33 |

30 |

38 |

42 |

|

Jun 2014 |

– |

– |

35 |

29 |

39 |

36 |

|

Dec 2013 |

– |

– |

42 |

30 |

41 |

33 |

|

Jun 2013 |

– |

– |

34 |

31 |

45 |

31 |

|

Dec 2012 |

– |

– |

33 |

33 |

44 |

32 |

|

Jun 2012 |

– |

– |

37 |

35 |

42 |

32 |

|

Dec 2011 |

– |

– |

34 |

29 |

39 |

31 |

|

Jun 2011 |

– |

– |

30 |

35 |

45 |

31 |

Practical Insights

- Performance Management (PM): Typically has a pass rate of around 40%–50%, largely due to its emphasis on practical scenarios and calculations.

- Advanced Financial Management (AFM): This professional paper has a pass rate that fluctuates between 35%-45%, reflecting its technical difficulty.

Factors Influencing ACCA Pass Percentage

The ACCA tests have proven rather challenging, with several factors that make the pass rates vary between sessions of the examinations. A better knowledge of these factors will help students in preparation for the exams and, therefore, succeed.

Internal and External Factors

- Difficulty of the paper: Some ACCA papers are naturally more challenging than others, but become harder with each level of professional papers.

- Preparation and preparation strategy: The kind of preparation matters. Regular time planners and revision class attendees, using approved learning materials, often fare better.

- Attitude of examiners: The attitude of examiners in marking papers may also determine the pass rate of the students appearing in the ACCA. The ACCA examiners are rather strict in implementing international accounting standards and ethical guidelines.

- General economic condition: Of course, economic downs in the world economies can also impact the ACCA pass rates since this will increase the stress of working professionals in handling both job and studies simultaneously.

Tips to Improve Your ACCA Pass Rate

For students aiming to improve their pass rate, certain strategies can make a significant difference in preparation and exam day performance.

Key Tips to Enhance Success

- Decide your study plan: It must be consistent. Do not take all cramming at the last minute. Plan dedicated time for every day.

- Utilize approved study materials: Excellent material is ACCA’s official learning partners, Kaplan and BPP.

- Past Paper TIPS: Attempting past exam papers allows students to get accustomed to the examination format, typical topics tested, and the amount of detail expected in answers.

- Join an ACCA study group: Interacting with peers can heighten your learning and provide a new view on difficult topics.

- Seek Professional Help: Enroll with an ACCA-approved tuition provider. This way, the student gets a comprehensive structure for studying, regular mock exams, and personalized feedback at every step.

How Plutus Education helps you study for ACCA subjects?

Learn from Plutus Education ACCA-certified experts and kickstart your global accounting career.

Enroll in the ACCA Success Path – Complete Certification Course at Plutus Education, designed to equip you with the skills, knowledge, and confidence to pass all 13 ACCA exams and land high-paying roles in top firms. Whether you’re a student, graduate, or working professional, this all-in-one ACCA program gives you the perfect launchpad for success.

Start your ACCA journey with Plutus Education — where success is structured, supported, and guaranteed.

Key Highlights of ACCA Success Path – Complete Certification Course

✅ Industry-Recognized Certification

Unlock a globally respected qualification with full support from ACCA-qualified trainers and mentors.

✅ 1000+ Hours of Interactive Learning

Master every ACCA concept with a rich blend of live classes, recorded videos, assignments, and mock tests.

✅ Full Exam Preparation Support

Get access to exam strategies, revision bootcamps, question banks, and personalized mentoring for every ACCA paper.

✅ Career Transformation Focus

Build real-world accounting and finance skills, with hands-on case studies and expert guidance from industry professionals.

✅ Complete Study Resources

Learn with ACCA-approved study material, Kaplan/BPP kits, doubt-clearing sessions, and progress tracking dashboards.

✅ Placement and Career Support

Finish your course job-ready with career workshops, resume building, interview training, and placement assistance in Big 4 and top MNCs.

Comparison with Other Accounting Qualifications

How does the ACCA qualification compare to other accounting bodies, such as CPA (Certified Public Accountant) and CIMA (Chartered Institute of Management Accountants)?

- ACCA vs CPA: CPA generally reports higher pass rates (around 50%-60%) as compared to ACCA’s professional-level exams, which hover around 40%-50%.

- ACCA vs CIMA: CIMA exams, especially at the professional level, have lower pass rates (typically around 35%-45%), similar to ACCA’s Strategic Professional level papers.

Scope of Qualifications

- Global recognition: ACCA offers more global recognition as compared to CPA which appears to be US-based, and CIMA, which has a lean towards management accounting.

- Format of the course: the ACCA examinations are comprehensive, providing wide financial, managerial as well as ethical competencies, compared to the more U.S.-focused knowledge of CPA and the leading emphasis on management accounting by CIMA.

Download ACCA Passing Percentage 2025 PDF

ACCA Passing Percentage FAQs

What is the pass rate for ACCA?

ACCA exams generally have pass rates that tend to be above 50%, reflecting the comprehensive nature of the qualification. The pass rates can vary slightly between different ACCA exams, but they typically remain consistent.

What are ACCA pass percentages by paper?

Pass percentages vary by paper. For example, Business and Technology (BT) typically has a pass rate of around 80%, while Financial Reporting (FR) often sees pass rates between 45%-55%.

Why are ACCA pass rates so low?

Some ACCA papers are inherently more complex, covering advanced topics that require not just theoretical knowledge but also practical application. Papers at the Strategic Professional level, for instance, often have lower pass rates due to their comprehensive and integrative nature.

What factors affect ACCA pass percentages?

Factors include the difficulty of the paper, student preparedness, exam approach, and external factors like global economic conditions.

Is ACCA tougher than CA?

Generally, the CA (Chartered Accountancy) course is considered more difficult than ACCA (Association of Chartered Certified Accountants). This is due to factors like the number of years it takes to complete, the number of papers, the exam pattern, and the curriculum.

How can I improve my ACCA pass rate?

To improve your ACCA pass rate, you should follow a structured study plan, practice past exam papers, use ACCA-approved learning materials, and seek help from professional tutors.

Which is the toughest paper in ACCA?

The most challenging ACCA paper is generally considered to be Advanced Audit and Assurance (AAA), followed by Advanced Financial Management (AFM) and Advanced Performance Management (APM). These papers have the lowest pass rates and are known for their depth and complexity.

How do ACCA pass rates compare to CPA pass rates?

ACCA pass rates, especially at the professional level, are generally lower than CPA pass rates, which tend to hover around 50%-60%.

Is the ACCA exam pattern going to remain same in 2025?

The exam pattern of ACCA 2025 is not decided. You can check the detailed paper pattern format on the official website of ACCA Global.