Equity shares are the shares of ownership in a company, which claim part of the company’s profits for the shareholder. In other words, equity shares are called common shares or ordinary shares. When you buy equity shares, you are a part owner of the company. People earn money from the shareholders through dividends and capital gains when the value of shares increases. Equity shares also carry voting rights. In other words, equity shareholders can vote in crucial company decisions, including electing the board of directors. Equity shares are quoted on stock exchanges, and the price for these shares varies with the market, company performance, and investor sentiments.

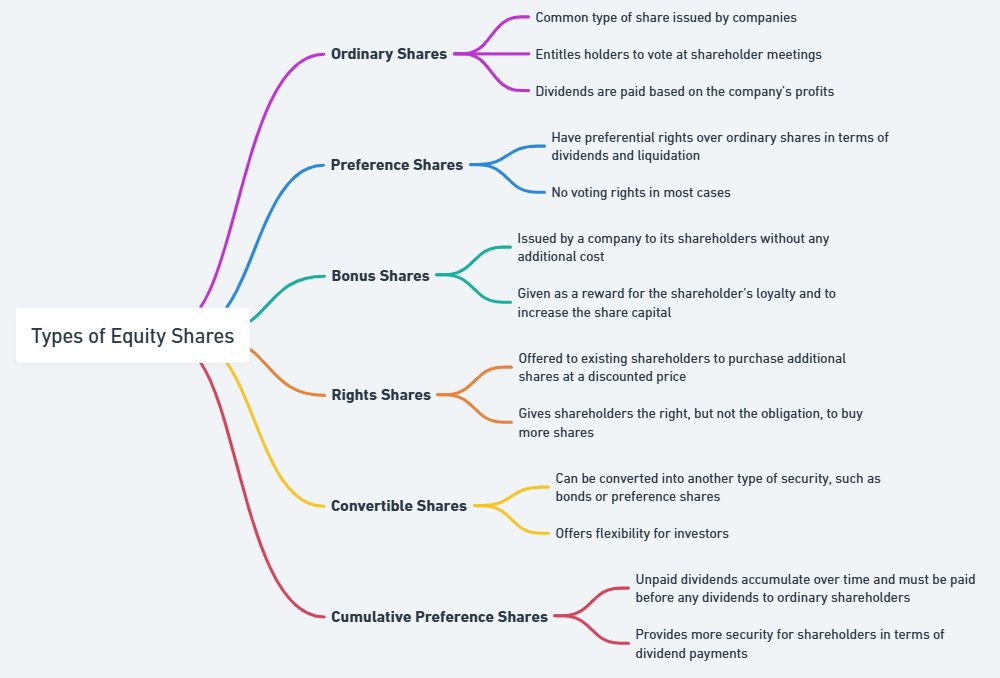

Types of Equity Shares

Equity shares come in different types, each with specific rights, privileges, and features. Understanding the various types will help you make better investment decisions. Below are the key types of equity shares that investors commonly come across.

1. Ordinary Equity Shares

The most common types of equity shares are ordinary shares. The ordinary shares give the shareholder voting rights and a portion of the company’s profit in the form of dividends. The value of ordinary shares fluctuates based on the company’s performance and the market’s perception of the company.

2. Preference Shares

Though “preference shares” are not literally “equity shares, they still bear some likenesses. Preference shareholders obtain dividends ahead of ordinary shareholders. Still, they mostly do not have voting power. Preference shares are more secure than common shares with ensured fixed dividends; thus, conserving investors prefer them.

3. Convertible Shares

With convertible equity shares, shareholders have the option of converting their shares into a determined number of ordinary shares. This is an equity-debt hybrid where investors are paid a fixed return in the initial stages but are given the chance to convert into equity if the company performs well.

4. Non-Convertible Shares

Unlike convertible shares, non-convertible shares do not have an option to convert into ordinary shares. They are mainly preferred by those who wish to have stability and do not want to take the risk of fluctuating market prices.

5. Voting Shares

The voting equity shares allow the investor to decide the company’s course by voting for major decisions such as mergers and acquisitions or electing board members. The shareholders holding voting rights generally hold more influence over the company’s decisions.

6. Non-Voting Shares

Non-voting equity shares cannot offer shareholders any rights to vote at the annual meeting. Investors continue getting dividend rights, though without voting powers in any aspect of the corporation.

7. Bonus Shares

Bonus shares issued by a company are bonus shares to the existing shareholders. Instead of paying them in cash, companies distribute new shares. This causes an increase in the total number of outstanding shares, with the existing shareholders receiving more shares than they already own in proportion to what they already own.

8. Rights Shares

These are shares that are given to existing shareholders of a company, and they allow the shareholders to buy extra shares at a discounted price. Rights shares are issued when the company needs more capital and offers current investors the opportunity to buy new shares before the general public is allowed to buy them.

Features of Equity Shares

Equity shares have several features that distinguish them from other forms of investments. Below, we will discuss the key features that make equity shares both attractive and risky for investors.

1. Ownership and Control

Whenever one purchases equity shares, that person becomes a partial owner of the company. Certain rights are bestowed upon such people, including voting rights over certain corporate matters. Shareholders can influence decisions such as electing the board of directors and approval of significant changes within the company.

2. Dividends

An equity shareholder has the chance of getting dividends. Corporates disburse a percentage of the profit to shareholders which could be annually or in three-monthly intervals. These may either be reinvested into shares or received as money in cash. However, in dividend payment, there is no promise, and the corporation performs as it decides to.

3. Capital Gains

Buying shares in the equity market gives you the chance to earn capital gains, which is what you make when your shares rise in price. If the company performs well, the value of its equity shares normally increases, and people can sell their shares to make a profit.

4. Risk and Return

Equities are usually high-risk investment instruments. The prices of equities may go swinging due to market, corporate, and overall economic reasons. Still, equities provide high returns in terms of capital appreciation and income compared to safer investments like bonds.

5. Liquidity

Equity shares are very liquid as they can easily be bought and sold on the stock exchanges. Investors can sell their shares at any time of their choice, provided that there is a market for them. This makes equity shares a flexible investment option, especially for short-term investors.

6. Subordinate Claim

Equity shareholders are the last to be paid in the event of liquidation of a company after creditors and preference shareholders. They may have high returns when the company makes profits, but they also suffer the highest risk when times are hard.

Why Should You Invest in Equity Shares?

Investing in equity shares offers several advantages, making it a popular choice for both individual and institutional investors. Below, we will discuss the main reasons why you should consider investing in equity shares.

Potential for High Returns

High returns can be received from equity shares, especially when the company performs well and the share price appreciates. In the long term, equity shares have historically outperformed other forms of investment like bonds, bringing significant capital gains to investors.

Ownership and Voting Rights

Owning equity shares means having a stake in the company’s operations. A shareholder usually obtains voting rights, meaning he has a right to vote on matters such as mergers or director elections. As such, it gives you a sense of control over your investments.

Diversification of Investment Portfolio

Equity shares form a significant part of the diversified investment portfolio. This helps to spread risk to different sectors and companies with the help of equity shares. In this way, it reduces the overall risk in your portfolio. The diversified portfolio helps in keeping market volatility at bay.

Dividend Income

Although not a promise, most firms do pay out dividends to their equity owners. For long-term investors, these dividends can therefore be a steady stream of passive income, if reinvested in more shares.

Liquidity

Equity shares are the most liquid assets. Therefore you may sell them quickly on the stock exchange whenever you want liquidity to raise cash. The high liquid ability of equity shares attracts all those who need flexibility in making investments.

Tax Benefits

In many countries, equity shares are liable to less tax compared with other types of income like interest on savings accounts or fixed deposits. Therefore, the attractiveness of equity shares is even more to a tax-conscious investor.

Alternatives to Equity Shares

While equity shares are a popular investment choice, there are several alternatives that investors can consider. Each alternative has its own set of benefits and risks. Below are some of the most common alternatives to equity shares.

Bonds

A bond is a debt security issued by corporations or governments. When you purchase bonds, you lend money to the issuer, who promises to pay you interest at regular intervals and then return your principal amount at maturity. Bonds are generally less risky than equity shares but offer lower returns.

Mutual Funds

Mutual funds pool money from many investors to invest in a diversified portfolio of stocks, bonds, or other assets. Investing in mutual funds provides diversification, which makes it a low-risk alternative for buying individual equity shares. However, they also charge management fees that can consume your returns.

Real Estate

Real estate is also a favorite investment option. Investors purchase property to generate rental income or sell it when property values increase. However, real estate generates steady income and capital gains, but significant capital is required to invest in real estate, and its liquidity is much lower compared to equity shares.

Commodities

Commodities including gold, silver, oil, and agricultural products are physical investments bought by investors. It serves as a hedge against inflation and economic uncertainty. However, their prices are volatile, and dividends or voting rights in equity shares are offered.

Cryptocurrencies

Cryptocurrencies such as Bitcoin, Ethereum, and others have been gaining popularity as an alternative investment. They offer a high return but are highly speculative and volatile. In contrast to equity shares, investments in cryptocurrencies are substantially riskier.

Equity Shares FAQs

What Are the Advantages of Equity Shares?

Equity shares offer high returns, ownership in the company, voting rights, and liquidity. They provide the potential for capital gains and dividends. However, they also come with the risk of market fluctuations and a subordinate claim in case of liquidation.

What is the Difference Between Equity Shares and Preference Shares?

The main difference lies in dividends and voting rights. Equity shareholders have voting rights and earn dividends based on the company’s performance. Preference shareholders receive dividends before equity shareholders, but they do not have voting rights.

Can I Sell Equity Shares Anytime?

Yes, equity shares are highly liquid and can be sold on the stock market at any time, as long as there is a buyer. The price of the shares may fluctuate depending on market conditions.

What Are Some Risks Associated with Equity Shares?

The major risk associated with equity shares is the fluctuation in their market prices. A company’s performance or overall market conditions can significantly affect share prices. Moreover, equity shareholders are last in line for compensation in case the company goes bankrupt.

What Are the Alternatives to Equity Shares?

Some alternatives to equity shares include bonds, mutual funds, real estate, commodities, and cryptocurrencies. Each investment type has its own set of risks and rewards, and it is important to choose based on your risk tolerance and financial goals.