Every company needs money to run its operations, buy equipment, pay workers, and grow over time. This money comes from two main sources: equity and debt. The way a company mixes these two sources of funds is called its capital structure. This includes money from shareholders (equity) and borrowed money (debt). Companies always try to choose the best capital structure. They want to raise enough money while keeping costs low and risks under control. A good capital structure helps a company grow, stay stable, and perform well even in tough times. The capital structure depends on many things like business size, market conditions, interest rates, and how much control the owners want to keep. Capital structure is very important in business decisions. It affects profit, risk, and how others see the company. Investors, lenders, and analysts always check capital structure before making any decision.

What is Capital Structure?

Capital structure tells how a company collects money for its business. It shows the percentage of funds that come from equity and the percentage that comes from debt. It helps in planning and managing money better.

Every business must use a proper mix of debt and equity. If it takes too much loan, it may face problems in paying interest. If it depends only on equity, then it may lose growth chances. A balanced capital structure brings good results and keeps the business safe.

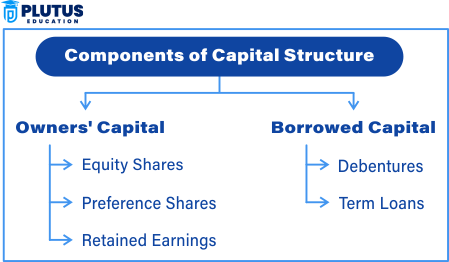

A company raises funds from owners (equity capital) and from lenders (debt capital). Equity includes shares, retained profits, and reserves. Debt includes loans, bonds, and debentures.

- Equity Capital

Equity capital comes from shareholders. They own part of the company. They get dividends and can vote on company decisions. The company does not return this money unless it closes. - Debt Capital

Debt capital is money borrowed from banks or the public. It must be paid back with interest. It includes term loans, bonds, and fixed deposits.

The correct capital structure balances risk and return. Companies check their profits, costs, and growth plans before choosing how much to borrow or issue in shares.

Types of Capital Structure

Different businesses use different types of capital structure depending on their needs and market conditions. The mix of debt and equity changes based on risk, control, and available finance options. Capital structure can be of many types.

A company may use more equity or more debt. Or it may keep both in equal proportion. All these types have different effects on profit and control. Understanding the types helps in choosing the right one.

- Equity-Based Capital Structure

In this type, the company uses only equity capital. It does not borrow money from outside. This reduces financial risk because there is no interest burden. But it also means lower returns. - Debt-Based Capital Structure

Here, the company mostly uses borrowed money. This increases financial risk due to fixed interest. But it also increases profits when business does well because owners do not share gains. - Balanced Capital Structure

A balanced or mixed capital structure includes both equity and debt. It reduces risk and improves returns. Most companies use this type. - Highly Leveraged Capital Structure

When debt is more than equity, it becomes a leveraged capital structure. It increases risk but may increase returns if managed well.

| Type | Equity % | Debt % | Risk Level | Control |

| Equity-Based | High | Low | Low | Full owner control |

| Debt-Based | Low | High | High | Lower control |

| Balanced | Equal | Equal | Medium | Shared |

| Highly Leveraged | Low | Very High | Very High | Lower control |

Each company must choose what suits its business model, size, and goals.

Factors Affecting Capital Structure

Many internal and external factors affect how a company builds its capital structure. These factors decide how much debt or equity is good for the business. Ignoring them may lead to poor results.

Knowing these factors helps in better financial planning. It allows companies to make smart decisions and reduce risk. Good capital structure brings stability even in hard times.

- Business Size and Nature

Big companies can get loans easily. Small businesses depend more on equity or retained earnings. - Profitability of the Company

Companies with high profits can take more loans as they can pay interest easily. - Cost of Capital

If debt is cheaper than equity, the company may prefer debt. But too much debt increases risk. - Market Conditions

In a booming market, companies issue more shares. In a slow market, they borrow more. - Control Consideration

Equity sharing reduces control of original owners. So, they may prefer debt. - Flexibility and Stability

Companies choose capital that gives flexibility and less pressure on cash flow. - Legal Restrictions

Some industries have limits on how much they can borrow.

All these factors must be reviewed regularly to keep capital structure healthy.

Features of Capital Structure

Capital structure has many features that make it important in financial decisions. It shows the financial strength and planning ability of a company. A well-designed structure shows balance and control.

Capital structure changes with time, depending on growth plans, profits, and debt capacity. But it must always remain clear and logical.

- Mix of Long-Term Sources

Capital structure includes only long-term sources like shares, bonds, and loans—not short-term loans. - Balance Between Risk and Return

The structure balances risk (due to debt) and return (from equity investment). - Cost Efficiency

A good structure reduces the average cost of capital and increases company value. - Influence on Financial Decisions

It affects other decisions like dividends, expansion, and mergers. - Time-Based Adjustments

Companies change their capital structure based on market changes and business needs.

These features make capital structure a key part of financial management.

Optimum Capital Structure

Optimum capital structure means the best mix of debt and equity. It gives maximum company value and minimum cost of capital. It helps the company grow while controlling risk.

Finding this balance is not easy. Companies use many tools and financial ratios to find the right mix. It also depends on market trends and business needs.

- Maintain Good Credit Score

A good credit record helps in getting loans at low rates. This lowers interest cost. - Keep Debt-Equity Ratio in Control

A 1:1 or 2:1 debt-equity ratio is considered safe. It avoids overdependence on loans. - Watch Cost of Funds

Companies compare cost of equity and cost of debt. They choose the cheaper one when needed. - Avoid Over-Leverage

Too much debt increases risk of bankruptcy. Companies must borrow within safe limits. - Adapt to Market Changes

When interest rates go high, companies switch to equity. When markets are good, they issue shares.

Proper planning and expert advice help in reaching optimum capital structure.

Capital Structure Example with Table

Let’s understand capital structure better with an example. Suppose a company needs ₹1 crore for expansion. It can raise this money using different mixes.

| Plan | Equity (₹) | Debt (₹) | Equity % | Debt % | Risk Level | Control |

| A | 1,00,00,000 | 0 | 100% | 0% | Low | Full |

| B | 50,00,000 | 50,00,000 | 50% | 50% | Medium | Shared |

| C | 25,00,000 | 75,00,000 | 25% | 75% | High | Less |

This example shows how risk and control change with each plan. Each business selects what suits its growth and stability.

What is Capital Structure Decision?

Capital structure decision means choosing how much money to raise through debt and equity. It is a long-term decision with deep impact. A wrong choice can hurt business performance.

This decision is not just about numbers. It includes risk planning, cost management, and control issues. Finance managers spend time finding the best option.

- Affects Business Survival

A bad capital structure can cause cash flow problems or bankruptcy. - Changes Company Image

Investors and banks check capital structure to judge company health. - Supports Future Goals

With proper capital structure, companies raise money easily for future projects.

Every capital structure decision needs analysis, market study, and expert input.

What is Capital Structure FAQs

Q1. What is capital structure in simple words?

Capital structure is the way a company arranges its equity and debt to run and grow its business.

Q2. What are the types of capital structure?

The types are equity-based, debt-based, balanced, and highly leveraged structures.

Q3. What factors affect capital structure?

Factors include business size, profit, market conditions, cost of capital, and control needs.

Q4. Why is capital structure important?

It helps balance risk and profit, supports growth, and affects how people see the business.

Q5. What is optimum capital structure?

It is the best mix of debt and equity that reduces cost and increases company value.

Q6. What is the difference between capital structure and financial structure?

Capital structure includes only long-term funds. Financial structure includes both short-term and long-term funds.