Financial management is a long-term, deliberate process aimed at guiding, organizing and directing an entity’s finances based on planned priorities. This will basically involve budgetary decisions, funding, and investment decisions, all to enhance an organization’s firm financial standing through profit maximization, among other means such as minimization of risk exposure, optimizing the utilization of funds, achieving long-run success along with business ventures, and obtaining security for the benefit of an enterprise.

What is Financial Management?

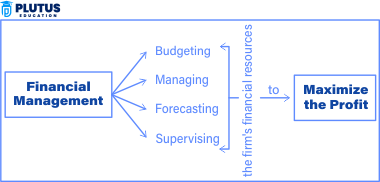

Financial management refers to planning, organizing, controlling, and monitoring monetary resources in order to achieve organizational goals. This management is very vital as far as business decisions are concerned; it ensures the growth and sustainability of the organization because it has various functions, such as budgeting, investment decisions, and risk management.

This means that the purpose of financial management is to make available resources in a company that align with both short-term and long-term goals. For example, while day-to-day operations in the short term can have cash liquidity planned for, investment and capital budgeting for growth is generally a stronger focus in the long-term planning process.

Functions of Financial Management

Several key functions fall under broad financial management that is essential for ensuring economic stability and achieving strategic goals:

Financial Planning and Forecasting

The primary functions of financial management are financial planning and forecasting. It includes the estimation of the business’s financial requirements and the provision of funds to meet such needs. Financial forecasting based on historical data and market trends portrays the prospects of revenue, expenses, and capital as well for proper decision-making about future growth and investments.

Cash Management

Efficient cash management will ensure the business has enough liquidity to pay its short-term obligations toward suppliers, employees, and creditors. Therefore, cash management is the process of tracking inflows and outflows of cash and ensuring that the company has sufficient liquid resources while at the same time maximizing returns on any surplus cash.

Forecast of Cash Flow

Proper cash flow prediction is required for a company to ensure it has sufficient funds to cover all its operations. It needs to predict when it will require the cash and how much in terms of payroll, payment to vendors, and loan repayment.

Estimating Capital Expenses

Capital expenditures are long-term investments a firm makes in the business for improvement or expansion of operations. Financial management plays a critical role in determining the need for capital investment in projects such as purchasing new equipment, expanding facilities, or a new product line.

Determining Capital Structure

A company, therefore, uses a mix of debt and equity for funding its operations; financial management determines the optimal capital structure that can minimize cost while maximizing profit by deciding the amount of capital to be generated from debt as borrowed funds and the amount coming from equity in terms of shareholder funds. A well-balanced capital structure will reduce the risk associated with it and also contribute to better financial health for the company.

Common considerations include the relationship between debt and equity, cost of capital, risk of bankruptcy, and return on equity.

Types of Financial Management

Two main types of financial management exist and, therefore, are used to address various needs of organizations. Each type has been emphasized, along with specific aspects of how to manage an organization’s financial resources correctly.

Strategic Financial Management

Strategic financial management is a long-term plan for the company to attain goals. It emphasizes wealth maximization among shareholders through deliberate investment, mergers and acquisitions, and restructuring of capital. This form of financial management is concerned with how the financial strategy will be aligned with the long-term vision of the company.

Example: Planning to acquire a competitor or entering a new market.

Tactical Financial Management

Tactical financial management is managing the short-term finances of an organization, which impacts its operations. It includes managing the cash flow to keep the company liquid and at optimum levels of working capital. The short-term gains should not severely affect the long-term objectives in such a manner.

Example: Managing daily cash flow or negotiating better credit terms with suppliers.

Importance of Financial Management

It is the financial management backbone for any organization to survive and sustain. They help businesses achieve their goals, make appropriate use of resources, and overcome changes in market conditions.

- Ensures Survival: Corrective financial planning ensures that a business can cover its daily running expenses during an economic recession.

- Supports Decision Making: Financial management also provides proper data and forecasts that can go into significant investment decisions, cost decisions, and expansion decisions.

- Attracts Investors: Good financial management gives the company credibility and helps in attracting investors.

- Supports Long-Term Goals: It makes sure businesses do not focus on short-term gains but instead on sustainable growth.

- Manages Risks: Analyzing financial risks allows a business to devise strategies that effectively reduce such risks.

- Compliance with Laws: It ensures financial activities are within regulatory requirements, hence no penalties or lawsuits.

Financial Management FAQs

1. What are the primary objectives of financial management?

Financial management is mainly concerned with maximizing the value of a business or an organization, which involves strategic decisions, such as taking investments, financing, and budgeting.

2. Why is financial management so important for the business?

Financial management is vital since it helps organizations plan and manage their financial resources in order to ensure profitability and minimize risks towards long-term growth.

3. What are the core functions of financial management?

Financial planning, budgeting, investment management, risk management, and financial reporting, to say it the other way around, help utilize the resources properly.

4. What does financial management contribute towards the process of making a decision?

It offers all data and analysis needed for any decisions to be taken for investment, cost management, and funding that can guarantee success for a business.

5. What are the fundamental elements of financial management?

The key elements in financial management include financial planning, capital structure management, investment decisions, cash flow management, and financial control and reporting.