A financial ratio is a numerical measurement by which a business or an organization can assess its financial health. These ratios help the investors, analysts, and management understand various aspects of the performance and condition of the company. All these financial ratios are derived from a company’s financial statements; the balance sheet and income statement are the primary sources. Using these ratios, one can evaluate a company on profitability, liquidity, efficiency, leverage, and market value.

Financial ratios break down complex financial data into simple, comparable figures. These ratios make it easier to assess whether a company is operating efficiently, how well it handles debt, how quickly it can turn assets into revenue, and how well it is positioned in the market.

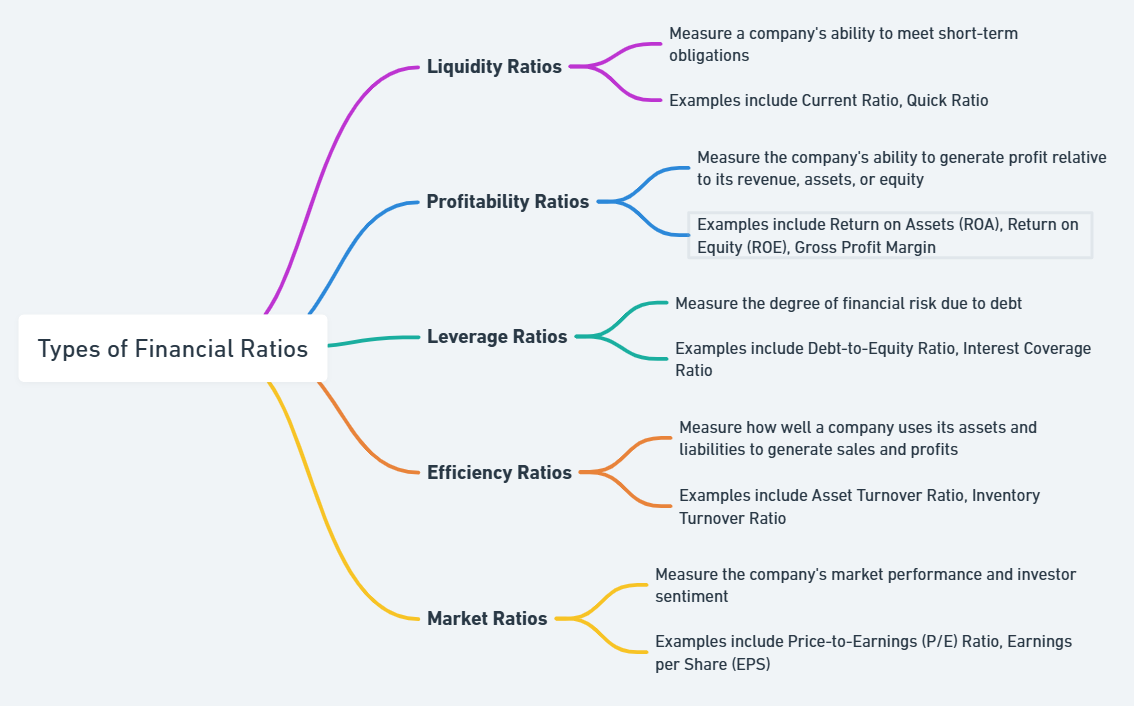

Liquidity Ratios

The Liquidity ratios are the set of financial metrics that compute the ability of a business organization to meet its short-term obligations. These ratios convey whether the company can pay short-term liabilities with its liquid assets. The most frequent liquidity ratios are the current ratio and quick ratio.

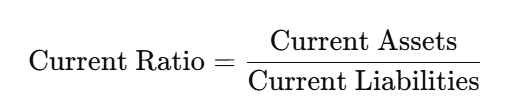

Current Ratio

The current ratio is calculated by dividing current assets by current liabilities. A current ratio higher than 1 generally indicates that a company has enough assets to cover its short-term debts. However, a ratio that is too high may indicate inefficiency in utilizing assets.

Formula

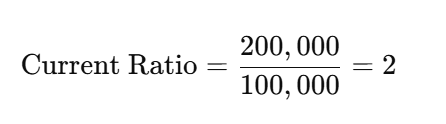

For example, if a company has $200,000 in current assets and $100,000 in current liabilities, the current ratio would be:

This means the company has $2 in assets for every $1 in liabilities.

Quick Ratio

More conservatively, the acid test measures of liquidity do not add any account that contains inventory under its current assets because of how long it takes for some of the inventory to sell and get cash in a business. The quick ratio is better used for short-term coverage of the liability using liquid assets within that particular company.

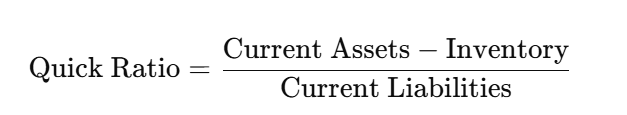

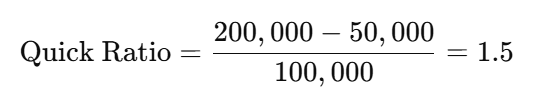

Formula

For instance, if a company has $200,000 in current assets, $50,000 in inventory, and $100,000 in current liabilities, the quick ratio would be:

This means the company has $1.50 in liquid assets for every $1 in liabilities, providing a better picture of its immediate solvency.

Leverage Ratios

Leverage ratios help measure the extent to which a company is using borrowed money to finance its operations and growth. These ratios point out how much financial risk a firm has and its ability to manage long-term obligations. Investors mostly look at leverage ratios when assessing the level of risk associated with the debt structure of a firm.

Debt-to-Equity Ratio

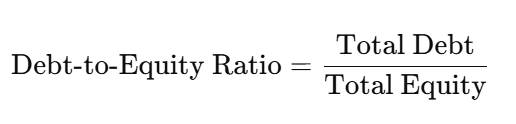

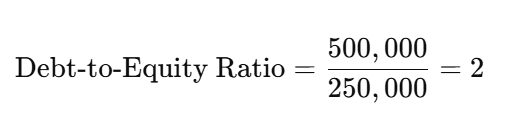

The debt-to-equity ratio measures a company’s financial leverage by comparing its total liabilities to its shareholder equity. A high ratio indicates that a company is heavily reliant on debt to finance its operations, which may be risky in times of economic downturn. A low ratio signifies that the company has more equity than debt, which is often seen as more stable.

Formula:

For example, if a company has $500,000 in total debt and $250,000 in equity, the debt-to-equity ratio would be:

This means that for every $1 of equity, the company has $2 in debt.

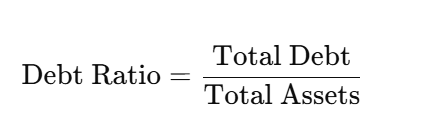

Debt Ratio

The debt ratio is the percentage of a firm’s assets financed by debt. It reflects the risk degree of the company’s capital structure. A high debt ratio may be a signal of greater financial risk, as it means that a considerable portion of the firm’s assets is financed through debt.

Formula:

For example, if a company has $500,000 in debt and $1,000,000 in assets, the debt ratio would be: Debt Ratio=500,000/1,000,000=0.5

This means that 50% of the company’s assets are financed through debt.

Efficiency Ratios

Efficiency ratios help determine how effectively the firm is generating revenue out of its resources and assets. These efficiency ratios portray the management capabilities of the firm in the management of operations. An increased ratio, for instance, indicates that a company has been generating revenue out of fewer resources.

Asset Turnover Ratio

The asset turnover ratio measures the ability of a company to generate sales from its assets. It gives the efficiency of using assets in generating revenue. The higher the ratio, the better the utilization of the company’s assets.

Formula: Asset Turnover Ratio=Revenue/Total Assets

For instance, if a company has $1,000,000 in revenue and $500,000 in assets, the asset turnover ratio would be: Asset Turnover Ratio=1,000,000/500,000=2

This means the company generates $2 in sales for every $1 invested in assets.

Inventory Turnover Ratio

The inventory turnover ratio measures how many times the inventory of a company sells and is replaced in a period. A high ratio means that the inventory of a company is selling quickly. A low ratio might suggest overstocking or poor sales.

Formula: Inventory Turnover Ratio=Cost of Goods Sold / Average Inventory

For example, if a company has a cost of goods sold of $300,000 and an average inventory of $100,000, the inventory turnover ratio would be: Inventory Turnover Ratio=300,000 / 100,000=3

This means the company sells and replenishes its inventory three times in the period.

Profitability Ratios

Profitability ratios evaluate a company’s ability to generate profits relative to its revenue, assets, equity, or other financial metrics. These are essential ratios for investors, as they want to know if the company is generating profits and how efficient it is in doing so.

Gross Profit Margin

The gross profit margin measures the percentage of revenue that exceeds the cost of goods sold (COGS). A higher gross profit margin indicates that a company can cover its operating expenses more comfortably.

Formula: Gross Profit Margin=Gross Profit / Revenue×100

For example, if a company has a gross profit of $500,000 and revenue of $1,000,000, the gross profit margin would be: Gross Profit Margin=500,000 / 1,000,000×100=50%

This means that the company keeps 50% of its revenue after covering the cost of goods sold.

Return on Assets (ROA)

The return on assets (ROA) measures how efficiently a company uses its assets to generate profit. A higher ROA indicates a more efficient company, while a lower ROA suggests that the company is not using its assets effectively.

Formula: ROA=Net Income / Total Assets×100

For instance, if a company has a net income of $100,000 and total assets of $500,000, the ROA would be: ROA=100,000 / 500,000×100=20%

This means the company generates 20% of its assets in profit.

Market Value Ratios

Market value ratios are those measures that help us find the market perception of a company and its financial position relative to its market price. Such ratios help investors determine if a company’s stock is overvalued or undervalued in the market.

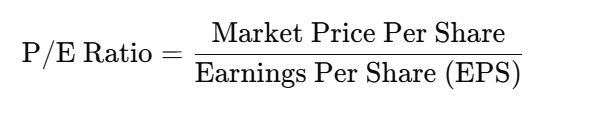

Price-to-Earnings (P/E) Ratio

The price-to-earnings (P/E) ratio compares a company’s stock price to its earnings per share (EPS). A high P/E ratio can indicate that the company is overvalued, while a low P/E ratio may suggest undervaluation.

Formula:

For example, if a company’s market price per share is $50 and its earnings per share are $5, the P/E ratio would be: P/E Ratio= 50 / 5=10

This means investors are willing to pay 10 times the earnings for each share of stock.

Benefits of Tracking Financial Ratios

Market value ratios are those measures that help us find the market perception of a company and its financial position relative to its market price. Such ratios help investors determine if a company’s stock is overvalued or undervalued in the market.

Better Decision Making

Financial ratios help business owners and investors make better decisions. For example, liquidity ratios show if the company can pay its short-term debts. Leverage ratios indicate how much risk a company carries with its debt. Profitability ratios show whether the company is generating enough income.

Performance Benchmarking

By comparing financial ratios against industry standards or competitors, companies can benchmark their performance. This helps in identifying areas for improvement and establishing strategies for growth.

Risk Assessment

Tracking financial ratios helps in assessing financial risks. Companies with high debt-to-equity ratios, for instance, may be at risk of defaulting on loans. Similarly, low profitability ratios may indicate that a company is not performing well financially.

Financial Ratio FAQs

What is a financial ratio?

A financial ratio is a metric used to evaluate a company’s financial performance and stability. It is derived from financial statements like the balance sheet and income statement. Financial ratios help assess profitability, liquidity, efficiency, leverage, and market value.

What are liquidity ratios?

Liquidity ratios measure a company’s ability to pay its short-term obligations. Common liquidity ratios include the current ratio and quick ratio, which assess the company’s ability to cover its liabilities with liquid assets.

How do leverage ratios work?

Leverage ratios measure the amount of debt a company has in relation to its equity and assets. These ratios help assess the financial risk of a company. Common leverage ratios include the debt-to-equity ratio and debt ratio.

Why are profitability ratios important?

Profitability ratios evaluate a company’s ability to generate profit relative to its revenue, assets, and equity. These ratios, such as gross profit margin and return on assets, are essential for understanding a company’s financial health.

What are market value ratios used for?

Market value ratios measure how the market perceives a company. Ratios like the P/E ratio help investors assess whether a company’s stock is overvalued or undervalued, based on its earnings and market price.