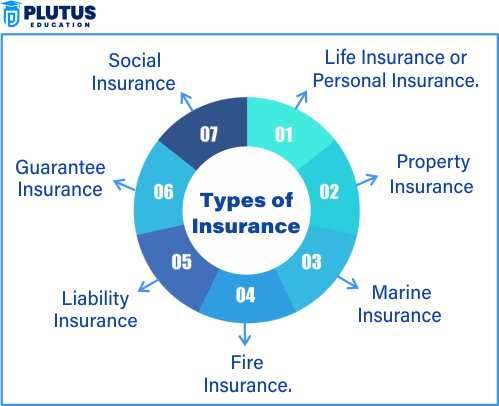

Everyone wants to feel safe and ready for unexpected things in life. Life has many risks — sickness, accidents, money loss, or sudden death. Insurance helps us manage these risks without worry. It offers help when bad things happen. So, what is insurance and types of insurance? Insurance is a plan where you pay money to a company regularly, and they help you financially when you face a loss. You get this support based on your agreement, called a policy. There are many types of insurance, such as life, health, car, home, and travel insurance. Each type protects a different part of your life. In India, more people now understand that insurance is not just for the rich — it’s for everyone. It builds good saving habits, offers tax benefits, and gives peace of mind.

What is Insurance and Types of Insurance

Insurance is a promise made by a company to protect you from financial loss. You pay a small amount regularly, called a premium. If something bad happens, like a fire or illness, the company gives you money to help you recover.

This deal is written in a paper called a policy. Insurance brings safety to your life, family, business, and things like your car or home. You do not feel alone in emergencies, because the company supports you.

Life Insurance

Life insurance protects your family if you die early. It helps them pay for daily needs, education, or home loans even after you are gone. This gives peace and support to your loved ones.

- Term Insurance

This is a simple and low-cost plan. It gives money to your family only if you die during the policy period. If you live longer than that, you don’t get anything back. - Whole Life Insurance

This plan covers you for your entire life. It gives money to your family whenever you die, even if it’s after 80 or 90 years. - Endowment Plan

It gives money on death, but also gives money if you live till the policy ends. It helps in saving money and building wealth over time. - Unit Linked Insurance Plan (ULIP)

This is a mix of insurance and investment. Some money goes to life cover and some gets invested in the stock market to grow your savings. - Money Back Policy

This plan returns money at regular intervals during the term. At the end, it also gives a lump sum amount. It helps you meet short-term needs like fees or bills.

Health Insurance

Health insurance covers the cost of hospitals, medicine, tests, and doctor fees. It protects you and your family from big medical bills. It lets you get treatment in good hospitals without worry.

- Individual Health Plan

This plan covers one person. The insurance company pays the bill when that person falls sick or has an accident. - Family Floater Plan

This plan covers your whole family in one policy. You pay a single premium, and any member can use the insured amount when needed. - Critical Illness Plan

It gives a large lump sum amount when you are diagnosed with a serious illness like cancer or heart attack. This money helps in costly treatments and recovery.

Motor Insurance

Motor insurance protects your bike, car, or truck. In India, it is required by law. It helps you if your vehicle is damaged or causes harm to others.

- Third-Party Insurance

This plan covers the cost of damage your vehicle causes to someone else’s property or body. It does not cover your own damage. - Comprehensive Insurance

This plan covers both third-party loss and damage to your own vehicle. It gives wider protection in case of accidents or theft.

Travel Insurance

Travel insurance keeps you safe during trips. It helps when your flight is late, you lose your bags, or you get sick far from home. It saves you from big costs abroad.

- Domestic Travel Insurance

This plan covers your travel within India. It helps in case of train or flight delays, medical emergencies, or lost tickets. - International Travel Insurance

It protects you during foreign trips. It covers hospital costs, lost passports, missed flights, and more while you are outside India.

Home Insurance

Home insurance protects your house from fire, flood, or theft. It helps you rebuild or repair your house if something damages it badly.

- Building Cover

This plan covers the physical structure of your house — walls, roof, floors, and fittings. It helps rebuild your house after damage. - Contents Cover

It protects your household things like TV, fridge, bed, or electronics. If thieves steal them or a fire damages them, this plan gives money to replace them.

Crop Insurance

Crop insurance helps farmers when crops fail. It supports them when bad weather, insects, or floods destroy their harvest. It helps rural families survive tough seasons.

- PMFBY (Pradhan Mantri Fasal Bima Yojana)

This government scheme gives low-cost insurance for all major crops. It pays farmers when crops fail due to natural reasons.

Why is Insurance Important in India?

India is a country where many families depend on a single income. Life is full of sudden events like accidents, sickness, natural disasters, or job loss. When such things happen, they bring not just pain but also big financial problems. That’s why insurance is not just helpful — it is essential.

Insurance supports people by giving them money during hard times. It builds peace, trust, and financial safety. In both cities and villages, insurance now plays a big role in health care, education, and protecting property.

1. Financial Protection

Insurance gives a lump sum or regular amount when you need money most. It helps cover hospital bills, accident costs, or house repairs after disasters. Without insurance, people might borrow money or sell assets.

2. Access to Healthcare

Health insurance allows you to get treated in private hospitals without paying from your own pocket. It covers surgery, medicines, ambulance, and room charges. It ensures better and faster care.

3. Legal Compliance

Motor insurance is legally required in India. Driving without it leads to penalties or jail. Having valid insurance keeps you safe under the law and avoids police trouble.

4. Family Security

If the main earner dies, life insurance helps the family continue daily life. It pays for children’s education, housing loans, or old-age care. It gives dignity to the family even after loss.

5. Economic Stability

Insurance also helps the country. It supports farmers during crop loss, shopkeepers during theft, and companies during fire. It reduces the burden on the government and boosts economic confidence.

Components of Insurance

Every insurance plan has parts that tell how the policy works. These parts help you understand your rights, how much you pay, and what benefits you get. Knowing these makes sure you choose a plan that fits your needs and avoids surprises.

Understanding each part helps you make a claim easily and know what is covered. Let’s look at each important component in detail.

1. Premium

This is the fixed amount of money you pay to keep the insurance active. It can be paid monthly, yearly, or all at once. If you don’t pay it on time, the policy may stop and offer no protection.

2. Policyholder

This is the person who owns the policy and pays the premium. The policyholder may or may not be the same as the person whose life or health is insured. They also choose the nominee and coverage.

3. Insured

The insured is the person who is protected by the policy. If anything happens to this person, the claim is made. It can be the policyholder or someone else like a child or spouse.

4. Sum Assured

This is the total money the insurance company agrees to pay when a claim is made. You choose this amount when buying the policy. Higher sum assured means better protection but also higher premium.

5. Nominee

The nominee is the person who gets the money if the insured person dies. Usually, it is a close family member like a wife, child, or parent. The nominee must be named clearly in the policy.

6. Maturity Benefit

Some policies like ULIP and Endowment Plans give a final amount if you live through the policy term. This helps in planning retirement, marriage, or children’s education.

7. Claim

A claim is your request for money from the insurance company when a covered event happens. You need to fill forms, submit documents, and follow steps. Quick and correct claims give fast results.

8. Exclusions

These are the events or conditions not covered by the policy. For example, some plans may not cover war, suicide, or pre-existing diseases for a certain period. Reading exclusions helps avoid claim rejection.

Principles of Insurance

Insurance is not just a product, it is a legal and ethical agreement. To make it fair and strong, every insurance plan is based on key principles. These rules protect both the buyer and the insurance company.

When you follow these rules, your policy remains safe and your claims are successful. If you break them, the company may cancel the plan or deny your claim.

1. Utmost Good Faith

Both you and the insurer must share correct information. If you hide any health issue, wrong age, or false details, the policy can be cancelled. Honesty builds trust in this contract.

2. Insurable Interest

You can only insure someone or something if their loss affects you financially. For example, you can insure your spouse, not a stranger. It makes sure you have a reason to buy the plan.

3. Indemnity

This means insurance pays only the actual loss amount, not more. You cannot make profit from insurance. For example, if your TV worth ₹30,000 is damaged, you cannot claim ₹50,000.

4. Contribution

If you have two health insurance plans, both may pay part of the hospital bill. You cannot take full money from both. This rule avoids overpayment and keeps things fair.

5. Subrogation

After paying the claim, the insurance company can recover the money from the person who caused the loss. For example, if a car hits your bike, your insurer can take money from the other driver.

6. Proximate Cause

Only the nearest or direct cause of the damage is checked. If that cause is covered, the claim is valid. This rule avoids confusion when multiple events are linked to a loss.

7. Loss Minimization

You must try to reduce your loss, even if you have insurance. For example, if fire breaks out, you must call the fire service immediately. You cannot just sit and watch because you have insurance.

What is Insurance and Types of Insurance FAQs

What is insurance and types of insurance in simple words?

Insurance is a plan that protects you from money loss. You pay a small fee regularly. If something bad happens, like illness or an accident, the company helps you with money. The types include life, health, car, travel, and home insurance.

What is the difference between life insurance and general insurance?

Life insurance gives money if the insured person dies or survives a long time. General insurance covers things like car damage, hospital costs, or lost luggage. Life insurance is long-term, general insurance is usually short-term.

What are the types of life insurance in India?

Types include Term Insurance, Whole Life Insurance, ULIP, Endowment Plan, and Money Back Plan. Each gives life cover, but some also give money if you live through the policy term. You can choose based on your need and budget.

What are the benefits of insurance in India?

Insurance gives you money during emergencies. It helps with hospital bills, car repairs, or sudden family loss. It also saves tax, builds saving habits, and gives peace of mind to you and your family.

Why should students and families in India learn about insurance?

Insurance helps students and families stay safe in tough times. It builds good habits, teaches money planning, and gives help during health or money problems. Learning early helps make smart decisions.