Reserves are an essential part of a company’s or bank’s financial planning. In accounting and finance, it refer to the portion of profits or capital that is set aside and not distributed to shareholders as dividends. These amounts are kept for specific purposes such as future expansion, unexpected liabilities, bad debts, or to meet legal requirements. In simple terms, it acts as a safety net. They help businesses withstand difficult times, such as losses, low revenue periods, or market fluctuations. In the banking sector, it ensures that banks have enough funds to meet withdrawal demands and comply with central bank rules. This builds trust among depositors and maintains the integrity of the financial system. Reserves are created from either capital profits or revenue profits. Maintaining appropriate reserves is a mark of financial prudence. It reflects the company’s ability to manage its earnings wisely and prepare for the future.

What is Reserves

Reserves are the portion of profit or capital that is set aside by a business or financial institution to meet future requirements, liabilities, or contingencies. The answer to what is reserves lies in the nature of business operations that are uncertain and require financial preparedness. It serves as a financial cushion, helping organizations maintain stability during fluctuations in income, unexpected losses, or planned expansions.

In simple terms, these are retained earnings or gains not distributed as dividends but kept aside for future use. They strengthen the financial position of an organization and support long-term planning. Reserves can be created voluntarily by the management or be a statutory requirement under law. They are shown on the liability side of the balance sheet under the head “Reserves and Surplus.”

Significance of Business

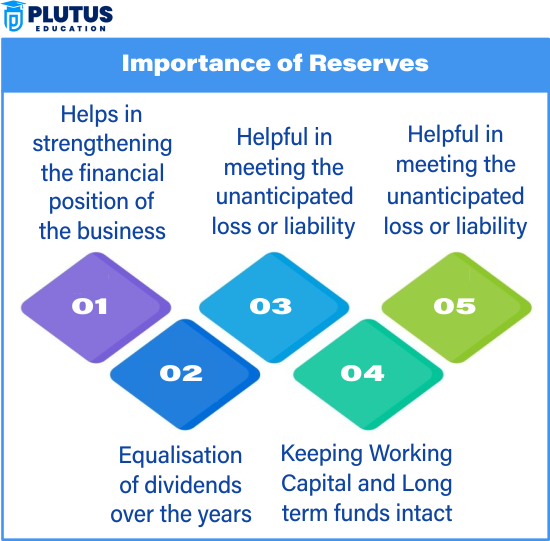

Reserves serve as financial cushions that help companies and financial institutions manage risk, ensure stability, and support future growth. They provide internal funding that minimizes reliance on external borrowing and enhances the company’s credibility.

- Financial Stability: They help maintain operations during downturns or losses.

- Planned Expansion: Companies can use them to invest in new projects without external funding.

- Dividend Consistency: It ensures that companies can continue paying dividends even in low-profit years.

- Legal Compliance: Some reserves are required by law, such as those mandated by banking regulations.

- Investor Confidence: Strong retained earnings reflect good financial health, attracting investors and improving creditworthiness.

Types of Reserves

Reserves can be classified based on their source and purpose. The two major types are capital reserves and revenue reserves.

Capital Reserves

Capital reserves are created from capital profits, which arise from non-operating activities. These are not available for dividend distribution but are used for long-term strategic purposes.

Sources of Capital Reserves:

- Profit from the sale of fixed assets

- Premium on issue of shares or debentures

- Profit on revaluation of assets

- Profit on redemption of debentures

Uses of Capital Reserves:

- Writing off capital losses

- Issuing bonus shares

- Financing capital projects

Revenue Reserves

Revenue reserves are created from the normal operational profits of a business. These reserves are used for regular business activities and may be distributed as dividends.

Types of Revenue Reserves:

- General Reserve: Not earmarked for a specific purpose. Used for various general business needs.

- Specific Reserve: Created for a specific purpose, such as:

- Dividend equalization reserve

- Investment fluctuation reserve

- Reserve for bad and doubtful debts

- Dividend equalization reserve

Uses of Revenue Reserves:

- Dividend payments

- Meeting operational contingencies

- Funding research and development

Banking Reserves

Banking reserves are mandatory funds that banks must hold either in their vaults or with the central bank. These reserves ensure liquidity and trust in the banking system.

Types of Banking Reserves

- Cash Reserve Ratio (CRR): A specific percentage of total deposits that banks must hold as cash with the central bank (RBI).

- Statutory Liquidity Ratio (SLR): A percentage of deposits that banks must maintain in the form of liquid assets like gold or government securities.

- Vault Cash: Physical cash kept in bank branches to meet day-to-day withdrawal demands.

These reserves control money supply, curb inflation, and ensure the stability of the banking sector.

Objectives of Creating Reserves

Creating reserves serves several financial and strategic objectives that support the long-term viability of a business.

- Contingency Funding: To meet unforeseen liabilities or losses.

- Support for Expansion: To finance new projects or acquisitions without borrowing.

- Dividend Stability: To maintain consistent dividend payments across profit cycles.

- Statutory Requirements: To comply with legal mandates in regulated sectors.

- Financial Discipline: Encourages responsible financial management and fund allocation.

Differences Between Reserves and Provisions

| Basis | Reserves | Provisions |

| Nature | Appropriation of profit | Charge against profit |

| Purpose | To meet unknown future liabilities | To meet known liabilities or losses |

| Creation | Usually discretionary | Often mandatory |

| Impact on Profit | Made after profit calculation | Deducted before profit calculation |

| Disclosure | Shown under “Reserves and Surplus” | Shown as liability or asset deduction |

Reserves in Balance Sheet

Reserves are part of shareholders’ equity and are listed under the head “Reserves and Surplus” on the liabilities side of the balance sheet.

Common Reserve Components:

- Capital Reserve

- Securities Premium Reserve

- General Reserve

- Specific Revenue Reserves

These components reflect the company’s retained earnings and financial prudence. A high reserve balance indicates strong financial management.

Role During Financial Crisis

Reserves play a critical role in ensuring business continuity during financial downturns, economic slowdowns, or other crises.

- Operational Continuity: It helps sustain operations when revenues fall.

- Debt Servicing: Allows timely repayment of loans and interest.

- Dividend Payments: Maintains investor trust even in tough times.

- Strategic Moves: Enables investment in acquisitions or restructuring when competitors are struggling.

Steps to Create and Manage Reserves

Effective reserve management requires clear policies and disciplined financial practices.

- Set Reserve Policy: Define the percentage of profits to allocate.

- Classify Reserves: Distinguish between capital and revenue reserves.

- Invest Wisely: Use safe, low-risk instruments for investing reserves.

- Review Regularly: Assess reserve adequacy in annual financial planning.

- Ensure Compliance: Follow legal and regulatory reserve requirements.

What is Reserves FAQs

Q1. What are reserves in accounting?

Reserves are retained portions of profit or capital kept aside to meet future business needs, liabilities, or expansions.

Q2. Can capital reserves be used to pay dividends?

No, capital reserves cannot be used for dividend payments as they arise from non-operational profits.

Q3. What is the purpose of general reserve?

General reserves act as a financial buffer for any general business purpose or unforeseen expenses.

Q4. Why do banks maintain CRR and SLR?

To ensure liquidity, control money supply, and maintain public confidence in the banking system.

Q5. How are reserves shown in the balance sheet?

They are shown under the head “Reserves and Surplus” on the liabilities side of the balance sheet.