The working capital turnover ratio shows the efficiency of a company in utilizing current assets during a short period to generate sales. A firm also uses the metric to ascertain whether they are turning working capital into revenue, which is also a significant pointer to cash flow and operational health. This ratio gives invaluable insight as to how efficiently a business manages its operations, whether one is a commerce student, an investor, or an entrepreneur. This guide’s benefits of working capital turnover ratio, such as the formula and meaning, will enable you to assess a company’s performance confidently.

What is Working Capital Turnover Ratio?

It’s the working capital turnover ratio. This working capital turnover ratio measures how effectively a business generates sales with its working capital. This figure is, in fact, vital for those who carry out high inventories and accounts receivable, such as retailers or manufacturers. The ratio allows tying current assets to sales and thus presents a company’s operational and fiscal discipline. The high turnover in working capital suggests proper scheduling, where the company has not tied up extra capital in inventory or receivables. Inversely, a low ratio would mean it has excessive working capital with inferior management or both, which will bring profit down. This ratio is critical for evaluating short-term financial health and operational scalability.

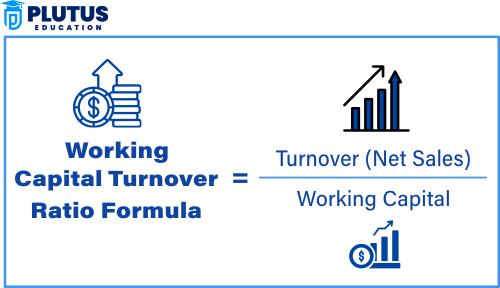

Formula of Working Capital Turnover Ratio

To understand better, one needs to know how to compute it, because here is the formula for the working capital turnover ratio :

Working Capital Turnover Ratio = Net sales / Average Working Capital

And here comes the description for each of them :

- Net sales: Total revenue, not including returns and allowances, and discounting any income from sales of goods or services.

- Average Working Capital: Computed as

(Opening Working Capital + Closing Working Capital) ÷ 2

Let’s walk through an example: Assuming a company has:

- Net Sales = ₹2,000,000

- Beginning Working Capital = ₹300,000

- Ending Working Capital = ₹500,000

Average Working Capital = (₹300,000 + ₹500,000) ÷ 2 = ₹400,000

Working Capital Turnover Ratio = ₹2,000,000 ÷ ₹400,000 = 5

This means the company generates ₹5 in sales for every ₹1 working capital invested. A 5 is generally considered healthy, but it depends on the industry.

Importance of Working Capital Turnover Ratio

The working capital turnover ratio indicates how well a company uses its finances for selling purposes. It’s not just a number—it’s a direct indicator of cash flow efficiency, inventory control, and accounts receivable management. Let’s take a look at some of the significant advantages.

Measuring Operational Efficiency

A high working capital turnover ratio shows that the company uses its current assets efficiently to generate sales. It reflects strong management of inventory, receivables, and payables. Efficient operations often lead to improved profitability and reduced overhead. A lower ratio may suggest underutilizing assets or cash being tied up in inventory that isn’t moving quickly enough.

Boosting Cash Flow and Liquidity

Even as the heart of every business works, companies with a promising working capital turnover ratio enjoy better liquidity, considering that converting working capital into sales to cash usually comes too fast, resulting in faster collection and fewer delays in the cash cycle.

Improved liquidity = reduced dependency on loans and credit = cost saving.

Increasing Investor Confidence

The specific ratio that investors look to measure is that of working capital. Its consistency in being high proves that capital is being used wisely, and the sales are good, which are factors for investment decisions. It shows that the company internally finances its growth, which is less risky for stakeholders.

Identifying Financial Red Flags

Declining or very low working capital turnover ratio reflects such problems as poor sales accomplishments, too much stock, or loose credit policies. All these red flags can help business owners and financial managers take early action. Regularly analyzing these ratios helps find and remedy inefficiencies early rather than allowing them to escalate into larger financial problems.

Industry Benchmarking

Every industry has a standard working capital turnover ratio. Comparing the ratio of your company against competitors provides good insight into how your company performs in relative terms. Compared to the industry peers, a high ratio affords a competitive advantage for your company and suggests better working capital management. Conversely, measured from a lower value, your company could have issues needing improvement.

How to Improve Working Capital Turnover Ratio?

Keeping this ratio well optimized is of utter importance, as it determines the financial soundness of any given entity. There are several practical ways to improve the working capital turnover ratio, thus improving operational performance.

Accelerate Accounts Receivable Collections

Give early payment discounts; tighten credit policies to prevent receivables from piling up. Prompt collection of accounts receivable will improve cash inflow. Good receivables management increases liquidity and speeds up the cash conversion cycle, thus increasing the ratio.

Manage Inventory Effectively

Too much inventory involves funds being tied up and increasing storage costs. Just-in-Time (JIT) inventory management, or techniques such as ABC analysis, made possible by adopting inventory management techniques, would keep amount stocks down without sacrificing the service. Hence, there would result a higher turnover rate and less blockage to working capital.

Optimize Accounts Payable

When it can be done without damaging relationships, postponing supplier payments can increase cash flow. Some smart negotiating would help the company obtain longer credit terms, thus allowing it more time to bring in sales before cash goes out. Efficient payable management is one of the prime strategies for enhancing the working capital ratio.

Streamline Operational Processes

Efficient processes result in quicker production cycles, faster order fulfillment, and lower overhead costs. When operations are optimized, sales increase relative to current assets, boosting the working capital turnover ratio. Lean management and automation also contribute to improved ratios.

Working Capital Turnover Ratio Limitations

Usefulness notwithstanding, the working capital turnover ratio has a few shortcomings. One understanding of those limitations is that, not alone, the ratio should be used to judge a company’s financial performance.

Doesn’t Consider Seasonality

Retail and agricultural economics are minimally seasonal businesses. There are periods where working capital turnover ratios for them may deviate from one period to another, thus making comparisons meaningless. It is advisable to measure this metric over multiple quarters so that one can get a meaningful picture.

High Ratios Not Always Good

A high ratio may speak of efficiency, but it may also indicate that a company lacks working capital, thus putting it at a very high risk for liquidity. The ones facing insufficiencies may need to run on very low current assets in certain situations to guard against a sudden obligation. Hence, depending on working capital, it would be either quality or efficiency.

Industry Dependence

Different industries have different capital needs. A “good” working capital turnover ratio in one industry may be inadequate in another. Always compare your results to those of others in your industry to interpret them correctly.

Reliance on Accurate Financial Reporting

This ratio relies greatly on accurate sales reporting concerning working capital. Any form of accounting inconsistency or manipulation may distort its results. Therefore, regular audits and transparent bookkeeping are necessary for a credible ratio analysis.

Learning from the Working Capital Turnover Ratio

The working-capital turnover ratio forms the backbone of a company’s measurement of time efficiency related to using short-term assets for sales. A better ratio means better cash flows, operational efficiency, and financial health—all of which an investor or stakeholder welcomes. This ratio should be calculated and monitored occasionally to highlight operational inefficiencies that could be closed for improved financial decisions. With these tools, one can easily apply the other financial tools for a broader, holistic analysis of company performance and growth potential.

Working Capital Turnover Ratio FAQs

Q1. What is the working capital turnover ratio?

A financial ratio shows how effectively a business uses its working capital to generate sales, indicating operational efficiency.

Q2. How do you calculate the working capital turnover ratio?

Use the formula: Net Sales ÷ Average Working Capital. Average working capital is calculated by averaging the working capital at the start and end of a period.

Q3. What does a high working capital turnover ratio mean?

A high ratio indicates that the company efficiently turns its working capital into revenue, reflecting good management and strong cash flow.

Q4. Is a low working capital turnover ratio bad?

Generally, yes. It may suggest poor utilization of current assets, excessive inventory, or slow collections, all affecting liquidity and profitability.

Q5. Why is this ratio important for investors?

Investors use it to evaluate how well a business uses its resources. A high ratio suggests less risk and more efficient operations, making the companies more attractive.