The ACCA exemptions provide the candidates an opportunity to speed up their academic journey of becoming qualified accountants. ACCA course provides in-sight into the accounting, finance and auditing field. Nonetheless, it’s imperative for the candidates to consider their existing eligibility and determine the probable effect on their knowledge base and career advancement. Exemptions have the potential to save valuable time of candidates because they have a solid understanding of the ACCA syllabus to move forward in their subsequent exams and professional careers. The students can achieve a professional strategic advantage if they are provided with the chance to focus on advanced topics as early as possible in their studies.

Its advantage is not merely professional balance but also places students at an advantageous position to continue their careers and enhances their learning experience. Ultimately, the ACCA course provides a stimulating mix of practice experience and challenging, continuous academic training. Accompanied by this, there is a judicious utilization of exemptions which can literally propel a candidate’s career in the fields of accounting, finance, and auditing.

ACCA Exemption Should We Claim It? | ACCA Exemption Details | By Sukhpreet Monga

What are the ACCA Exemptions?

An internationally renowned association for professional accountants, the Association of Chartered Certified Accountants (ACCA) provides highly certified professional qualifications. Prospective employers will be aware that you have the depth of company experience required of professional accountants once you earn your ACCA certification. This suggests that you can work as an accountant anywhere in the world. National accountants are required to follow the particular certification guidelines that are stipulated by each nation. For most, nevertheless, an ACCA certification serves as a suitable substitute. It’s one of the most comprehensive certifications in the world. About 320,000 people have earned it.

To get into the details, what you must know about ACCA exemptions is that they let you free from certain papers and tests. But this is only applicable when you meet certain requirements. The effort, time, and number of exams required to obtain certification are progressively decreased. The purpose of these exemptions is to recognize the candidates’ prior knowledge and abilities.

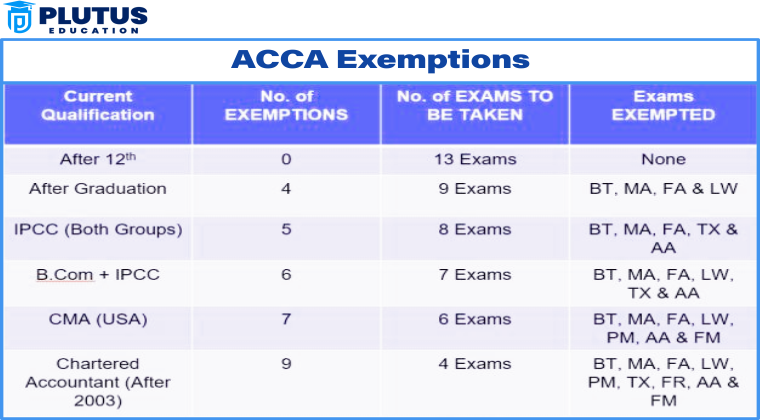

ACCA Exemptions

The ACCA exemptions are the ones provided to the students who have certain prior qualifications. This helps the students to skip certain exams and accelerate their journey in the academic process of ACCA. It says that having a degree in finance can help you get exempt from some of the 13 exam papers. Don’t neglect to determine your eligibility if you aren’t sure you want to pursue a career in accounting or finance. Using the eligibility calculator on the ACCA website, this is a simple process. Students who meet specific prerequisites in the past are eligible for ACCA exemptions. As a result, students can speed up their progress through the ACCA academic program and avoid some exams.

ACCA Exemptions for CA

Chartered Accountants (CAs) are eligible for a few exemptions when pursuing the ACCA qualification, thanks to the considerable overlap in syllabus content between the two programs. Qualified CAs can receive exemptions for up to nine papers, primarily from the Applied Knowledge and Applied Skills levels of the ACCA curriculum. These exemptions not only reduce the number of exams but also reduce the time and efforts needed to acquire the prestigious ACCA designations.

ACCA Exemptions for CA Inter

Candidates who have completed the CA Inter (intermediate) level are eligible for exemptions in up to five papers within the ACCA qualification. These exemptions typically cover subjects from the Applied Knowledge level and select papers from the Applied Skills level. This streamlined pathway allows CA Inter candidates to bypass foundational topics they have already mastered, enabling them to focus on advanced concepts and professional-level studies. By reducing the total number of exams required, this exemption policy not only saves time but also recognizes the prior knowledge and expertise gained through the CA Intermediate curriculum.

ACCA Exemptions for BCom

Graduates from BCom programs are eligible for large-scale exemptions in the ACCA qualification, depending on the subjects studied during the undergraduate program. Students can claim an exemption for up to nine exams. Therefore reduce the number of exams to be passed in total. These exemptions cover the Applied Knowledge level in full and can include papers at the Applied Skills level, like Financial Reporting or Management Accounting. It means B.Com graduates are recognized for prior learning and get a head start in their ACCA qualification. It saves them time and effort as they focus on more advanced modules of relevance to their career.

ACCA Exemptions After BBA

The BBA graduates will receive an exemption for one paper at the Applied Knowledge level of the ACCA. BBA and ACCA are different in their core subjects and syllabus which is why you get only one exemption.

ACCA Exemptions for MBA

MBA graduates may be given various exemptions to specific ACCA papers by their specializations. Thus streamlining their route to ACCA certification. Traditionally, these exemptions are accorded for Applied Knowledge level subjects, such as Business Technology, Management Accounting, and Financial Accounting, which fit directly into most ACCA standard curricula. In addition, exemptions may also be awarded at the Applied Skills level for MBA graduates who have undertaken advanced studies in relevant areas that include Financial Management, Corporate and Business Law, or Performance Management. The number of exemptions is dependent upon the nature of the MBA curriculum and whether it covers accounting and finance principles.

| Qualifications | Number of exams to give | Exemptions |

| MBA Qualifications | 13 papers | NIL |

| Commerce Graduate | 9 papers | BT, MA, FA, LW |

| MCom Post Graduate | 9 papers | BT, MA, FA, LW |

| CA IPCC (Both Groups) | 8 papers | BT, MA, FA, TX, AA |

| CA | 4 papers | BT-FM (9 subjects) |

CPA Exemptions for ACCA

ACCA members may be eligible for exemptions from certain parts of the CPA program, depending on the U.S. state’s requirements. While there is no universal exemption policy, several states recognize ACCA qualifications and offer credits toward the 150-hour education requirement. However, ACCA members typically still need to pass all four CPA exams, as exemptions for these are rare. To qualify, ACCA members must have a bachelor’s degree or equivalent and meet the specific credit hour requirements in accounting and business. ACCA membership demonstrates a strong accounting foundation which may simplify meeting CPA eligibility criteria.

ACCA Exemptions for CMA

CMA aspirants with an ACCA qualification are often eligible for significant exemptions in the CMA program. ACCA membership reflects expertise in financial reporting, management accounting, and business strategy, areas that overlap with the CMA syllabus. While no exemptions are provided for the CMA exams themselves, ACCA members typically meet the educational and work experience prerequisites required to enroll. This alignment allows ACCA-qualified professionals to pursue CMA certification more efficiently, leveraging their existing knowledge in strategic management and financial accounting to prepare for CMA’s two-part exam structure.

CFA After ACCA Exemptions

ACCA qualification does not grant direct exemptions for the CFA program, as the CFA Institute mandates that all candidates pass each of the three levels of the CFA exam. However, ACCA members benefit from a strong accounting and financial analysis background, which provides a significant advantage in understanding CFA topics such as financial reporting, corporate finance and investment analysis. ACCA professionals often find it easier to navigate the CFA curriculum and can complete the program faster due to their existing expertise, especially in areas like ethics, portfolio management and financial analysis.

CIMA Exemptions for ACCA

ACCA-qualified professionals are eligible for substantial exemptions when pursuing CIMA certification. Typically, ACCA members are exempted from up to 9 out of the 16 exams in the CIMA qualification pathway. These exemptions cover subjects at the Operational and Management levels, reflecting ACCA’s comprehensive coverage of financial and management accounting. ACCA members can enter directly into the Strategic level, significantly shortening the time needed to achieve the CGMA designation. The overlapping focus on financial reporting, business strategy, and management principles makes ACCA a strong foundation for advancing into CIMA’s strategic and leadership-oriented syllabus.

ACCA Exemption Fee

The students who are interested in starting their ACCA journey then all such students need to be prepared to pay an ACCA exemption fee. This will be for every paper they will be exempted from according to their previous qualifications. This fee will be different according to the number of exemptions permitted and the concerned papers. The ACCA exemption fee is designed to pay for the administrative charges that are related to the assessment and processing of exemption applications. Students should factor the payment of these fees into their total ACCA qualification expenses. Further information concerning the current exemption fees can be accessed on the official ACCA website, keeping students well aware of the finances involved in their ACCA experience.

ACCA Exemptions Process

The process of ACCA exemption application is very important to be known by the students to figure out how to go through the process. The process needs to be followed step by step for a smooth journey.

- Research and Check Eligibility: Based on your previous qualifications the candidate can check on the exemptions they can avail.

- Register with ACCA: If you’re not yet registered as an ACCA student, you’ll need to do this before you can apply for exemptions. You can register online on the ACCA website. Complete the student registration form.

- Prepare Supporting Documents: Gather all relevant documentation, such as academic transcripts, certificates, and detailed syllabi of the courses you’ve completed if these are required. Make sure these documents are certified copies. Non-English documents need official translations.

- Submit Your Application: Log in to your MyACCA account. Then go to the ‘My Qualification’ section and select ‘Manage My Exemptions’. Thereafter upload the required supporting documents. Also ensure that all documentation is clear, complete, and legible to avoid delays.

- Pay the Exemptions Fee: For availing the exemption in the ACCA course, there a certain fees to be paid which is compulsory to be paid which is to be paid online via your MyACCA account.

- Wait for Confirmation: Once your application is submitted, ACCA will review your documents and assess your eligibility for exemptions. This process can take a few weeks, so be patient.

- Seek Further Assistance if Needed: For seeking any assistance related to ACCA exemptions, one can mail or connect through the helpline center.

Students can also check exemption eligibility with our ACCA exemption calculator now.

Tips for a Smooth Application Process of ACCA Exemptions

The below-mentioned tips if followed will make the process of ACCA exemption smoother.

- Double-Check Entry Requirements: Ensure you meet all the criteria before submitting your application.

- Certified Documents: Documents must be stamped and signed by an authorized person (like a university official or notary public).

- Timely Submission: Apply for exemptions as soon as possible after your registration after going through the eligibility stated to ensure that you can plan your studies accordingly.

- Keep Copies: It is advisable to keep all the submitted copies handy for cross-verification.

- Follow-up: If you don’t hear back within the expected timeframe, contact ACCA to check on the status of your application.

ACCA Exemptions University List

ACCA exemptions can be obtained by students who have passed relevant degree courses such as B.Com and equivalent courses. ACCA tests these courses and grants exemptions using matching syllabus criteria. ACCA provides a list of institutions where students might be able to obtain exemptions for ACCA courses on its website. Some of the universities with ACCA exemptions are:

- Acharya Nagarjuna University: B.Com General, B.Com Computer Applications, Bachelor of Commerce (B.Com), B.Com in Income Tax and Management Accountancy, B.Com in Taxation.

- Adikavi Nannaya University: B.Com (Computer Applications), B.Com (General), B.Com – Taxation & Accounting.

- Mahatma Gandhi University: B.Com, B.Com (Computer Applications).

- Andhra University: B.Com in Computer Application, Bachelor of Commerce (B.Com), B.Com with Computers, Bachelor of Commerce (B.Com) Vocational, B.Com in Business Mathematics Commerce & Computer Science.

- University of Mysore: Bachelor of Commerce (B.Com Hons.) with CA, B.Com in Association of Chartered Certified Accountants (ACCA), Online Bachelor of Commerce (B.Com), Bachelor of Commerce (B.Com), B.Com.

- Oxford Brookes University: BSc in Applied Accounting.

ACCA Exemptions FAQs

How many ACCA exemptions are there?

The ACCA gives a maximum of nine exemptions to its core level exams based on the applicability and the intensity of previous study in accounting subjects that an individual has achieved.

When can I apply for ACCA exemptions?

You should apply for exemptions when you first register as a student with ACCA.

Which subjects are exempted from ACCA?

You are entitled to the following ACCA qualification exemptions:

- Business and Technology (BT)

- Management Accounting (MA)

- Financial Accounting (FA)

- Corporate and Business Law (LW)

- Taxation (TX)

What documents do I need to submit with my application for exemptions?

You must upload official proof of completed or partially completed qualifications, including certificates and transcripts, for exemption assessment. Non-English documents must be officially translated, stamped, and signed by the translator, along with the original language copies.

How do I apply for ACCA exemptions?

After finding out the eligibility criteria, the students need to log in to the official portal and submit the necessary documents after paying registration fees.

Why do I have to pay for exemptions?

ACCA strive to make their globally recognized qualification accessible by maintaining competitive fees and a fair pricing model. Exemption fees support rigorous assessments and accreditation, ensuring students can begin their ACCA journey at the appropriate level and stay in demand worldwide.