Obtaining a job after passing the ACCA is a major step. You better prepare for your interviews. Many students get nervous before the interview questions for actual jobs come in. Being confident is a matter of knowing what to expect. This article will make you ready for the most frequently asked ACCA interview questions. You will learn the type of question to expect, how to answer them, and what to mentally prepare for on the big day. ACCA interview questions test your technical knowledge and practical thinking skills. Interviewers want to know how much you understand finance, accounting, audit, and tax rules. They want to test your communication and decision-making skills to see if you could actually work with them in a company solving real problems.

Why Study ACCA?

Studying ACCA will give you global options for career promotion. Many Indian students tend to choose ACCA because it opens up avenues of employment both here and outside. The Association of Chartered Certified Accountants is the UK-based acting body promoting one of the highly respected finance qualifications.

Global Recognition and Career Growth

ACCA helps you stand out in the world of finance. The qualification is accredited in over 180 countries. The companies in the UK, UAE, Singapore, and India hire ACCA professionals. You can work as an accountant, auditor, tax consultant, or maybe even a CFO one day. With ACCA, the development stage will not cease. There is knowledge beyond accounting; you learn about business laws, ethics, audit, and financial reporting, which prepares you for

- Financial Analyst

- Tax Advisor

- Internal Auditor

- Finance Manager

Job Security, and High Salary

Companies value ACCA members. Even at entry-level, good salary packages crisp ACCA members. With more experience, a higher income awaits. ACCA also provides you with job security since you learn how to solve business problems. In India, ACCA-qualified professionals draw anywhere between ₹5 and ₹15 lakhs per year, depending on the company and location.

Flexibility and Student Support

You can study ACCA while working or doing your internship. You can take exams four times a year, with ACCA exams conducted in March, June, September, and December. You will get online support along with study materials and have access to an extensive alumni network to help you study better and feel supported all the way through.

Professional Ethics and Skills

ACCA guides you into ethical conduct. Companies want people who do the right thing. You also gain soft skills like decision-making, time management, and leadership. These skills help you perform better at work and during interviews.

ACCA Interview: Preparation Tips

Preparing ACCA interview questions takes time and strategy. One must be able to demonstrate that they have book knowledge yet can think the matter through in real life. This section will take you through smart ways to properly prepare for the interview.

Know the Job Role

Have the job description on hand before your interview. Internal auditor positions require one to revise audit standards; in tax roles, one must revise tax laws. Each job requires a different set of answers. Match your skills to the job.

Visit the company website. Get to understand the values, services, and recent news about the firm. Interviewers mostly want you to answer, “Why do you want to work here?” so be sure to come up with an honest and smart answer.

Revise ACCA Concepts

Go into your study books and review important topics, such as

- Financial reporting (IFRS standards)

- Audit and Assurance

- Financial management

- Performance management

- Taxation (especially for India or the country where the job is)

The interviewer could ask you technical questions on these subjects. Provide basic and clear answers.

Practice Mock Interviews

Practice makes a person better. Take your friends or mentors in the role as interviewers. Record your responses. Listen to those responses. Work on your intonation, rate of speech, and confidence. Have a good deal of oral practice of ACCA interview questions.

Prepare Real-Life Examples

Sometimes, the interviewer says, “Tell me about a time you solved a problem,” so prepare 2-3 real-life examples from college or an internship. Try to follow the STAR method (Situation, Task, Action, and Result) to answer.

For example:

- Situation – During your internship, you had to prepare final accounts.

- Task – You identified a mismatch in the trial balance.

- Action – You went through each ledger to identify the mistake.

- Result – Having identified the error, you amended the accounts in good time.

Dress Smart and Arrive Early

Keep it formal. Bring extra copies of your resume. Arrive early for interview appointments so you can soak in the feel of the venue. Test internet speed, camera, and sound systems ahead of time if it is an online interview.

Top Interview Questions for ACCA in 2025

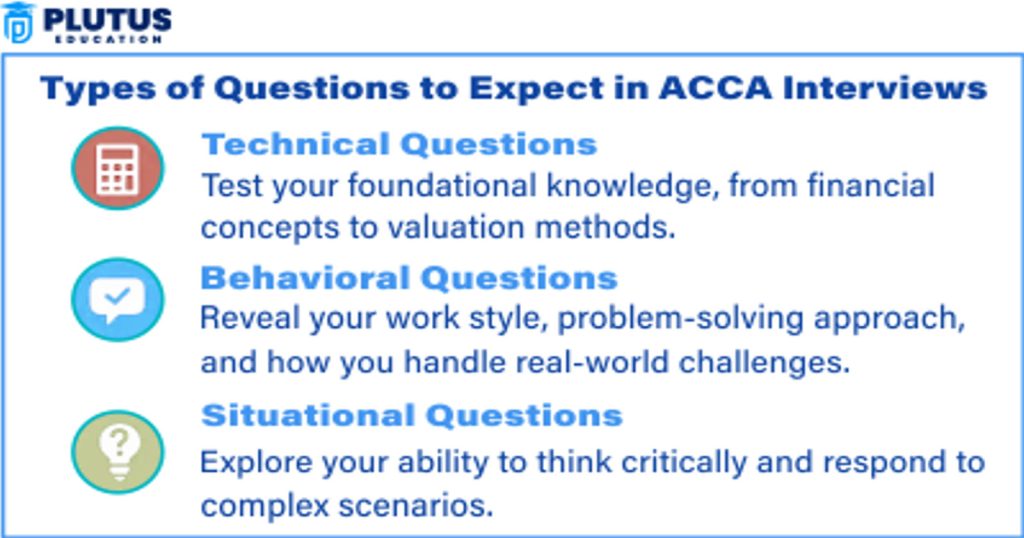

Attending an interview as an ACCA student or affiliate in 2025 may indeed seem challenging. Employers expect practical thinking, ethics, and communication beyond textbook answers. You must demonstrate that you can handle real business situations and apply ACCA knowledge on a day-to-day basis at work. Below is the list of major types of ACCA interview questions that you may face in 2025, along with hints for answering them.

Technical ACCA Interview Questions

These questions check your knowledge of financial concepts, reporting standards, audit principles, and the like. Organizations may want to see how deeply you know the technicalities of your ACCA studies.

1. What is the difference between the IFRS and Indian GAAP?

Discuss:

- The IFRS has a global acceptance; Indian GAAP is local.

- The IFRS accepts fair value; Indian GAAP uses historical cost.

- Revenue recognition, lease accounting, and financial instruments have essential differences.

2. How would you prepare a cash flow statement?

Explain:

- Has Three parts: Operating activities, Investing activities, and Financing activities.

- For operating activities, either the direct or indirect method is used.

- Net cash reconciliation with the actual change in cash as per balance sheet should always be maintained.

3. What are audit assertions?

Say:

- Assertions are the claims made by management.

- They include completeness, existence, accuracy, valuation, and rights & obligations.

- Auditors test these assertions to establish the reliability of the financial statements.

4. What is working capital? Why is it important?

The following must be mentioned:

- Working capital = Current Assets – Current Liabilities.

- It shows a company’s short-term health. Positive working capital means the business can meet day-to-day costs.

5. Explain the difference between capital and revenue expenditure.

- Capital expenditure creates future value (buying machines).

- Revenue expenditure is for daily operations (paying salaries, repairs).

6. What is deferred tax? Give an example.

It is a tax difference that will be remitted or recovered in future. For example, the depreciation rate is different in tax books and in accounting books.

7. What is materiality in auditing?

- Materiality means the importance of an item or error in financial reporting.

- If it can influence decisions of users, it is material.

Behavioral and HR-Based ACCA Interview Questions

These questions check the candidate’s attitude, approach towards work, and soft skills. Interviewers want to see whether the candidate would gel well with their team and how he behaves under stressful situations.

1. Tell me about yourself.

Structure:

- Name, your education, and papers passed in ACCA.

- Any work experience or internship.

- Area of major strengths and objectives.

2. Why did you choose ACCA instead of CA or MBA?

Say that:

- ACCA is an internationally recognized qualification.

- It provides good flexibility in exams and training.

- It is much more practical and ethical in regard to its learning.

3. Tell us about a time you worked in a team.

Answer using the STAR technique:

- Situation– College or internship project.

- Task– What your role was.

- Action– What action did you take?

- Result– What did the team achieve?

4. What are your strengths and weaknesses?

Be honest:

- Strengths: Hardworking, good attention to detail, good communication

- Weakness: Overthinking or perfectionism. Add how you are working on it.

5. Where do you see yourself in 5 years?

Example:

- I want to be an ACCA member.

- I want to lead a finance team or be involved in decision-making in a company.

6. Why do you want to work with our firm? Tailor your response.

- Discuss something about the company’s values, expansion, or projects.

- Relate your goals to their vision.

Scenario Oriented ACMA Questions

These types of questions examine your logical and ethical usage of ACCA knowledge in the handling of concrete business situations.

1. A client asks you to delay those expense records on purpose to show more profits. What do you do?

Say:

- I cannot cooperate, as this is against accounting ethics.

- I will explain the risk of misstatement of financials.

- If he insists, I will bring the matter up to a higher authority.

2. You have found an error in your manager’s report. What do you do?

Answer:

- I will respectfully inform the person about the error.

- I want to ensure the quality of the work and protection of the company’s name.

3. Your colleague is not performing well. What do you do about it?

Explain:

- My first step would be to talk to him/her in private.

- I will try to understand the reason and also offer help.

- If it does not work, I will inform the team lead.

4. What will you do if you discover fraud in the course of an audit?

Answer:

- I will gather evidence with care.

- I will follow the whistleblower policies of the company or report to senior auditors on the matter.

- I will not keep such matters concealed and will not ignore them.

5. Your senior asks you to sign a paper without reading it. What do you do?

Answer:

- I will politely tell the senior that I need to read and understand the paper before signing.

- I will quite surely not sign anything I do not understand.

Situational Financial Case-Based Questions (New Trend for 2025)

Nowadays, case questions are included in quite a few interviews. You get a real company issue and are asked for an account of how you intend to solve it.

Example 1:

The company’s sales have dropped, and there are suspicions of high operating costs. What will you do as an ACCA professional?

Steps:

- Check cost breakdown reports.

- Compare these with data from the previous year.

- Any sudden cost increases?

- Suggest areas for cuts or controls on costs.

Example 2:

Your company intends to invest in a new product. How will you analyze the financial viability of this investment?

Answer:

- Prepare projected P&L and cash flow.

- Apply NPV (Net Present Value), and IRR (Internal Rate of Return).

- Consider whether there are risk factors, which could be either markets-based risks or cost rises.

ACCA Interview Questions FAQs

1. What questions are asked in an ACCA?

There are scenario-based, multiple-choice, and application-based questions in an ACCA exam to test concepts, ethics, and decision-making in real-world business situations.

2. Does ACCA repeat questions?

ACCA may not repeat the exact questions but may repeat question patterns or styles. Familiarity with past papers will assist you in identifying the common areas on which you are tested.

3. What questions are asked in accounting interviews?

Accounting interviews will test for technical topics such as IFRS, tax, and auditing. They will also have HR questions, as well as ethical case studies.

4. How do you answer ACCA questions?

Read the question carefully, plan your structure, and apply concepts to real scenarios using simple language and examples where necessary.

5. What would be the hardest exam in the ACCA?

Most students feel Advanced Audit and Assurance (AAA) or Strategic Business Leader (SBL) to be the hardest. These require deep analysis and strong writing skills.