Accounting is more than just recording business transactions—it is a critical tool for gathering, organizing, and interpreting financial data. This data serves as the foundation for decision-making, not just for internal management, but for a wide range of external stakeholders. The American Institute of Certified Public Accountants (AICPA) has defined accounting as the “art of recording, classifying, and summarising in a significant manner and in terms of money, transactions, and events which are, in part at least, of financial character, and interpreting the results thereof.”. In this article, we’ll explore how accounting acts as a valuable source of information, the different types of users who rely on this data, and the crucial role it plays in the broader business environment.

Accounting as a Source of Information

Accounting is the management information system of any organization and is concerned with providing necessary information to the management, i.e., it is a source of information. The accounting process serves as a comprehensive system that provides financial information about a business’s economic activities. By systematically recording, classifying, summarizing, and interpreting financial transactions, accounting transforms raw data into meaningful insights. In the account, every step involves either the generation or processing of accounting information. It serves as a means as well as an end to providing information to all stakeholders who need information to make a proper decision.

Fun Fact

Did you know? The first known recorded financial statement dates back over 7,000 years, to ancient Mesopotamia, where businesses tracked goods traded with clay tokens!

Role of Accounting in Providing Information

Accounting plays an important role in serving information by systematically recording, analyzing, and reporting financial transactions. This ensures transparency so that all stakeholders may know about an entity’s financial health and operational performance vividly. Accounting provides information by:

- Recording Business Data: Every business transaction, from sales to payments, is recorded systematically to ensure that there is a complete and accurate history of financial activity.

- Summarizing Financial Data: Accounting helps summarize large volumes of financial data into clear financial statements like the balance sheet, income statement, and cash flow statement.

- Offering Insights for Decision-Making: By analyzing the financial data, businesses can make decisions regarding investment, operations, and resource allocation.

- Accounting as a Communication Tool: In many ways, accounting acts as a communication tool, providing a common language for businesses and their stakeholders. Through financial reports, businesses communicate their financial health and prospects to internal and external users.

Users of Accounting Information

Accounting information is used by a diverse range of stakeholders. All those who use accounting information about the business to make decisions are called users. These users are typically classified into two groups: internal users and external users. Each group uses the data for different purposes.

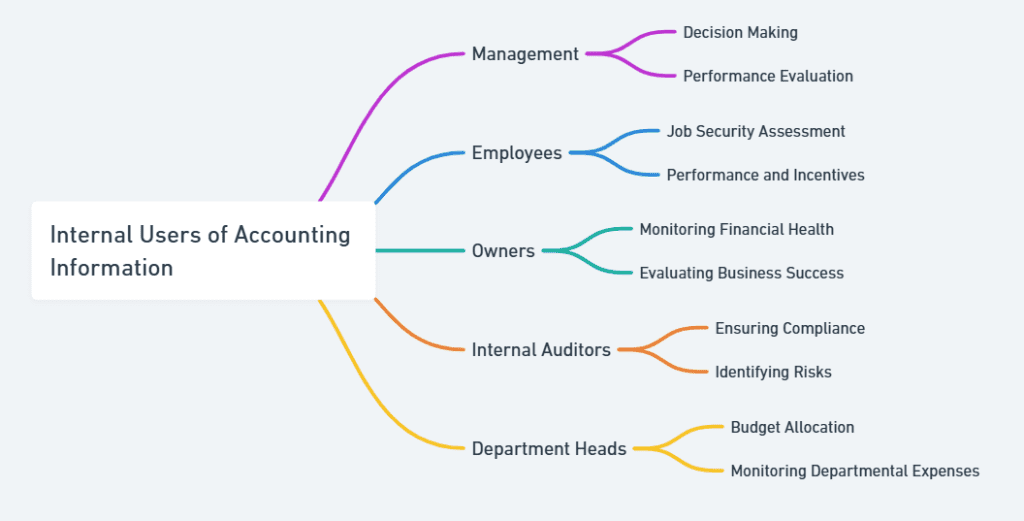

Internal Users of Accounting Information

Internal users are individuals within the business who use accounting information to make day-to-day and strategic decisions. These users are involved in the management and operation of the company and rely on timely and detailed data to guide their decisions.

1. Management

Management is the primary internal user of accounting information. Managers need detailed and up-to-date financial information on selling prices, controlling and reducing costs, and investing in new projects to make decisions regarding the business’s operations. Accounting helps managers assess performance, identify inefficiencies, and allocate resources effectively.

Example: A company’s management may use sales reports and cost data to decide whether to expand production or introduce new products.

2. Employees

Employees may also be internal users of accounting information. Although they don’t directly manage the financial data, they have an interest in the company’s profitability and stability, as it affects job security and future career opportunities. Employees may look at a company’s financial performance to gauge the likelihood of promotions or bonuses.

3. Department Heads

Department heads use accounting information to manage specific areas of the business. They rely on financial data to control budgets, manage expenses, and measure the performance of their departments. The head of the marketing department may use accounting data to evaluate the return on investment (ROI) of recent campaigns.

4. Internal Auditors

Internal auditors ensure that a business’s financial processes are accurate and compliant with regulations. They use accounting information to monitor internal controls, detect fraud, and ensure that the company’s records are accurate. Internal auditors may review transaction records to ensure that expenses are being properly documented and authorized.

External Users of Accounting Information

External users are individuals or entities outside the business who use accounting information for various reasons, including investment, regulatory, and lending decisions. These users rely on financial statements and reports that provide a clear view of the company’s financial position.

1. Investors

Investors are one of the most important external users of accounting information. They use financial data to evaluate the profitability, financial health, and growth potential of a business before deciding to invest. They take on risk and lack direct control over business operations. Investors rely on accounting information to evaluate the enterprise’s earning capacity and the safety of their investment.

Decision-Making Role Investors

They look at financial metrics like earnings per share (EPS), return on equity (ROE), and net income to make informed decisions about buying, holding, or selling stock. An investor might review a company’s income statement to assess profitability before purchasing shares.

2. Creditors and Lenders

Creditors and lenders, such as banks and financial institutions, use accounting information to assess the risk of lending money to a business. They focus on a company’s ability to repay loans and meet financial obligations. Creditors look at the company’s liquidity ratios, debt-to-equity ratio, and cash flow to evaluate its financial stability.

A bank may analyze a company’s cash flow statement to determine whether the business generates enough income to cover loan repayments before extending credit.

3. Government and Regulatory Agencies

Government bodies and regulatory agencies require accounting information for tax purposes and to ensure compliance with financial regulations. Accurate accounting records are essential for determining a company’s tax liabilities and ensuring transparency in financial reporting.

Governments use financial statements to assess tax obligations, while regulators may review reports to ensure adherence to financial laws like GAAP (Generally Accepted Accounting Principles) or IFRS (International Financial Reporting Standards). The tax authorities may examine a company’s financial statements to verify reported income and calculate tax due.

4. Suppliers

Suppliers use accounting information to evaluate the creditworthiness of a business before extending trade credit. They need to ensure that the business can meet its payment obligations. A supplier may review a potential client’s financial position, particularly liquidity ratios, to assess whether to offer favorable credit terms for large orders.

5. Customers

Large customers may review a company’s financial information to ensure the business can deliver goods or services reliably. For customers who depend on long-term contracts, the financial stability of a supplier is critical.

Example: A large retailer might assess the financial health of a supplier before entering into a long-term contract to ensure an uninterrupted supply of goods.

6. Public

The general public, including financial analysts and consumer groups, might use accounting information to assess the impact of a company’s activities on the economy, employment, or even the environment. Environmental agencies may use financial reports to gauge a company’s investment in sustainable practices and its overall impact on the environment.

The Importance of Reliable and Accurate Accounting Information

Accounting information is only useful if it is reliable, accurate, and timely. Here are the key reasons why reliability is essential in accounting:

1. Ensures Sound Decision-Making

For both internal and external users, the accuracy of accounting information is critical to making informed decisions. Inaccurate financial data can lead to poor decisions that affect the overall success of the business.

Example: Management relies on accurate cost data to make decisions about pricing and budget allocations.

2. Enhances Stakeholder Confidence

Reliable financial reports foster trust between the business and its stakeholders. Investors, creditors, and regulators are more likely to engage with a company that consistently provides transparent and reliable financial information. A company with a reputation for providing trustworthy financial statements is more likely to attract investment and favorable credit terms.

3. Supports Compliance and Accountability

Reliable accounting information ensures that businesses comply with legal and regulatory requirements. It also helps in maintaining accountability by providing a transparent record of all financial transactions.

Companies that follow accounting standards like GAAP or IFRS provide clear, comparable, and accurate financial reports, which help in regulatory reviews.

Role of Accounting Information in Decision-Making

Accounting is a powerful tool in business decision-making. By providing a clear view of a company’s financial performance and position, accounting information helps businesses make strategic decisions that affect their growth, profitability, and sustainability.

1. Strategic Planning

Accounting information plays a critical role in strategic planning by helping businesses forecast future revenues, expenses, and capital needs. This allows management to set achievable goals and allocate resources effectively. A company may use historical sales data to forecast future demand and plan for capacity expansion.

2. Performance Measurement

Businesses rely on accounting data to measure performance against targets. Key performance indicators (KPIs) such as return on investment (ROI) and gross profit margin are derived from accounting records and are essential for evaluating business success.

A business may use accounting reports to compare actual performance against budgeted targets to identify areas of underperformance.

3. Risk Management

By analyzing financial reports, businesses can identify potential risks, such as cash flow shortages or increasing debt levels. Accounting provides the data necessary for assessing these risks and developing mitigation strategies.

A company may notice rising inventory costs in its financial reports and decide to renegotiate supplier contracts to control expenses.

4. Investment Decisions

Accounting data is vital for making investment decisions, both for the business itself and for external investors. Accurate financial records allow businesses to evaluate potential investments in new projects, technologies, or markets.

A company may analyze its cash flow to determine if it can afford to invest in new equipment or expand into a new geographic region.

Key Points to Remember

- Accounting serves as a reliable source of financial information for both internal and external users.

- Internal users (management, employees, and department heads) use accounting information for operational decisions, performance evaluation, and strategic planning.

- External users (investors, creditors, and government) rely on financial reports for assessing financial health, compliance, and creditworthiness.

- Reliable and accurate accounting data enhances decision-making, promotes stakeholder confidence, and ensures legal compliance.

- Accounting information is essential for evaluating business performance, managing risks, and making investment decisions.

Accounting as a Source of Information FAQs

How does accounting serve as a source of information for management?

Ans. Accounting acts as a management information system. It offers detailed financial data that helps in decision-making about pricing, cost control, and business investment.

What are internal and external users of accounting information?

Ans. Internal users include management, employees, and department heads. Whereas external users encompass investors, creditors, government agencies, and suppliers.

What is the role of accounting in risk management and investment decisions?

Ans. Accounting identifies financial risks like cash flow shortages. It helps in decision-making by analyzing financial health and the feasibility of business.