The Bachelor of Commerce (BCom) program offers a strong academic foundation in accounting, business law, economics, taxation, and finance. It equips students with knowledge of business operations and prepares them for professional roles or advanced studies. BCom subjects are designed to foster analytical and managerial skills necessary for rolling, auditing, and the corporate sectors.

What is BCom?

BCom is a three-year undergraduate commerce, business principles, finance, economics, and accounting course. This lays the groundwork for a career in business management, taxation, auditing, and financial analysis. BCom graduates are well-trained to handle real-world challenges by emphasizing practical and analytical skills. Many students prefer to use this as a stepping stone for professional qualifications such as CA, CS, CMA, and MBA. However, this adaptability makes BCom one of the most chosen options after 12th commerce.

Types of BCom Courses

- BCom General: This covers a broad range of subjects within commerce.

- BCom Honours is specialisation-based and imparts in-depth knowledge in subjects like Accountancy or Finance.

- BCom Computer Applications: Where IT fits into commerce.

- BCom Professional: For professions in accounting and finance.

- BCom Banking and Insurance: This course is BFSI-focused.

Duration and Structure

The course runs for six semesters over three years. Each semester adds new subjects that gradually become complex. Along with core subjects, students also take up electives and practical components.

| Course Type | Duration | Key Focus |

| BCom General | 3 Years | Basic commerce & finance |

| BCom Honours | 3 Years | Specialized subjects |

| BCom with CA/ACCA | 3-4 Years | Integrated with certifications |

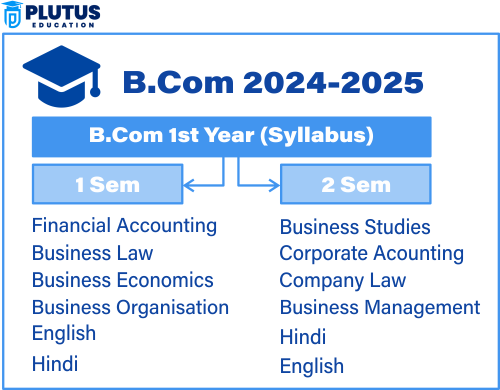

BCom Subjects (Semester-wise Breakdown)

BCom subjects are carefully designed to develop a student’s understanding of finance, accounting, business law, and taxation. Each semester builds upon previous concepts, gradually enhancing analytical and practical knowledge. The subjects are divided into core, elective, and specialization-based modules. Here’s a detailed semester-wise breakdown.

Semester 1 Subjects in BCom

Semester 1 sets the groundwork for commerce principles. Students are introduced to fundamental topics that build a base for future specialisation. These subjects aim to develop communication, managerial thinking, and basic commerce understanding.

Financial Accounting

This subject introduces students to basic fundamental counting principles. It teaches them how to prepare financial statements, ledger accounts, trial balances, and balance sheets. It develops the skills required to record and analyze transactions. This subject forms the basis for all future accounting topics. Students also learn error rectification and bank reconciliation.

Business Economics

This subject introduces students to microeconomic and macroeconomic concepts. Students learn about market demand, pricing strategies, and supply chains. Cost and revenue analysis, which is paramount for business decision-making, is also studied. It encompasses topics like market equilibrium, consumer behavior, and national income. It thus prepares the ground for the application of economic reasoning to business.

Business Mathematics

The syllabus covers commercial arithmetic, ratios, percentages, and statistics. Students learn how to compute interest, depreciation, and annuities. The mathematical concepts are relevantly tied to some business scenarios. This subject fosters a sense of analytical thinking combined with decision-making ability. Related subjects such as financial analysis and costing are supported.

Business Communication

This subject trains students in verbal and written communication. It includes formats for business letters, emails, memos, and reports. Emphasis is given on presentation and public speaking. Grammar and vocabulary are improved for professional communication. It is essential for effective business correspondence.

Principles of Management

Students learn how businesses are structured and managed. It teaches planning, organizing, staffing, and controlling. Real-life case studies help students understand management concepts. It introduces organizational behavior and leadership styles. The subject sets the tone for management specialization.

Semester 1 Subjects Overview

| Subject | Focus Area | Skills Developed |

| Financial Accounting | Bookkeeping, Journal Entries | Accuracy, Ledger Management |

| Business Economics | Micro & Macro Economics | Market Analysis |

| Business Mathematics | Interest, Ratios, Statistics | Quantitative Aptitude |

| Business Communication | Reports, Presentations | Writing and Speaking Skills |

| Principles of Management | Planning, Staffing, Control | Leadership, Strategy |

Semester 2 Subjects in BCom

Semester 2 deepens the study of business laws, accounting systems, and statistical analysis. This prepares students for regulatory and marketing roles.

Advanced Financial Accounting

Introducing accounting for partnerships, consignment, and joint ventures. It also discusses specific other complex accounting standards. Students learn about accounting for firms, branches, and departments, and practical exercises that hone accuracy and regulatory compliance. It’s essential for a career in CA, CMA, and auditing.

Corporate Law

Corporate Laws form the Legal framework for businesses. They include the Companies Act, 2013. Students learn about the formation of companies, directors’ duties, and shareholders’ rights. These legalities would help them in their roles in compliance and governance. It prepares them for company secretaries or the legal department.

Business Statistics

The subject is focused on data collection, tabulation, and analysis. It covers averages, dispersion, correlation, and regression. Students are going to use statistical tools in the market and financial analyses. Business research and forecasting also sharpen their accuracy and analytical thinking.

Environmental Studies

Students should be aware of sustainability and moral considerations regarding the environment. It puts much emphasis on business responsibility toward nature. Pollution control, biodiversity, and climate change are some of the most common topics. Present businesses ought to adopt green practices. It creates socially responsible behavior.

Marketing Management

It will teach about product development, the pricing that comes with it, and promotion. They will be learning about consumer behavior and how to segment a market. Students would learn through case studies and be equipped to develop a campaign strategy and brand design. This would prepare them for success in sales as well as digital marketing. Real applications make it lively.

Semester 2 Subjects Overview

| Subject | Focus Area | Relevance |

| Advanced Accounting | Partnership & Consignment Accounts | Audit and Tax Preparation |

| Corporate Laws | Company Rules & Governance | Legal & Compliance Roles |

| Business Statistics | Data Interpretation, Forecasting | Business Analysis |

| Environmental Studies | Sustainability, Climate Awareness | CSR, Green Business |

| Marketing Management | Promotion, Consumer Behavior | Sales, Brand Management |

Semester 3 Subjects in BCom

Semester 3 deals with applied commerce concepts: namely, cost control, taxation, labor management, and macroeconomics. These subjects prepare students to cement the theoretical foundation for business applications.

Cost Accounting

This subject takes students through the management and reduction of business costs. It discusses the costing sheets, break-even analysis, standard costing, and variance analysis. It is essential for manufacturing and management accounting. The course imparts budgeting, analysis, and cost control knowledge, which will also aid in CMA preparation and other finance-related jobs.

Business Law

This semester, Business Law focuses on Contracts, Sale of Goods, Negotiable Instruments, and Partnership Acts, with students attaining knowledge of legal rights and obligations surrounding a business transaction. Such knowledge suits professionals in legal, business advisory, and compliance-related jobs. Case laws are discussed for real-life applicability. It also intersects with the legal modules of CS and the MBA.

Income Tax Law and Practice

The students are acquainted with the Indian taxation system, which includes residential status, the heads of income, deductions, tax computations, and filing of returns. The curriculum uses case studies to simulate return filings and is very practical and relevant to those who aspire to become tax consultants, accountants, or government tax officers. Knowledge of tax law is pertinent for financial planning.

Human Resource Management (HRM)

HRM includes recruitment, selection, training, performance appraisal, industrial relations, and employee motivation. It enables students to become professionals in talent acquisition and organization development. HR case studies help in developing soft skills and decision-making. HRM engages students in the MBA-HR tracks.

Macro Economics

It covers national income, inflation, unemployment, and monetary policy. Students learn about the overall structure of the economy and government fiscal policy. It helps prepare for competitive exams such as UPSC, SSC, and RBI. It also helps in logical thinking and the evaluation of policies.

Semester 3 Subjects Overview

| Subject | Focus Area | Key Outcome |

| Cost Accounting | Cost Control, Budgeting | CMA, Management Roles |

| Business Law | Contracts, Negotiable Instruments | Legal & Compliance Careers |

| Income Tax Law | Tax Planning, Returns | Tax Advisor, Analyst |

| HRM | Recruitment, Training | HR Careers, MBA-HR Foundation |

| Macro Economics | Inflation, Govt Policy | Policy Analyst, UPSC Preparation |

Semester 4 Subjects in BCom

Semester 4 focuses on legal, managerial, and digital transformation in business. Students are introduced to indirect taxes and IT-related operations relevant in today’s businesses.

Management Accounting

This subject teaches analysis of financial statements using ratios, cash flow, and fund flow. Students learn budgeting, margin analysis, and financial planning. It is essential for decision-making roles in corporations. It also helps prepare for CA and CMA exams. Real-life case studies improve analytical thinking.

Company Law

The subject discusses company formation, legal status, duties of directors, and meetings. It gives insights into corporate governance. It’s helpful for aspiring CS, corporate lawyers, and legal officers. Understanding company structure builds compliance readiness. It also emphasizes the role of SEBI and shareholders’ rights.

Indirect Taxes (GST)

Students study Goods and Services Tax (GST), registration, returns, and invoicing. Real-world filing examples make this subject practical. It prepares students for accounting, compliance, and audit roles. GST is now a central part of Indian commerce, making this subject very job-relevant. Topics like input tax credit and reverse charge are covered.

E-Commerce

Students learn about online business models, payment systems, and digital marketing basics. They explore website management, SEO, and consumer data privacy. This subject equips students for digital entrepreneurship and e-business careers. It’s ideal for those aiming to work in IT + business roles. Cybersecurity and e-tailing are discussed.

Organizational Behavior

Organizational Behavior (OB) teaches workplace psychology, group behavior, motivation, and leadership. It prepares students for team management and HR functions. Real-world cases improve emotional intelligence and conflict resolution. It builds a base for management roles and postgraduate business studies.

Semester 4 Subjects Overview

| Subject | Focus Area | Industry Relevance |

| Management Accounting | Financial Decision-making | Finance & Strategy Roles |

| Company Law | Corporate Compliance | CS, Legal Advisor |

| Indirect Taxes (GST) | Tax Filing, Compliance | GST Consultant, Accountant |

| E-Commerce | Digital Business Models | Startup, Tech, Digital Marketing |

| Organizational Behavior | Team Dynamics, Leadership | HRM, Management Consulting |

Semester 5 Subjects in BCom

Semester 5 introduces global business concepts and specialized subjects that prepare students for industry-specific careers. Students begin to choose electives based on their career interests.

Financial Management

This subject covers capital budgeting, cost of capital, working capital management, and capital structure. Students learn how firms raise and allocate funds. It builds skills needed for finance managers and investment analysts. Topics like NPV, IRR, and leverage are introduced. It aligns with CFA and MBA-Finance modules.

Auditing and Assurance

Students study auditing principles, vouching, verification, internal control, and audit reports. It provides practical auditing procedures for CA, CMA, and government exams. Field assignments help build accuracy and observational skills. Understanding audits is essential for compliance and internal review roles.

Banking and Insurance

This subject introduces banking operations, insurance types, risk management, and regulations. It is relevant for those pursuing jobs in PSU/private banks, RBI, or IRDAI. It also helps prepare for IBPS, SBI PO, and LIC AAO exams. Case laws and regulatory bodies are discussed.

International Business

This subject focuses on globalization, trade agreements, currency markets, and MNCs. Students study WTO, EXIM policy, and trade practices. It prepares them for export/import firms, global logistics, and consultancy. Careers: The role of foreign exchange and international market entry is covered.

Elective (e.g., Investment Analysis / Entrepreneurship)

Based on the institution, students choose electives that suit their career goals. Investment Analysis covers portfolio theory, risk-return, and market analysis. Entrepreneurship covers the startup lifecycle, funding, and innovation. Both prepare students for high-skill, high-pay careers.

Semester 5 Subjects Overview

| Subject | Focus Area | Career Path |

| Financial Management | Capital Decisions, ROI | Finance, Banking |

| Auditing and Assurance | Internal Controls, Reporting | Auditor, CA |

| Banking and Insurance | Loan, Risk, Insurance Laws | Bank Officer, IRDAI Roles |

| International Business | Global Markets, Trade | Export, Consulting |

| Elective | Investment/Startup | Analyst, Entrepreneur |

Semester 6 Subjects in BCom

Semester 6 is the capstone stage where students are introduced to corporate leadership, strategic thinking, and tech-driven laws. The goal is to produce industry-ready graduates.

Advanced Financial Management

Students explore dividend policy, mergers & acquisitions, and capital structure. It helps in valuation roles and investment banking. The course uses real company data to simulate decisions. Students are prepared for strategic finance positions. It adds value to MBA and CFA preparation.

Strategic Management

This subject involves SWOT, competitive analysis, resource planning, and business strategies. It trains students to think like decision-makers. Strategy tools like BCG’s Matrix and Porter’s 5 Forces are discussed. It is ideal for those planning to pursue an MBA. It builds a strong base in business planning.

Corporate Governance

Covers board structure, ethics, CSR, transparency, and whistleblower policies. It strengthens understanding of corporate accountability. Ideal for compliance, law, and HR roles. Emphasizes good business practices and sustainability. International governance norms are included.

Elective (e.g., Financial Modeling / Supply Chain Management)

Financial Modeling teaches Excel-based projections and valuation. SCM includes procurement, logistics, and vendor management. These electives target highly employable domains. Modeling helps in analyst roles and SCM and prepares students for logistics and e-commerce jobs.

Cyber Crimes and Laws

Students learn about the IT Act, hacking laws, data protection, and digital evidence. It is essential in today’s e-commerce, fintech, and social media world. This subject also builds awareness of cyber law careers. Data privacy and fraud management are covered.

Semester 6 Subjects Overview

| Subject | Focus Area | Job Role/Industry |

| Advanced Financial Mgmt | M&A, Capital Planning | IB, CFO Track |

| Strategic Management | SWOT, Strategy Tools | Business Strategy, MBA |

| Corporate Governance | Ethics, CSR, SEBI Rules | Compliance, Risk |

| Elective | Modeling / Logistics | Analyst, Operations Head |

| Cyber Laws | IT Act, Data Privacy | Cybersecurity, Legal |

B Com Subjects FAQs

1. What are the main subjects in BCom 1st year?

Core subjects include Financial Accounting, Business Economics, Business Mathematics, and Principles of Management.

2. What is the difference between BCom and BCom Honours?

BCom is general, while BCom Honours offers specialization in finance, accounting, or taxation.

3. Is Mathematics compulsory for BCom admission?

Mathematics is not compulsory for all colleges but is required for BCom Honours in many institutions.

4. What career options are available after BCom?

You can become an accountant, financial analyst, HR executive, or pursue a CA, CS, MBA, or MCom.

5. Are electives available in BCom, and how do they help?

Yes, electives like Investment Analysis or Financial Modeling help tailor your career to specific industries.