A common debate among finance and accounting professionals aspiring to take their careers to the next level. Choosing between a CFA, Chartered Financial Analyst, and ACCA, which are both globally recognized, leads to immensely well-paying job opportunities in the field of finance and investment, along with accountancy. For aspirants who would like to gain a deep understanding of such qualifications, knowing them properly is very important. Then this article gives an overall comparison between the CFA vs ACCA, mentioning the differences in the definitions, areas of concentration, and the fundamental differences that separate the two.

CFA vs ACCA: Key Differences

The reason to differentiate between CFA vs ACCA is to understand where their skills gap lies and what practical knowledge can be augmented to have a successful career. Great expertise in both qualifications, though, caters to different areas within the financial and accounting sectors.

| Category | Chartered Financial Analyst (CFA) | Association of Chartered Certified Accountants (ACCA) |

| Course Structure | CFA Level 1 | Knowledge Level |

| CFA Level 2 | Skill Level | |

| CFA Level 3 | Professional Level | |

| Duration | 4 years, if candidates can clear their exams in the first attempt | Most candidates take 3 to 4 years to complete the course. Has a mandatory time limit of 10 years from passing the first exam. |

| Registration Fee | USD 450 | GBP 79+ Subscription fee of GBP 116 per year |

| Eligibility | You must have a bachelor’s degree or equivalent, or your exam window is within 23 months of your graduation month. | You need three GCSEs and two A levels in five separate subjects, including English and maths or their equivalents. You must have three years of relevant work experience. |

| JobProfile / Areas | Research Analyst | Accounting Advisory |

| Portfolio Management | Financial Performance Reporting | |

| Wealth Manager | International TaxationRisk and Control Evaluation | |

| Investment Analyst | Legal Compliance | |

| Chief Level Executive | ||

| Risk Manager | ||

| Corporate Audit and Assurance | ||

| Recognition | Recognized in 206 countries | 170+ countries |

| Governed By | CFA Institute, USA | ACCA, UK |

CFA vs ACCA Salary Comparison

- CFA Salary: A CFA charter holder newly will receive higher compensation as an investment banker, or portfolio manager, or equity analyst. They are experienced professionals well paid, which can go up to a handsome amount of 20 lakh-35 lakhs per year.

- ACCA Salary: ACCA also have competitive salaries in accounting roles as well. A fresher person will get approximately 5 to 10 lakhs. Senior roles in financial control will get at 17 lakhs or above, depending on experience and location.

ACCA vs CFA: Which is Harder?

- CFA Difficulty: The CFA tests are ranked among the toughest ones in the finance industry primarily due to investment analysis technicality and the requirement to uphold superior ethical practices.

- ACCA Difficulty: ACCA is broad in scope compared to CFA, and is considered more accessible because they are generally more applied but more along the lines of accounting standards in addition to having a broad range of topics encompassed in accounting and finance.

What is CFA?

CFA stands for Chartered Financial Analyst, which is a professional designation awarded by the CFA Institute. The CFA program is designed for investment and financial professionals and focuses on investment management, financial analysis, and portfolio management.

A professional degree sanctioned by the CFA Institute, the CFA, or Chartered Financial Analyst, is recognized around the world as a standard measure of investment management and financial analysis. The CFA program has been designed to provide deep knowledge in investment strategy, portfolio management, and ethical practices in finance. One of the most respected certifications for professionals aiming for excellence in asset management, equity research, and investment banking.

Key Features of CFA

- Core Focus Areas of the CFA Curriculum

- The CFA curriculum incorporates, basically, a broad range of topics that relate to core concepts, such as financial analysis, investment management, portfolio strategy, equity and fixed-income securities, and derivatives.

- The focus is on ethical standards where the candidates excel in the maintenance of a highly considered professional ethics level within investment-making decisions.

- Other important features include a focus on quantitative methods and theories regarding economics to prepare candidates for work in financial analysis and economic forecasting.

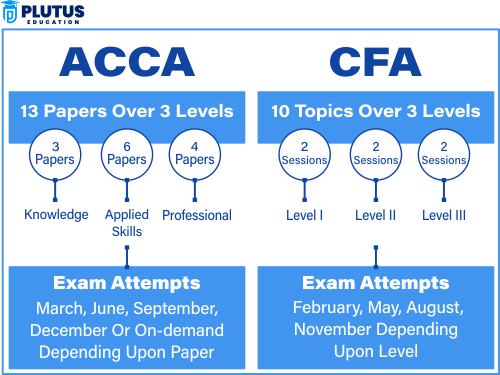

- Exam Structure of CFA: The CFA is organized into three levels, and these levels function to increase with complexity as one progresses through the system. The three levels are Level I, Level II, and Level III.

- Level I: encompasses the basic concepts of financial analysis, ethical practices, and the tools that form the basis of any analyst’s work.

- Level II: This is as the name goes; it digs deeper into matters such as asset valuation, financial reporting, and corporate finance.

- Level III: Portfolio management and wealth planning is given at this level, whereby what is learned at the previous levels is enhanced by applications.

- To become a CFA, candidates have to clear all three levels in a sequence and are required to study hard for years.

- Skills Developed Through CFA

- Investment Analysis is the Art of Analyzing Stocks, Bonds, Derivatives, and Other Investments to Make Proper Investment Decisions.

- Portfolio management is the ability to manage diversified investment portfolios by the client’s financial objectives and levels of risk.

- Ethics and Professional Conduct: Stricter codes of ethics for the investment industry, full transparency, integrity.

Career Opportunities for CFA

- A portfolio manager: A portfolio manager is an investment professional entrusted with handling individual and institutional investment portfolios, or corporate entities on behalf of their owners, to maximize returns.

- Equity Research Analyst: A market trend and economic factor assessment/analysis concerning the company’s performance- Equity Research Analyst.

- Investment banking analyst: Advises clients on mergers, acquisitions, capital raising, and other strategic financial decisions.

- Financial Advisor: They advise clients to invest and make plans in finance, which will help those clients reach their financial goals.

What is ACCA?

ACCA is a very renowned accounting qualification accepted globally. It provides qualifications in such fields as financial reporting, taxation, and business law. ACCA Global offers this accreditation to people who wish to have careers in accounting, and financial consultancy. ACCA relies on the knowledge of the whole accounting system and has extensive repute in ethics, governance, and professional skills.

Key Features of ACCA

- Core Focus Areas of the ACCA Curriculum

- There is an examination syllabus designed in respect of all the four levels of the ACCA qualification, among which is a broad range of subjects including financial accounting, management accounting, taxation, auditing, and business law.

- It provides participants with the necessary knowledge of accounting principles, corporate governance, the standards of financial reporting like IFRSs, and risk management practices.

- ACCA also incorporates the strategic perspective of business management, which includes corporate finance, strategic business analysis, and professional ethics.

- Exam Structure of ACCA: The ACCA qualification is applied at three levels: Applied Knowledge, Applied Skills, and Strategic Professional. They must pass 13 papers, unless exempted, and gain practical experience to be qualified for the ACCA, which gives them recognition as professional and technically competent accountants.

- Applied Knowledge: Exposes the candidates to the basics of accounting, management, and finance.

- Applied Skills: focuses on the intermediate concepts of taxation, financial reporting, and audit and assurance.

- Professional level Strategic: Professional has been developed with more complex themes, including strategic business leadership and performance management.

- Skills Developed Through ACCA

- Accounting competency: Preparing, and presenting financial statements, and keeping the right accounts and records of accounts.

- Auditing Techniques: Skills in doing both internal and external audits of compliance with financial regulations and standards.

- Tax Planning: Expertise in providing counsel on tax matters, planning optimal tax strategies, and maintaining compliance with laws.

Career Opportunities for ACCA Professionals

- Chartered Accountant: Keeps in control the financial records of businessmen and individuals, prepares financial statements, and can conduct audits.

- Tax Advisor: Provides planning and advisory services in taxation to the business thereby optimizing their tax liability.

- Financial Controller: Controls an organization’s financial working that comprises budgeting and forecasting, as well as other forms of financial analysis.

- Audit Manager: Leading audit teams, performing evaluations of internal controls, and ensuring that companies comply with regulatory requirements.

Comparing and contrasting CFA vs ACCA, career aspirations, and interest in finance and accounting would dictate the choice. For example, the CFA might be relevant and well-suited for investment management with financial analysis and portfolio strategy, and the ACCA will be ideal if put on accounting, auditing, and financial reporting. The qualifications would offer great professional benefits as well as salary strength, hence valuable assets in their respective domains.

CFA vs ACCA FAQs

What is the main difference between CFA and ACCA?

ACCA is broader, focusing on accounting, auditing, taxation, and financial management, suitable for roles in public accounting, corporate finance, and government. CFA is more specialized, concentrating on investment management, financial analysis, and portfolio management, better suited for careers in investment banking, asset management, and financial research.

Is CFA better or ACCA?

Both ACCA and CFA are not ones that are inherently superior, but the fact is that they point to different job opportunities. By and large, ACCA routes the certification for people who want to make their careers in accounting, auditing, and money management, whereas CFA routes the certification for people who want to get a specialization in investment management, portfolio management, and the analytical aspects of financial markets.

Is the CFA harder than the ACCA?

ACCA exams are computer-based and can be taken at any time of the year, while CFA exams are paper-based and are offered once a year in June. CFA is considered more difficult and requires more study time than ACCA. The pass rate for CFA exams is also lower than the pass rate for ACCA exams.

Who earns more, CFA or ACCA?

Generally, CFA charterholders tend to earn more than ACCA professionals, particularly in roles focused on investment management and financial markets. However, ACCA offers broader career paths in accounting and finance, leading to diverse job opportunities with competitive salaries as well. The specific salary ranges can vary significantly based on experience, industry, location, and company size.

How hard is CFA after ACCA?

In comparison, a CFA certification is a lot tougher than the ACCA one even after completing ACCA. The diversity of the CFA Program syllabus: The CFA syllabus, which is comprehensive, starts with ethical standards and finishes with even complex financial analysis skills is dealt with.

Should I do both CFA and ACCA?

Having both certifications builds a broad and transferable skill set, making candidates exceptionally valuable and allowing them to pivot between different finance roles such as investment management, financial accounting, and corporate treasury.