The entry-level exam for those interested in India for the attainment of the Certified Management Accountant (CMA) is the CMA Foundation. The program offers foundational building skills with key subjects so as to understand management accounting, finance, and operations within a business. The CMA (Certified Management Accountant) Foundation covers the core subjects that provide a strong base for management accounting. These include financial accounting, management accounting, economics, business law, and business ethics. The CMA Foundation lays the groundwork for the advanced CMA certification program, equipping candidates with the essential financial and managerial skills needed for strategic decision-making roles.

- The subjects of the CMA Foundation course address the fundamentals or the basic principles of accounting and management. The Intermediate and Final course syllabus is split into two categories and comprises topics related to accounting, management, laws, etc.

- After a candidate passes the CMA Foundation exam, s/he will be eligible for intermediate and final exams.

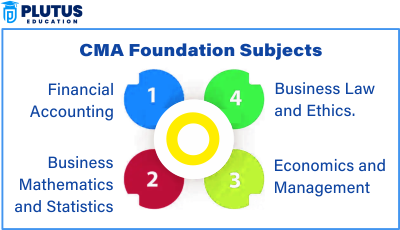

CMA Foundation Subjects

Subjects in CMA foundation refers to the fundamental topics in the CMA certification program. Topics include financial accounting, management accounting, economics, and business ethics to give prospective management accountants a solid foundation to work from as they move on to the CMA curriculum. All of the subjects are compulsory and are meant to give an individual a very good basic understanding of principles and concepts that will be further developed at the higher levels of the CMA program.

| Paper | Subjects | Sections | Marks |

| Paper 1 | Fundamentals of Business Laws and Communication | Section A: Fundamentals of Business | 80 |

| Section B: Business Communication | 20 | ||

| Paper 2 | Fundamentals of Financial and Cost Accounting | Section A: Fundamentals of Financial | 70 |

| Section B: Fundamentals of Cost | 30 | ||

| Paper 3 | Fundamentals of Business Mathematics and Statistics | Section A: Fundamentals of Business | 40 |

| Section B: Fundamentals of Business | 60 | ||

| Paper 4 | Fundamentals of Business Economics and Management | Section A: Fundamentals of Business | 70 |

| Section B: Fundamentals of Management | 30 |

These subjects are interconnected and help develop the analytical and problem-solving skills necessary for a career in management accounting.

Fundamentals of Economics and Management

Fundamentals of Economics and Management is one of the significant subjects of CMA Foundation course. This subject focuses mostly on fundamental microeconomics and macroeconomics and how these economies affect business management and decision-making. Key areas of study:

- Microeconomics Fundamental Concepts: Supply & demand, market structure, Elasticity, Price determination.

- Macroeconomics: Air bubbles, ideology, inflation, unemployment and fiscal and monetary policies.

- Management Principles: Management Theories, Planning, Organizing, Leading, Controlling

Importance

So, the field of economics is very useful to a management accountant in analyzing business environments and making predictions of what will happen and decisions that can be made for the cause of business growth. The managerial principles further allow the students to be familiar with the practices that can be adapted in leadership and management skills handling real-time business situations.

Fundamentals of Accounting

The Fundamentals of Accounting may be considered the most crucial subject in the CMA Foundation course since it provides the base foundation for financial accounting and cost accounting. The relation and significance of this subject are determined by the necessity of students to pursue a profession in the related areas of accounting, auditing, and finance. Among the topics that have been explored:

- Financial Accounting: Drafting of financial statements, journal entries, ledgers, trial balance, and balance sheet.

- Basic concepts of costing: Technique, meaning of cost, techniques of cost finding.

- Fundamental Accounting: The basic concepts and principles that form the foundation of accounting practices, including the matching principle, prudence and materiality.

Importance

Accounting forms the core of management accounting. It would be beneficial to the prospective CMAs in gaining knowledge of financial statements, cost composition, and accounting principles, since they are required to guide firms on their finances, develop budgets and make cost analyses.

Fundamentals of Laws and Ethics

Fundamentals of Laws and Ethics provides an introduction to business laws and ethical practices important in the practice of a professional accountant. It helps students to understand the legal environment that impacts businesses. Key topics covered :

- Business Laws: Contract laws, the Indian Companies Act, Partnership Act, Sale of Goods Act and basics of corporate governance.

- Ethics: Business: Ethics, corporate social responsibility, ethical role of a management accountant in decision-making, etc.

- Commercial Law and Governance: The importance of governance in transparency and accountibility of organizations.

Importance

CMA foundation course subjects enables students to know the legal frameworks that govern business operations. The creation of ethical choices is also an important aspect of maintaining public confidence and compliance with the law in financial activities.

Fundamentals of Business Mathematics and Statistics

Anyone looking to build the analytical and quantitative skills necessary for problem-solving in management accounting. Key topics covered:

- Praxis test – 75 multiple-choice questions (two and a half hours) on Mathematics.

- Interest and annuities, ratio analysis, indices, logarithms, linear equations.

- Statistics: Data collection, tabulation, measures of central tendency (mean, median, mode), dispersion, and probability.

- Understanding the mathematical basis of financial mathematics: present value, future value, etc.

Importance

Management accountants should analyze financial data and also forecast business outcomes. They must have powerful mathematical and statistical skills in their work, like budgeting, financial planning, and even performance analysis.

CMA Foundation Subjects FAQs

Where can i find CMA syllabus?

You can find the CMA syllabus, including the Foundation, Intermediate, and Final courses, on the official website of the Institute of Cost Accountants of India (ICMAI).

Will CMA syllabus change from year to year?

Yes, the CMA syllabus is reviewed and revised from time to time by the Institute of Management Accountants (IMA) to keep up with the changing needs of the enterprise, that is, it can and does vary from one year to another.

What are the topics involved in CMA Foundation course?

There are Fundamentals of Economics and Management, Fundamentals of Accounting, Fundamentals of Laws and Ethics, and Fundamentals of Business Mathematics and Statistics, all comprising the CMA Foundation course.

What are areas that are mainly covered in business law for CMA Foundation?

Business law encompasses laws on contracts, the Companies Act, corporate governance, and many more legal frameworks which operate a business.

Why is accounting important in the CMA Foundation?

Accounting is important because it gives the foundational knowledge of financial reporting, cost determination and analysis of a budget-the essentials that make management accounting.