In today’s fast-paced business world, numbers alone aren’t enough—understanding the tools behind those numbers is the real game-changer. Companies now rely on competent, tech-savvy professionals who can not only read financial data but also manage it using modern software. Whether it’s preparing a tax report, analyzing sales, or building financial models, the right computer skills in finance can transform your career. These skills open doors to jobs in accounting firms, startups, corporations, and even freelance opportunities. The demand is apparent: finance professionals with technical know-how are no longer optional but essential.

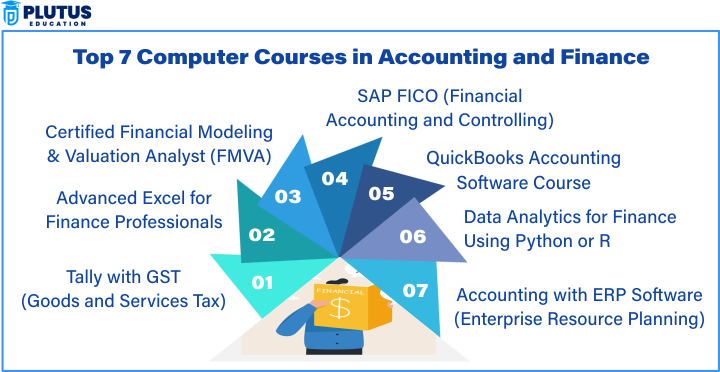

Top Computer Courses in Accounting and Finance

Computer courses in accounting and finance teach how to use tools like Tally, SAP FICO, Excel, and QuickBooks to manage money, taxes, and business reports effectively. These programs cover various skills—from accounting software training, Tally ERP course, and financial modeling with Excel, to advanced tools like cloud accounting software, Zoho Books training, and computerised accounting certification. Courses such as Advanced Excel for Finance Professionals, Certified Financial Modeling & Valuation Analyst (FMVA), SAP FICO training, and QuickBooks Accounting Software Course help students become job-ready. Whether you are a beginner or a finance graduate, learning digital finance tools can significantly improve accuracy, reporting speed, and job opportunities.

Tally with GST (Goods and Services Tax)

Tally with GST is one of the most common and useful accounting tools in India and many other countries. It helps accountants and small business owners manage invoices, track taxes, and handle payments using simple computer entries. The course teaches how to create ledgers, post transactions, and file GST returns. It is widely used by CA firms, shops, and business offices for daily financial records. Students also learn how GST changes entries, forms, and monthly returns.

Course Duration and Fees

The course usually takes about 2 to 3 months to complete. Institutes and online platforms across India offer it. The fees range from ₹4,000 to ₹8,000 depending on the institute, location, and depth of training. Some centers provide GST return filing practice as part of the course. This is one of the most affordable Tally ERP course options available.

Scope After Course

After this course, students can work as junior accountants, tally operators, or tax assistants. It is also helpful for people who want to work in small shops or start their own accounting business. Many companies hire Tally experts to perform daily entry and GST tasks. This course is a good base for those planning a computerised accounting certification later. It can also lead to jobs in back-office support and billing departments.

Advanced Excel for Finance Professionals

Advanced Excel is used in every finance office for reports, analysis, and dashboards. This course teaches formulas, VLOOKUP, pivot tables, conditional formatting, and financial charts. Students also learn how to build templates for budgets, business models, and cash flows. Excel helps in building MIS reports that managers use to make daily decisions. It is one of the most essential tools for finance professionals to use in Excel.

Course Duration and Fees

The course takes 1 to 1.5 months, with online and offline options available. Fees range from ₹3,000 to ₹7,000 depending on the depth of training and location. Some courses also include dashboard creation and macro recording as part of the package. The course is short and suits students as well as professionals. Free trials and lifetime access are available on some learning platforms.

Scope After Course

This course opens up jobs in data entry, MIS reporting, and business analysis. Many companies use Excel to track daily targets, sales, and budgets. Financial analysts, project managers, and HR teams rely on Excel-trained staff. This course also supports the MIS reporting course and budgeting tools training. Professionals can move into dashboard development or advanced analytics roles after mastering Excel.

Certified Financial Modeling & Valuation Analyst (FMVA)

The FMVA certification by CFI (Corporate Finance Institute) is one of the top-rated courses for finance students globally. It uses Excel and PowerPoint to build company valuation models, budget forecasts, and strategic business decisions. Students learn to value startups, forecast revenues, and study case-based modeling used in investment banks. It is perfect for people who want to work in mergers, acquisitions, or financial consulting. FMVA is also a popular path for MBA aspirants.

Course Duration and Fees

FMVA certification takes around 3 to 6 months to complete. The fees are ₹45,000 to ₹60,000, depending on currency conversion and the package chosen. Students can study at their own pace with lifetime access to course materials. There are over 20 modules and final case studies to test knowledge. The course also includes downloadable templates and honest company examples.

Scope After Course

After FMVA, students can become investment analysts, equity researchers, or M&A advisors. The course is globally accepted and gives a substantial profile boost for finance jobs. FMVA fits perfectly with financial modeling with Excel and opens doors in private equity firms. Many students use it to get roles in Big 4 firms or start investment careers. It also helps with resume building and interviews.

SAP FICO (Financial Accounting and Controlling)

SAP FICO is part of large companies’ ERP software for their whole accounting system. The course teaches how to manage assets, ledgers, profit centers, and business processes inside SAP. Students also learn to run reports, post journal entries, and check compliance. SAP is used in sectors like manufacturing, IT, and retail. This top course under ERP for finance helps you handle advanced tasks in big firms.

Course Duration and Fees

The training takes 2 to 4 months, depending on full-time or part-time classes. Fees range from ₹30,000 to ₹50,00,0, depending on the institute and certification. SAP-authorized centers may charge more due to better placement support. Online SAP FICO training is also available with live practice servers. Recorded sessions and project assignments are often included.

Scope After Course

After SAP FICO training, students can become ERP consultants, SAP finance users, or business analysts. The course opens up job opportunities in multinational companies and shared service centers. SAP experts are paid well and are always in demand for implementation and support. This course is also considered a top digital finance certification for mid-level professionals. Students with SAP FICO knowledge can grow into team leads and process heads.

QuickBooks Accounting Software Course

QuickBooks is popular in the US, UK, and India for small business accounting. It records transactions and manages payroll, billing, and expense tracking. This course teaches using QuickBooks Online for business reports and tax filings. Students also learn to create balance sheets, income statements, and audit logs. It is beneficial for freelancers and startups.

Course Duration and Fees

The course lasts 1 to 2 months. Fees are between ₹5,000 and ₹9,000, depending on course level and access to QuickBooks software. Some programs include free software usage for practice. Online options are available with certification and community support. Students may also get bonus topics like cloud accounting basics.

Scope After Course

After the course, students can work as QuickBooks operators, billing specialists, or freelance accountants. The course is part of QuickBooks online training programs used in global markets. Many small businesses and US-based clients need help with QuickBooks. Freelancers also use it to manage client finances. This is great for remote work roles.

Data Analytics for Finance Using Python or R

Data analytics is now a must-have skill for finance professionals who want to work with large amounts of data. This course teaches how to use Python or R to analyze sales, costs, forecasts, and risk. Students learn data cleaning, visualization, and modeling techniques. The training includes building financial dashboards and working with tools like pandas, NumPy, and ggplot2. This course supports advanced roles in data-driven finance departments.

Course Duration and Fees

It takes 3 to 6 months to complete, depending on pace and experience. The fees range between ₹25,000 and ₹50,000. Many institutes offer online or hybrid options, with downloadable code examples. A certificate of completion and real-time case studies are usually included. Some platforms provide lifetime access or job assistance.

Scope After Course

After this course, students can work as financial data analysts, risk analysts, or fintech consultants. Companies like banks, startups, and investment firms hire people who know finance and programming. This course blends well with the financial data analysis course and digital finance certification needs. It also builds a path toward AI and machine learning in finance. Students can expect higher salaries and remote job flexibility.

Accounting with ERP Software (Enterprise Resource Planning)

This course covers multiple ERP tools like SAP, Zoho Books, Oracle NetSuite, and Microsoft Dynamics. It focuses on how ERP systems automate accounting, inventory, and reporting. Students learn modules like accounts receivable, payables, general ledger, and financial close. It is perfect for those who want to work in large finance teams. This course is a complete cloud accounting software learning path.

Course Duration and Fees

It usually takes 2 to 4 months to finish. The cost ranges from ₹10,000 to ₹25,000, depending on the ERP tool and institute. Some platforms include access to cloud software and live dashboards. Students get project-based learning and certification. Weekend and part-time options are widely available.

Scope After Course

After finishing, students can become ERP users, support staff, or ERP trainers. This course is helpful in IT companies, manufacturing, e-commerce, and shared services. It fits well with Zoho Books training and computerized bookkeeping course roles. Many companies use ERP to manage money, so demand is strong. The course also gives a base for SAP or Oracle specialization.

Computer Accounting courses List

Here is the list, depicting all the computer accounting courses available , which can add on to the skill sets of the student and increase his employability.

| Course Title | Duration | Fees (INR) | Career Scope |

| Tally with GST | 2–3 months | ₹4,000–₹8,000 | GST Assistant, Tally Operator, Junior Accountant |

| Advanced Excel for Finance | 1–1.5 months | ₹3,000–₹7,000 | MIS Executive, Finance Analyst, Budget Planner |

| FMVA Certification | 3–6 months | ₹45,000–₹60,000 | Investment Analyst, Equity Research, M&A Analyst |

| SAP FICO Training | 2–4 months | ₹30,000–₹50,000 | ERP Consultant, SAP FICO User, Finance Lead |

| QuickBooks Course | 1–2 months | ₹5,000–₹9,000 | QuickBooks Specialist, Freelancer, Startup Accountant |

| Data Analytics (Python/R /R) | 3–6 months | ₹25,000–₹50,000 | Financial Data Analyst, Risk Analyst, Business Consultant |

| Accounting with ERP Software | 2–4 months | ₹10,000–₹25,000 | ERP Support, Accountant, Cloud Finance User |

Download Computer Courses in Accounting and Finance PDF

Best Online and Free Computer Accounting Courses with Certificates (2025)

Computer accounting is no longer a skill just for finance professionals — it’s a necessity for anyone working in business today. Whether you’re a student, job-seeker, or business owner, understanding how to handle accounting software like Tally, QuickBooks, or Excel can open up career opportunities in every industry. This article highlights the best online accounting courses, including free online accounting courses with certificates, as well as short term certification courses in accounting and 6 months diploma courses in accounting that are ideal for Indian students and working professionals.

Best Online Accounting Courses to Learn Computer Accounting Skills

Choosing the best online accounting courses means looking for programs that cover both conceptual accounting and software-based training. These courses teach you practical financial tasks such as ledger maintenance, GST filing, payroll, and bank reconciliation using real-world tools.

What to Look for in the Best Online Accounting Courses:

- Software training: Tally ERP, QuickBooks, Zoho Books, MS Excel

- Certificate of completion: Recognized by industry or institutions

- Real projects and case studies

- Affordable or EMI-based payment options

- Job placement or internship support

Top Platforms Offering Best Online Accounting Courses

| Platform | Course Highlights | Certificate | Price Range |

| Coursera | Taught by university professors, Excel + QuickBooks training | Yes | ₹2,000–₹5,000 |

| Udemy | Lifetime access, Tally ERP 9 + GST + Payroll | Yes | ₹499–₹2,000 |

| LinkedIn Learning | Industry-focused Excel and accounting tutorials | Yes (with LinkedIn Premium) | Free trial |

| ICA Edu Skills | Live classes with placement support, Tally & GST | Yes | ₹20,000–₹35,000 |

| EduPristine | Certification in Business Accounting & Taxation | Yes | ₹40,000+ |

These best online accounting courses are suitable for B.Com, M.Com, MBA finance students, and working professionals wanting to upskill. Most come with self-paced options and offer value-added training like resume building and mock interviews.

Free Online Accounting Courses with Certificates for Beginners

Not everyone can afford expensive courses. If you’re just starting out, enrolling in a free online accounting course with certificate is a great way to build knowledge without spending money. These courses are ideal for students, homemakers, and entry-level job seekers.

🔹 Benefits of Free Online Accounting Courses:

- No upfront cost or subscription needed

- Beginner-friendly modules with simple language

- Digital certificate upon successful completion

- Access to learning communities and discussion forums

- Flexible schedules and mobile-friendly interfaces

Top Platforms Offering Free Accounting Courses with Certificates

| Platform | Course Name | Duration | Certificate |

| SWAYAM (India) | Financial Accounting, GST Accounting | 4–12 weeks | Free |

| NPTEL | Accounting for Managers | 8 weeks | Free |

| Alison | Diploma in Accounting | 6–10 hours | Free |

| FutureLearn | Bookkeeping for Beginners | 4 weeks | Free |

| TCS iON Digital | Accounting Fundamentals | Self-paced | Free |

These courses make learning accessible for everyone. Whether you’re looking for a computer accounting course online free or simply want to test your interest in finance, these platforms offer flexible, high-quality training with certificates you can add to your resume.

Short Term Certification Courses in Accounting and 6 Months Diploma Options

If you want to quickly become job-ready, short term certification courses in accounting or a 6 months diploma course in accounting can provide you with both skills and career options. These programs are designed to teach you both manual and computerized accounting within a short time frame.

🔹 Who Should Take These Short-Term Programs?

- 12th pass or commerce graduates looking for quick employment

- Freshers aiming for jobs in accounting, billing, or GST roles

- Housewives or career-switchers needing flexible and fast upskilling

- Working professionals aiming for promotions or profile upgrades

- Freelancers wanting to handle small business accounts or GST filings

Popular Short-Term Accounting Courses & Diplomas in India

| Institute / Platform | Course Name | Duration | Mode | Certificate |

| ICA Edu Skills | Certified Industrial Accountant | 3–6 months | Offline + Online | Yes |

| Aptech Learning | Smart Pro Accounting + Tally Prime | 4 months | Hybrid | Yes |

| NIIT | Accounting & GST using Tally + Excel | 2–6 months | Online | Yes |

| NSDC Approved Centers | Accounting Technician with GST & TDS | 3–6 months | Offline | Yes |

| CAclubIndia | GST Practitioner & Advanced Tally Course | 3 months | Online | Yes |

These short term certification courses in accounting are ideal for practical learning. Many of them also offer internships and placement assistance, which adds great value for job seekers. If you’re looking for 6 months diploma courses in accounting, then institutes like ICA and NIIT offer detailed curriculums covering GST, TDS, PF/ESI, Payroll, Income Tax, and advanced Excel.

Computer Courses in Accounting and Finance FAQs

1. Which is the best computer course for accounting jobs in small businesses?

Tally with GST and QuickBooks are best for small business jobs. They help with invoices, GST returns, and daily entries, which most small firms use.

2. Can I learn ERP accounting software without coding knowledge?

Yes, you can. ERP software like SAP, Zoho, and Oracle has user-friendly interfaces. These courses teach business users how to work with the system without coding.

3. Which course is better: FMVA or SAP FICO?

FMVA is great for investment and modeling careers. SAP FICO is ideal for ERP and accounting roles in big companies. Choose based on your long-term goals.

4. What is the benefit of learning data analytics in finance?

Data analytics helps in forecasting, budgeting, fraud detection, and reporting. It also builds a foundation for fintech, AI, and automation in finance.

5. Can I work online or remotely after completing these courses?

Yes. Courses like QuickBooks, Excel, data analytics, and FMVA allow remote freelance jobs. Many companies now hire online finance support staff.