A concentration of economic power occurs when the majority of the control of the resources, decisions, and power lies with a few people, companies, or organizations. Such an outcome often leads to excessive influence in market control, price fixing, and policymaking that goes against fair play and the equalization of wealth distribution. The simplest way to say it is an aggregation of economic and wealth power to the few hands. This centralization arises from monopolistic practices, loopholes in policies, or mergers and acquisitions, creating a hardship on economic equity and sustainability.

Meaning of Concentration of Economic Power

The concentration of economic power takes place when a few entities, be it an individual, a corporation, or even a government, control a large share of economic activity. It may be in the form of monopolies, oligopolies, or even political influence over markets. The significance of concentrated economic power is profound. It lessens competition, facilitates price manipulation, and promotes inequality.

For example, multinational companies operating within the technology, energy, and finance industries have a great deal of control over world markets and policy decisions. Companies such as Google or Amazon occupy market leadership positions in their respective markets, affecting competitors, consumers, and policymakers significantly. The characteristic of concentrated economic power is its ability to influence market outcomes and decisions for the benefit of the dominant players at the expense of smaller entities and individual consumers.

Historical Background

The concentration of economic power is not a recent phenomenon. It has evolved over the centuries through historical events and economic transformations.

Pre-Industrial Revolution

In ancient and feudal societies, economic power was closely tied to land ownership. Wealthy landlords or monarchs controlled vast estates and resources, while the majority of the population lived in servitude. Economic decision-making was centralized, with little room for competition or upward mobility.

The Industrial Revolution

The industrial era was a great shift in economic power. The late 18th and early 19th centuries witnessed the emergence of industrial magnates and monopolies in key sectors like steel, oil, and railroads. For instance, in the United States, figures like John D. Rockefeller and Andrew Carnegie controlled large parts of their respective industries. Rockefeller’s Standard Oil, at its peak, refined over 90% of the U.S.’s oil supply, exemplifying economic concentration.

In the late 19th and early 20th centuries, governments addressed these issues. Antitrust laws like the Sherman Antitrust Act of 1890 in the U.S. were enacted to curb monopolistic practices and foster competition.

The Digital Age

The tone of power in the 21st century has shifted with technological growth. Big technology companies such as Facebook, Google, and Apple have become masters in the global market, significantly controlling digital advertisement, privacy rights, and communication channels. Also, compared to the earlier monopolies, these companies rely heavily on data and innovation, leaving it very challenging for regulatory and competition enforcement.

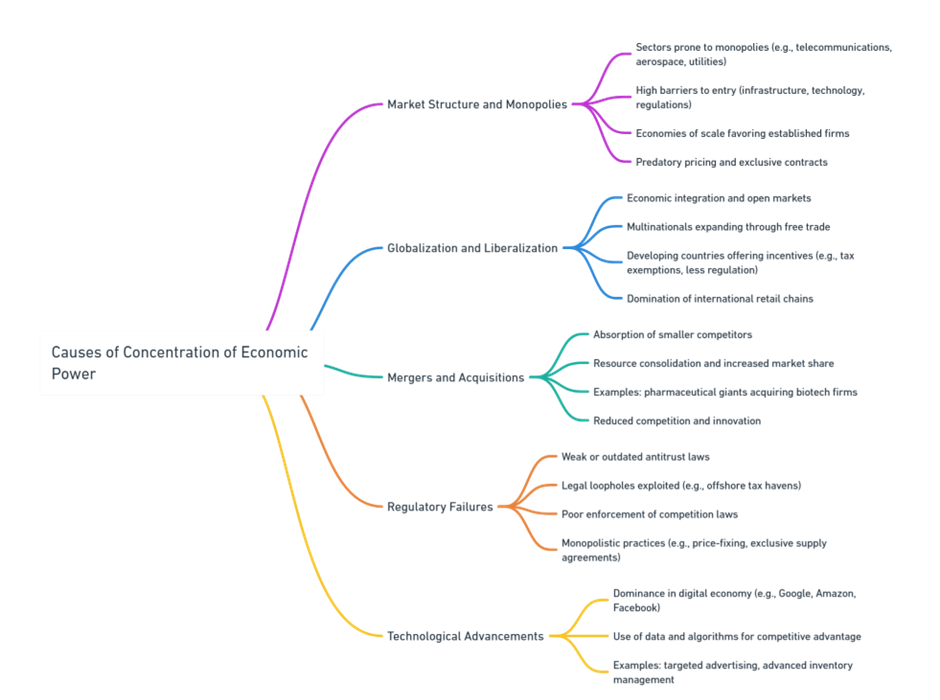

Causes of Concentration of Economic Power

Causes of Concentration of Economic Power

The centralization of economic resources can be attributed to a number of interlinked causes, from market dynamics to policy frameworks.

Market Structure and Monopolies

Some sectors are intrinsically prone to monopolistic or oligopolistic structures because entry into such markets is expensive and difficult. The sectors include, for example, telecommunications, aerospace, and utilities, where high initial investment in infrastructure, technology, and compliance with regulatory standards is required. Companies that are already established in these sectors have economies of scale wherein their per-unit cost reduces as their level of production increases.

As a result of this cost advantage, it becomes too hard for smaller firms to compete. Subsequently, once a set of dominating firms succeeds in reaching substantial market shares, these firms normally begin to defend those through predatory price cuts or, on exclusive contractual terms to ban new arrivals completely, from further entrance.

Globalization and Liberalization

Globalization has given rise to both economic integration and the concentration of economic power. Multinationals have taken advantage of free and open markets resulting from the dismantling of international trade barriers to expand their transnational reach. Developing countries offer incentives to attract foreign direct investment (FDI) in the form of tax exemptions and lessened regulatory requirements

For instance, international retail chains may dominate small markets because they will be able to offer lower prices through global supply chains and economies of scale. Eventually, these lead to small businesses being driven out and resource centralization in foreign corporations.

Mergers and acquisitions

Among other things, corporate mergers and acquisitions are one of the most direct causes of the concentration of economic power. This can result in giant firms absorbing smaller competitors, consolidating resources, and yielding a bigger market share.

For instance, pharmaceutical giants have been known to buy out smaller biotech firms to take over patents and new drug innovations. This consolidation reduces competition, and the lead firm can set the prices and terms of the business. In addition, mergers often result in job loss and decreased market dynamism as smaller firms that might have provided innovative solutions are absorbed into larger, less agile corporations.

Regulatory Failures

Weak or archaic regulatory systems may worsen the concentration of economic power. In such cases, if governments do not enforce antitrust laws or close legal loopholes, corporations take advantage of the loopholes to gain an unfair edge.

For instance, some companies take advantage of offshore tax havens to reduce their tax burden, thereby gaining a financial edge over competitors that operate within the law. Further, weak enforcement of competition laws permits monopolistic practices like price-fixing or exclusive supply agreements. In the absence of proper regulation, these practices further entrench the dominance of large corporations at the expense of smaller players and consumers.

Technological Advancements

Technological innovation has been a leading driver of progress; however, at the same time, it has resulted in unprecedented concentration in some industries. The digital economy, for example, has permitted the dominance of Google, Amazon, and Facebook in their specific markets. These companies rely on data and advanced algorithms to keep their competitive advantage.

For instance, Google has maintained its dominance in the global search engine market due to its ability to use user data for targeted advertising, which is something that its competitors cannot easily compete with. Similarly, Amazon’s enormous distribution network and data-driven inventory management enable it to outstrip traditional retailers.

Impact of Concentration of Economic Power

The causes and effects of the concentration of economic power expose its deep and far-reaching impacts on markets, societies, and governance. There is requirement of efforts to enforce regulatory frameworks, promote competition, and ensure equitable distribution of resources to address these issues. Policymakers can work toward a more inclusive and sustainable economic system by understanding and mitigating the risks associated with economic power concentration.

Economic Inequality

The concentration of economic power directly contributes to the increase in income and wealth inequality. Corporate interests or individuals owning immense economic assets, bu have baised interest for the benefits of economic growth . For instance, top executives and shareholders of large firms benefit disproportionately from the surplus, whereas workers and small businesses lack wealth generation. This translates into unequal opportunities for people and continues cycles of poverty.

Market Distortion

Market distortion is when dominant firms are able to set prices, restrict competition, or erect barriers to entry. This goes against the principles of a free market economy, where competition should drive innovation and fair pricing.

Pharmaceutical companies, for example, typically have a patent over life-saving medicines. This grants them the privilege of setting extreme prices for life-saving medicines. Such extreme pricing makes such medicine unaffordable to most people, which in turn has a distorted effect on the market’s efficiency and results in negative social outcomes.Additionally, small firms and start-ups suffer in an impaired market. Such an environment would reduce diversity and innovation.

Impact on Policy

With concentrated economic power comes significant political influence. Large corporations often lobby governments to enact favorable policies or regulations that benefit their interests. For instance, oil and gas companies have historically influenced energy policies to ensure continued reliance on fossil fuels, delaying the transition to renewable energy sources. This kind of regulatory capture undermines democratic processes because policies become shaped to favor a few rather than serve the greater public interest. Over time, this erodes public trust in government institutions.

Global Vulnerabilities

The global economy becomes vulnerable somtimes. For instance, dominance in cloud computing or digital communication by a handful of companies raises the risk of disruption. If one company undergoes a cyberattack or suffers an operational failure, its impact can easily cascade through businesses and consumers around the globe. Moreover, reliance on a handful of dominant firms can choke supply chains across borders, as when the COVID-19 pandemic put the brakes on a few high-profile industries but had significant, rippling consequences.

Lower Consumer Welfare

The concentration of economic power adversely affects consumers. When there are fewer competitors in the market, large firms have little incentive to increase the quality of their products or reduce their prices. A monopolistic internet service provider can charge a high price for bad service, knowing that there is no other alternative for consumers. Reduced consumer choice and higher prices over time lead to lower overall consumer welfare, creating dissatisfaction and limited access to necessary goods and services.

Concentration of Economic Power FAQs

What is economic power concentration?

The concentration of economic power is a state where a significant share of economic resources or decision-making authority is controlled by a few.

Why is economic power concentration bad?

It lowers competition, increases inequality, and gives birth to monopolies that take advantage of consumers.

How does globalization impact economic power concentration?

Globalization facilitates corporations’ expansion across international borders, hence raising their power and market influence beyond borders.

Can governments prevent economic power concentration?

Governments can regulate monopolies through antitrust laws, promote competition, and prevent unethical mergers.

What are examples of concentrated economic power?

Tech giants like Google and Amazon, and monopolistic control in industries like pharmaceuticals and utilities, are examples of economic power concentration.