Determination of income and employment is at the center of a macroeconomic concept that emphasizes how an economy can achieve equilibrium in its aggregate income and employment levels. It shows the interaction between aggregate demand and aggregate supply and is useful for understanding stability trends in the economy-inflation and unemployment. From such an analysis, therefore, policy strategists can try to devise strategies for fostering growth, reducing unemployment, and stabilizing the economy.

This article deals with the more critical aspects of aggregate demand and its components, income determination in the two-sector model, and equilibrium income determination in the short run.

Aggregate Demand and Its Components

Aggregate demand is the total of all spending on goods and services over a given period, at specified price levels within an economy. It is the basis upon which spending and production are said to drive employment and income. Major components of aggregate demand play an important role in economic activity. The study of each of these elements delves into something about economic policies or market dynamics.

Aggregate demand is the sum of four primary components:

AD=C+I+G+(X−M)AD = C + I + G + (X – M)

Where:

- CC = Consumption

- II = Investment

- GG = Government Spending

- (X−M)(X – M) = Net Exports (Exports – Imports)

Consumption (C)

Consumption is expenditures by households on commodities and services, accounting for a large fraction of aggregate demand. The factors affecting consumption are as follows:

- Disposable Income: Consumption increases as disposable income increases.

- Interest Rates: Borrowing costs decline with lower interest rates, and therefore consumption rises.

- Consumer Confidence: Better future economic expectations increase consumption.

Investment (I)

Investment constitutes business expenditures on capital goods like machinery, equipment, and infrastructure. Factors driving investment include:

- Interest Rates: Higher rates discourage borrowing for investment, while lower rates encourage it.

- Technological Advance: Innovations increase productivity, thus triggering higher investment.

- Business Expectations: Favorable outlooks trigger greater investment activity.

Government Spending (G)

Government spending comprises public spending on infrastructure, education, health care, and defense. Government spending directly stimulates aggregate demand and forms one of the most important instruments in countering economic recessions through fiscal policy.

Net Exports (X – M)

The difference between a nation’s exports and imports influences aggregate demand:

- Positive Net Exports: Higher exports boost domestic production.

- Negative Net Exports: Excessive imports can reduce aggregate demand.

Aggregate Demand Curve

The aggregate demand curve represents the relationship of the price level to the aggregate demand for goods and services. It slopes downward for three basic effects:

- Wealth Effect: Lower price levels increase real wealth, promoting spending.

- Interest Rate Effect: A decline in prices reduces interest rates, which increases investment.

Exchange Rate Effect: Lower domestic prices raise the international competitiveness of domestic exports.

Determination of Income in the Two-Sector Model

The two-sector model simplifies the economy by focusing only on households and firms while excluding government intervention and foreign trade. Such a model provides a basis for understanding the circular flow of income and the mechanisms that equilibrate income and expenditure. Equilibrium income occurs when planned savings by households equate to planned investment by firms. The relationship is given as:

Y=C+IY = C + I

Where:

- YY = National income

- CC = Consumption expenditure

- II = Investment expenditure

- Savings (S): Households save part of their income instead of spending it.

- Investment (I): Firms invest in capital goods, using these savings.

The equilibrium condition is:

S=IS = I

This equality ensures that resources are optimally utilized without surplus or deficit in the economy.

Importance of the Two-Sector Model

- Foundation for Larger Models: The basis for more complex models is a two-sector model that incorporates government and foreign trade.

- Policy Implications: Understanding this model helps to design fiscal and monetary policies aimed at achieving equilibrium income.

Determination of Equilibrium Income in the Short Run

In the short run, the equilibrium income is determined by aggregate demand interacting with aggregate supply. The focus on the short run is important for dealing with some of the immediate economic problems, such as unemployment and demand-supply imbalances.

Short-Run Aggregate Supply (AS-SR)

The short-run aggregate supply curve is positively sloping, capturing the fact that firms produce more as demand and prices are higher. This relationship depends on:

- Sticky Prices and Wages: Prices and wages do not adjust immediately to changes in demand.

- Profit Motive: Higher prices invite firms to expand their production to extract more profits.

Aggregate Demand and Equilibrium Income

Equilibrium income in the short run occurs where the aggregate demand curve intersects the short-run aggregate supply curve. At this point:

- Total output produced equals total spending.

- There is no unintended inventory accumulation or shortage.

The Keynesian Multiplier Effect

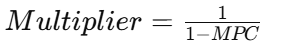

The Keynesian multiplier magnifies changes in spending into more significant changes in income and output. The multiplier formula is:

Where MPC is the marginal propensity to consume. For instance:

If MPC=0.8MPC = 0.8, a $100 million increase in investment leads to a $500 million increase in total income.

Determination of Income and Employment FAQs

What is aggregate demand, and why is it important?

Aggregate demand is the total spending on goods and services in an economy. It determines output, income, and employment levels, making it a critical factor in economic stability.

How does the two-sector model determine income?

The two-sector model achieves equilibrium income when household savings equal firm investments, ensuring optimal resource utilization.

What is the Keynesian multiplier effect?

The Keynesian multiplier amplifies changes in spending into more significant changes in income and output, demonstrating the ripple effects of initial investments.

How does government spending influence aggregate demand?

Increased government spending directly raises aggregate demand by funding infrastructure, healthcare, and other public services, stimulating economic growth.

What is the significance of equilibrium income in the short run?

Short-run equilibrium income addresses immediate economic issues like unemployment and inflation, guiding policymakers in stabilizing the economy.