Capital structure and financial structure are similar, institutionally, to a company’s economic foundation, but they’re clearly differentiated on the scope of application components of focus and decision-making implications. Capital structure looks only at those long-term sources of finance, such as equity and long-term debt. In contrast, the financial structure covers short-term and other liabilities in addition to shareholders’ equities and longer-term liabilities and thus is wider in scope. These concepts are crucial for business executives in terms of strategy for funding, risk management, and cost optimization. Besides, they go a long way to ensure more liquidity, solvency, and ability for future long-term growth for a company. This article would summarize both terms, outline their characteristics, and give a comparison clear enough to show the difference between capital and financial structure.

What is Capital Structure?

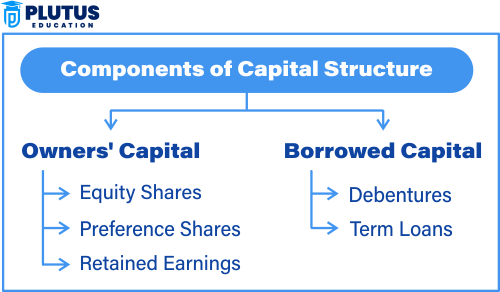

Capital structure deals with how a company funds its operations and growth over extended periods; the mix of long-term financing sources gives rise to common stock, preferred stock, retained earnings, and long-term debt (such as bonds, debentures, or term loans). All short-term liabilities, such as trade payables or short-term borrowings, are excluded from capital structures.

It aims to find the correct combination of equity and debt so that the company’s overall cost of capital is minimized and value maximized for shareholders. Furthermore, it requires a sound capital structure concerning long-term financial stability and investor confidence.

Management of Cost of Capital

Capital structure ultimately depends on the company’s weighted average cost of capital (WACC). An optimal combination of debt and equity keeps the WACC low and thus increases the firm’s value. Debt is usually cheaper due to the tax effect, but it has some risk.

The right mix needs to be high, as too much debt will increase financial risk, too much equity will dilute the ownership, or an EPS downsize is done. In capital structure decision-making, expert judgment comes along with economic modelling.

Risk-return Trade-Offs

Debt provides leverage to develop the return potential further using equity; however, this also increases the enterprise’s exposure to financial risk. In poor years, heavy interest obligations can cause default or even bankruptcy.

Hence, the companies should assess their industry risk, cash flow stability, and growth opportunity before increasing the debt in their capital structure. An efficient structure comprises a risk appetite in tune with the financial objectives.

Appeal To Investors And Planning For Growth

Capital structure is another aspect that influences how investors perceive the company. Investors can view a company as stable if it has a strong equity base; otherwise, high debt might be regarded as relatively risky but potentially profitable. Investors often determine capital structure to calculate the financial discipline and the risk that a company is exposed to or in control of, being able to finance large projects or mergers.

Strategic Financing Decisions

Such decisions include issuing shares or long-term loans for capital structure. The capital structure must be strategically aligned with future expansion, market positioning, and industry norms. If managed properly, capital structure can provide financial flexibility and allow a business to survive and grow compared to its competitors in bad economic times.

Factors Affecting Capital Structure

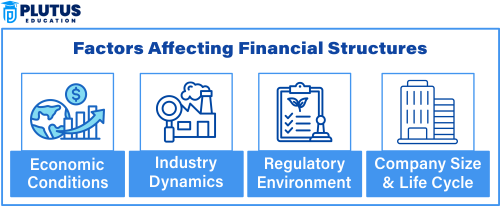

Different elements that bring about decisions concerning capital structure include business risk, prevailing market interest rates, tax policies, and company size. Firms in sectors that require heavy capital, such as manufacturing or telecom, will use more debt financing. Debt financing is highly appealing due to the tax-deductible aspect of interest, stable cash flows, and excellent credit ratings; however, it depends on creditworthiness and financial health.

What is a Financial Structure?

Financial structure presents the entire picture of a company’s financing through short and long-term liabilities and shareholder equity. It includes accounts payable, short-term loans, accrued expenses, long-term debt, and equity capital. Strategic capital funding will vary from operational financing and liquidity, which are all found in the financial structure, measuring a company’s solvency, economic risk, and cash flow management skills.

Liquidity and Management of Working Capital

Current liabilities, such as trade payables or short-term bank loans, form part of a company’s financial structure, which most significantly carries permission for operational day-to-day functioning. Therefore, it connects liquidity with operational continuity.

It is essential to ensure that the short-term commitments are met without compromising long-term viability through a healthy financial structure. Mismanagement of short-term obligations might damage supplier relationships or incur penalties.

Complete Picture of Obligations

All liabilities, be they short- or long-term, form the financial structure and show a complete picture of what the business owes. Then, both management and investors can assess the soundness and sustainability of the economic situation. In a world of changing market volatility, total liabilities must be monitored. Too much leverage in the financial structure may also expose an organization to credit risk and a lower chance of getting more financing.

Risk Evaluation Support

Complete liabilities have a financial structure that gives a deeper analysis of liquidity and solvency risks. Analysts use this tool to measure a firm’s ability to weather economic downturns.

A weak financial structure means short-term funding largely depends on cash flow crises that develop in tight credit terms or when the general market situation changes.

Refers to Tactical Decisions

On the contrary, capital structure is used in strategic planning, while financial structure is used for tactical decisions such as payment cycle optimization and cash reserves management.

This guides working capital decisions, short-term financing requirements, and expenditure control strategies. Managers will use their financial structure in the same vein to ensure that financial operations are a smooth and sustainable legacy for the organization.

Components Affecting Financial Structure

The nature of a business, working capital norms of industries, supplier credit terms, and macroeconomic conditions all determine financial structure. A company with stable cash flows could enjoy greater short-term borrowings. Internal factors like an increase in interest rates or even the possibility of less credit could force an enterprise to readjust its financial structure to these new conditions.

Difference Between Capital Structure and Financial Structure

Although capital and financial structure are similar concepts, they differ in breadth, orientation, components, objectives, and outcomes concerning financial decision-making. Learning these differences helps companies to make better funding decisions and manage financial risk effectively.

Scope and Definition

Capital structure refers to long-term financing, including equity and long-term debt only. In contrast, the financial structure combines all liabilities (short-term + long-term) and shareholders’ equity. Thus, capital structure is a sub-collection of financial structure. While the former deals with strategic and futuristic aspects, the latter reflects current financial obligations.

Composed Involved

Capital structure involves retained earnings, equity shares, preference shares, bonds, debentures, and term loans. Whereas financial structure involves short-term obligations, trade payables, taxes payable, and short-term borrowing, the financial structure reveals the company’s whole funding picture, thus giving it a much more dynamic view of its financial health and risk exposure.

Purpose And Focus

Capital structures are designed to minimize capital costs while optimizing returns. This will affect investors’ sentiments, financing capacity, and long-term viability. Unlike this, financial structure considers liquidity, solvency, and operational endurance, equipping the organization to deal with cut-throat financial realities in the short run.

Risk Implications

Differentiating in risk, an entity’s capital structure will raise its debt financing, resulting in financial leverage, which causes the magnification of profit and risk. A high degree of leveraged capital structure usually leads to financial insolvency unless appropriately managed. Financial structure manifests liquidity risk from short-term liabilities and solvency risk from long-term obligations, which is also a significant determinant of economic health.

Impact Decision-Making

This means that capital structure significantly influences decisions regarding new equity issuance, debt raising, or share repurchases, all of which affect the company’s valuation. On the other hand, financial structure supports short-term decisions on managing cash flow or payout to vendors. Sound financial management requires the marriage of both strategic vision and operational discipline.

Detailed Table: Capital Structure vs Financial Structure

| Aspect | Capital Structure | Financial Structure |

| Definition | Long-term funding mix of equity and long-term debt | Complete mix of all liabilities (short & long-term) + equity |

| Scope | Narrow – focuses on long-term financing only | Broad – includes short-term and long-term obligations |

| Components | Equity shares, retained earnings, debentures, and long-term loans | All capital structure elements + accounts payable, short-term loans |

| Primary Focus | Minimizing the cost of capital, maximizing shareholder value | Ensuring liquidity, solvency, and day-to-day financial stability |

| Risk Management | Deals with financial leverage and return-on-equity risk | Includes liquidity and solvency risk |

| Decision-Making Impact | Affects long-term funding, investments, and capital budgeting | Affects cash flow, vendor payments, and short-term credit policies |

| Stakeholder Relevance | Relevant to investors and lenders assessing long-term performance | Important to internal managers and creditors evaluating short-term viability |

Capital and financial structures relate to and influence financial management, albeit for different purposes. The capital structure is concerned primarily with long-term sources of financing and has a vital role in optimizing financial leverage and minimizing the cost of capital. In contrast, the economic structure encompasses the entire economic environment of the business, dealing with questions of liquidity, solvency, and operational funding.

What separates capital structure and financial structure, in the long run, enables organizations to strategically examine their investments, funding decisions, and short-term obligations. Ultimately, these two become a part of maintaining financial balance, resilience, and growth for the company.

Capital Structure vs. Financial Structure FAQs

1. What is the main difference between capital structure and financial structure?

Capital structure comprises long-term sources like equity and debt, whereas financial structure encompasses all liabilities and equity, whether short- or long-term.

2. How does financial structure affect the liquidity of a company?

The economic structure includes short-term obligations of a company that directly affect meeting daily operational expenses and smooth cash flow.

3. Why is capital structure important for firms?

Capital structure helps adjust the proportion of debt and equity to lower the cost of capital, maximize the shareholders’ return, and minimize financial risks.

4. Do capital structure and financial structure overlap?

Yes. Capital structure is part of the larger economic structure. The whole lot in capital structure, plus everything in short-term liabilities, comprises the economic structure.

5. What is the difference between capital structure and financial leverage?

Capital structure is the mix of all sources of funds, while financial leverage refers to the extent to which debt is used to finance assets.