Sizing up the accounting method for the considered decision, managing funds, and any other requirements are crucial in making the actual business judgment on either a cash or accrual basis. Cash and accrual basis are the devi,l and deep blue sea for considering income and expenses. According to the cash basis of accounting, revenues and costs can be recognized only at the time of cash settlement, whereas, under the accrual method, revenues and expenses are recorded as earned or incurred. The choice between these methods can affect tax returns, profitability analysis, strategic considerations, and financial statements. This guide explains the differences between cash and accrual accounting, addressing the main features, compliance requirements, and types of businesses that may be considered in weighing their appropriateness.

Definition of Cash Basis Accounting

Cash basis accounting is a straightforward form where revenues and expenses are recorded only when cash is received or paid out. This method is used by sole proprietors, independent contractors, and small businesses because of ease of administration and little reporting required. The clarity offered by cash-based accounting concerning cash movement truly enables one to see liquidity at any given instance. This suits a business that works daily without giving any credit. It does not use accounts receivable or accounts payable, which keeps things simple. Nevertheless, this single-minded approach to cash may not always accurately reflect the health of such a business, especially if accounts receivable are significant. Despite its simplicity, cash accounting may not be a suitable option for organizations that aspire for growth or seek funds, as it provides a partial financial picture.

Revenue Recognition under Cash Accounting

Revenue is recorded only when it is physically received. Hence, if a client is invoiced today but pays after 60 days, the revenue will reflect only when the payment lands in the bank account. This method simplifies the bookkeeping but can distort performance metrics since this might delay revenue recognition.

Such delay could be significant in service businesses or other businesses with irregular cash flows. It might showcase lesser income in the prevalently busy months if cash receipts are postponed and show high income in the off months if payments relating to prior work are collected. Thus, by nature of income distortion, cash-based accounting might vary in financial health over time.

Expense Recognition Under Cash Basis

Expenses are recognized only when they are paid. This means that anything owed, from Wednesdays to rent or vendors’ invoices, is ignored until cash leaves the company’s account. This way, the cash basis ensures that double counting or confusion in accounting for expenditures never occurs.

Unfortunately, such a law limits the usefulness of a couple of months with a value-for-money profit and loss statement, notably those months of considerable outflow for expenses incurred previously. The business can show complete unprofitability during one month and massive profit in another while carrying on business uniformly in practical situations.

Limited Insight into Financial Health

Since it doesn’t account for unpaid bills or pending income, cash accounting is very limited in its views. It may show that another company is doing well only in cash while it’s neck deep in liabilities.

It becomes challenging for stakeholders, investors, and lenders, not to mention internal management, to make any good decisions without knowledge of what is owed or expected to come in. This leads to incidences of poor planning, and it’s a fire-fighting approach to cash flow management.

Best for Small-Scale Operations

Cash basis is the best form of accounting for businesses that do not extend credit and do not require detailed reports by investors or government compliance. Freelancers, consultants, and micro-businesses benefit the most from this model.

However, once businesses embark on expansion, consider investments, or apply for government contracts, they may need to shift to accrual accounting soon. A cash basis may lead to blind spots concerning the signs necessary for scaling operations, managing long-term agreements, or hiring on credit terms.

Not GAAP Compliant

Cash-basis accounting does not follow Generally Accepted Accounting Principles (GAAP). Given the lack of detail and accuracy in tracking cash flows, it does not work well for financial reporting.

Therefore, its usage is considerably less among large clubs and public organisations. Usually, there are statutory law requirements to ensure an unequivocal matching of income and expenses, a requirement that cash accounting does poorly. Because of such failures, cash accounting is mainly limited to smaller entities faced with minimal compliance challenges.

What Is Accrual Basis Accounting?

Accrual accounting provides an all-encompassing solution that recognizes income and expenses when earned or incurred, irrespective of cash exchange. This method accurately reflects the organisation’s actual performance and obligations, providing an overview of all its economic activities.

Due to this reason, with higher accuracy and being in line with the financial principles, accrual accounting has gained popularity with those above the threshold of medium size with rigorous demands of public scrutiny and outside investors. This assures matching revenues with expenses, which is critical in judging profitability and making strategy decisions.

Revenue Recognition in Accrual Accounting

Revenues are recognised when earned, with the actual cash receipt usually delayed. A case in hand is a software company recognising revenue for delivered service and not for receipt of cash weeks later from the same client.

This system provides a continuing assessment of revenues and enables evaluation of business performance over time. Furthermore, cash flow planning becomes easier, as expected cash is known and collection is aligned with that cash inflow.

Matching Principle in Expense Recording

Expenses are recognized when they are incurred; expenses are recorded when incurred, not necessarily when paid. For example, costs relating to December’s salaries are to be recorded in December, irrespective of whether the payment may be made in January.

By applying this matching principle, accurate profit measurement may be done for every accounting period. Henceforth, businesses shall judge whether revenues earned account for the expenses incurred and whether their cost structure can sustain the pressures.

Keeps Track of Receivables and Payables

One of accrual’s main advantages is the presence of accounts receivable and payables. Thus, it allows firms to know exactly how much they owe and how much is owed to them at any moment.

It provides clarity of the financial state, thus aiding accurate forecasting, budgeting, and working capital management. Not allowing unpleasant surprises in terms of cash shortage or sudden realisation of liabilities is another benefit of accrual accounting.

Best Suited for Complex Financial Environments

Accrual is a better scheme for firms with multiple transactions, customer credit terms, inventory management, or divergent revenue streams. It is indispensable for such environments since they demand timely and accurate tracking of financial statements.

By imparting holistic financial views, accruals facilitate the processes of internal performance review, investment proposal generation, tax planning, and executive decision-making.

GAAP and Compliance Benefits

Accrual accounting is GAAP-compliant and maintains detailed, exact, and timely financial records. That is fundamental for firms listed on a stock exchange or subject to formal audit.

Therefore, compliance not only guarantees regulatory scope for stakeholder engagement, such as investors, creditors, and regulatory agencies but also enhances credibility and transparency to a great degree.

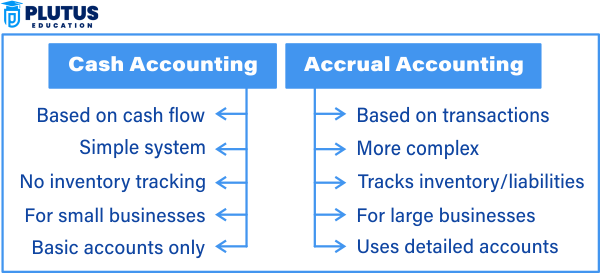

Key Differences Between Cash Basis and Accrual Basis of Accounting

The choice to be made requires an understanding of the differences. The timing of transaction recording greatly influences financial accuracy, ex-post reporting, and compliance with the law. Cash bookkeeping emphasizes its simplicity and capacity for real-time cash tracking, while accruals provide greater financial accuracy based on period performance. This section will discuss the significant differences and give instances where using one or the other method is prudent.

Timing of Revenue Recognition

Cash basis recognizes income only upon its actual receipt. This leads to inconsistencies, as payment may be delayed. Accrual accounting recognizes income on the earning occasion. Thus, income is reported for the correct period.

The accrual method more accurately reflects operating results. It is relevant for measuring performance month-by-month or year-on-year while eliminating distortions introduced by late or early payments.

Expense Recognition Timing

Under a cash basis, the expense is recognized only when paid; in many cases, it would distort profits. Under the accrual principle, expenses are recorded when they are incurred, irrespective of any payment made, thus directly associated with their respective revenues.

This corroborates earnings with real expenses, thereby providing a real profit figure. This expenditure recognition method determines profit in the real sense and prevents overspending based on misrepresented surplus or deficit.

Veracity of Financial Statements

Cash basis would invariably hide liabilities and receivables, limiting any insight into the business’s financial status. The accrual basis grabs all obligations and expected incomes into the frame of reference, giving a clearer economic picture.

To decision-makers, more dependable insights and minimized surprises. Accurate reporting goes a long way in budgeting, forecasting, and trying to lure investors.

Bookkeeping Complexity

Cash accounting is easy to manage manually or with simple software. Accrual accounting requires skilled oversight and detailed record-keeping, thus requiring professional auditing services in many cases.

However, although a more complex method, accrual accounting helps businesses grow and cater to various operational needs, such as inventory control and tracking project-based costs.

Regulatory Compliance

The cash basis does not meet GAAP requirements. Accrual basis is the industry standard for precise and legally compliant financial reporting, and it is mandated by most regulatory frameworks for larger businesses.

This means businesses using the accrual method are often more prepared for audits, investor evaluations, or funding applications.

Suitability for Business

A cash basis is more favourable to very small or seasonal businesses. Accrual basis favours companies with more complex operations, high transaction percentages, or long-term projects.

Choosing the correct method will depend on the mode of operation of a company, its future growth plans, and reporting needs.

Detailed Table: Cash Basis vs Accrual Basis of Accounting

| Aspect | Cash Basis Accounting | Accrual Basis Accounting |

| Revenue Recognition | Recorded when cash is received | Recorded when earned, regardless of payment |

| Expense Recognition | Recorded when payment is made | Recorded when incurred |

| Financial Accuracy | May provide incomplete or delayed financial data | Offers an accurate, real-time financial view |

| Complexity | Simple, easy to use without formal training | Requires skilled accounting and thorough records |

| GAAP Compliance | Not compliant with financial regulations | Fully GAAP-compliant, suitable for audits and formal reporting |

| Business Suitability | Ideal for freelancers, small businesses | Best for large businesses or those with complex operations |

| Tax Reporting | Easier for straightforward cash-based tax filings | Better for accrual-based tax strategies and deductions |

Cash or accrual basis is chosen based on the slow business’s size, complexities, or goals. The cash system is simple; the accrual basis is deeper, more accurate, and respects regulations. The cash basis would work on a simple level for those small businesses with simple bookkeeping needs; the accrual basis works well on the higher levels for companies seeking growth or enhanced financial tracking. Clarity on both methods gives a solid measure for ensuring good and accurate reporting, effective financial planning, and a road to long-term success.

Cash basis vs Accrual Basis of Accounting FAQs

1. Which one makes the main difference between cash and accrual basis of accounting?

Cash basis accounting records transactions only after consideration has been transferred. In contrast, the Accrual basis records if an economic entity earns or incurs it, tracking performance better than the cash basis.

2. Is accrual accounting better for tracking business performance?

Yes. It matches revenue with expenses incurred in earning that revenue in one period for a better picture of financial performance over time.

3. Who should be using cash-based accounting?

It is best suited for freelancers, consultants, and tiny businesses mainly operating with cash and not giving credit.

4. Why is accrual accounting necessary under the Generally Accepted Accounting Principles (GAAP)?

Because it reflects the actual financial position by reporting receivables, payables, and accrued transactions, thus adding transparency and accuracy.

5. Can a business change from cash to accrual accounting?

Yes. With proper documentation for substantiating the transition and IRS approval for tax purposes, the business can change into accrual to meet shifting financial or compliance needs.