When one evaluates the company’s liquidity position and whether it is liquid enough to meet its short-term obligations, financial ratios become vital. Two of the most popularly applied ratios to compute liquidity are the current ratio and quick ratio. The variation between the current ratio and quick ratio exists in what assets each counts. Both ratios measure the ability to meet short-term liabilities, but the current ratio takes into account all of the current assets, whereas the quick ratio excludes inventory, so it is a more conservative measure of liquidity.

What is Current Ratio?

The current ratio is one of the fundamental financial metrics used by investors and analysts to gauge a company’s ability to meet its short-term obligations. This ratio measures the total current assets relative to the current liabilities of a company, providing an overview of the company’s short-term financial health.

Simply put, it means that the current ratio will show if a company has enough cash-generating assets to settle its immediate liabilities. This is because it is a broad indicator as it incorporates all of those assets that are expected to be converted into cash within one year, including cash, accounts receivable, and inventory. The current ratio, though providing a general picture of the liquidity, may not always depict an accurate reflection of the ability of a company to pay off debts since it comprises assets that might not be as easily liquidated as others.

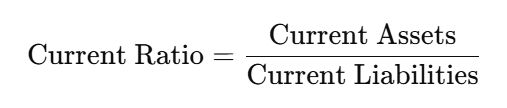

Current Ratio Formula

The formula for calculating the current ratio is:

Where:

- Current Assets are assets that can be converted into cash within a year (e.g., cash, accounts receivable, and inventory).

- Entities need to settle current liabilities within a year. (e.g., short-term debts, accounts payable).

A current ratio of 1 or more usually means that the company has sufficient assets to pay off its short-term liabilities. However, a too-high ratio (say above 2) may imply inefficiency in using assets to generate revenue.

How to Calculate Current Ratio

To calculate the current ratio, follow these steps:

- Identify the company’s current assets: Current assets generally consist of cash, accounts receivable, inventory, and short-term investments.

- Identify the company’s current liabilities: Current liabilities may consist of accounts payable, short-term loans, and any other obligations due within one year.

- Apply the formula: Use the formula above to divide current assets by current liabilities.

For example, if a company has current assets worth $500,000 and current liabilities worth $250,000, the current ratio would be: Current Ratio=500,000/250,000=2

This means that for every dollar of liability, the company has $2 in current assets to cover it.

What is Quick Ratio?

The quick ratio is more stringent in measuring liquidity, often referred to as the acid-test ratio. The quick ratio gives a more accurate picture of how likely a company is to fulfill its short-term obligations through the sale of less liquid current assets. In the case of a current ratio, it excludes inventory and other less liquid current assets from the calculation, giving only the most liquid items, such as cash and marketable securities, with accounts receivable.

People consider the quick ratio a more accurate measure of a company’s short-term liquidity than the current ratio. It presumes that inventory may not be easily converted into cash in the short term, especially in industries where inventory may not be as liquid.

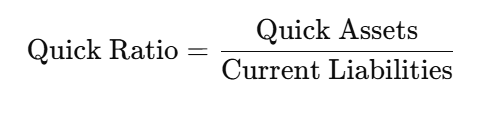

Quick Ratio Formula

The formula for calculating the current ratio is:

Where:

- Quick assets include cash, marketable securities, and accounts receivable. Anything that you can quickly turn into cash within a short time frame.

- Current Liabilities remain the same as in the current ratio.

Generally, experts consider a quick ratio of 1 or more to be a sign of good health for a company.

This indicates that the company has adequate liquid assets to meet its short-term liabilities. If the quick ratio is less than 1, then the company may face difficulty in meeting its short-term obligations without liquidating the inventory or seeking further finance.

How to Calculate Quick Ratio

To calculate the quick ratio, follow these steps:

- Identify quick assets: These include cash, cash equivalents, marketable securities, and receivables. Exclude inventory and prepaid expenses.

- Identify current liabilities: Current liabilities, as with the current ratio, are those due within one year.

- Apply the formula: Divide quick assets by current liabilities.

For example, if a company has quick assets worth $400,000 and current liabilities worth $250,000, the quick ratio would be:

Quick Ratio=400,000/250,000=1.6

This implies that the company has $1.60 in liquid assets for every dollar of liability.

Key Differences Between Current Ratio and Quick Ratio

The difference between the current ratio and quick ratio lies in the assets they include in their calculations and how they assess a company’s short-term liquidity.

- Inclusion of Inventory: The key difference is that the current ratio includes inventory as a current asset, whereas the quick ratio excludes inventory and emphasizes more liquid assets.

- Conservatism: People consider the quick ratio a more conservative measure of liquidity because it removes inventory from the equation. Converting inventory into cash in the short term may not always be easy.

- Liquidity Focus: The current ratio gives a more general sense of liquidity by taking into account all current assets, while the quick ratio gives a more stringent test of the ability of a company to meet its short-term obligations without selling inventory.

- Proper Application: Industries apply the current ratio well when they can easily liquidate their inventory, such as in retail. However, the quick ratio is more proper in an industry wherein its inventory takes a longer time to sell or may not liquidate into cash, manufacturing for example.

| Factor | Current Ratio | Quick Ratio |

|---|---|---|

| Assets Included | Includes all current assets, including inventory | Excludes inventory, only includes liquid assets like cash, receivables |

| Formula | Current Assets / Current Liabilities | Quick Assets / Current Liabilities |

| Liquidity Measure | General measure of liquidity | More conservative, focuses on liquid assets |

| Use Case | Used when inventory is liquid and easily converted to cash | More useful when inventory cannot be quickly sold |

| Risk Level | Higher risk if the ratio is too high (inefficiency) | More conservative, focus on liquid assets |

Conclusion

The difference between the current ratio and the quick ratio is important for financial analysis. The current ratio gives a broad view of liquidity, encompassing all current assets, whereas the quick ratio is more stringent, excluding inventory. Both ratios are important in assessing the ability of a company to meet its short-term obligations, but they serve different purposes and are useful in different contexts. By knowing these ratios, the investor, manager, and analyst can make better decisions about a company’s financial health.

Current Ratio and Quick Ratio FAQs

What is the difference between current ratio and quick ratio?

The difference between current ratio and quick ratio lies in the assets they include. The current ratio includes all current assets, including inventory, whereas the quick ratio excludes inventory and focuses only on more liquid assets, such as cash, accounts receivable, and marketable securities.

Why is the quick ratio considered a more conservative measure than the current ratio?

The quick ratio is more conservative because it excludes inventory, which may not be easily liquidated in the short term. This gives a more accurate picture of a company’s ability to meet short-term obligations without relying on inventory sales.

Which ratio is better for assessing a company’s liquidity, current ratio or quick ratio?

The best ratio depends on the industry and the company’s financial structure. Businesses find the current ratio useful when they can easily convert inventory into cash, while industries find the quick ratio more useful when inventory is less liquid.

What does a quick ratio below 1 indicate?

A quick ratio below 1 indicates that a company may have insufficient liquid assets to cover its short-term liabilities without relying on inventory or external financing. It suggests potential liquidity issues.

How does inventory affect the current ratio and quick ratio?

Inventory inflates the current ratio since it is included in the calculation of current assets. However, the quick ratio excludes inventory, making it a more conservative indicator of liquidity.