The difference between liquidity ratio and solvency ratio lies in their focus on financial health. Liquidity ratios measure a company’s ability to meet short-term obligations, while solvency ratios assess the firm’s capacity to meet long-term liabilities. These ratios are critical for evaluating a company’s overall financial stability, ensuring it can operate effectively without financial distress. Understanding both is essential for investors, creditors, and management to make informed decisions about the business’s health and sustainability.

What is Liquidity Ratio?

A liquidity ratio is a financial metric that evaluates a company’s ability to cover its short-term obligations using its liquid assets. These ratios are vital indicators of a firm’s operational efficiency and its capacity to handle immediate financial needs without additional borrowing.

Key Liquidity Ratios

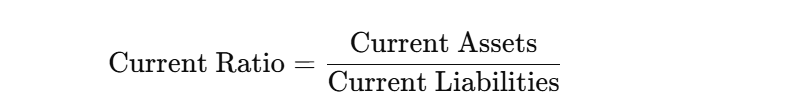

- Current Ratio: The current ratio measures a company’s ability to cover its short-term liabilities with its short-term assets. It reflects the margin of safety available to meet immediate financial obligations without resorting to external financing. A ratio of 2:1 is generally considered healthy.

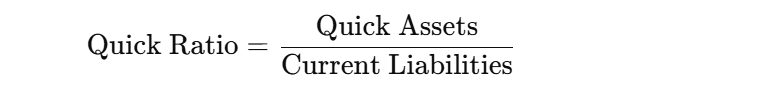

- Quick Ratio (Acid-Test Ratio): The quick ratio provides a more stringent assessment of a company’s liquidity by excluding inventory from current assets. It evaluates the ability to meet short-term obligations using only the most liquid assets. A ratio of 1:1 indicates sufficient liquidity without depending on inventory.

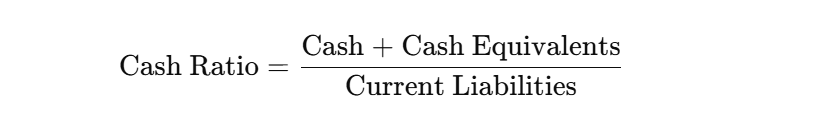

- Cash Ratio: This is the most stringent measure of liquidity, considering only cash and cash equivalents. Reflects the ability to pay off immediate obligations using readily available funds. A ratio of 0.5:1 or above is acceptable, depending on business needs.

What is Solvency Ratio?

A solvency ratio assesses a company’s capacity to meet its long-term financial commitments. These ratios measure the proportion of a firm’s debt relative to its assets, equity, or earnings, highlighting its financial stability and ability to sustain operations over the long term.

Key Solvency Ratios

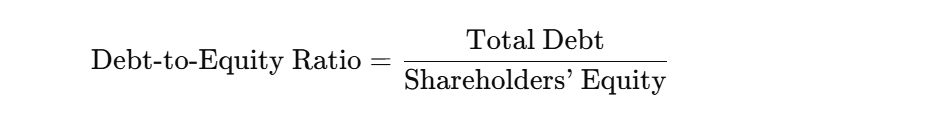

- Debt-to-Equity Ratio: The debt to Equity ratio indicates how much debt is used to finance the company relative to equity. Crucial for investors and lenders to assess financial stability and potential risks of over-leverage. A higher ratio suggests greater reliance on debt, increasing financial risk, while a lower ratio indicates conservative financing.

- Interest Coverage Ratio: It measures a company’s ability to pay interest on its debt. Key for evaluating the company’s operational profitability and its capacity to manage debt. A ratio below 1 indicates insufficient earnings to cover interest payments, raising concerns about financial distress.

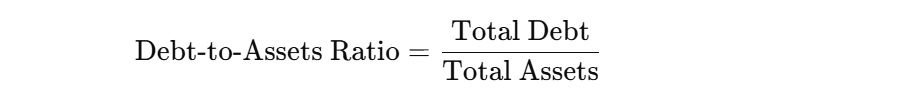

- Debt-to-Assets Ratio: The debt-to-assets ratio shows the proportion of assets financed through debt. Helps assess the balance between debt and asset utilization to maintain financial stability. A ratio above 0.5 implies that over half of the company’s assets are funded by debt, potentially increasing risk exposure.

Differences Between Liquidity Ratio & Solvency Ratio

Understanding the difference between liquidity ratio and solvency ratio is crucial for analyzing a company’s financial health comprehensively.

Definition

- Liquidity Ratio: This metric evaluates a company’s capability to meet its short-term financial obligations as they come due. It highlights the sufficiency of liquid assets such as cash and receivables to cover immediate liabilities, ensuring smooth day-to-day operations.

- Solvency Ratio: This ratio assesses a company’s ability to manage and fulfill its long-term financial commitments. It provides insights into a company’s overall financial health and sustainability, determining whether the organization can survive over the long term.

Focus

- Liquidity Ratio: The focus is primarily on current liabilities (obligations due within a year) and liquid assets (cash, accounts receivable, marketable securities). It gauges how easily a company can convert assets into cash to cover pressing financial obligations. Metrics like the current ratio emphasize whether current assets exceed current liabilities, indicating a healthy liquidity position.

- Solvency Ratio: The focus extends to the company’s total debt and its long-term financial stability. It evaluates whether the company generates enough earnings and cash flow to repay its long-term debts, including bonds, loans, and other liabilities.

Time Frame

- Liquidity Ratio: Concentrates on short-term financial health and operational stability. It answers the question: Can the company pay its immediate bills? Example: A high quick ratio signals that the company can handle unforeseen financial challenges without requiring additional borrowing.

- Solvency Ratio: Looks at long-term financial sustainability, addressing questions like Is the company over-leveraged? or Can it sustain its operations and debt repayments over several years? Example: A healthy interest coverage ratio ensures that the company can meet its interest expenses consistently without distress.

Key Metrics

- Liquidity Ratio: Current Ratio: Measures the proportion of current assets to current liabilities. A ratio above 1 indicates more current assets than liabilities. Quick Ratio (Acid-Test Ratio): Excludes inventory to measure the company’s ability to meet obligations using the most liquid assets. Cash Ratio: Focuses solely on cash and cash equivalents against current liabilities, emphasizing immediate repayment ability.

- Solvency Ratio: Debt-to-Equity Ratio: Compares the company’s total debt to its shareholder equity, highlighting how much of the business is financed through borrowing. Interest Coverage Ratio: Indicates how comfortably a company can pay interest on its outstanding debt using its earnings before interest and taxes (EBIT). Debt-to-Assets Ratio: This shows the proportion of a company’s assets financed through debt.

Stakeholder Relevance

- Liquidity Ratio: Important for short-term creditors, suppliers, and stakeholders who are concerned about the company’s ability to honor immediate obligations. These stakeholders typically focus on the day-to-day operational liquidity of the company.

- Solvency Ratio: Crucial for investors, long-term lenders, and other stakeholders who prioritize the company’s financial stability and risk profile over the long run.

| Aspect | Liquidity Ratio | Solvency Ratio |

| Definition | Measures a company’s ability to meet short-term obligations. | Assesses a company’s capacity to fulfill long-term financial commitments. |

| Focus | Focused on current liabilities and liquid assets. | Focused on total debt and long-term financial stability. |

| Time Frame | Short-term financial health. | Long-term financial sustainability. |

| Key Metrics | The current ratio, quick ratio, and cash ratio. | Debt-to-equity ratio, interest coverage ratio, debt-to-assets ratio. |

| Stakeholder Relevance | Important for creditors and suppliers to evaluate immediate repayment ability. | Vital for investors and lenders analyzing long-term viability and risk. |

Conclusion

The difference between liquidity and solvency ratio is more in their focus on time frames and financial obligations. Liquidity ratios measure a firm’s ability to meet short-term liabilities with liquid assets, while solvency ratios reflect its capacity to meet long-term financial commitments. Therefore, both are needed to gain an in-depth understanding of financial health, enabling informed decisions to be made by stakeholders, along with a balanced approach to maintaining liquidity and solvency that ensures operating stability and growth potential.

Liquidity vs Solvency Ratio FAQs

What is the primary difference between liquidity ratio and solvency ratio?

Liquidity ratios focus on a company’s ability to meet short-term obligations, while solvency ratios assess its capacity to handle long-term debts.

How is liquidity ratio calculated?

Common liquidity ratios include the current ratio (Current Assets÷Current Liabilities) and the quick ratio (Quick Assets÷Current Liabilities).

Why is the solvency ratio important?

Solvency ratios determine a company’s long-term financial health and its ability to sustain operations while managing debt obligations.

Can a company have strong liquidity but weak solvency?

Yes, a company can manage short-term obligations effectively but still struggle with long-term debt, highlighting weak solvency.

How do liquidity and solvency ratios complement each other?

Together, they provide a complete picture of a company’s financial health, balancing short-term operations with long-term stability.